Editors: Tom Whipple, Steve Andrews

Quote of the Week

“Funding for Arctic drilling is becoming harder and harder to find. Both oil companies and banks have decided they can no longer tolerate the risk of drilling in one of the fastest-warming places on the globe.”

Jennifer Dhouly, Bloomberg News

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

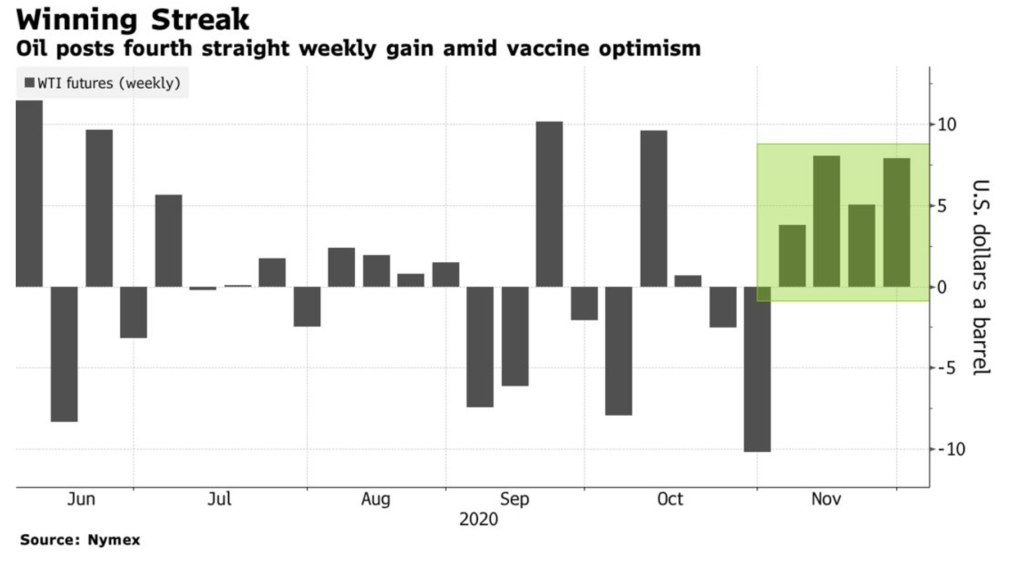

Oil: Prices rose for a fourth straight week, buoyed by optimism over Covid-19 vaccine progress ahead of an OPEC+ ministerial meeting this week. Futures in New York advanced 8 percent last week, despite edging lower on Friday. The shape of the oil futures curve firmed over recent sessions, with some nearer-dated futures contracts rising above later-dated ones. It’s a sign of how the market has dramatically repriced the increased likelihood of a vaccine rollout jumpstarting more robust demand next year.

West Texas Intermediate crude settled at $45.53 a barrel in New York, while Brent settled at $48.14, up 7 percent for the week.

US crude oil inventories edged lower in the week ended Nov. 20th amid an uptick in refinery demand and exports. EIA data showed total commercial oil stocks declined 750,000 barrels to 488.72 million barrels. This counter-seasonal draw narrowed the surplus to 6.2 percent of the five-year average — the weakest since early April. Crude stocks were lower across all regions outside the US Gulf Coast. Still, the draw was concentrated at the NYMEX delivery point of Cushing, Oklahoma, where inventories declined 1.72 million barrels to a six-week-low 59.89 million barrels.

A Rystad Energy market analysis says that planned refinery additions will far exceed closures in the next five years. The utilization rates will likely never recover to pre-pandemic levels unless some capacity closes early. New and expanding projects from the beginning of 2020 and up until the end of 2025 are estimated to add about 13 million b/d of global capacity as Asian and Middle Eastern refiners complete expansions and new plants. Meanwhile, a surge of capacity closures will reach only about 3 million b/d, a relatively small number compared to additions. This means that net refining capacity additions will reach 10 million b/d between the beginning of 2020 and the end of 2025.

OPEC: Formal ministerial meetings are scheduled for Monday and Tuesday this week when producers decide whether to postpone the planned output hike. OPEC and its Russia-led partners are leaning toward extending oil production cuts for another two to three months, a move they hope will keep markets tight as prices start to recover. Officials said a deal isn’t done yet, and issues related to several countries’ past compliance could still prevent an agreement when the group meets this week.

World oil prices are now near $50 a barrel, up 25 percent this month and Chinese and Asian demand has recovered as Covid-19 eases there. Promising results for several Western vaccines have lifted stock markets and crude prices. Taken together, these developments argue for increasing production. Some OPEC members like the UAE, Iraq, and Nigeria have expressed misgivings over maintaining the status quo.

Natural Gas: US production has been at a seven-month high over the past week as producers in Texas, Louisiana, and Appalachia reset the outlook for supply and prices this winter. On Nov. 17th, total US output climbed to its highest since April at more than 90 billion cf/d followed up with another single day high at nearly 92 billion on Nov. 23rd. These production gains have added to market jitters over this November’s mild weather. Over the past week, the Henry Hub’s cash prices have averaged just $2.28, down 50 cents, or about 18 percent, from a prior-week average of $2.78 per million Btu.

The US natural gas storage withdrawal season started one week later than usual. A below-average draw of 18 Bcf for the week ended Nov. 20th as the Henry Hub winter strip shows slight declines with demand somewhat muted for the week in progress. US natural gas storage inventories decreased to 3.940 Tcf for the week ended Nov. 20th.

It’s shaping up to be another warm winter, which would be bad news for natural gas prices. A collection of long-range government and commercial forecasts points to the southern and eastern US being warmer than usual through December, January, and February. Northern Europe will likely have milder temperatures too. If the forecasts hold, the 2020-2021 season will be the latest in a series of abnormally mild winters across the Northern Hemisphere, and more proof that the climate is changing.

Around the North Pole, a situation is developing that mirrors last year. The polar vortex, a band of winds that swirl around the borders of the Arctic, is starting to build. The stronger the vortex, the more the cold remains stuck over the pole, rather than spilling into the population centers of Asia, Europe, and North America.

Prognosis: Next week’s meeting of OPEC and its partners, at which the alliance will decide on production levels from January, will determine the market’s direction in the short term. Over the longer haul, uncertainties remain. Covid-19 vaccines could boost global economic prospects and bolster demand for oil in 2021 if there is widespread distribution of the shots. However, the current coronavirus cases in both the US and Europe could prompt new travel and business restrictions, weighing on demand.

2. Geopolitical instability

(These are the situations that are reducing the world’s energy supplies or have the potential to do so.)

Iran: The situation in the Middle East could have changed dramatically when Iran’s top nuclear scientist was killed in an ambush on Friday. The scientist, Mohsen Fakhrizadeh, was considered the driving force behind Iran’s nuclear weapons program for two decades, and he continued to work after most of the effort was quietly disbanded in the early 2000s.

Iran’s supreme leader promised on Saturday to retaliate for the assassination. Ayatollah Ali Khamenei, who says Tehran has never sought nuclear arms, pledged in his statement to continue the work of Fakhrizadeh. The killing, which Iran’s president was swift to blame on Israel, threatens to spark a new Middle East confrontation in the final weeks of President Trump’s term. It could also complicate any efforts by President-elect Joe Biden to revive a detente with Tehran forged when he was in Barack Obama’s administration.

The Iraqi government is on edge as the Trump presidency enters its final weeks, fearing that a confrontation between the US and Iran could erupt on Iraqi soil. Iraqi Prime Minister al-Kadhimi is under pressure from US officials to escalate his government’s crackdown on Iran-backed militias in Iraq, whose rockets have repeatedly targeted diplomatic and military sites used by Americans over the past year. President Trump has now told his advisers he is prepared to order a devastating response if any Americans are killed in attacks attributed to Iran.

The US and Iran have been messaging their resolve in recent days. The US sent a B-52 bomber task force to the Middle East “to deter aggression and reassure US partners and allies”. The Navy begin moving an aircraft carrier task force toward the Persian Gulf as a hedge against unanticipated events. The show of force comes as the Trump administration is drawing down US troops in Afghanistan, Iraq, and Somalia. The Pentagon’s message to Iran seems to be a cautionary warning against exploiting the situation, rather than a direct threat. But the confrontation over Iran’s nuclear program looms in the background.

A recent meeting between Israel’s prime minister and Saudi Arabia’s crown prince sent a strong signal to allies and enemies alike. The two countries remain deeply committed to containing Iran, their common foe. This was the first publicly confirmed visit to Saudi Arabia by an Israeli leader and a meeting that was unthinkable until recently as the two countries do not have formal diplomatic relations.

Europe is looking to the incoming Biden administration to reduce tensions with Tehran but won’t press Washington to re-enter the 2015 nuclear accord with Iran quickly. While European countries remain supportive of the 2015 nuclear deal, officials from France, Britain, and Germany—countries that helped negotiate the accord—say a full return to the agreement might not be achievable or even desirable before Iran’s presidential elections in June.

Iraq: Iraq is seeking an upfront payment of about $2 billion in exchange for a long-term oil-supply contract, the latest sign of Baghdad’s growing desperation for cash as its economy unravels. As state coffers dwindle and schoolteachers go unpaid, the country risks a repeat of upheaval last year that brought down the government and saw hundreds of protesters killed. The government is seeking to improve its financial position by proposing five-year supply contracts to export 4 million barrels a month, or about 130,000 b/d. The buyer would pay upfront for one year of supply, which at current prices would bring in just above $2 billion.

Cash-strapped oil producers have in the past relied on pre-payments deals to raise money, but Baghdad hasn’t done so until now. The semi-autonomous Kurdistan Regional Government in northern Iraq has used similar contracts, as have Chad and the Republic of Congo. In a pre-payment deal, the oil buyer effectively becomes a lender to the country. The barrels are a security for the loan. Iraq’s proposal to offer crude buyers a five-year contract already has garnered interest from several Asian oil companies.

Baghdad no longer wants to accept the OPEC model of “one size fits all” output cuts without considering members’ economic and political conditions. The country’s deputy prime minister said Nov. 23rd, “I would say that we have reached the limit of our ability and willingness to accept a policy of one size fits all. We are beginning to articulate that position.”

Iraq could wean itself off Iranian energy imports by taking advantage of gas production in the semi-autonomous Kurdistan region, a US official said. The country continues to come under pressure from Washington to part ways with Tehran. “The US remains a steadfast champion of Iraqi sovereignty and continues to oppose Iran’s efforts to undermine it,” Mark Menezes, US Deputy Secretary of Energy, told a virtual Kurdistan conference organized by the US-Iraq Business Council.

Baghdad has taken a significant step toward holding early elections by ratifying an election law that addresses some anti-government protesters’ demands who blamed the old system for helping perpetuate a dysfunctional status quo. The legislation makes two significant changes. Under the new “single non-transferable vote” system, Parliament’s seats will be awarded to the candidates who win the greatest number of votes. This is in contrast to the old system, in which candidates ran on electoral lists and parties could transfer votes among list members, which empowers party bosses.

Libya: Libya’s National Oil Corporation (NOC) will not be transferring the revenues from crude oil sales to the Central Bank of Libya until the Bank adopts transparent policies on the spending of those revenues. The NOC said last week that the Central Bank is providing false and misleading figures about the revenues and expenditures from the oil fund.

The company also said that it would like to reassure the Libyan people of the accuracy of the payment and collection systems and confirm that the total revenues of the State of Libya, as well as the rights of the foreign partners, are accurately documented and held in the National Oil Corporation account at the Libyan Foreign Bank. These revenues will not be transferred to the Central Bank until the Bank has transparency regarding the spending of the oil revenues during recent years and the entities that benefited from such payments.

An armed group attempted to break into the National Oil Corporation’s Tripoli headquarters on Nov. 23rd as the state-owned company was engaged in the dispute over oil revenues with the country’s central Bank. The incident came a few days after Libyan oil production reached 1.2 million b/d, its highest level in almost a year.

Venezuela: Caracas has restarted direct shipments of crude oil to China despite the US sanctions. Venezuela’s oil company sold oil to China via ship-to-ship transfers at sea, similar to how Iran avoided the sanctions. Now tankers loaded with Venezuelan crude are sailing straight to China, which is the biggest buyer of Venezuelan oil as it is of Iranian oil.

A Venezuelan judge found six American oil executives guilty of a wide-ranging corruption scheme and immediately sentenced them to prison. The so-called “Citgo 6” — employees of the Houston-based Citgo refining company, which is owned by Venezuela’s state oil company, PDVSA — had been lured to Venezuela three years ago for a business meeting and arrested. The men each face more than eight years in prison.

Five of the six are Venezuelan-Americans with families in Texas and Louisiana, and one is a permanent US resident. The men were summoned to the headquarters of the Venezuelan state-run oil firm PDVSA, the Houston-based Citgo parent company, for what they had been told was a budget meeting on Nov. 21, 2017. Instead, military intelligence officers swarmed the boardroom, taking them to jail. Last week the US Secretary of State said the US “unequivocally condemned” a Venezuelan court’s conviction of the six former US refiner Citgo executives of corruption charges and called for them to be sent home.

Yemen: The Houthi rebels said last week they had fired a missile against a distribution center of Saudi Aramco in the Saudi city of Jeddah and had hit it. The group also warned that “operations will continue,” advising foreign companies and Saudi Arabia residents to be cautious. The incident took place a week after Saudi Arabia said it had thwarted a Houthi attack on an oil products terminal near the border between the Kingdom and Yemen.

Later in the week, an oil tanker was damaged in the Red Sea. The tanker, managed by a Greek company, was hit by a mine off the Saudi city of Shuqaiq near Yemen. The ship was struck about 1 meter above the waterline and suffered a breach of the hull.

In retaliation, the Saudi-led coalition fighting Houthi forces in Yemen carried out a series of air raids on barracks used by the Iran-aligned group in and around the Yemeni capital Sanaa on Friday. Saudi-led coalition forces intervened in Yemen’s war in March 2015 to restore the Yemeni government ousted from power in Sanaa by the Houthis in late 2014. Houthi forces have staged many missile and drone strikes on civilian airports and oil infrastructure in Saudi Arabia, including on the capital Riyadh. Cross-border attacks by Houthi forces, who control most of north Yemen, have escalated since late May when a ceasefire for the coronavirus pandemic expired.

3. Climate change

President-elect Biden affirmed climate change as a top priority by selecting former Secretary of State John Kerry to serve as a special envoy for climate and giving him a seat on the National Security Council. Kerry’s task will be not only to bring the US back into the Paris Agreement but to lead a push for more ambitious commitments to cut carbon emissions worldwide.

Progressive environmentalists are mounting an effort to get the president-elect to go beyond naming a climate czar and declare a national environmental emergency, borrowing a tactic employed by President Trump to fund part of his border wall. Invoking a climate emergency could give Biden the authority to circumvent Congress and fund clean energy projects, shut down crude oil exports, suspend offshore drilling, and curtail fossil fuels’ movement on pipelines, trains, and ships, according to a research note by consulting firm ClearView Energy Partners.

Janet L. Yellen, the president-elect’s pick to run the treasury at a critical time, may also play a crucial role in getting corporations to take global warming seriously. Yellen, a former chair of the Federal Reserve, often has talked about addressing climate change. Climate activists now hope the department will guide the Biden administration’s tax, regulatory, and budget policies with that in mind.

The IEA executive director, Fatih Birol, said the election of Biden and his commitment to rejoining the Paris Agreement would create a “tremendous momentum” to fight climate change. It will also likely lead to a “big push” for technological innovation. Speaking at an online Autumn Conference organized by Norway’s Equinor, Birol warned that despite COVID-19, China is set to produce more emissions this year than in 2019, as it leads the recovery from the pandemic.

Europe is moving to a decisive stage in discussions to toughen the bloc’s 2030 climate target and put into law the ambition to become the world’s first climate-neutral continent by the middle of the century. European Union governments will discuss a plan for the leaders to endorse at their Dec. 10-11 meeting to reduce greenhouse gases by at least 55 percent by 2030 from 1990 levels.

Can you put a price on pollution? Some of the world’s biggest economies are doing just that as they wrestle with how to make good on grand pledges to tame planet-warming emissions. China, Japan, and South Korea have followed the European Union in pledging to cut emissions to “net zero” in recent weeks, where they release only as much as they remove from the air. US President-elect Biden made the same promise in his election campaign. Next year they are set to layout the first practical measures to meet these targets as part of commitments under the Paris climate accord. Putting a price on carbon emissions will be at the center of the deliberations.

4. The global economy and the coronavirus

Last Monday, the announcement that a cheap, easy-to-make coronavirus vaccine appeared to be up to 90 percent effective was greeted with jubilation. The vaccine, developed by AstraZeneca and the University of Oxford, costs less than a cup of coffee. However, since unveiling the preliminary results, AstraZeneca has acknowledged a critical mistake in the vaccine dosage received by some study participants, adding questions about whether the vaccine’s apparently spectacular efficacy will hold up under additional testing.

The world’s economic recovery is wildly uneven — and that again was on display this week. US data on the eve of the Thanksgiving holiday offered signs of both strain and strength. Germany’s resilience was also on display in European PMI numbers — even amid new lockdown measures that have knocked the economy back. No matter where in the world you are, the economic consequences of the pandemic are falling disproportionately on the young.

Air passenger numbers are set to have weakened by almost 61 percent in 2020 on the year to 1.8 billion. This is level with the number the industry carried in 2003, the association added. However, passenger numbers are expected to grow again in 2021 to around 2.8 billion.

United States: Daily coronavirus-related deaths in the US have reached levels not seen since the pandemic’s early throes. A surge in the number of those hospitalized is an ominous sign that the current jump in cases is beginning to take its deadly toll and that more grim months lie ahead. Last week the US recorded more than 2,200 new deaths, as well as the highest-single day increase since May 6th.

US health authorities will hold an emergency meeting this week and will likely recommend that a coronavirus vaccine awaiting approval be given first to healthcare professionals and people in long-term care facilities. The meeting, announced on Friday by a US Centers for Disease Control and Prevention committee on immunizations, suggests that the Food and Drug Administration may be close to authorizing distribution of the long-anticipated medication, at least to those considered most vulnerable. United Airlines has begun moving shipments of the vaccine, developed by Pfizer Inc, on charter flights to ensure it can be quickly distributed once it is approved.

Layoffs are rising again, and Americans’ incomes are falling. The latest signs of a resurgent pandemic and waning government aid are undermining the US economic recovery. Applications for state jobless benefits rose for the second straight week last week. Unemployment filings are up by more than 100,000 from the first week of November when they hit their lowest level since the start of the pandemic.

China: A spurt of missed debt repayments by Chinese state-owned firms – a coal miner, a chipmaker, and an automobile company – has shaken local markets and heightened speculation that a campaign to wean the economy off massive credit is back. The defaults have angered investors, who say their faith in the firms’ top-notch ratings, seemingly sound finances, and implicit state backing has been violated.

Chinese companies are facing a reality check after years of ramping up debt. A crackdown on unregulated lending — so-called shadow banking — and tighter rules on asset management made it harder for some to borrow fresh funds to repay existing debt. As the year wound down, private-sector defaults seemed to be coming down, but the list of state-tied firms in distress had grown, despite signs of an economic recovery.

In 2016, most defaults were in industries with excess capacities such as coal and steel. This year, transportation, tourism, and retailing were especially hard hit by the pandemic. But the pain extended wider. Yongcheng Coal & Electricity Holding Group Co., a state-run coal miner, blamed tight liquidity for its November default. Other companies with government ties that failed to repay domestic notes included Tsinghua Unigroup, a top chipmaker, and Brilliance Auto Group Holdings Co.

Crude throughput at China’s refineries is slightly higher in November, with state-owned oil companies lifting their average run rates by one percentage point month on month to 79.8 percent of capacity. According to the data, 39 refineries of state-owned oil giants Sinopec, PetroChina, CNOOC, and Sinochem planned to process 7.07 million b/d of crude in November, 79.8 percent of their nameplate capacity of 8.86 million b/d.

The explosive growth seen in China’s grain demand this year has not been caused by a temporary supply shortage but signals a structural change in domestic food consumption. China’s corn imports hit 7.8 million tons between January and October, a 1,151 percent increase from last year. China’s import volumes are already above the set annual tariff rate quota level of 7.2 million tons. Similarly, China’s wheat imports have hit 6.69 million mt in January-October, up 127 percent year on year. In comparison, barley imports rose 98.3 percent on the year to 6 million tons during the same period.

European Union: The continent’s Covid-19 crisis is moving eastward, from the wealthiest and best-prepared countries on the continent into the poorer states that have exported doctors for decades. With 238 physicians per 100,000 people, Poland has the lowest such ratio in the European Union, nearly half the level of Germany, whose relative success in handling the virus owes much to its foreign staff. The average age of Polish nurses is 53, just seven years short of retirement.

Primarily spared during the spring surge, Hungary, Slovakia, Poland, and Romania braced for autumn by stocking up on ventilators. But they lack people to operate the equipment. The shortages, which have prompted strict stay-at-home orders through Christmas in Poland, are the consequence of a borderless Europe that has seen prosperous countries—particularly in Western Europe—soak up talent from regions that offer lower pay. As a result, Italian and British hospitals are coping with Covid-19 with help from Polish, Romanian, and Hungarian staff.

The European Union and Britain said on Friday there were still substantial differences over a Brexit trade deal. With just five weeks left until the UK finally exits the EU on Dec. 31st, both sides call on the other to compromise on the three main contention issues – fishing, state aid, and how to resolve any future disputes. The two sides will shortly resume face-to-face negotiations after they were suspended last week when one of the EU chief negotiator Michel Barnier’s team tested positive for COVID-19.

British business activity contracted in November as a new wave of coronavirus restrictions hammered the huge services industry, but news of possible vaccines has boosted hopes for 2021. Britain’s economy is widely expected to contract in the fourth quarter – albeit by less than it did around the time of the first coronavirus lockdown.

Leading energy companies have urged the UK to embrace carbon trading after the Brexit transition period concludes and not adopt a carbon tax instead. In a letter to Boris Johnson, the group, which includes RWE and Uniper, said that tradable carbon credits remain the best way of cutting emissions. Currently, the UK is a member of the EU’s carbon trading system, allowing members to buy and sell credits enabling them to emit a certain amount of carbon. Although the government has said that it backs the development of a UK emissions trading system that can be linked to the EU’s, it is also mulling the introduction of a carbon tax if a deal cannot be agreed by Jan 1st.

Germany’s partial lockdown measures could be extended until early Spring if infections are not brought under control, Economy Minister Peter Altmaier said on Saturday. Altmaier told Die Welt it was impossible to give the all-clear while there were incidences of more than 50 infections per 100,000 inhabitants in large parts of Germany. “We have three to four long winter months ahead of us,” he was quoted as saying. “It is possible that the restrictions will remain in place in the first months of 2021.” Chancellor Angela Merkel agreed with leaders of Germany’s 16 federal states on Wednesday to extend and tighten measures against the coronavirus until at least Dec. 20th.

Russia: The “official “daily toll of Covid-19 deaths in Russia exceeded 500 for the first time. The rise in infections across the country puts increasing strain on hospitals, and medical staff complains about a lack of medicines and protective gear. The seven-day average number of Covid-19 deaths has reached 450, the highest so far, compared to less than 400 a week ago. Russia says it has the fifth-most cases globally, approaching 2.2 million, after the US, Brazil, India, and France. Federal authorities have refrained from locking down during the second wave of the pandemic. Instead they have announced limited restrictions in hard-hit regions. So far, only one of Russia’s 85 regions has imposed a lockdown.

President Vladimir Putin told officials last week that the situation wasn’t easy and described the rising mortality rate as the “most alarming” trend. More than 80 percent of Russia’s 265,000 Covid-19 beds are occupied, with several regions reporting occupancy above 90 percent. According to the government’s daily reports, 39,000 people have died from the disease since the start of the epidemic. But more complete official data on mortality released with a substantial lag put the toll far higher, at 55,671 from April through September. According to a former employee of the statistics agency, the real death toll could be three times the official daily total.

The makers of Russia’s flagship Covid-19 vaccine said that interim results from phase 3 trials showed efficacy rates of “above 95 percent”, overperforming some of the most effective of the western vaccines that have released results. The Kremlin is trumpeting the two-shot vaccine, known as Sputnik V after the Soviet satellite that kicked off the space race, as an alternative to vaccines from Moderna, Oxford University and AstraZeneca, and Pfizer/BioNTech.

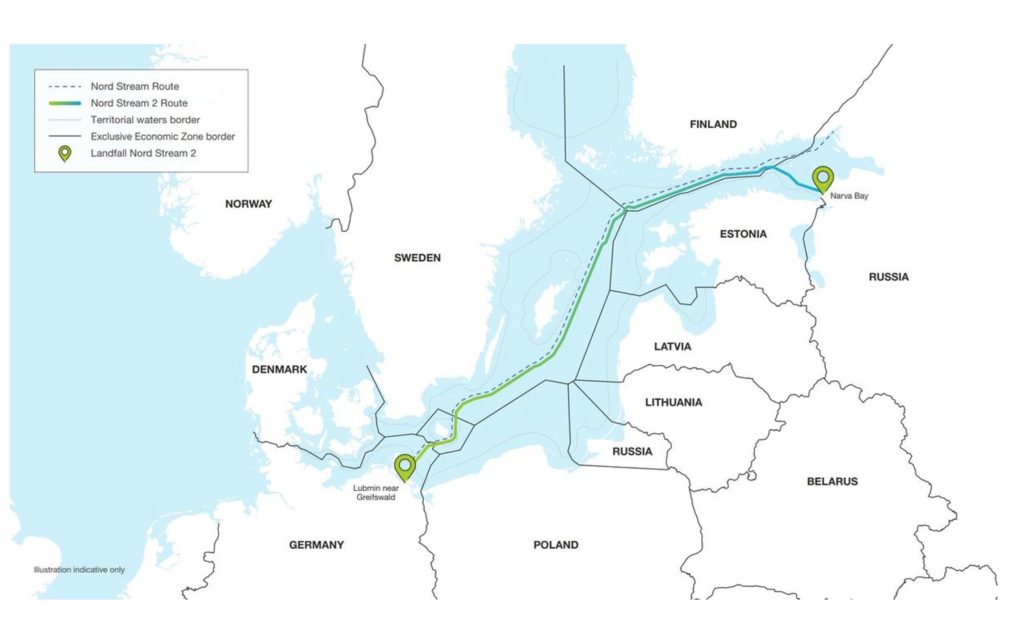

DNV GL, a Norwegian risk management and quality assurance firm, told Reuters it had suspended work on the gas pipeline Nord Stream 2 to avoid US sanctions on the Russia-led project. According to the new guidance in the Protecting Europe’s Energy Security Act, the US sanctions now include companies “providing services or facilities for upgrades or installation of equipment for those vessels, or funding for upgrades or installation of equipment for those vessels.”

The $11.2 billion gas pipeline under the Baltic Sea has become a significant source of friction in the trans-Atlantic relationship. President Trump urges Europe to roll back its dependence on Russian energy supplies. German companies and Chancellor Angela Merkel are against America’s interference, and the western companies set to reap the rewards once gas starts flowing have vowed to move ahead.

Gazprom has three problems to resolve before it can move forward: finding a ship to do the work, obtaining insurance for the project, and getting a certification that the work being done is safe and complies with European Union standards. Gazprom and Russia are working on all three fronts. “It is still possible for Nord Stream 2 to be built by summer 2021 and get all the necessary certification to flow gas the following winter,” says the Oxford Institute for Energy Studies, one of Europe’s foremost authorities on pipeline politics.

Saudi Arabia: The OPEC leader says it is likely to continue exporting oil at the same levels “for decades to come,” even as the world shifts towards renewables, former energy minister Khalid al-Falih said last week. Speaking at the G20 summit in Riyadh, Falih, who served as energy minister from 2016 to 2019, cautioned against a rapid transition to renewables, citing potential damage to the economy. “The kingdom believes that during the energy transition the world is going to need all energy sources, and that the transition from fossil to all-non-fossil fuels is a multi-decade, perhaps a multi-generational, journey.”

Crown Prince Mohammed bin Salman heralded the initial public offering of shares in Saudi Aramco as a showcase for raising massive capital for the kingdom. However, the offering has only put Aramco into a debt spiral and highlighted many problems in Saudi Arabia to international investors. Aramco is digging itself further into serious debt through bond issuances simply to pay for the substantial dividend payments promised by the crown prince that were required to persuade anyone to buy into the IPO. At this rate, the debt taken on by Aramco and other Saudi bond offerings to pay for the dividends will be far more than the amount of money raised in the IPO.

Saudi Arabia has used its year in the G20 presidency to promote its circular carbon economy scheme, reducing carbon emissions if adopted worldwide while maintaining abundant energy supplies. G20 member states have endorsed the circular carbon economy concept. Still, it has yet to be put into practice, and the kingdom has not revealed any timelines or targets associated with the plan. The Saudi climate change mitigation scheme is based on “four R’s” — reduction, reuse, removal, and recycling of carbon — to lower the amount of carbon emissions being released into the atmosphere. This includes initiatives such as planting trees as natural carbon sinks.

India: The pandemic has strangled one of the most potent economic growth engines in the world: spending by India’s 1.3 billion consumers. The country’s gross domestic product shrank 7.5 percent last quarter compared with a year earlier as Covid-19 has transformed the world’s fastest-growing economy into one that is now among those contracting the fastest. With more than 9.3 million people infected and 135,000 killed by the virus, India has been hard hit by the pandemic.

The latest GDP data marked the first time in decades that the country’s growth has contracted for two consecutive quarters. Private consumption, which makes up more than half of the country’s GDP, fell 11 percent during the quarter from a year earlier. Government spending, which made up about 11 percent of GDP during the period, was down 22 percent. Capital expenditures fell 7 percent.

Almost 300,000 farmers from various states are on their way to India’s capital to protest against new agricultural laws they say will severely hurt their incomes. About 100 leaders representing farmers have been arrested. The authorities in several states are trying to stop farmers from marching toward New Delhi, they said.

“We want the three bills to be repealed in toto,” a member of the coordination committee told a virtual press conference Wednesday. “We don’t subscribe to the view that” they are going to boost earnings of farmers, he said. Analysts and industry experts have said that a slew of reforms introduced by the government in September can change the face of Indian agriculture, which has been hampered by low yields and inefficient smallholdings. The new rules make it easier to sell crops in other states, while a rise in production would boost exports and farm incomes, they said.

However, farmers are worried that the new measures will eventually kill the government’s price support regime for crops and leave them at the mercy of big corporations to control the market.

5. Renewables and new technologies

The US Department of Energy is awarding $35 million to 11 projects as part of the Advanced Research Projects Agency-Energy’s Submarine Hydrokinetic And Riverine Kilo-megawatt Systems (SHARKS) program. The award recipients will develop new economically competitive hydrokinetic turbine designs for tidal and riverine currents. Hydrokinetic energy is an abundant renewable resource that can boost grid resiliency and reduce infrastructure vulnerability, but it is currently a cost-prohibitive option compared to other energy generating sources.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

International air travel could come booming back next year but with a new rule: Travelers to certain countries must be vaccinated against the coronavirus before they can fly. (11/25)

Tanker rates plunging: The amount of oil in floating storage has fallen significantly since this summer, thanks to OPEC+ cuts and a recovery in demand in China and, to a lesser extent, India. As a result, there is now a surplus of free tankers, which has brought daily freight rates—and consequently revenues and profits—down from the record high the industry enjoyed this spring. The immediate future looks even bleaker. (11/24)

New rule slammed: The International Maritime Organization approved on Friday a ban on the use of heavy fuel oil for ships in the Arctic, but environmental organizations criticized the new regulation as “riddled with loopholes” that would continue to exonerate some polluters well into the end of 2020s. (11/23)

Spain’s oil major Repsol plans to reduce its oil business operations and increase five times its renewable energy portfolio by 2030 as part of its latest strategic plan unveiled on Thursday. (11/27)

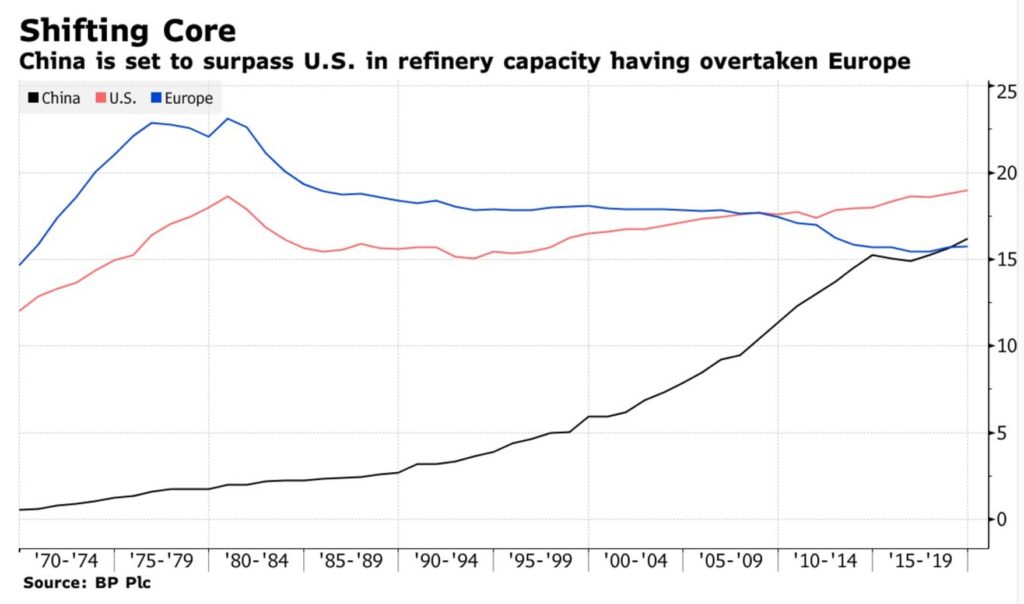

China’s refineries headed for #1: America has been the world’s top refiner since the start of the oil age in the mid-nineteenth century, but China will dethrone the US as early as next year, according to the IEA. Oil exporters are selling more crude to Asia and less to long-standing customers in North America and Europe. About two-thirds of European refiners aren’t making enough money in fuel production to cover their costs, so they will need to close more capacity as China expands theirs. (11/24)

Offshore Mozambique: ExxonMobil and Total are renegotiating a natural gas resource sharing deal for their respective liquefied natural gas projects. Both oil majors, looking to cut project costs, want to use the resources from a shared field first because that field will be cheaper to develop and operate. (11/27)

Angola plans to raise much-needed cash via selling a stake in its state oil firm Sonangol by early 2022 as the crash in oil prices—and the pandemic—severely weakened the country’s finances. (11/26)

In Nigeria’s delta region, explosions have damaged oil and gas facilities belonging to the Shell Nigeria and Agip Oil Company in Bayelsa State. (11/25)

Nigeria’s National Petroleum Corporation said it seeks to achieve 3 million barrels per day oil production soon. Their plan includes expanded exploration work, more seismic efforts, and resolving regional disputes that have hampered production activities. (11/26) (Ed. note: we’ve heard this before; according to BP, Nigeria’s 2019 production was 2.1 mb/d and has ranged between 1.9 and 2.5 mb/d since 1990)

Nigeria has this past week indicated its gradual departure from over-dependence on oil sales in a new plan that banks on five major sectors of the economy to reduce the debt burden, control inflation, and raise the employment rate for youth. (11/24)

Cry for Argentina? Chevron, ExxonMobil, Shell, and other international companies have reported that Vaca Muerta is as good or even better than Permian Basin, the most productive shale play in the US. The challenge, of course, is not below the ground but above it. Argentina has been in and out of economic crises for decades, defaulting three times on its debts over the past two. Frequent changes in regulations and controls on energy prices, including caps on diesel and gasoline prices, are hampering long-term investment plans. (11/25)

In Peru, a combination of sharply weaker oil prices, inconsistent regulation, the COVID-19 pandemic, and constant conflict in the Amazon, where most of Peru’s onshore oil industry is located, has triggered a crisis that has brought the industry to the brink of collapse. (11/27)

Mexico has granted full control over its natural gas supply to the state utility CFE and the national oil and gas company through a five-year plan for infrastructure development recently published. The project is designed to meet the needs of CFE as a dominant gas distributor and power generator, limiting access to other distributors. It is in line with recent decisions and regulations to restore the former monopolies’ dominance in power generation, oil, and gas. (11/26)

Piracy is a well-established problem in the energy industry, often seen in West Africa and other world regions. However, following the rise of the phenomenon during the 2020 Covid-19 pandemic, pirates are nearing US shores, presenting a new threat to the industry. This has become an increasingly common event in Mexico’s Bay of Campeche, the origin of 17 percent of US oil. (11/27)

According to Baker Hughes’ latest report, the US oil rig count grew by ten last week to reach 241, while the gas rig count increased by 1 to 77. Against the year-ago combined count of 802, the latest total US rig count is down by 482 drilling units. (11/27)

Arctic no-go? The break-even price for the oil that companies drilling in ANWR—a wilderness area without oil infrastructure–could be as high as $80 per barrel, according to Rystad Energy. That’s a barrier unlikely to help the Trump administration’s last-ditch effort to lease acreage for oil drilling in the high-cost and high-risk wildlife refuge. (11/25)

Arctic drilling–point-counterpoint: POINT: Banks’ public pledge to stop supporting Arctic drilling is little more than virtue signaling. Banks can hardly refuse to fund any oil and gas projects without violating laws. But they wouldn’t refuse to fund non-Arctic oil and gas projects because many of those projects remain too lucrative to shun. COUNTER-POINT: Oil prices are low; with a view to profits, most oil companies are far from eager to go drilling in the Arctic National Wildlife Refuge. (11/26)

Pipelines to be on hold? Climate activists hope the ascendance of President-elect Joe Biden, who has called for a transition away from the oil and gas industry, will now end the Dakota Access and Keystone XL pipelines. (11/25)

Drilling setbacks expanded: The Colorado Oil and Gas Conservation Commission (COGCC) approved stricter rules for oil and gas drilling this week, extending the setbacks for oil wells from homes and schools to 2,000 feet, four times the current buffer, and banning routine flaring as of January 15, 2021. The state passed Senate Bill 181 during 2019, which says that public health and welfare should be prioritized in oil and gas drilling regulation. (11/25)

According to the US EIA, the average retail price for gasoline in the US on Nov. 23 was $2.10/gal, the lowest for the first day of the week before Thanksgiving since 2015. The COVID-19 pandemic has wrecked US gasoline demand since March. (11/26)

Exxon’s view on oil prices: In the wake of the pandemic, ExxonMobil has significantly lowered its expectations about oil prices for the next seven years, expecting Brent Crude to average between $50 and $55 a barrel until 2025, according to internal Exxon documents. (11/26)

Berlin batteries: Tesla plans to turn its Berlin-Gruenheide factory into the world’s largest EV battery plant, CEO Elon Musk said Nov. 24 at an EU battery conference. Tesla plans to produce batteries in Germany with government support, creating 10,000 jobs. (11/26)

Stimulate EVs? Stimulus packages around the world could help a rise in EV sales and speed up progress in decarbonization in the transportation sector, the IEA said on Monday, noting that recovery packages should reflect the change in the global car fleet over the past decade. This year, electric vehicle sales are expected to grow from 2.1 to 2.3 million, reaching a 3.2 percent market share, even as overall vehicle sales decline 15%. (11/24)

Self-driving EV: Tesla Inc Chief Executive Officer Elon Musk said on Friday there would probably be a wider roll-out of a new “Full Self Driving” software update in two weeks. (11/28)

Chinese-Aussie spat shelves coal: More than $500 million worth of Australian coal is on ships anchored off Chinese ports, as a diplomatic spat between the two countries cuts into trade, idles a portion of the world’s dry bulk carriers, and threatens to spiral into a humanitarian crisis. More than 50 vessels have been waiting a month or longer to offload coal from Australia. (11/24)

General Motors Co. will no longer back the Trump administration in its legal battle to strip California’s authority to set its own fuel-efficiency regulations, saying GM’s goals for green cars are aligned with the state and the incoming Biden administration. (11/24)

RE 100 Club: 270 global companies have joined the RE100 club, i.e., companies committed to source 100 percent of their energy needs from renewable sources. That’s a 22 percent increase from last year’s tally of 221 members. Big Tech players such as Google, Apple, Facebook, and Microsoft may be the clear leaders in the renewable energy space, but Big Oil might soon rival it. (11/26)

Italian renewables push: Enel SpA plans to spend €70 billion expanding its presence in wind and solar power in the coming decade, seeking to cement its position as the world’s largest renewable energy producer outside China, and capitalize on the shift to green energy. (11/25)

The world’s most ambitious renewable energy project to date is the proposed Australia–ASEAN Power Link. It would combine the world’s largest solar farm (10 gigawatts), the largest battery (30 gigawatt-hour), and the longest undersea electricity cable 3,700 kilometers). The 10 gigawatts (GW) solar farm would cover 30,000 acres in Australia’s sunny Northern Territory. The solar farm and battery would provide round-the-clock dispatch of renewable power. (11/24)

RE price pinch: Sony, Ricoh, and several other Japanese technology corporations have warned the government they may have to shift manufacturing out of the country unless rules on renewable energy are relaxed. Meeting the 100 percent green energy promises of customers such as Apple, Facebook, and other big-tech corporations is much more expensive in Japan. (11/27)

Global greenhouse gas emissions in 2020 will drop by 4 percent to 7 percent in 2020 because of the response to the coronavirus pandemic. According to the World Meteorological Organization, that decline won’t stop the continued overall buildup of heat-trapping carbon dioxide in the atmosphere. (11/24)

Measuring ocean rise: As the planet warms, sea levels threaten to uproot more than a third of the world’s population. Understanding exactly how fast and how much they’re rising is crucial information for policymakers trying to protect communities that live near the coast and for scientists modeling the effects of global warming. Earth observation satellites are the best tool we have for measuring sea-level rise. (11/23)

Carbon exchange: The International Air Transport Association has launched the Aviation Carbon Exchange — the first centralized, real-time market for trading aviation carbon offsets. The move is likely to enable increased activity in the market for aviation carbon offsetting by making transactions more straightforward for airline operators. (11/26)

China may delay its national carbon market for power companies to the first half of 2021. Before that market can open, China still has to complete the necessary database for emissions and decide on the market’s legislative rules. (11/24)

EU’s bad air: A new report says most Europeans living in cities still breathe dangerously unhealthy air. Governments are not doing enough to cut toxic emissions. Those emissions, primarily from farming and domestic heating, are not decreasing fast enough. (11/24)