Oil Extends Decline Below $40 as OPEC Abandons Production Target

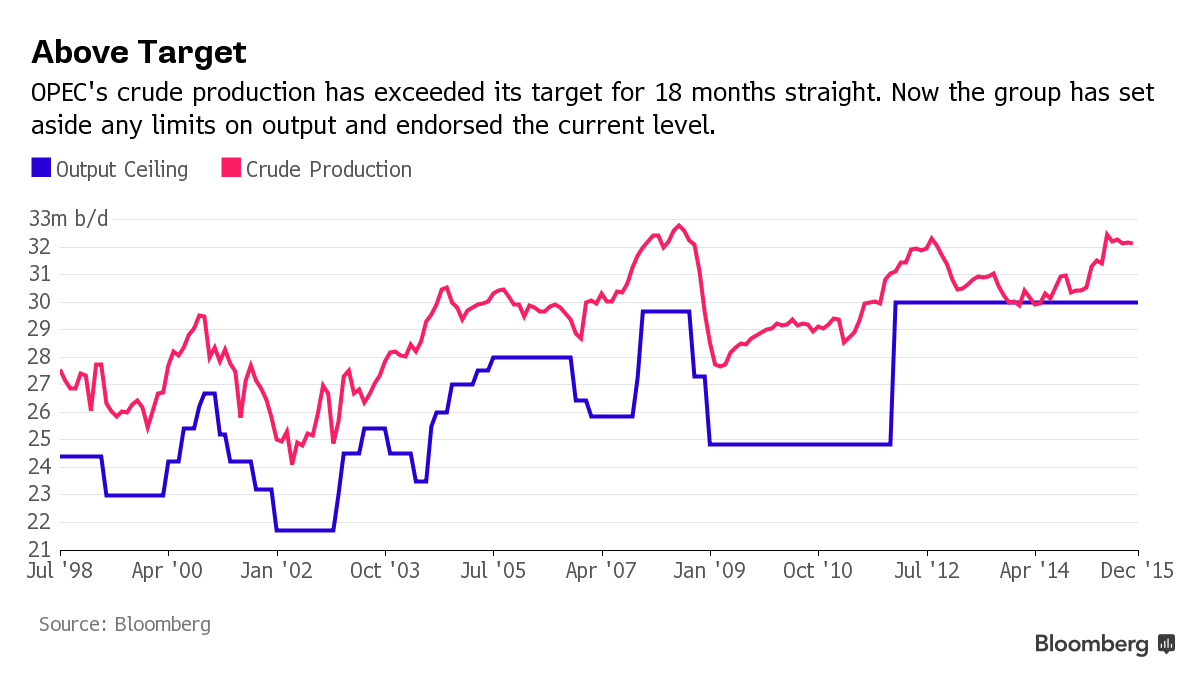

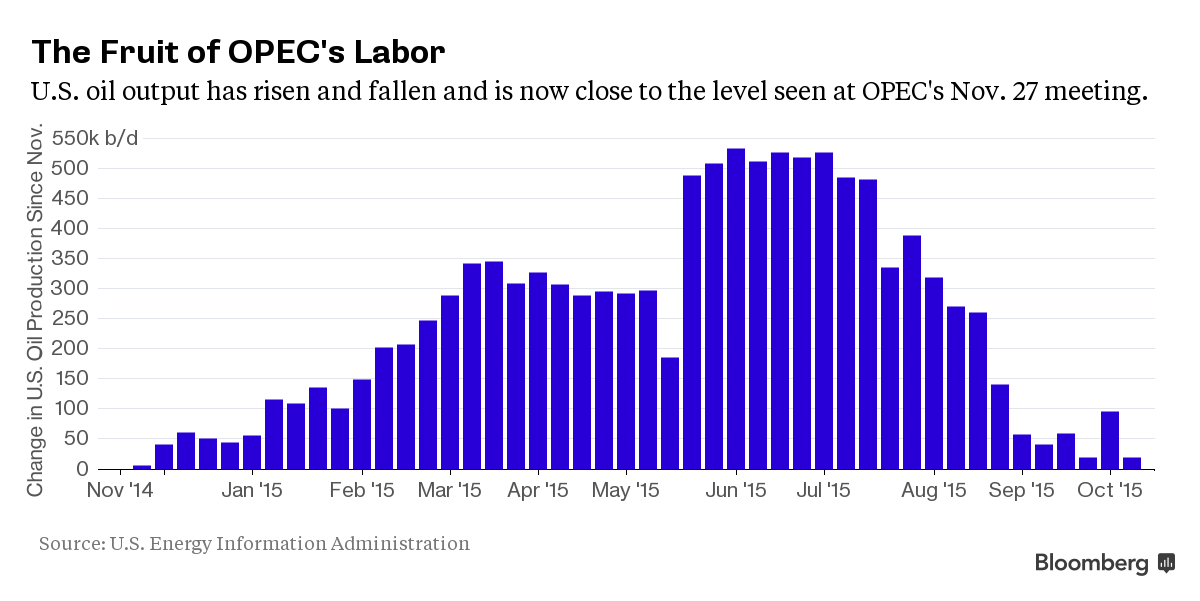

(Bloomberg) Oil extended losses below $40 a barrel amid speculation a record global glut will be prolonged as OPEC abandoned its long-time strategy of limiting production to control prices.