Editors: Tom Whipple, Steve Andrews

Quotes of the Week

“We designed this system [ERCOT] for Ozzie and Harriet weather and we now have Mad Max. Texas is now reaping the bitter harvest of avoiding federal transmission regulation and state energy sector regulation.”

Alison Silverstein, energy consultant, former Texas Public Utilities Commissioner

“Drill, baby, drill is gone forever. Shale companies are now more focused on dividends…They have had their fair share of adventure and now they are listening to the call of their shareholders.”

Prince Abdulaziz bin Salman, Saudi Arabia’s energy minister, on the US shale oil industry

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Briefs |

1. Energy prices and production

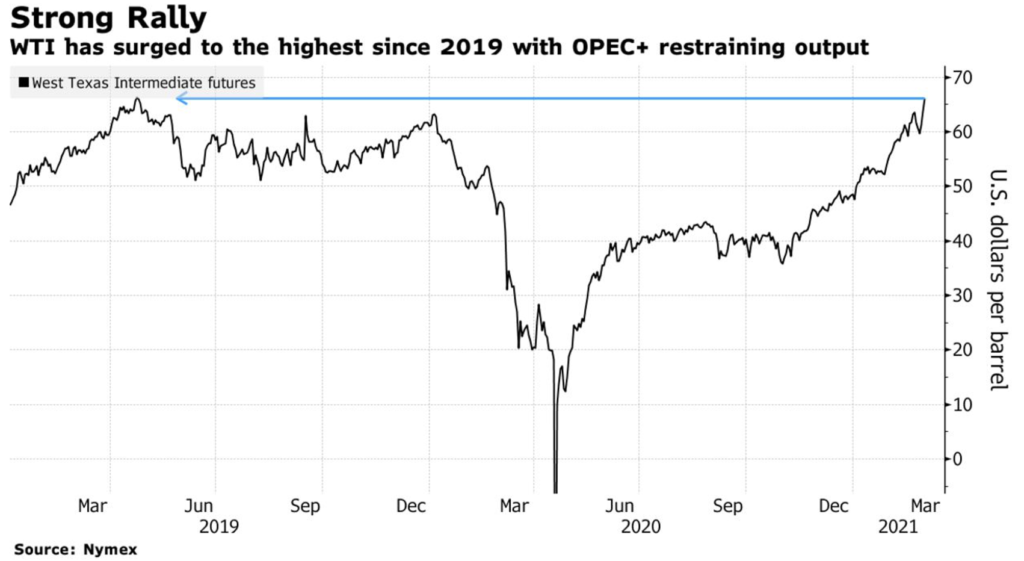

Oil: Futures rallied to the highest in nearly two years in New York after OPEC+ shocked markets with a decision to keep supply limited as the global economy starts to recover from a pandemic-driven slump. US benchmark crude futures topped $66 a barrel on Friday, while its international counterpart Brent neared the $70 level. Major banks upgraded price forecasts, with some calls for oil reaching north of $100 next year. Crude has soared more than 30% this year, with OPEC+’s output restraint holding the market over until a full-fledged comeback in consumption. The group’s latest decision represents Riyadh’s victory, which has advocated for tight curbs to keep prices supported.

US crude oil production fell in December, the last full month for which there is actual data, to an average of 11.063 million b/d. The most prolific oil production district, including Texas, some federal offshore production, New Mexico, Louisiana, Mississippi, Arkansas, and Alabama, stayed the same at 7.611 million b/d.

Maintenance at three oil sands upgraders in Canada will take offline some 500,000 b/d in production, helping tighten supply amid a price rally.

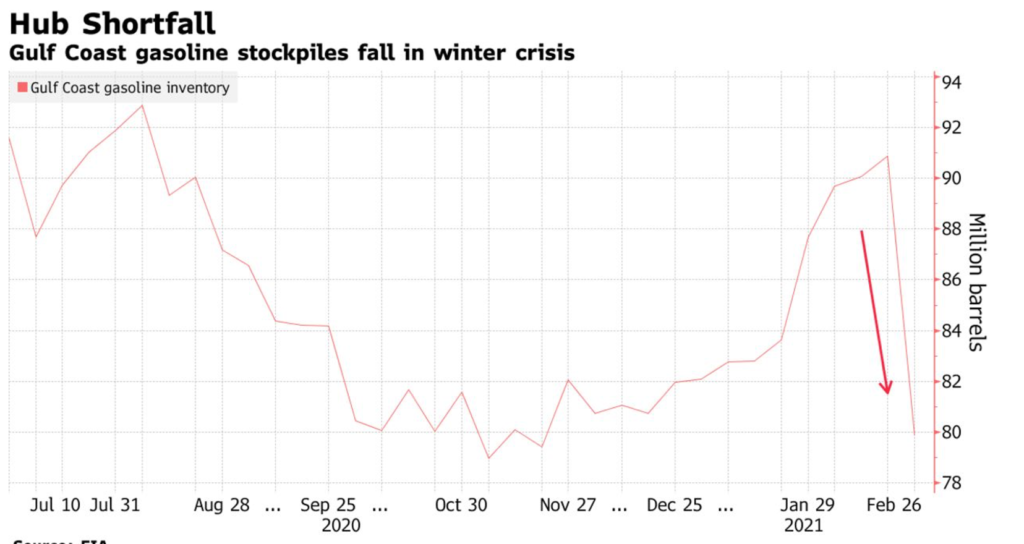

Texas fuel makers are racing to restore operations knocked out by mid-February’s winter storm, but they’re also casting a wary eye on improvements in the market and may be reluctant to come back at full throttle. Refiners are gun-shy after 12 months of losing money in a market that was hit hard by Covid-19, prompting several plants to close or slash production. Gasoline inventories on the Gulf Coast plunged by 11 million barrels last week as the region’s refining capacity sank to a record low of less than 41%, while gasoline demand rose the most since May. Demand for this time of the year remains significantly lower than in March 2019, pre-pandemic.

Crude exports from Louisiana’s offshore supertanker port tumbled to zero as Asian buyers limited purchases to manage high inventories that threaten to overwhelm storage facilities. The lack of shipments in February from the Louisiana Offshore Oil Port — for the first time in nearly two years — is a stark contrast from January when the facility sent out a record of almost 15 million barrels of domestic crude to buyers in China, South Korea, and India. Oil tanker owners and shipbrokers are set to suffer longer than expected from the massive OPEC+ production cuts after the coalition surprised the oil and tanker markets.

OPEC: Caution about the pandemic took the upper hand Thursday at a meeting of the oil cartel and allied countries, as they left most of their production cuts in place amid worry that coronavirus restrictions could still undermine recovering demand for crude. Many analysts had expected a small production increase as the oil price has risen 30% since the start of the year in hopes that the pandemic will ease, allowing for an economic rebound that should increase energy consumption. Instead, the group of oil producers opted for caution, and their decision in favor of supply restraint quickly sent crude oil prices even higher.

Shale Oil: Temperatures dipped far below normal levels in the US’s mid-region during the week ending Feb. 19th, causing substantial production freeze-offs and power outages at refineries, terminals, and processing plants. Oklahoma and Texas were significantly impacted by the extreme cold, with portions of those regions dipping to 40 degrees below average temperatures for that time of year. On the supply side, the impact from freeze-offs peaked on Feb. 17th with 4 million b/d of crude being offline, resulting in production being down 2.5 million b/d on average during the week. Approximately 90% of the losses were estimated to be back online early the following week. The freeze-offs also caused 20+ Bcf/d of natural gas to be offline at the storm’s peak.

Overall, the loss in refinery runs is expected to total 50-70 million barrels, while the loss in crude production will be around 19 million barrels. For products, roughly 30 million barrels of gasoline and 20 million barrels of middle distillates were not produced, at least until refineries ramp back up and probably increase their run plans to backfill.

A return to oil production growth in the Permian Basin during the next few years will largely depend on how the major oil producers there, particularly Chevron and ExxonMobil, pace their activity, Pioneer Natural Resources CEO Scott Sheffield said. The basin’s oil production is capable of growing 5%, or 200,000 b/d, per year, said Sheffield in a panel discussion at the CERAWeek energy conference. “It can do that for several years,” Sheffield said. “A big factor is what majors like ExxonMobil and Chevron do.” The Permian Basin, the US’s largest oil reservoir, currently produces around 4.18 million b/d and about 12 Bcf/d of natural gas. Still, that is down from a little under 5 million b/d in January 2020 due to lower demand stemming from the coronavirus pandemic.

Pioneer, which is nearly a pure-play Permian operator, completed its Parsley Energy acquisition in January, bulking up its already large position in the basin. The combined company is now running 20 rigs, Sheffield said – nearly 10% of all the rigs in that basin. But ExxonMobil and Chevron have pulled back considerably, Sheffield said. ExxonMobil currently has eight rigs in the basin, versus 57 in the first quarter of 2020, while Chevron is at five rigs, down from 17 in from Q1 2020. These major oil companies continue to claim that they have improved their techniques so that they can produce more oil with fewer rigs than a few years ago.

Natural Gas: Operators reported the second-largest weekly net withdrawals for the Lower 48 states following a week characterized by widespread extreme cold throughout most of the country, which increased heating demand for natural gas. Net withdrawals from underground natural gas storage facilities totaled 338 billion cubic feet for the week ending Feb. 19th. This withdrawal was 218 Bcf more than the five-year average net withdrawals for the week and only 21 Bcf less than the all-time weekly record withdrawal of 359 Bcf reported for the week ending Jan. 5th, 2018. As a result, working gas stocks fell lower than the five-year average. Net withdrawals from natural gas storage facilities for winter 2020–21 have increased late in the season due to the extreme cold event.

Electricity: The fallout from the mid-February freeze and blackout in Texas continues to roil the state, with charges of misconduct continuing to fly. An independent market monitor said the Texas power-grid operator made a critical mistake that resulted in $16 billion in electricity overcharges last month and recommended that the charges be reversed. The monitor concluded that Texas kept wholesale prices high for 33 hours longer than warranted as the state dealt with a significant winter storm.

Electricity retailers then asked Texas’ power regulator to suspend immediate collections on the massive bills arising from the electricity outage. On Friday, however, Texas regulators declined to order the Electric Reliability Council of Texas to reprice real-time prices, from mid-night Feb. 18th through 9 am Feb. 19th, which resulted in $16 billion in excess charges by load-serving entities. “Decisions were made at these prices in real-time, based on the information that was available to anybody,” said the chairman of the Public Utility Commission of Texas, during Friday’s meeting.

Last Monday, Texas’s largest and oldest electric power cooperative filed for bankruptcy protection, citing a $1.8 billion bill from the state’s grid operator. Brazos Electric Power Cooperative Inc is one of the dozens of electricity providers facing enormous charges stemming from a severe cold snap last month. The fallout threatens utilities and power marketers who collectively face billions of dollars in blackout-related charges. Unusually frigid temperatures knocked out nearly half of the state’s power plants in mid-February, leaving 4.3 million people without heat or light for days and bursting water pipes that damaged homes and businesses.

The real problem, not just in Texas but everywhere where energy demand is growing, is grid reliability and resiliency. The US electrical grid is the largest interconnected machine on Earth: 200,000 miles of high-voltage transmission lines and 5.5 million miles of local distribution lines, linking thousands of generating plants to factories, homes, and businesses. This is one massive system, and the sources that feed it electricity have become increasingly diversified. Grid reliability has come to the fore because of the decarbonization of electricity generation. While the Texas legislature will have to deal with Texas’s current mess, there are more important problems that can only be dealt with in Washington.

Prognosis: The annual “CERAWEEK” conference, which took place virtually for the first time, attracted more notable speakers having more things to say and more reporters writing stories about the conference. Last year, the 2020 meeting was canceled on coronavirus concerns. This year, over 19,000 delegates registered, three times previous attendance levels. The 2021 conference, arguably the premier fossil fuels forum, may have been the most unique of its nearly 40-year history by highlighting that the march by an “old-economy” industry into the energy transition has revved up and is gaining momentum.

The energy transition took off in a big way, just as the coronavirus pandemic was overtaking the globe in 2020. However, fossil fuels are still seen growing at least through the 2030s, even as renewables usage rises in popularity and affordability. Upstream producers will need to sharpen their skills, revise their portfolios, position themselves for changes ahead, become more efficient, fiscally disciplined, and focus on investments, representatives from large international oil companies said.

Climate change and renewable fuels took center stage at this year’s gathering of energy leaders, investors, and politicians from around the globe, with oil companies trying to reorient their portfolios after the coronavirus pandemic eroded demand and caused the loss of thousands of jobs. The industry scaled back investments and cut budgets as prices crashed in 2020. Still, next year, investments are likely to rebound, said Lorenzo Simonelli, chief executive officer of oil services company Baker Hughes. il company executives were adamant that crude demand would rise over the coming decade and that fossil fuels will remain a crucial part of the energy mix even as renewables draw increasing attention.

Executives from major oil companies clashed over oil and gas prospects for the future at the CERAWeek conference. While BP’s Bernard Looney and Shell’s Ben van Beurden boasted about their shift away from their core business and into renewable energy, Baker Hughes, Hess Corp., and Spain’s Repsol were among those believing that fossil fuels are on a permanent downhill path.

During the final day of the CERAWeek meeting, several US lawmakers outlined legislative priorities pertaining to the energy sector, ranging from critical minerals development to mitigating cybersecurity threats. US Sen. Joe Manchin, D-W.Va., the new chairman of the Senate Energy and Natural Resources Committee, said the US must “challenge itself to produce cleaner energy” but noted that the transition must not leave workers behind or threaten the country’s energy security. With Democrats holding a narrow majority in the US Senate, the moderate fossil fuel-state lawmaker’s support will be critical to any climate proposal Democrats want to advance. “My main goal is to make sure that we remain energy independent.”

The American Petroleum Institute is debating whether to support a carbon price. While API’s expected endorsement is indeed a sign of the times, it’s a mixed bag. For one, API is late to the party. BP, ConocoPhillips, Exxon Mobil, Royal Dutch Shell, Total, and many others have supported just such a price for a while. In January, Total quit its API membership because of a conflict over climate change policy. BP, Shell, and others said that they would remain in the group to influence discussions from within. In a statement at the time, Shell said that API was moving closer to Shell’s stated views on climate policy. That seems to have finally happened. Last week, Megan Bloomgren, senior VP of communications at API, said in a statement that the industry is “evolving,” and “our efforts are focused on supporting a new US contribution to the global Paris agreement.”

API’s potential support for a carbon price comes with a serious catch. A draft statement reads, “API supports economy-wide carbon pricing as the primary government climate policy instrument to reduce CO₂ emissions while helping keep energy affordable, instead of mandates or prescriptive regulatory action.” The group has signaled an embrace of carbon pricing because it sees the writing on the wall. Some observers say that the API’s change of heart is an effort to defer outright regulation of carbon emissions.

2. Geopolitical instability

(These are the situations that reduce the world’s energy supplies or have the potential to do so.)

Iran: Tehran is ready to resume talks on the nuclear deal with the US and other western powers if they are provided with a “clear signal” that sanctions will be lifted within a year, a senior Iranian conservative figure said. “They can announce and reassure us that all sanctions imposed after the 2015 nuclear accord would be lifted in less than one year and tell us to go and negotiate this process,” according to Mohsen Rezaei, who led the Revolutionary Guards for 16 years. These comments are the most unambiguous indication yet of the Islamic republic’s willingness to engage with the US.

“We have to see every month during the talks that some sanctions which are of urgency to us are being lifted,” Rezaei said, outlining Iran’s most precise demands yet for a return to the discussions. “For instance, sanctions on financial transactions and restrictions that European banks have imposed should be lifted in the first month. Oil exports are also among our top priorities.” He said other US moves, such as, for example, helping unfreeze billions of dollars of Iranian money held in overseas banks as an encouragement to start talks, would be akin to giving the republic “a candy.”

The Iranians are reaching out to old customers in Asia to gauge their interest in buying its oil as it might get US sanctions lifted. The National Iranian Oil Co. has approached at least five refiners across the region to discuss the possibility of supply deals if sanctions are eased. One processor has been contacted twice this year after having no interaction with Iran at all in 2020

Iran’s crude shipments dwindled to a trickle after reaching around 2.5 million b/d in early 2018 as the US tightened sanctions and ended waivers for some countries in 2019. Still, some Chinese refiners continued to take Iranian oil. Before the penalties — put in place to pressure Tehran into renegotiating a nuclear deal — China and India were Iran’s biggest buyers in Asia, followed by South Korea and Japan.

The Iranians believe now is the time to move ahead with its long-term strategy to become a leading global LNG supplier. A key focus for this would be the North Pars non-associated natural gas field that was the largest gas reservoir in Iran before discovering the supergiant South Pars field in 1990. The North Pars gas field has around 59 trillion cubic feet (about 1.67 trillion cubic meters) of gas in place.

Israel accused Iran of being linked to a recent oil spill off its shores that caused significant ecological damage, calling the incident environmental terrorism. According to Israeli Environmental Protection Minister Gila Gamliel, the spill was caused by an oil tanker carrying oil from Iran to Syria last month. The vessel sailed through the Gulf and the Red Sea without radio contact, switching its tracking devices back on before passing through Egypt’s Suez Canal. It turned the devices off again before entering Israeli waters in the eastern Mediterranean and dropped off oil along the Israeli coast between Feb. 1-2.

Iraq: Nationwide oil exports increased to 3.395 million b/d in February, up from 3.266 million the month before, according to an analysis of data from Iraq’s Oil Marketing Company and other industry officials. As global oil prices surged, Iraq benefited last month from the biggest monthly oil revenue haul since February 2020.

Iraq’s Prime Minister, Mustafa al-Kadhimi, appears to believe that he can begin a completely new cycle of playing off the US against China and Russia, as it has been doing since the US invasion of Iraq in 2003. The game is simple: Baghdad sends a signal that it may move even closer to Iran, or Russia, or China through oil field awards or other contracts. The US feels compelled to counter the offer of more funding directly or indirectly through massive deals between US firms and Iraqi ones. Iraq then takes the money and the contracts. It continues to do what it was going to do anyway, which is to remain firmly on Iran’s side, whose grip over the country is interwoven into its polity through the Shiite religion.

At least ten rockets landed on Wednesday at Iraq’s Ain al-Asad airbase that hosts the US, coalition, and Iraqi forces. It was the second rocket attack in Iraq this month and came two days before Pope Francis visited the country. The attack caused no significant losses.

Libya: The Country has once again risen to become the top exporter of crude oil in the Mediterranean since November, only two months after having lifted force majeure at various export locations. So far this year, Libya has exported 1.08 million b/d, while Turkey and Egypt, by comparison, have shipped 981,000 b/d and 609,000 b/d. The crude exported from Turkey originates from Azerbaijan and Iraq’s semi-autonomous Kurdistan region.

According to the provisional loading program seen by Platts, loadings in Libya of oil and condensate are scheduled to average around 1.13 million b/d in March. Libyan exports seesawed last year, from a seven-year low of 90,000 b/d in March to a two-year high of 1.19 million b/d in December. Since December, Libyan output has fallen slightly due to problems arising from aging infrastructure and grievances over salary payments to the Petroleum Facilities Guards, which led to a halt in crude exports from some of Libya’s critical eastern terminals.

Yemen: On Thursday, Houthi rebels said they launched missile and drone strikes against a Saudi Arabian oil facility and a military base as their attacks on the kingdom’s energy and security installations continue. The Houthis, backed by Iran in Yemen’s civil war, said they bombed King Khalid Air Base in Saudi Arabia’s southwestern city of Khamis Mushait with a drone and hit a Saudi Aramco fuel depot in Jeddah with a Quds-2 cruise missile. On Friday, there was a second attack on the King Khalid Air Base. It was not clear how much damage the strikes caused. Houthi attacks on Saudi Arabia rarely claim lives or cause extensive damage. Still, their frequency has increased, creating unease in the Gulf.

Tensions have mounted as President Biden explores rejoining a 2015 accord designed to reduce Iran’s nuclear activities. He’s also vowed to bring an end to the conflict in Yemen, which the UN says has caused the world’s worst humanitarian crisis. The Houthis have been fighting Yemen’s United Nations-recognized government since 2014 and have taken over the capital Sanaa. A Saudi-led coalition intervened the following year on the side of the government.

While Yemen no longer exports any oil, the involvement of Iran, the US, and the Saudis in the conflict carry the possibility of a threat to Middle Eastern oil exports.

Venezuela: There is disagreement over whether Caracas’s oil exports went up or down last month. According to Tanker Trackers and OilX, crude oil exports from Venezuela were up in February to over 500,000 b/d vs. 468,000 in January. Bloomberg, however, reported that Venezuela’s exports had fallen to less than 420,000 b/d in February, down 13% over January.

The Venezuelan National Assembly will consider reforms to the country’s oil law that will open the door to “new business models,” President Nicolas Maduro said last week. Maduro did not offer any details on the reforms and what these new business models would entail. The statement appears to be the Venezuelan government’s latest attempt to reverse an irreversible downturn in the country’s oil industry, resulting from years of underinvestment, mismanagement, and US sanctions. The current law states that PDVSA must hold majority stakes in any oil venture with foreign and local private companies and is the only entity allowed to market Venezuelan oil. PDVSA has joint ventures with Russian and Chinese companies, and it operated a joint venture with Chevron until President Trump ordered the major to leave Venezuela last year.

3. Climate change

The pandemic resulted in a large absolute drop in annual global C02 emissions during 2020, as economies gripped by the pandemic ground to a standstill. But the recovery in activity in the second half of 2020 and “a lack of clean energy policies” caused emissions to rise a further 2% year on year in December. “In the absence of major and immediate policy changes in the world’s largest economies, global emissions will continue to increase,” said Fatih Birol, the IEA executive director. Governments must put clean energy policies “at the heart of their [pandemic] recovery packages,” he said, or risk a “substantial rebound of emissions” in 2021.

This year’s CERAWeek conference is largely about topics like carbon capture and investing influenced by ESG, (environmental, social, and governance factors)—a sign of how swiftly the energy industry is being buffeted by the world’s accelerating transition to cleaner energy sources. The influential gathering of global energy leaders, which began last Monday, featured a succession of CEOs and government officials detailing efforts to reinvent themselves for a lower-carbon world. CERAWeek also marked one of the first encounters between oil executives and the new Biden administration.

President Biden’s new Energy Secretary Jennifer Granholm is ready to let loose $40 billion in Department of Energy loans, she said on Wednesday at CERAWeek. Granholm has selected Jigar Shah, founder of SunEdison, to spearhead the loan program as Director of the Loan Program Office. The DoE’s loan program has been in place for years and is responsible for backing the first five US utility-scale solar projects.

According to a research team backed by Bill Gates, the US could cut emissions from its electricity grid in half within the next decade through investments in renewables and transmission. At the cost of $1.5 trillion, the US could reach 70% carbon-free electricity and reduce its emissions by 42% by 2030.

The US can compartmentalize its geopolitical tensions with China to work with the country on climate plans to limit global temperature rise to 1.5 degrees Celsius, John Kerry said at the CERAWeek conference. The partnership between the US and China forged under the Obama administration to combat climate change was seen by many as a turning point in galvanizing global action on carbon emissions reductions and other green policies. However, geopolitical tensions between the US and China intensified under the Trump administration over trade and technology grievances.

A spate of studies suggests that the northern portion of the Gulf Stream and the deep ocean currents it is connected to may be slowing. Pushing the bounds of oceanography, scientists have placed necklace-like sensor arrays across the Atlantic to better understand the complex network of currents that the Gulf Stream belongs to, not only at the surface but hundreds of feet deep. “We’re all wishing it’s not true,” Peter de Menocal, a paleoceanographer and president and director of the Woods Hole Oceanographic Institution, said of the changing ocean currents. “Because if that happens, it’s just a monstrous change.”

The consequences could include faster sea-level rise along the Eastern US and parts of Europe, stronger hurricanes barreling into the Southeastern US, and perhaps reduced rainfall across a semi-arid swath of land running the width of Africa.

According to the US Drought Monitor, the 2020 drought is the worst, in terms of its geographical scope, in more than 20 years. Almost 80 percent of the Western US is in drought, with nearly 42 percent of the region in “extreme” or “exceptional” drought. Much of the area experienced developing drought during last summer, following a warm and dry spring. Since then, conditions have deteriorated, and the precipitation deficits continue to build. At its maximum extent in January 2021, 47 percent of the West was in extreme drought or worse. However, February did bring an active weather pattern with it. The Pacific Northwest received more than 10 inches of precipitation last month. Much of the interior Rockies through Idaho, Montana, Wyoming, Utah, and Colorado received between 1 and 5 inches of moisture for the month. The Sierra Nevada in California received between 2 and 6 inches, much of that in snow.

4. The global economy and the coronavirus

A University of Washington disease expert whose projections on COVID-19 infections and deaths are closely followed worldwide is changing his assumptions about the course of the pandemic. The expert had until recently been hopeful that the discovery of several effective vaccines could help countries achieve herd immunity or nearly eliminate transmission through a combination of vaccination and previous infection. But in the last month, data from a vaccine trial in South Africa showed not only that a rapidly spreading coronavirus variant could dampen the effect of the vaccine, but it could also evade natural immunity in people who had been previously infected.

United States: President Biden said the US expects to deliver enough coronavirus vaccine for all adults by the middle of May — two months earlier than anticipated. He pushed states to get at least one shot into the arms of teachers by the end of March to hasten school reopening. Biden also announced that Merck would help produce rival Johnson & Johnson’s newly approved one-shot vaccine. “We’re now on track to have enough vaccine supply for every adult in America by the end of May,” Biden said.

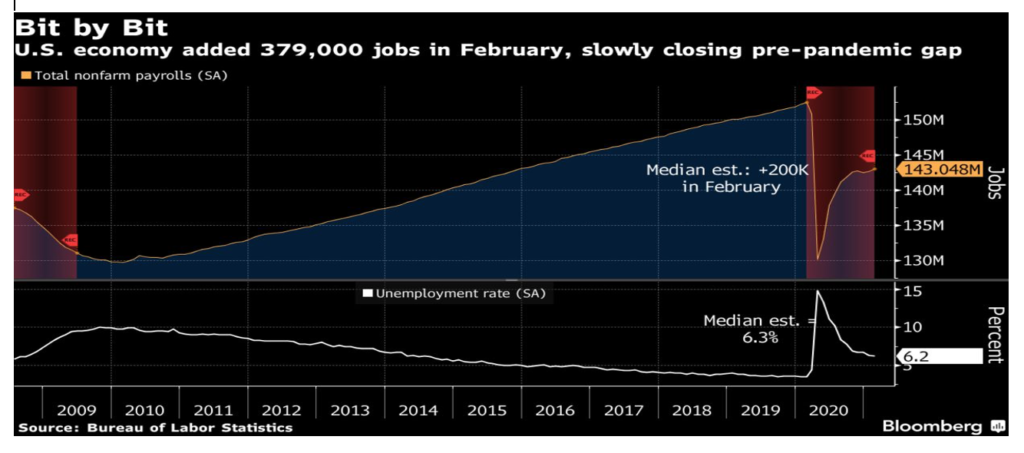

US employers added more jobs than forecast in February, and the unemployment rate declined, suggesting the labor market is clawing its way forward again following several disappointing months. Payrolls increased 379,000 after an upwardly revised 166,000 January increase, according to a Labor Department report Friday.

The US economic recovery continued at a modest pace over the first weeks of this year, with businesses optimistic about the months to come. Still, the job market is showing only slow improvement, the Federal Reserve reported on Wednesday. “Economic activity expanded modestly from January to mid-February for most” of the Fed’s 12 regional districts, the US central bank said in its latest “Beige Book” compendium of anecdotes about the economy. “Most businesses remain optimistic regarding the next 6-12 months as COVID-19 vaccines become more widely distributed.” The Fed, however, reported that the labor market remains about 10 million jobs short of where it was before the start of the coronavirus.

China: Some communities in Beijing have started giving COVID-19 vaccine doses to people older than 60, even as the city’s disease-control authorities publicly advise this age group against inoculation. China’s vaccination program, under which 40.5 million doses had been administered as of Feb. 9th, excludes those ages above 59 and those younger than 18. Chinese vaccine makers are citing incomplete clinical trial data for minors and the elderly.

According to two surveys, China’s manufacturing recovery weakened for a third month in February as exports and new orders declined. A monthly purchasing managers’ index fell to 50.9 from January’s 51.5 on a 100-point scale on which numbers above 50 show activity is accelerating. A separate PMI issued by the Chinese statistics agency retreated to 50.6 from 51.3. Manufacturers received a boost from China’s relatively early reopening after the coronavirus hit. But sales have been hurt by unease among Chinese consumers about the economic outlook and renewed disease outbreaks abroad that have prompted governments to reimpose business and travel curbs.

China’s economic success is being held back by disruption to global shipping supply chains. The surge in exports from China to the west, combined with disruption at ports due to coronavirus, has left many containers out of position, resulting in ships’ queues outside ports and soaring freight rates. The Chinese media have dubbed it “a single box is hard to find.” The amount it costs to send a 40-foot container from China to the US has more than quadrupled in the past year, Chuang said: “We have never seen anything like this in the last two decades . . . Empty containers cannot get back to Hong Kong.”

Robust oil demand in Asia has supported the bullish sentiment on the oil market in recent weeks, but higher oil prices may cool off crude purchases from China. Signs have already emerged that no crude buying spree will occur in the second quarter, with oil prices above $60 eating into refining margins and planned maintenance at Chinese refineries beginning in March and April.

China’s first road map to achieving net-zero emissions by 2060 may be too slow to stop the world’s biggest polluter from hastening global warming. Thousands of Chinese delegates to the National Party Congress applauded when Premier Li Keqiang said the country would act forcefully on climate change. The country’s 14th five-year plan, released later that morning, was awash with ways to increase renewable energy use by 2025. However, when it came to greenhouse-gas emissions — the critical metric that will determine whether the world reins in a global temperature increase — Friday’s announcements were disappointing. Beijing didn’t set a challenging target for the emissions, nor did it bring forward from 2030 the date it expects them to peak.

Chinese leaders said they would target a GDP growth of 6% or more this year. This is a relatively modest goal that nonetheless signals continued optimism after a year in which the coronavirus eviscerated the global economy. The target, announced Friday in Beijing by Premier Li Keqiang, is comfortably lower than most economists’ expectations that the world’s second-largest economy will grow by 8% or more this year.

European Union: A coronavirus resurgence across Europe has ended a six-week decline in new cases on the continent, the World Health Organization said Thursday, reflecting a broader global trend that has seen infections on the rise again. New covid-19 cases in the European region rose by 9 percent over the past week, the WHO’s regional director for Europe said in a briefing. More than half of the region sees an increase in new infections, he said, including a particularly worrying surge in the east. The EU will urge the US to permit the export of millions of AstraZeneca’s Covid-19 vaccine doses to Europe as Brussels scrambles to bridge supply shortfalls that have hobbled its inoculation drive.

EU officials formally approved the bloc’s multi-billion-euro fund to help wean countries off fossil fuels by shielding vulnerable communities from the economic impact of transforming polluting sectors. As part of its plan to eliminate net greenhouse gas emissions by 2050, the EU has set aside part of its budget and COVID-19 recovery fund to support those most affected by programs targeting industries relying on or producing fossil fuels.

Higher demand from China, the US, and Europe drove growth in German factory activity to its highest level in more than three years in February, brightening the outlook for Europe’s largest economy. IHS Markit’s Final Purchasing Managers’ Index for manufacturing, which accounts for about a fifth of the economy, jumped to 60.7 from 57.1 in January. It was the highest reading since January 2018. Factories have been humming along during the pandemic on higher foreign demand, helping the German economy avoid a contraction in the last quarter of 2020.

Russia: Last month, Moscow pumped below its OPEC+ oil-output target for the first time since the historic curbs began last May, failing to take full advantage of a more generous quota. According to preliminary data from the Energy Ministry, the nation produced 10.095 million barrels a day of crude and condensate in February. It’s difficult to assess the nation’s compliance. Still, if February’s condensate production were in line with January’s, then the daily crude output would be around 9.155 million barrels, some 30,000 barrels lower than its OPEC+ quota.

Russia could end up borrowing $6.8 billion less than planned this year as rising oil prices help its critical oil revenues increase. The rally in oil prices, which have risen by about 30% this year, also coincides with Russia’s economy emerging from the slump during the pandemic. Last year, Russia’s economy suffered the consequences of the oil price crash. It helped create the temporary rift with its OPEC+ partner Saudi Arabia in March 2020.

Russia’s local bonds fell the most in three weeks on speculation the US could target the nation’s sovereign debt with a more stringent round of sanctions over the poisoning and jailing of opposition leader Alexey Navalny. Ruble-denominated notes dropped for the first time this week after Bloomberg reported President Biden would consider imposing sanctions on Russia’s bonds if it is again found to commit a significant transgression of the international ban on chemical weapons.

India: Record pump prices of gasoline and diesel are the newest threat to the economy’s nascent recovery, as high local taxes on retail fuel risk fanning inflation and driving a wedge between the objectives of fiscal and monetary policymakers. Gasoline prices were at an all-time high of $1.3 a liter in Mumbai Tuesday, while diesel — the forerunner of industrial activity — sold for a record $1.21 a liter. Taxes make up more than half of that cost and represent a sore point for the inflation-targeting Reserve Bank of India, which has vowed to keep borrowing costs low for as long as needed to support economic growth.

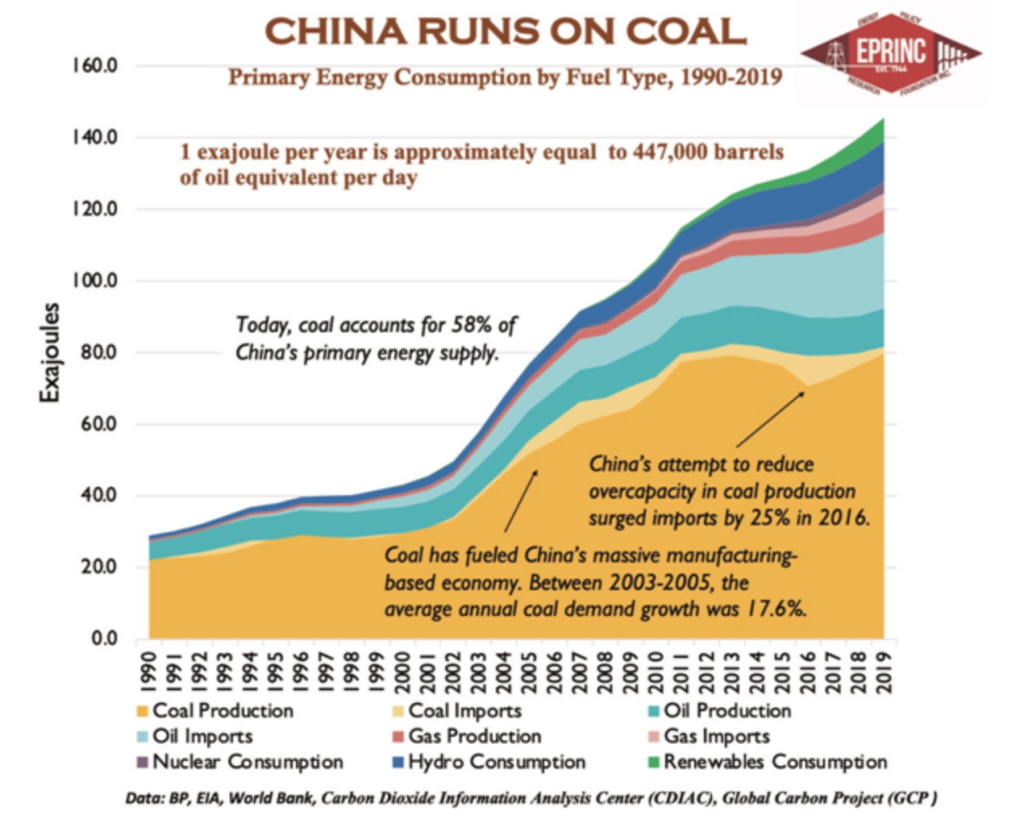

India and other developing nations should get international financial support and strong government commitment and aid, phase out coal and contribute to emissions reduction, Fatih Birol, the Executive Director of the IEA, said last week. He said the world needs to exit coal. Still, he noted that for many coal-dependent nations, including India, the exit would need a lot of international financial assistance. It would not be fair to ask emerging economies to stop using coal without support. “Therefore, it is essential on how we, on the one hand, get out of the coal and at the same time do not harm emerging markets,” Birol said.

Water shortages in India are already acute. Nearly half the country’s population faces high-to-extreme water stress, and about 200,000 die each year due to inadequate access to safe water. Stoked by climate change, the water crisis has forced Prime Minister Narendra Modi’s government to try and turn around decades of established farming practices and convince the country’s most powerful voting bloc to change the crops they plant. Water-guzzlers like rice and wheat are out, corn and pulses are in.

An increase in extreme weather events such as floods, droughts, and cyclones risk soaring debt worth more than $84 billion at India’s most important financial institutions. The banks flagged exposure to environmentally sensitive businesses, including cement, coal, oil, and power. They also listed the effects of cyclones and floods on loan repayments in farming and related sectors. Lenders accounted for 87% of the total risk, valued at about $97 billion, across 67 top Indian companies. “Climate is the biggest risk to businesses in the long run. Financial institutions are beginning to understand it.”

State officials in Maharashtra, of which Mumbai is the capital, said that its cyber department’s initial investigation found evidence that China could have been behind a power outage that left millions without power in October. It was the worst blackout in decades, and officials investigate whether cyberattacks from China could have been behind the blackout of India’s financial capital, stopping trains and prompting hospitals to switch to diesel-powered generators. The megacity has long prided itself on being one of India’s few cities with uninterrupted power supply, even as most of the country struggles with regular blackouts.

5. The Briefs (date of the article in the Peak Oil News is in parentheses)

Offshore oil and gas development is not only set to recover from the pandemic shock to prices and demand; it is also set for a new record in project commitments in the five-year period to 2025, said Rystad Energy. (3/6)

The de facto ruler of Abu Dhabi, the richest oil emirate in the United Arab Emirates, became the chairman of the newly formed board of directors at state oil firm Abu Dhabi National Oil Company, formalizing a role that analysts say he has been exerting in recent years. (3/2)

Offshore Turkey, the potential Sakarya gas field development will almost be at the greatest depths in the Black Sea. To develop Sakarya, Turkey needs to attract foreign expertise to drill in the extremely harsh environment. The confrontational style and bellicose language of the current leadership in Ankara make it difficult for Western firms to close an agreement with Turkey. (3/4)

In Singapore, Exxon Mobil expects to cut about 300 jobs in the Asian oil-trading hub by the end of 2021, part of a global retrenchment that was announced last year. The planned lay-offs equate to about 7% of its 4,000-strong workforce in the city-state. Exxon said in October that it would slash its global workforce by 15%, or about 14,000 people, by the end of 2022. (3/3)

Vietnam is poised to actively venture into Africa to secure a regular dose of light and medium sweet crude supply for the coming years, as the country’s domestic crude production continues to decline due to naturally aging fields, while state-run Binh Son Refining and Petrochemical, or BSR, finds Nigerian and Angolan grades cheaper than Southeast Asian oil. (3/2)

Nigerians were thrown into confusion as fuel scarcity hit Lagos, Abuja, and many other cities across the country. Many fuel stations did not open. (3/1)

Some of Africa’s leading oil producers are in dire straits after the 2020 oil price crash. To wit, Angola has gone from being Africa’s top crude producer just five years ago to barely pumping more than war-torn Libya while Nigeria–another key OPEC member–is in grave danger of suffering Angola’s fate as Big Oil makes yet another round of deep capex cuts. (3/2)

Mexico, after decreasing production to match lower demand in 2020, plans to boost oil exports in 2021 as worldwide demand gradually increases. Pemex produced an average of 1.65 million b/d of crude in January, barely less than the previous year but roughly half of what it produced 20 years ago. (3/4)

The US oil rig count increased by 1 this week, and the number of gas rigs stayed the same, according to Baker Hughes. Canada’s overall rig count decreased this week by 22. Oil and gas rigs in Canada are now at 141 active rigs and down 62 year on year. (3/6)

Five gasoline tankers that were en route to the US East Coast diverted to the Port of Houston to help ease a supply crunch after last month’s freeze crippled the region’s refineries. (3/6)

Oil and gas companies are legally required to “plug” wells that they’re no longer using to extract oil and gas by pouring concrete into all their openings and cracks; this prevents them from leaking fossil fuels or harmful pollutants into the air and water sources nearby. But many companies that abandon wells say they no longer have the financial means to do so, leaving government regulators on the hook for the cost. The problem is massive: There are approximately 2.1 million unplugged abandoned wells across the country. (3/3)

This time could be different for US shale firms in terms of restraining production as prices rise. It could be different for OPEC+ in terms of adding extra barrels before the market overheats. But the behavior of both shale firms and OPEC+ is deeply entrenched and it would be unwise to bet against the cycle repeating itself. (3/6)

The hired hands of America’s oil patch have now lost all the job gains they made during a brief recovery last year. The companies that frack wells and make the equipment necessary to produce oil cut an estimated 12,321 jobs over the three months ending in February. That wiped out the 11,282 jobs added between September and November. Nearly all of the large publicly traded shale explorers are continuing to hold the line and not boost output this year, in an effort to appease investors demanding greater returns. (3/6)

Exxon Mobil, which is counting on carbon capture and storage as a primary way to achieve its targets for reducing greenhouse gas emissions, touted the recent creation of a new business unit to commercialize the technology during its annual analysts day Wednesday, saying political changes and other advances were combining to make it more viable. (3/4)

Exxon Mobil added two new directors to its board Monday as the beleaguered energy company tries to fend off calls for change from a pair of activist investors. “While ExxonMobil has now conceded the need for board change, what is missing are directors with diverse track records of success in the energy industry who can position the Company for success in a changing world,” Engine No. 1 said in a statement. (3/2)

Coal deliveries from Central Appalachia mines to US power plants dropped 37.5% from those delivered in 2019, according to US EIA data. (3/3)

Profitable coal: Since the end of 2014, five US private equity firms have bought coal plants in markets where regulators pay them to be on standby to provide emergency power when demand surges with extreme hot or cold weather. The investments illustrate how fossil fuels will remain an important part of the energy mix and continue rewarding investors even years after demand for them peaks as the world transitions toward cleaner energy sources. (3/3)

Geothermal energy is fully comparable with wind and solar, which are also not entirely emission-free given the materials they need to operate. Yet geothermal has been slow to take off because of the high upfront costs and the general uncertainly about the result of drilling. Industry experts invariably note that the heat is everywhere beneath us, but they also make a point of emphasizing that not all of that heat is that easy—or economical—to reach. (3/2)

General Motors is looking to build a second battery factory in the US with joint-venture partner LG Chem Ltd., the latest move in the Detroit auto maker’s efforts to expand its investment in electric vehicles. (6/5)

Volvo’s entire car lineup will be fully electric by 2030, joining a growing number of carmakers planning to phase out fossil-fuel engines by the end of this decade. The Swedish carmaker said 50% of its global sales should be fully-electric cars by 2025 and the other half hybrid models. (3/2)

FedEx promised to be carbon-neutral by 2040, 10 years faster than the timeline laid out by the Paris climate accord. The company pledged an initial investment of $2 billion to start electrifying its massive fleet of more than 180,000 vehicles and $100 million for a new Yale Center for Natural Carbon Capture. (3/6)

Volkswagen gave a first design preview of Project Trinity. The electrically powered sedan is to be built in Wolfsburg from 2026 and is intended to set new standards in terms of range, charging speed and digitization—as well as being able of delivering Level 4 automated driving. (3/6)

US energy storage boomed in the last quarter of 2020, with record 2,156 megawatt-hours (MWh) of new energy storage systems brought online, up by a massive 182% compared to the third quarter, Wood Mackenzie and the US Energy Storage Association said. (3/6)

Batteries: GAC Group recently announced “a major achievement in battery technology”. GAC stated that it achieved breakthrough progress with its graphene-based super-fast-charging battery and has now entered the phase of actual vehicle testing. (3/3)

Batteries for solar: US engineers have joined forces to develop high-voltage reference batteries for behind-the-meter energy storage applications, based on a bipolar technology that uses silicon wafers in traditional lead batteries. The bipolar technology is known as Silicon Joule and has been developed by Gridtential Energy with the goal of reducing lead batteries’ weight and achieving a performance competitive with that of lithium-ion batteries but at a lower cost. (3/2)

E-plane: Rolls-Royce has successfully completed the taxiing of its ‘Spirit of Innovation’ aircraft, the latest milestone on its way to becoming the world’s fastest all-electric plane. (3/3)

The oil industry’s top lobbying group is preparing to endorse setting a price on carbon emissions in what would be the strongest signal yet that oil and gas producers are ready to accept government efforts to confront climate change. (3/2)

Kerry on H2: The US oil and gas industry should embrace “huge opportunities” in producing and transporting hydrogen, with the potential for that cutting-edge energy source to fuel long-haul trucks and supply power globally, presidential climate envoy John Kerry said Tuesday. (3/5)

Hydrogen: Korea-based SK Group will invest about US$16.4 billion over the next five years to create a domestic hydrogen ecosystem—production, distribution, and consumption—through creation of hydrogen infrastructure and also through partnerships with global companies. (3/6)

Hydrogen: Danish catalyst manufacturer Haldor Topsoe plans to build a large-scale facility to manufacture electrolyzers that would be used for green hydrogen production and potentially reduce the cost of green hydrogen by 20%. (3/6)

In Miami, climate experts warned that the Miami-Dade county’s optimistic plan for combating rising seas downplayed the magnitude of the threat, saying it failed to warn residents and developers about the risk of continuing to build near the coast in a county whose economy depends heavily on waterfront real estate. (3/3)

Flood non-disclosure: There are few places to purchase a home in the US that have a greater risk of flooding than the Florida coast. But sellers needn’t lose sleep over that because the Sunshine State doesn’t mandate disclosure of whether a property has previously flooded. Nearly 30 percent of Florida is in a high-risk area, and that number is expected to increase over the coming decades as climate change causes sea levels to rise. Some 21 states have no rules requiring owners to reveal a property’s flood history. (3/2)

US freight railroads are trying to take advantage of a train enthusiast president, who is concerned about global warming, with a lobbying campaign depicting their industry as part of the solution to climate change. (3/2)