Falling knives and dead cats: When will the oil slump end?

(Reuters) As oil traders have learned time and again, picking a bottom in today’s glutted global market can be a fool’s game: just when prices start to rebound, as they have three times this year, a wave of renewed bearishness smacks them back down.

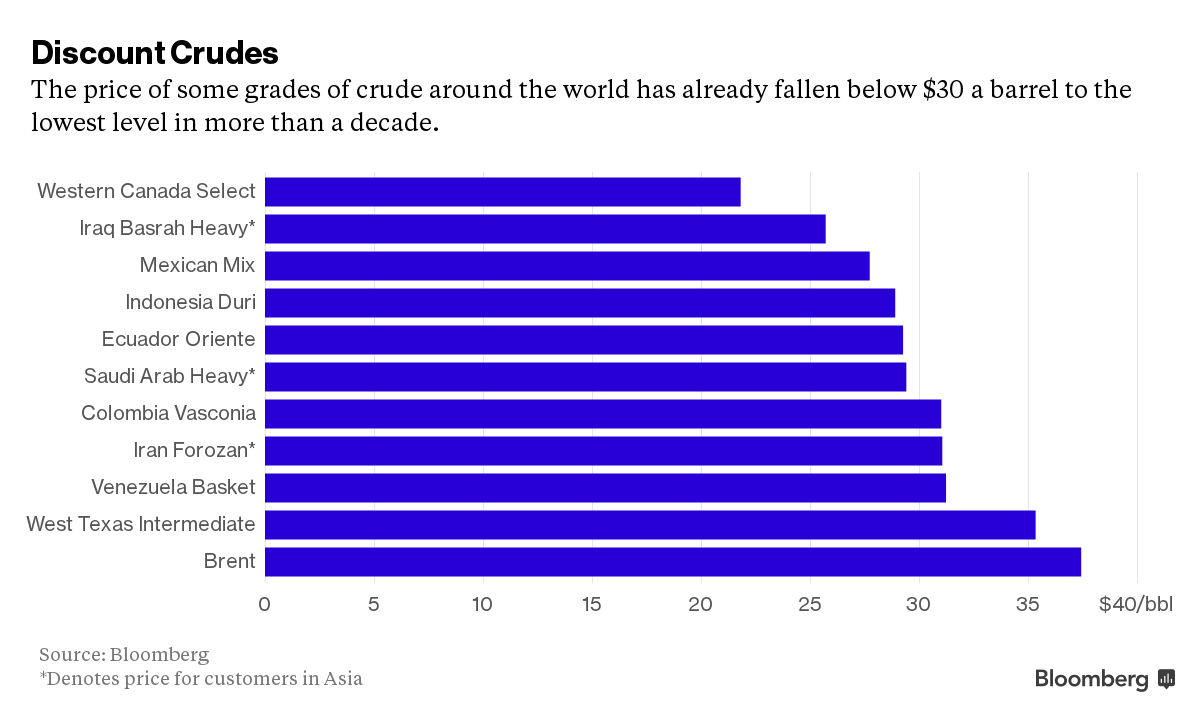

With oil resuming its southward march due to yet more oversupply, closing in on $35 a barrel after trading at $100 in June 2014, any number of factors could indicate when the rout may finally be over – for real this time.