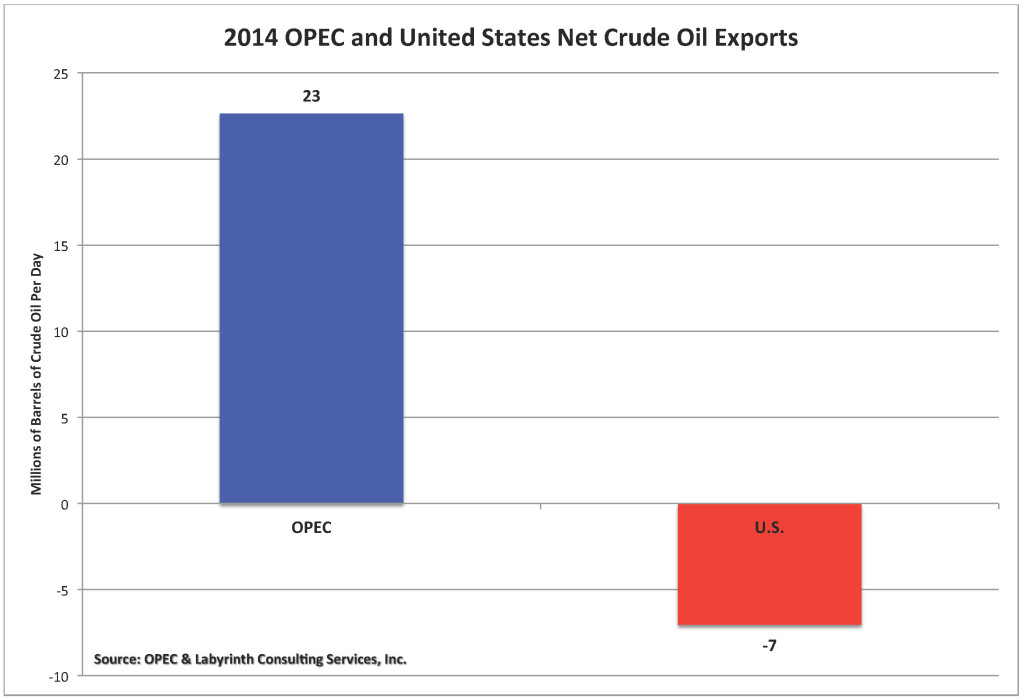

Oil prices plunged again last week from a high above $38 a barrel on Monday to a new low of $32.10, touched by NY futures on Thursday. For the week New York futures were down $3.88 or 10.5 percent to close at $33.16. London’s Brent was down 10 percent for the week closing at $33.55, the lowest closing since June of 2004. The usual factors of too much oil and too little demand as the US and Chinese economies continue to weaken were behind the move. A number of the factors that usually move oil markets are beginning to change. For example, another large drop of 20 units in the US rig count failed to drive the market higher for more than a few minutes as traders have come to recognize that changes in the rig count do not translate into short-term supply changes. Likewise the increase in enmity between Iran and the Saudis is having very little impact on prices as the markets believe the harsh rhetoric is unlikely to lead to hostilities – at least in the short term. Even a US jobs report which showed the creation of 292,000 new jobs, 39 percent more than expected, did little to move prices higher. Usually traders see more people working as a sign that there will soon be more demand for gasoline, but not this time. Fundamentals are ruling the markets.