Editors: Tom Whipple, Steve Andrews

Quote of the Week

“The environmental, social and governance factors linked with oil and gas development exposes your company to unnecessary reputational, legal and financial risk. Two-thirds of American voters oppose drilling in the Arctic refuge which is consistent with the long-held, popular, and bi-partisan support for permanent protection of the Arctic refuge.”

From a report by Trillium Asset Management, to investor holdout Bank of America Corp., asking how it will deal with the business risks of backing Arctic oil ventures.

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

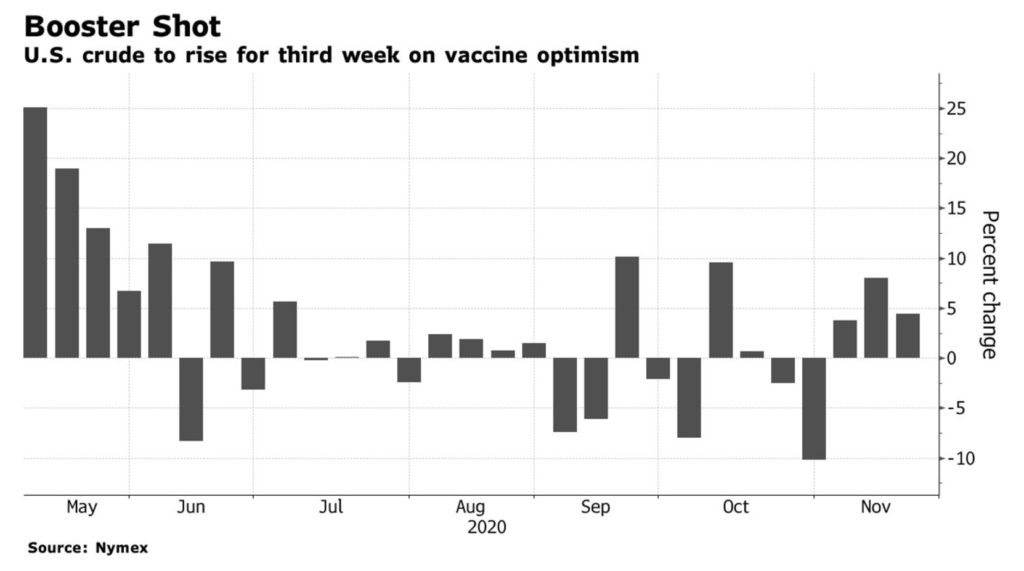

Oil: Last week. prices rose to the highest in nearly three months, with positive Covid-19 vaccine developments paving the way for a more sustained oil demand recovery. Futures rose 5 percent in New York for a third straight weekly gain as Pfizer and BioNTech requested emergency authorization of their Covid vaccine Friday. Moderna also released positive interim results from a final-stage trial and said it is close to seeking emergency authorization. Gains were limited by broader market declines amid a dispute between the White House and the Federal Reserve over emergency lending programs. Brent crude closed out the week at $44.96 a barrel. The more active US West Texas Intermediate closed Friday at $42.42.

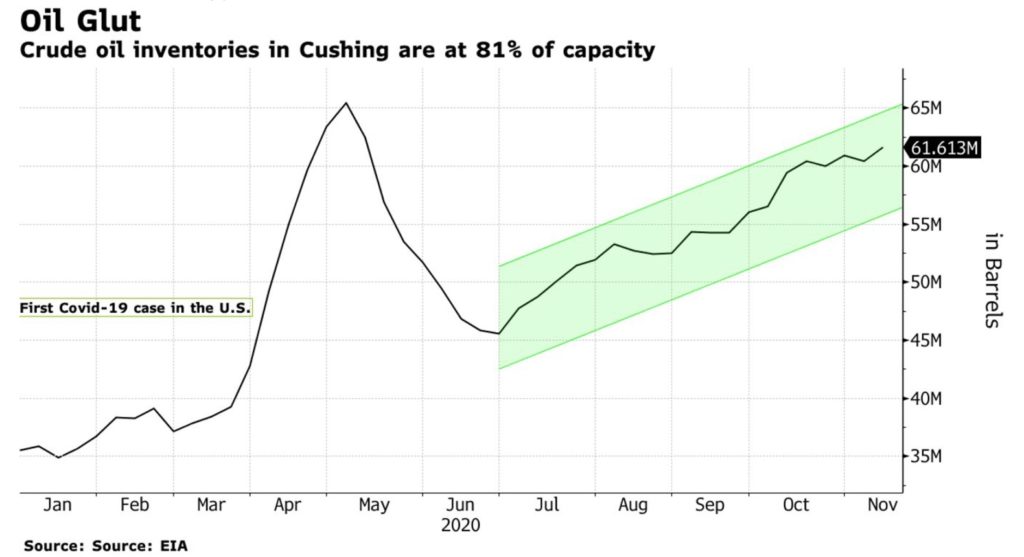

Oil tanks at Cushing, Oklahoma, America’s most important crude storage hub, are filling to the brim again, quickly approaching the critical levels reached in May after prices crashed. According to the most recent US government data, stockpiles stood at 61.6 million barrels as of November 13th, or about 81 percent of capacity. That’s 3.83 million barrels shy of the levels seen in May.

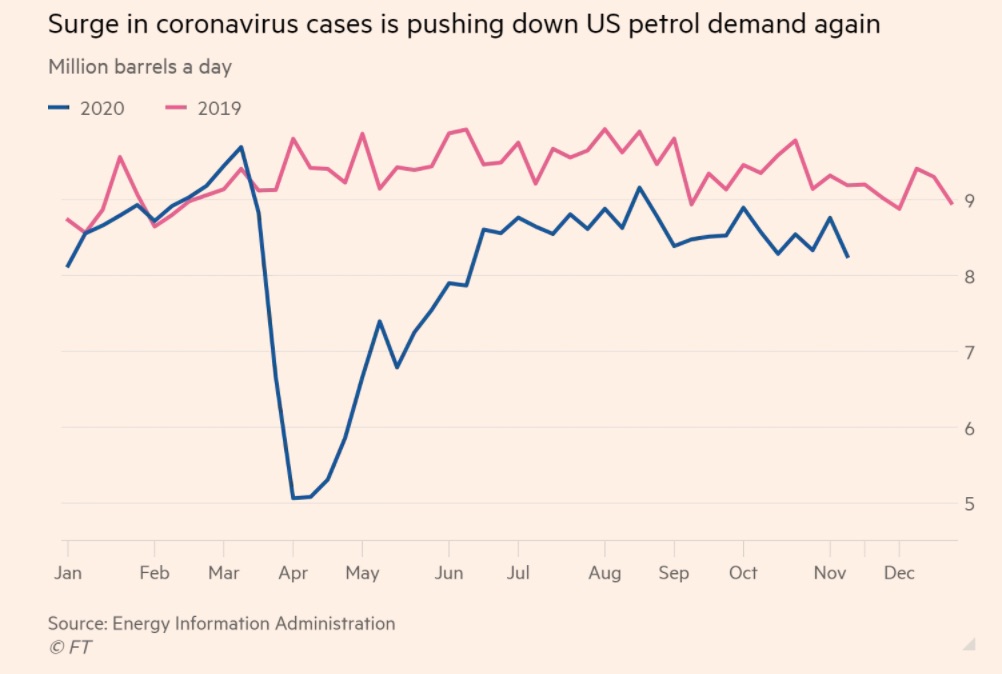

US petroleum demand fell last week amid surging coronavirus cases, setting the scene for a lackluster Thanksgiving holiday when more American motorists opt to stay home. Gasoline demand fell by 6 percent in the seven days to November 13th to 8.3 million b/d. “What you’re seeing is that people are staying closer to home and celebrating with fewer people,” said Patrick De Haan, head of petroleum analysis at GasBuddy.

Air travel, another critical segment of the oil market, has remained subdued as international travel has failed to recover from coronavirus’s blow.

OPEC+: Between May and October, participants in the OPEC+ agreement pumped 2.346 million barrels more than allowed under the pact.. The OPEC countries pumped 1.32 million b/d over quota, mainly due to Iraq’s non-compliance in the early months of the deal, before Saudi Arabia scolded the OPEC+ members for dodging their obligations. Iraq still has a lot to compensate—its overproduction was 600,000 b/d between May and October.

The Joint Ministerial Monitoring Committee meeting last week failed to offer insight as to whether the group would extend its current output quotas into next year. The 22-country producer bloc will announce its decision when it convenes online Nov. 30th-Dec. 1st. Thus OPEC and its allies will keep the oil market guessing for a few weeks whether they will maintain their deep production cuts into 2021, as traders expect and ministers themselves have hinted.

Anonymous UAE officials claimed earlier last week that the country was considering breaking away from OPEC, citing the difficulties it is facing due to the stringent production cuts it must adhere to. However, the UAE’s Energy Minister officially responded to the allegations. “As a reliable and longstanding member of OPEC, we have always been open and transparent in all our decisions and strategies in support of OPEC.” UAE Energy Minister Suhail al-Mazrouei told Reuters on Thursday, adding that it had “demonstrated this commitment through our compliance to the current OPEC+ agreement.”

Shale Oil: The EIA forecasts that US shale oil production will total 7.63 million b/d in November and 7.51 million in December, a decline of 140,000 b/d between the two months. The US oil rig count fell by 5 to 231 the week before last after eight weeks of small increases. It takes about six weeks from the time decisions are made to add or mothball oil rigs. Hence the decision to mothball the rigs that showed up last week were likely taken in early October. This was before the vaccine and Covid-19 surge announcements were made and were probably taken due to declining demand and stagnant oil prices.

After a wave of bankruptcies in the third quarter, oil producers and oilfield services companies in the US shale business continued to file for protection from creditors at the start of the fourth quarter, law firm Haynes and Boone said in its latest tally. The firm warned that the ongoing borrowing base redetermination season could result in more filings. Bankruptcies from exploration and production firms numbered 17 in the third quarter, while another three firms filed for bankruptcy in October. “While the pace of bankruptcy filings for producers has slowed from last summer, the current borrowing base season for oil and gas borrowers may put further pressure on some of the already financially stressed producers. Combined with the general lack of access to capital, additional filings are likely before 2020 comes to a close.”

Natural Gas: Stockpiles are 8 percent above last year’s levels and 6.2 percent above their five-year average for this time of year. Prices fell last week, extending the November slide as moderate temperatures swept across the US, limiting demand for heating and the power-generation fuel. Demand for natural gas typically rises late in the fall and early in the winter when more people turn on heating systems in their homes.

According to the EIA, nearly half of US homes are heated with natural gas, so investors typically enter the colder months preparing for demand and price increases. Forecasts for the coming winter call for above-average temperatures suggesting that global warming is affecting natural gas prices.

Prognosis: Crude oil demand is likely to rebound next year following the news about a vaccine for the coronavirus, according to Fitch Ratings. In its latest Global Commodities Strategy report, the ratings agency noted the imminent emergency approval for a vaccine as a significant factor for the recovery in global oil. Fitch also noted plans by OPEC+ to extend its oil production control deal at current restriction levels.

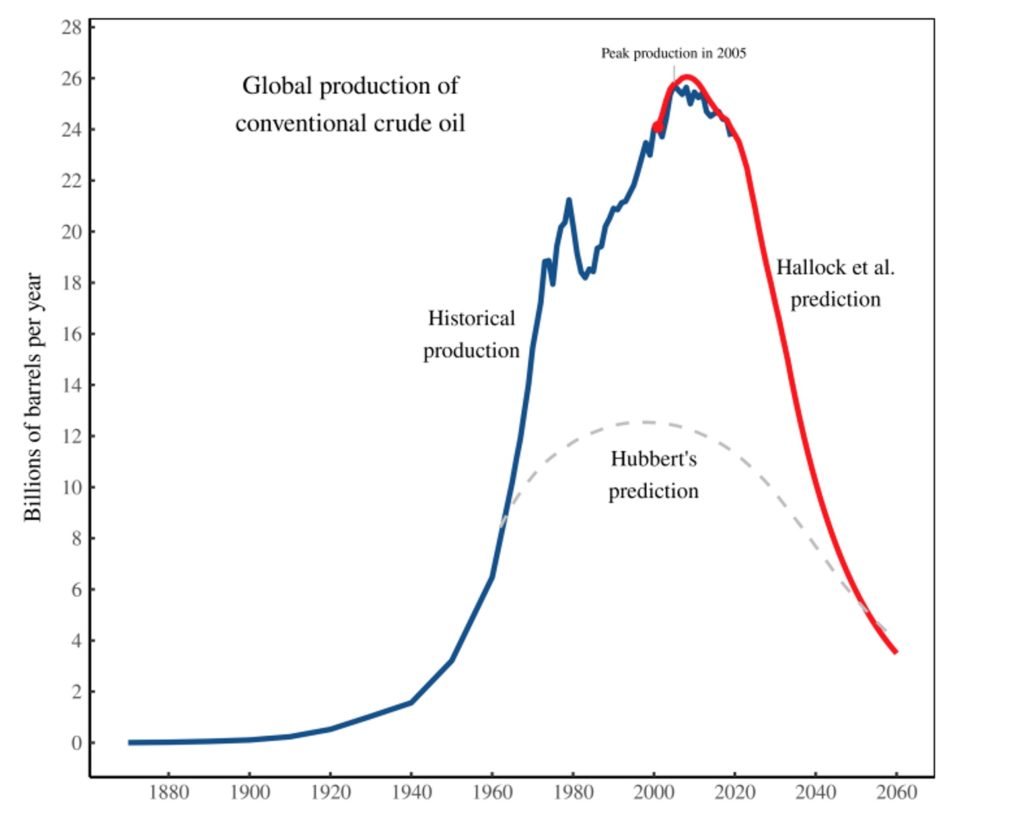

However, slower demand growth due to the pandemic and a drop in global oil supply due to low investments could result in peak oil demand 2-3 years sooner than the 2030 forecast by Norway’s Equinor. The company recently announced its ambition to become a net-zero energy business by 2050, following other major European companies in this pledge.

US President-elect Biden will almost certainly focus on dealing with the COVID-19 pandemic and repairing the US’s economic damage that it has wrought. Washington’s policy in the Middle East is likely to be significantly different from his predecessor’s in crucial policy areas. Top of the list of his considerations is expected to be what to do about Iran, particularly the Joint Comprehensive Plan of Action from which the US unilaterally withdrew in May 2018, and Saudi Arabia, especially its Crown Prince Mohammed bin Salman. For Iran, although Biden is widely expected to try bringing the US back into the JCPOA, there are indications that Biden will insist on adding clauses to the agreement that President Obama dropped during the negotiations to get a deal.

These clauses include the safety and security of US troops from Iran or Iran-sponsored attacks in Iraq and elsewhere, Israel’s safety and security, and the link between Iran’s nuclear enrichment program and its ballistic missile program. Biden’s team would make it clear – and there is no room for alteration on this point – that Iran is not to build, import, maintain, hold, or test any ballistic missiles with a range of more than 2,000 kilometers.

Given Iranian politics’ current state, these clauses will be hard for the Iranian government to accept. Tehran’s demand that the US reimburse them for the billions of dollars in oil revenue they have lost will be a non-starter in Washington.

2. Geopolitical instability

(These are the situations that have reduced the world’s energy supplies or have the potential to do so.)

Iran: President Trump asked senior advisers in a meeting on Thursday whether he had options to take action against Iran’s main nuclear site in the coming weeks. The meeting occurred a day after international inspectors reported a significant increase in the country’s nuclear material stockpile. A range of senior advisers dissuaded the president from moving ahead with a military strike — warning that a strike against Iran’s facilities could quickly escalate into a broader conflict.

The US leveled sanctions against Iran’s Islamic Revolution Mostazafan Foundation, a conglomerate of holdings in Iran’s economy, including the energy sector. The organization acts as a charity but uses its holdings to enrich Iran’s Supreme Leader Ali Khamenei, “reward his political allies, and persecute the regime’s enemies,” the US Treasury said in a press release. The Treasury also targeted Mahmoud Alavi, Iran’s minister of intelligence and security.

Iraq: Iraq’s readiness to hit its 7 million b/d production target by 2025 came into question again last week. Statements from the developers of two of its significant fields – BP in Rumaila and Japan Petroleum Exploration in Gharraf — said that achieving higher output from their respective developments is not as straightforward as it might appear. Baghdad’s ability to attain the 7 million b/d target looks far from certain in the current circumstances.

The China National Petroleum and China National Offshore Oil Corporations are interested in buying ExxonMobil’s entire operating stake in one of the largest oilfields in Iraq, West Qurna 1. The potential sale of Exxon’s 32.7-percent interest in West Qurna 1 could be worth at least $500 million. In 2010 ExxonMobil signed an agreement with the Iraq Ministry of Oil to rehabilitate and redevelop West Qurna I. Exxon is the lead contractor, while a Shell affiliate was also holding a stake under the 2010 agreement. In 2018, Shell sold its stake in West Qurna 1 to Japan’s Itochu.

Iraq plans to invite international companies to compete to build a 300,000 b/d refinery. The refinery, to be built in the Basra Governorate, will be offered under the Build Operate Transfer or Build Own Operate Transfer investment model. A petrochemical facility could be integrated into the refinery at a later stage.

The US granted a 45-day waiver extension to Iraq, allowing it to keep paying for Iran’s electricity imports. The prior 60-day waiver extension was due to expire on Nov. 22nd. Iraq depends on imports because of frequent power shortages and its flaring of associated gas, bound by production limits due to the country’s attempted adherence to OPEC+ cuts.

Libya: France’s Total is in talks to increase energy investment in Libya, where oil output has surged in the past two months amid a truce in the OPEC member’s civil war. According to the National Oil Company, output had already recovered to 1.25 million b/d, the same amount Libya was producing before it collapsed into political chaos. The speedy resurgence in Libyan oil flows — it was producing less than 100,000 b/d in early September — has surprised oil traders and exceeded analysts’ forecasts.

France’s Total has been active in Libya for decades and holds shares in crucial oil fields, including the nation’s largest — Sharara — and the offshore Al Jurf deposit. The company also has a stake in the Mabruk field, which has been closed for years because of political upheaval. The North African country produced 1.6 million b/d before a 2011 uprising toppled long-time dictator Muammar Qaddafi.

Venezuela: The US Treasury said Chevron and US oilfield services firms could remain in Venezuela until June, extending a wind-down deadline set to expire on Dec. 1st. The move effectively punts Chevron’s oil and gas operations to the administration of President-elect Biden, who could choose a more lenient path in negotiations with Caracas. Chevron has long argued the US benefits from having a producer on the ground in a country that holds the world’s largest crude reserves. But the sanctions imposed by President Donald Trump against Nicolas Maduro’s regime have won bipartisan support, making it difficult for Biden to change course.

Oil production in Venezuela fell to 367,000 b/d in October, the lowest level seen since the 1940s. Sanctions caused partners in oil fields to reduce operations significantly. After Russia’s Rosneft and China National Petroleum stopped buying oil from the regime, Maduro relied mostly on another sanctioned nation – Iran.

Creditors from hedge funds to oil companies are moving closer to seizing billions of dollars in Venezuela’s overseas assets, posing a threat to an opposition movement that has sought to protect the assets for an eventual change of government. Tens of billions in Venezuelan money and property is up for grabs, including Houston-based oil-refining company Citgo Petroleum Corp., gold bullion housed in the Bank of England, bank accounts in New York and real estate and aircraft in South Florida.

Fuel shortages in Venezuela are so dire amid the deepening crisis that Venezuelans are stealing crude oil from idle oilfields and processing it at home to make low-quality gasoline. The quantities of stolen crude are small, but they nevertheless show the desperation of Venezuelan people.

3. Climate change

President-elect Biden is already drafting orders to reduce planet-warming pollution and seeking nominees who will embed climate policy not only in environmental agencies but in departments from Defense to Treasury to Transportation. Top candidates for senior cabinet posts, such as Michèle Flournoy for defense secretary and Lael Brainard for Treasury, have long supported aggressive policies to curb climate change. Mr. Biden’s inner circle routinely asks, “is the person climate-ambitious?” of candidates even for lower-profile positions like the White House budget and regulatory offices. Transition team members have been instructed to identify policies that can improve Black and Latino communities’ pollution levels. And one of Mr. Biden’s early executive orders is expected to require that every federal agency have a pollution control plan.

The American Farm Bureau Federation has long pushed against climate legislation and worked closely with the fossil fuel industry to defeat it. Last week, however, the Bureau announced it had joined an unlikely alliance of food, forest, farming, and environmental groups to work with Congress and the incoming Biden administration. The coalition hopes to reduce the food system’s role in climate change and reward farmers for lowering their greenhouse gas emissions.

The Trump administration asked oil and gas firms to pick spots where they want to drill in Alaska’s Arctic National Wildlife Refuge as it races to open the preserve to development and lock in drilling rights before President-elect Biden takes office. The move would be a capstone of President Trump’s efforts to open up public lands to logging, mining, and grazing — something Biden strongly opposes. The Trump administration abruptly removed a top official charting the government’s research on global warming, just as his agency began writing the next climate report card.

Last July Hurricane Hanna offered a preview of what was to come during the record-setting and destructive 2020 Atlantic hurricane season. Storm after storm underwent a process known to meteorologists as “rapid intensification,” in which storms gain strength extremely fast. This is an especially dangerous process when it occurs close to land, coming too suddenly for coastal residents to escape an exponentially potent storm.

Medical experts warn that the toxic pollution that envelops New Delhi annually will lead to more coronavirus deaths. By mid-November, the air in the city smells of acrid smoke, and a grimy brown haze covers the sky. The air quality is comparable to Beijing on its most polluted days. Air quality will deteriorate further as the temperature and winds drop, blanketing the nation’s capital region in smog for months. Farm stubble burning, vehicle emissions, and the encroaching winter have pushed the city’s air quality index into the severe category, while more than 5,000 coronavirus cases are being confirmed daily. Long-term exposure to air pollution is linked to 15 percent of “potentially avoidable” Covid-19 deaths, said researchers behind a new study published in the journal Cardiovascular Research.

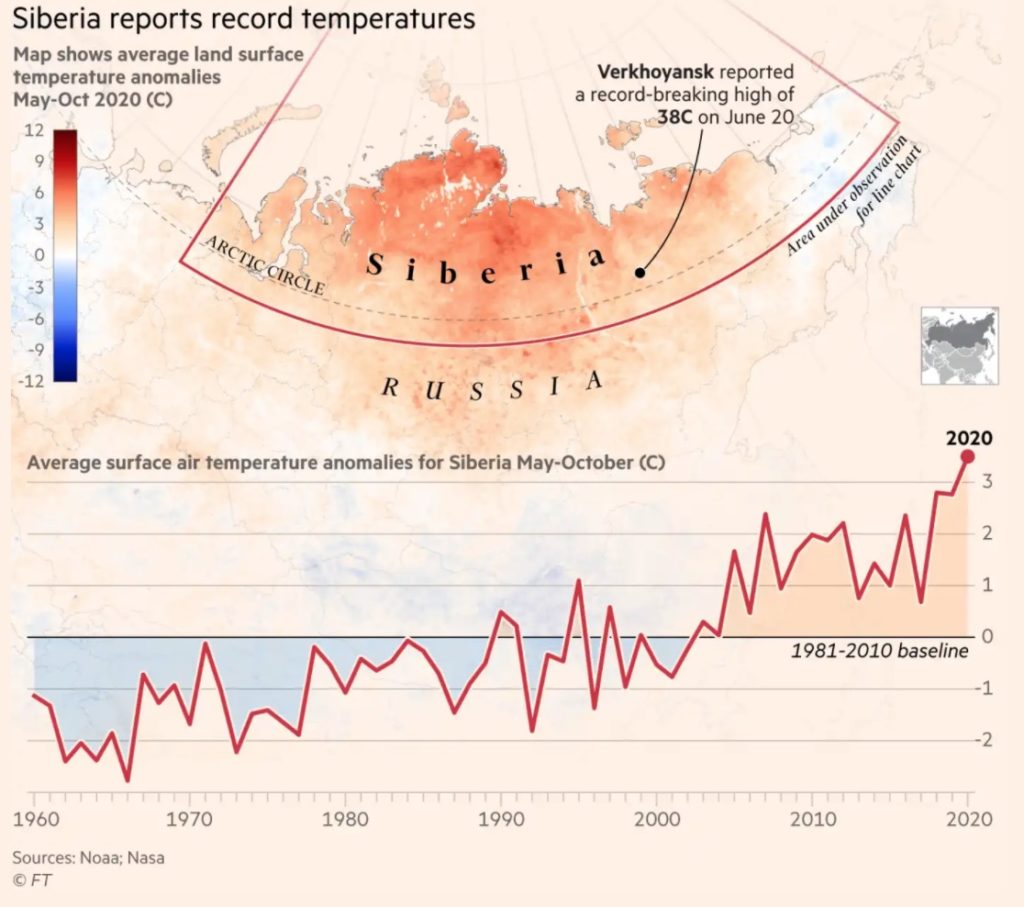

Siberia has experienced unusually high temperatures during the six months from May to October this year – more than 3 degrees C above average – to make 2020 one of the warmest years in the National Oceanic and Atmospheric Administration’s 141-year records. These warmer temperatures could lead to widespread effects, including more wildfires and melting of permafrost. Verkhoyansk, located inside the Arctic Circle, holds the record for both the hottest and the coldest temperatures in the Arctic. Temperatures have ranged from as low as 89F below zero to as high as 100F. It is thought that this amplification is caused by melting ice leading to a receding reflective surface for the sun’s energy. However, recent research focuses on further atmospheric and water temperature changes.

In the US, the coronavirus pandemic triggered a sharp drop in air travel and greenhouse gas emissions, which fell a record 9 percent in 2020 — the lowest level in at least three decades. According to a private research organization, the stalled economy is projected to have generated 5.9 billion metric tons of emissions, about the same level as 1983. As a result, the US has been inadvertently pushed back on track to meet the Obama administration’s commitments at the Paris climate agreement in December 2015, despite the Trump administration pulling the country out of the deal.

4. The global economy and the coronavirus

Leaders of the global economy are warning that the recovery from this year’s recession is at risk and could be derailed as the resurgence of Covid-19 forces new restrictions on households and companies. The International Monetary Fund and the Group of 20 sounded the alert as the G-20 prepare for a virtual summit hosted by Saudi Arabia. The IMF noted progress on a vaccine and said elevated asset prices point to a disconnect from the real economy and a potential threat to financial stability.

“While global economic activity has picked up since June, there are signs that the recovery may be losing momentum, and the crisis is likely to leave deep, unequal scars,” officials at the Washington-based fund said in a report published Thursday. “Uncertainty and risks are exceptionally high.”

United States: With a third surge of the Covid-19 pandemic hitting the US, many public-health authorities are warning the coronavirus is now so widespread that it will take pervasive new measures to contain it. Almost 80,000 patients are hospitalized with Covid-19 in the US. The Midwest saw horrific pressure on its medical system. North and South Dakota hospitals saw the highest number of inpatients Wednesday when, scaled for population, roughly one out of every 1,685 residents were hospitalized.

The number of Americans seeking unemployment aid rose last week to 742,000, the first increase in five weeks and a sign that the viral outbreak is likely slowing the economy and forcing more companies to cut jobs. The worsening pandemic and the arrival of cold weather could accelerate layoffs in the weeks ahead. Of the roughly 20 million Americans now receiving some form of unemployment benefits, about half will lose those benefits when two federal programs expire at the end of the year. The expiration of federal benefits later this year will put a renewed strain on household incomes. Overall, the labor market remains under stress.

China: Nearly one million people have taken an experimental coronavirus vaccine developed by China National Pharmaceutical Group. In July, China launched the vaccination program, which includes three vaccine candidates for essential workers and other limited groups of people, even as clinical studies have yet to be completed to prove their safety and efficacy. No severe adverse reaction has been reported from those who received the vaccine in emergency use.

China’s economic activity posted a broad-based recovery in October, paving the way for a faster economic rebound in the final quarter. Both investment and consumer spending grew faster in October than the month before, while industrial production, the first sector to emerge from this year’s coronavirus-induced slump, remained stable.

President Trump plans several new hardline moves against China in the remaining weeks of his term, potentially tying President-elect Biden’s hands. Actions under consideration include protecting US technology from exploitation by China’s military organizations, countering illegal fishing, and more sanctions against Communist Party officials for institutions causing harm in Hong Kong or the far western region of Xinjiang.

After 30 years of moving tens of millions from rural villages to cities where they could supply the inexpensive labor that sent the nation’s economy surging, now Beijing is urging people to return to villages in the countryside. President Xi wants to repopulate rural towns with entrepreneurs and consumers.

European Union: The British government unveiled a sweeping package of measures designed to zero out Britain’s greenhouse gas pollution by mid-century. The prime minister’s 10-point plan covers everything from diesel cars to hydrogen and offshore wind power. It’s one of the most significant packages of climate measures set out by a British prime minister—and even won measured praise from Greenpeace.

However, experts say the government will have to more than double the $16 billion it proposed and develop a more detailed road map if it wants to achieve carbon-neutrality by 2050. Analysis by the independent UK Climate Change Committee showed Britain isn’t even on track to reach its previous goal of cutting emissions by 80 percent in the next 30 years.

Many new targets are in line with what businesses have been asking to decarbonize transport and industry—two of the most challenging areas to clean up. That includes a plan for 5 gigawatts of hydrogen capacity by 2030 and a commitment to developing small modular nuclear reactors. Other proposals are more contentious, including banning the sale of new diesel and gasoline cars from 2030. The government recently reached a compromise with the auto industry by delaying the ban on hybrids until 2035.

Passenger car sales in Europe slumped again in October amid new restrictions in many countries aimed at containing a coronavirus’s resurgence, the European carmakers’ association reported. The European industry registered 953,616 new cars last month, a decrease of 7.8 percent, and a reversal of fortunes after September marked the first increase of the year.

Germany’s construction sector expects nominal sales to fall for the first time in more than a decade this year. Companies in Europe’s largest economy are scaling back building activity due to the pandemic. In real terms, sales are seen falling by roughly 1 percent this year and between 3-4 percent next year. The main drag comes from weaker construction orders from industrial clients, while public sector activity and real estate construction are expected to fare better.

France’s second lockdown will push its economy back into a slump and slow the recovery in 2021, even though restrictions to contain the coronavirus aren’t as severe as earlier in the year. In a best-case scenario of restrictions ending Dec. 1st and a quick return to the activity levels seen just before the second lockdown, the output would still drop 2.5 percent. If activity remains at November’s levels through December, the contraction could be as deep as 6 percent.

Middle East: Gulf oil producers are losing billions of US dollars from oil revenues this year due to the pandemic that crippled oil demand and prices. Because of predominantly oil-dependent government incomes, budget deficits across the region are soaring. Middle East’s oil exporters rushed to raise taxes and cut spending earlier this year, but these measures were insufficient to contain the damage. The major oil producers in the Gulf then rushed to raise debt via sovereign and corporate debt issuance. The region’s issues have already hit $100 billion, exceeding the previous record amount of bonds issued in 2019. Thanks to low-interest rates and high appetite from investors, the petrostates are binging on debt-raising to fill the widening gaps in their balance sheets that oil prices well below their fiscal break-evens leave.

While many Gulf nations were already working to diversify their economies before the pandemic, the subsequent economic downturn and collapse in oil prices have meant that governments in the region have had to reassess and – in some cases – accelerate their strategic plans. With economies operating under capacity and global travel severely curtailed, there has been a significant drop in demand for oil, accounting for around 45 percent of GDP in Saudi Arabia and 75 percent of government revenue in Oman. This oil dependency explains why the IMF collectively projects gulf economies to contract by 6.6 percent in 2020.

Saudi Aramco returned to the debt markets for the first time since April 2019, selling $8 billion of bonds to help fund the world’s largest dividend. The state oil and gas firm issued the debt on Tuesday after slumping crude prices caused profit to fall by 45 percent in the third quarter. That has left it unable to generate enough cash to fund shareholder payouts it promised will reach $75 billion this year. Almost all of those will go to the Saudi Arabian government.

UN Secretary-General Antonio Guterres said on Friday that Yemen is in “imminent danger of the worst famine the world has seen for decades.” Aid workers have raised fears that if Washington designates the Houthis as a Foreign Terrorist Organization, it could prevent life-saving aid from reaching the country.

After years of intense fighting, which killed half a million people and ensnared world powers from Moscow to Washington, President Bashar al-Assad’s regime — accused of war crimes and arbitrarily jailing thousands without trial – now controls two-thirds of the country. Fighting has subsided across much of Syria except in the north-west, where Russian jets back Assad and Turkish troops support opposition fighters.

Syria’s economic collapse has been aggravated by pandemic-related lockdowns, the Lebanese banking crisis, and the regime’s international isolation. Western financial sanctions prohibit fuel sales to Syria, meaning the only country it can buy oil from is Iran. A minor oil producer and once a wheat exporter, the government is so cash strapped that last month it reduced subsidies on the one staple Syrians could just about afford – bread. The price of bread produced by government bakeries has doubled to 100 Syrian pounds. Even before it cut subsidies, people living in regime-controlled areas – in effect, much of the country — complained that bread and fuel shortages, as well as endless queueing, had become a fact of life in a country previously classified as “middle income”.

5. Renewables and new technologies

A new hydrocarbon study led by researchers at Los Alamos National Laboratory contradicts conventional wisdom about how methane is trapped in rock. The study suggests a new strategy to access energy resources more quickly. The most challenging issue facing the shale energy industry is the low hydrocarbon recovery rates: less than 10 percent for oil and 20 percent for gas. The study yielded new insights into the fundamental mechanisms governing hydrocarbon transport within shale nanopores. The results could help develop better pressure management strategies for enhancing unconventional hydrocarbon recovery.

BP and Ørsted signed a letter of intent to develop a project for industrial-scale green hydrogen production via electrolysis using renewable power which produces zero emissions. In their proposed Lingen Green Hydrogen project, the two firms intend to build an initial 50-megawatt electrolyzer and associated infrastructure at BP’s Lingen Refinery in northwest Germany. This will be powered by renewable energy generated by an Ørsted offshore wind farm in the North Sea, and the hydrogen produced will be used in the refinery.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

Norway’s Equinor will raise crude production from its flagship Johan Sverdrup field to 500,000 b/d by year-end from 470,000 b/d, with the second phase of the project eventually taking production to 720,000 b/d. (11/18)

More refineries in Europe are at risk of permanent closures, with fuel demand on the continent falling again as major economies re-imposed lockdowns to fight the spike in coronavirus cases. Gasoline demand in Europe is expected to be between 15 and 20 percent lower in November and December than in the same months of 2019. (11/21)

Nigeria’s infrastructure is behind other emerging market peers, with about $3 trillion needed over 30 years to close the gap. Given the country’s budget constraints, the rating agency noted that addressing this shortfall will require financing from the private sector, multilateral development institutions, and other non-state investors. (11/21)

Brazil is fast shaping up to the world’s premier offshore oil boom. A combination of vast oil potential, low sulfur light, and medium crude oil blends, and growing demand from refiners for sweet lighter crude oil coupled with low breakeven costs makes it a highly appealing jurisdiction for investment from global energy majors. (11/16)

In Argentina, sharply weaker oil prices, growing threats to oil demand, and the imminent arrival of peak oil demand could unleash a wave of stranded oil assets in South America. Among the most vulnerable is Argentina’s Vaca Muerta shale play. There were already significant headwinds impacting operations and investment in the shale oil and gas play before the March 2020 price crash and the outbreak of the COVID-19 pandemic. (11/18)

Guyana disappointment: After a series of significant oil discoveries offshore Guyana, ExxonMobil and partners found that the deepest well drilled so far offshore the Latin American country did not have commercial potential for a stand-alone development. (11/18)

Keystone pipeline: TC Energy Corp says it is continuing to advance its Keystone XL oil pipeline, the $9 billion project that would move oil from Alberta to Nebraska. A Canadian indigenous group recently said it would invest C$1 billion ($764.35 million) in the project, which has been in the works for 12 years. That surprised some. (11/19)

The US oil rig count decreased by 5 to 231, ending eight weeks of increases, according to Baker Hughes. Meanwhile, active gas rigs rose by 3 to 76. Canada’s overall rig count rose by 12 this week. Canada’s active oil and gas rigs are now at 101, down 36 year on year. (11/21)

GOM lease strong: In a move that came as a surprise to some, last week’s oil and gas lease round in the US Gulf of Mexico generated substantial interest on Wednesday. The sum of the high bids clocked in at $120 million. Of the 14,900 blocks offered in Sale 256, 93 received bids, for a total 517,732 acres that received bids. Twenty-three companies submitted bids. The deepest blocks generated the most interest. (11/19)

Halt ANWR auction: A group of investment firms, conservationists, and indigenous groups have called on some of the world’s biggest insurers to cease supporting oil and gas projects in the US Arctic National Wildlife Refuge, even as the Trump administration advances plans to auction drilling rights in the Alaska wilderness. (11/20)

GM’s EV push: General Motors says a pending breakthrough in battery chemistry will cut its electric vehicles’ price, so they equal those powered by gasoline within five years. The technology also will increase the range per charge to as much as 450 miles. The company’s product development chief promised a small electric SUV that will cost less than $30,000 and pledged to roll out 30 battery-powered models worldwide by 2025. (11/20)

CA’s EV sales: BEV (battery electric vehicles) registrations saw a slight increase from the 3rd quarter of 2019 (from 26,210 to 27,565 units), reaching a 6.7 percent market share in Q3 as registrations of traditional fuel vehicles were down more sharply. According to California’s New Car Dealers Association, year-to-date 2020 new vehicle market-share for full electrics is 6.1%, up from 5.1 percent in 2019. (11/18)

The growth in EV adoption, especially in emerging markets, threatens long-term oil demand growth, Carbon Tracker has reported, citing these markets’ dependency on imports that could be relieved by switching to electric vehicles. Emerging market oil importers spend 2 percent of GDP on oil imports. (11/21)

New gasoline car sales ban: The UK is bringing forward a ban on sales of new gasoline and diesel cars to 2030 while maintaining a 2035 cut-off for hybrids — vehicles that include battery propulsion alongside an internal combustion engine. The decision is intended to boost investment in electric vehicles (EVs) and charging networks and contribute to a UK target of “net zero” carbon emissions by 2050. (11/19)

More new gas car sales ban: The Canadian province of Quebec said that it would ban the sale of new gasoline-powered passenger cars as of 2035. The province joins California and others in announcing moves to shift to electric vehicles and reduce greenhouse gas emissions. (11/17)

Coal plant conversion: Xcel Energy Inc. intends to convert its first coal-fired power plant in Texas — a 1,018-MW generating station — to run on natural gas, a plan in line with the investor-owned utility’s goal to cut emissions from its generation facilities 80 percent from 2005 levels by 2030 and be carbon-free by 2050. The first of the three units at the plant began operating in 1976, with others added in 1978 and 1980. All were designed to burn both coal and natural gas; the conversion will occur by January 1, 2025. (11/17)

UN: no more coal. The world must stop building new coal power plants and instead embrace green alternatives in a post-coronavirus reset world, UN Secretary-General Antonio Guterres said on Saturday. (11/16)

EU’s green push: The European Union wants a massive increase in offshore wind to help clean up the electricity industry and aid the recovery after the pandemic. To meet its mid-century goal of becoming the world’s first climate-neutral continent, the region needs to boost offshore wind capacity to 300 gigawatts by 2050 from just 12 gigawatts now. (11/19)

Spain’s H2: Spain’s government has opened a month-long window for green hydrogen project developers to register their plans with the state following a pledge to invest Eur1.5 billion ($1.8 billion) in the sector through to 2023. (11/21)

H2 in ships: For several years now, the Norway-based marine and maritime technology company Havyard Group has carried out R&D work on hydrogen propulsion for large vessels. Havyard’s complete hydrogen system for ships will be completed in 2021. The group is now establishing a separate company to meet market demand for the solution, which will make it possible for large ships to sail longer distances with zero emissions. (11/21)

Small nukes: The UK is championing small nuclear reactors as a crucial part of its decarbonization strategy in a move that left developers of traditional large-scale plants in limbo. Small modular reactors can be prefabricated and delivered to sites partly constructed. (11/19)

Transit nightmare: New York City would collapse without its subway system. That kind of dire outcome is a real risk if proposed transit cuts come to pass, experts say, as the pandemic wreaks havoc on agency budgets. New York’s MTA faces a $16.4 billion deficit through 2024; officials have asked for $12 billion in emergency relief by the end of 2021. Ridership on the subway is well below pre-pandemic levels. (11/20)

In the UK, Prime Minister Boris Johnson called the devolution of powers to Scotland “a disaster”, a comment that played into the hands of Scottish nationalists pushing for an independence referendum that 14 recent opinion polls suggest they could win. (11/17)

Looming famine concerns: In April, the head of the WFP warned of devastating famines in dozens of countries due to the ramifications of COVID-19. World leaders responded with funds and stimulus packages and managed to avoid the worst-case scenario. As the coronavirus continues to surge, prompting another wave of shutdowns, David Beasley says funding available this year will not be available in 2021. (11/18)