Editors: Tom Whipple, Steve Andrews

Quotes of the Week

“It is not a secret that COP26 is a failure. It should be obvious that we cannot solve the crisis with the same methods that got us into it in the first place…We need immediate, drastic annual emission cuts unlike anything the world has ever seen. As we don’t have the technological solutions that alone will do anything even close to that, that means we will have to fundamentally change our society.”

Greta Thunberg, climate activist

“The UN’s Intergovernmental Panel on Climate Change estimates that the world may ultimately have to remove 100 billion to one trillion tons of carbon from the air this century to stay below 1.5 degrees of warming, in part because countries have been so slow to reduce their emissions.”

The New York Times (writer: Brad Plumer)

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil: The OPEC+ group of major producers agreed on Thursday to stick to their plan to raise oil output by 400,000 b/d from December, ignoring calls from President Biden for extra output to cool rising prices. This decision led to a price rebound on Friday, leaving Brent crude finishing the week at $82.74 a barrel. US WTI closed at $81.27. Following the OPEC+ announcement US Energy Secretary Granholm said President Biden is considering a release from the US’s Strategic Petroleum Reserve (SPR) as a possible move to reduce gasoline prices in the US. The SPR is the world’s largest supply of emergency crude oil and it currently holds around 600 million barrels.

According to Baker Hughes, the number of oil and gas rigs in the US rose by six last week. The total rig count is now at 550, up 250 from this time last year, but still under the 790 active rigs as of March 2020. The EIA’s estimate for oil production in the United States for the week ending Oct. 29th rose 200,000 b/d, to 11.5 million b/d—matching this year’s record set on Aug. 28th. Secretary Granholm also said on Friday that it was “curious” as to why oil and gas companies weren’t incentivized to produce more at $80 per barrel. Although the modest production increases over the last month occurred as the US oil and gas sector recovers from the effects of Hurricane Ida, oil production is still well below the 13.1 million b/d records set in the previous year before the pandemic took hold.

As of Nov. 4th, the national average price of a gallon of regular gasoline was $3.41, according to the AAA. The national average gasoline price is 21 cents more than a month ago, $1.27 higher compared to a year ago, and 79 cents more than at this time of the year in 2019. The crude price rally, the still strong US gasoline demand even after Labor Day, and the falling gasoline inventories across the country have pushed US gasoline prices higher this fall. However, US retail gasoline prices have started to decline in recent days and could drop even further, according to GasBuddy.

Global oil demand has already exceeded the threshold of 100 million b/d last seen before the pandemic, supermajor BP says. Moreover, demand will continue to increase and reach pre-COVID levels at some point in 2022, BP’s CFO Murray Auchincloss said on a conference call. “Somewhere next year, we will be above pre-Covid levels,” Auchincloss said. “OPEC+ is doing a good job managing the balance, so we remain constructive on oil prices.”

For the first time in 2021, the Middle East’s share of crude imports into Asia has risen above 60%. The Middle East is capitalizing on high-priced cargoes from Africa, Europe, and the US, offering Asia cheaper crude when it needs it the most. The largest oil exporters in the Middle East are reaping the benefits of the rally in crude oil prices.

International Energy Agency: Fatih Birol, head of the IEA, said a deal to phase out the dirtiest fossil fuel was one of three actions that must emerge from the Glasgow meeting for the rise in temperatures to stay below 1.5C since preindustrial times. Global temperatures have risen an estimated 1.1C in that period. “Without addressing this problem, the chances to reach our 1.5C target is close to zero,” Birol told the Financial Times. “I hope all the countries are going to be part of a deal where they can take these early steps for early retirements or repurposing their coal plants,” he added.

The UK hosts wanted the summit to be known for consigning “coal to history” but were forced to weaken the pact to draw more signatories. The timeframe was extended to allow another decade, or even longer, for coal plant shutdowns. After frantic last-minute negotiations, 40 countries, including South Korea, Vietnam, and Poland, signed the pledge, which commits them to shut their coal plants and stop issuing licenses for new plants. A further six countries, including Indonesia and Morocco, signed up to portions of the deal without endorsing the entire pact. The world’s top-three coal consumers China, India, and the US, representing 72 percent of global emissions from coal-fired power, did not sign, nor did Australia.

“Phasing out coal in China and India even over the next two decades is simply not feasible due to their reliance on coal to meet demand,” said Dan Klein, head of Future Energy Pathways, S&P Global Platts.

OPEC: For the past year, oil-consuming countries have become increasingly anxious at crude’s resurgence: first to $50 a barrel, then $75, and now to more than $85. And when Vladimir Putin, one of the leaders of the OPEC+ cartel, warned that $100 a barrel was a distinct possibility, the alarm bells started ringing. In October, the increase in OPEC’s oil output fell short of the rise planned under a deal with allies, as involuntary outages in some smaller producers offset higher supplies from Saudi Arabia and Iraq.

OPEC+ added just 140,000 barrels daily of crude oil last month as production constraints in Angola and Nigeria were part of the problem. Several OPEC members said in recent days they saw no need for additional production despite multiple calls for more supply amid soaring prices that are fueling inflation.

After a brief meeting on Thursday, the cartel approved a 400,000 b/d output hike for December. However, significant consumers say that’s not enough to sustain the post-Covid economic recovery, with the US asking for as much as double that amount. The rejection prompted a quick response from the White House, which reiterated that it would consider “the full range of tools” to protect the economy.

“Your problem isn’t our problem” was the harsh message delivered by OPEC+ on Thursday at a post-OPEC+ meeting press conference. Referring to the energy crisis and soaring energy costs, Saudi Arabia’s Energy Minister Prince Abdulaziz bin Salman argued that “oil is not the problem.” Indeed, the energy crisis began with a natural gas crisis that eventually spilled over into coal before snowballing into fertilizer, food, and other situations. Finally, it spread to Asia and throughout the globe. The Saudi Prince offered the market a solution: focus on the supply of natural gas to Europe and Asia—where the problem originated.

Shale Oil: Oil prices have climbed to multi-year highs, and oil companies are raking it in. Some industry insiders are even speculating whether oil is on track to hit $100 a barrel. Though oil companies typically open the taps when oil prices are high, the industry shows some notable restraint. Big oil is clearly aware that world leaders are getting more serious than ever about the clean energy transition, and the future of fossil fuels is far from certain.

Diamondback Energy recently said it planned to pump some 221,000 to 225,000 barrels of crude daily, and for 2021 production would come in at between 222,000 to 223,000 b/d. Diamondback Energy also said it would not increase its crude oil production next year despite the surge in prices. Most large shale drillers are adopting the same approach to keep their shareholders happy after years of burning cash to boost production to a maximum.

Large oil companies are racing to sell land in the Permian shale formation. Rising crude prices present them with a golden opportunity to jettison unwanted acreage and meet shareholder demands to lower costs. Worldwide oil demand rebounded faster than expected in 2021. As a result, output has also bounced back in the Permian, the pillar of US oil production, where buyers are paying for land at high values not seen in three years. The flurry of purchases kicked into high gear with big sales from Royal Dutch Shell, which sold its Permian assets for $9.5 billion in September, followed by last week’s land sale by Pioneer Natural Resources to Continental Resources for $3.25 billion.

BP aspires to be the oil industry’s climate champion. It became the first of the world’s supermajors to embrace an eventual phase-out of all greenhouse gas emissions. But a Bloomberg News analysis of new data collected from the Permian Basin shows that BP’s operations emit the most methane of dozens of companies operating there. The same study shows Exxon Mobil Corp., which has resisted a net-zero target, is among the cleanest.

Natural Gas: Asian LNG prices fell for a third straight week, as improved gas supply in Europe reduced the competition for LNG in Asia. However, declines were limited by new demand from Pakistan and Turkey. Industry sources said that the average LNG price for December delivery into Northeast Asia fell to $29.50 per million Btu’s, down $1.50 or about 5% from the previous week. European wholesale gas prices fell this week after flows from Russia through the Yamal pipeline resumed after a five-day pause. LNG cargoes were also sold to Europe from Oman and Australia in the spot market.

China’s Sinopec has signed a contract with US Venture Global LNG to buy 4 million tons of LNG annually for 20 years. The deal is the largest LNG long-term contract signed between Chinese and US companies. The LNG will be supplied from the plant in Plaquemines, Louisiana. The sale will double China’s imports of US LNG.

As Europe enters the heating season with natural gas inventories at the lowest level in a decade, policymakers, consumers, and industries are left at the mercy of the weather, hoping for a mild winter to avoid further tightening the already tight European gas market. Following the colder than usual 2020/2021 winter, Europe has been struggling to fill gas storage sites to adequate levels in recent months as Asian buyers have been snapping up LNG cargoes. Naturally, buyers prefer to ship LNG to Asia, where the price of gas is higher.

The supply of Algerian gas via Morocco to Spain in the GME pipeline was set to end Nov. 1st after the long-term transit deal between the two countries was not renewed. In recent months, relations between Algiers and Morocco have worsened significantly, with Algerian President Tebboune ordering state-owned Sonatrach to break all commercial ties with Morocco’s state utility ONEE. Several times, Algeria has said that it can meet Spanish gas demand using only its direct subsea Medgaz line and LNG deliveries.

The Environmental Protection Agency took a long-awaited step toward cutting planet-warming emissions last week with the proposal of a new rule to regulate methane from oil and gas operations. The agency estimates that the regulations will cut methane emissions by 41 million tons between 2023 and 2035 — the equivalent of shutting down 234 coal plants for one year. With two pieces of legislation that contain climate provisions currently on shaky ground on Capitol Hill, the rule lends some credibility to President Biden’s calls on other nations to step up their climate commitments at COP26.

Coal: European coal futures for delivery next year continue to tumble as China boosts production, easing power prices across the continent. With China taking measures to increase internal production rather than the previous mantra of securing supplies “at all costs,” prices on the global market are falling. Europe’s benchmark front-year contract has tumbled more than 50% since hitting an intraday peak of $193 per metric ton in early October. Daily output from China’s coal mines has been above 11.5 million tons since mid-to-late October, about 1.1 million tons higher than the end of the previous month.

US coal is enjoying a brief resurgence under President Biden. The amount of coal fed into US power stations this year will rise by almost 20% to 521 million tons, according to the EIA, allowing the fuel to surpass nuclear as the second-biggest source of American electricity, after natural gas.

According to the EIA, the jump in US coal use this year will also contribute to an 8% surge in energy-related carbon emissions. Coal’s revival is partly an outcome of US natural gas production which fell last year as crashing oil prices forced shale operators to idle rigs and slash planned spending on drilling. That gas supply shortage, coming alongside a recovery in the global economy and energy demand, has pushed up natural gas prices — and enticed power generators to burn more cheap coal. This is the first annual rise in US coal electricity generation since 2014.

Electricity: Estimated capital costs of Dominion Energy Virginia’s 2,640-MW offshore wind farm are rising to $10 billion from $8 billion. The higher cost will increase the Levelized Cost of energy to $87/MWh from $80/MWh, but a higher capacity factor will limit customer bills.

Prognosis: Two years ago, many forecasters predicted that oil and gas prices would likely remain lower for longer. Thanks to a perfect mix of demand destruction, then underinvestment and now rebounding demand, energy prices are soaring. The next crunch could be caused by actual shortages of fossil fuels, just like this year’s record coal prices were driven as much by the sudden spike in demand.

Crude oil prices will continue rising this quarter as global oil inventories drawdowns continue and OPEC sticks to its limited-additional-output policy, Citi’s head of commodity research Ed Morse told Bloomberg. Morse commented that it was funny how oil prices reacted following OEPC+’s latest announcement after its meeting on Thursday, going down instead of up as one would expect. He also noted that OPEC had moved from the “central bank of oil” to the role of regulator, keeping a cap on supply to keep prices higher.

2. Geopolitical instability

(These are the situations that reduce the world’s energy supplies or have the potential to do so.)

Iran: Talks with world powers aimed at reinstating a 2015 nuclear deal will resume on Nov. 29th, its top nuclear negotiator, Ali Bagheri Kani, said on Wednesday, as Western concerns over Tehran’s nuclear advances grow. According to senior economic and political sources close to the Iranian government, “the Supreme Leader, Ali Khamenei, himself is behind this new initiative, which is being driven primarily by the increasingly poor state of the country’s economy…The aim is to get a new version of the JCPOA agreed and the US-enforced sanctions dropped by the end of the current [Iranian calendar] year [ending on Mar. 20, 2022],” he added. Although Iran’s economy has been boosted in parts by the ongoing 25-year agreement with China, Beijing has been reluctant to be too overt in its direct financial support for Tehran.

The Pentagon rejected claims by Iran’s Revolutionary Guards that the Guards had thwarted an attempt by the US to detain a tanker carrying the Islamic Republic’s oil in the Sea of Oman. American officials said that, in reality, Iranian forces had seized a Vietnamese-flagged oil tanker last month, and US naval forces were just monitoring the situation.

Iraq: Prime Minister Mustafa al-Kadhimi escaped unharmed from an assassination attempt by armed drone in Baghdad. Six members of Kadhimi’s personal protection force stationed outside his residence in the Green Zone were wounded.

Supporters of Iran-backed militias clashed Friday with Iraqi security forces outside the fortified Green Zone complex as tensions spiked over the results of national elections last month. At least 125 people were injured, according to Iraq’s Health Ministry. Iran-backed groups have been demanding a recount of the Oct. 10 parliamentary election results. After the Fatah alliance saw its seats in parliament cut by about two-thirds, militia supporters began camping outside the gated Green Zone, home to government offices and foreign embassies. For several weeks the protesters have rotated shifts inside tents on the sidewalk or sitting outside under banners that denounce Iraq’s election as fraudulent.

Bagdad is in discussions to sign energy deals with Saudi Arabia worth tens of billions of US dollars, according to Iraq’s oil minister. The two are discussing contracts in the energy, water desalination, and petrochemical sectors. Iraq is also in talks with Saudi Aramco about a potential partnership to explore and develop natural gas fields in the western desert in Iraq. Despite holding colossal oil and gas reserves, Iraq has struggled to develop them and is not self-sufficient in energy and electricity. Iraq has suffered from power outages and disruptions due to a lack of investment in its transmission grid.

The ratification of a $480 million deal for US oilfield services giant Schlumberger to drill 96 horizontal and diagonal oil wells at the supergiant West Qurna 1 field fits precisely into this mold of perennial game-playing by Iraq with the US and China. So, moreover, does the news that the US’s Halliburton is in talks over bidding for ExxonMobil’s long-troublesome stake in the field.

Libya: The civil war may have ended, but plenty of uncertainty remains ahead of elections to be held next month. The country’s oil industry has suffered from significant underinvestment; the country’s Energy Ministry now appears intent on attracting international investment. While it may seem like a long shot now, there is a glimmer of hope for Libya’s oil industry if it can successfully hold the December elections and bring in renewed oil major interest.

Venezuela: The state oil company PDVSA halted two critical gasoline production units at its Amuay refinery, the country’s largest, after a fire in the area. The fire took place in a ditch on the west side of one of the distillers and obliged PDVSA to call an emergency halt to the units. Amuay, which can process 645,000 b/d, restarted its catalytic cracking unit in July. Much of PDVSA’s 1.3 million b/d refining capacity is offline after years of underinvestment and lack of maintenance, prompting the OPEC nation to depend on imported fuel. However, US sanctions have restricted those imports, contributing to long lines at service stations for motorists to fill their tanks.

3. Climate change

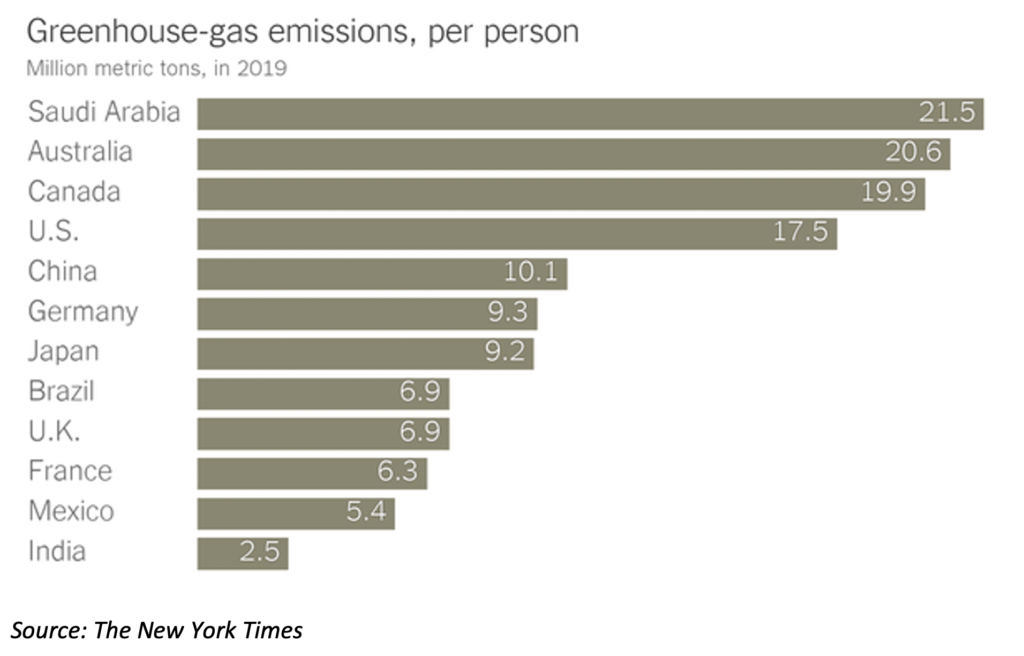

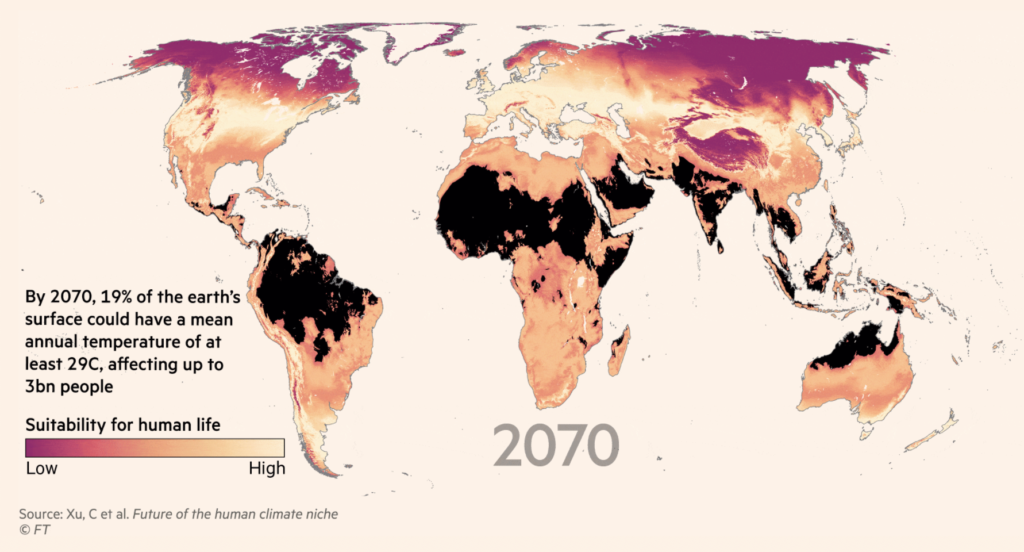

According to scientists from China, the US, and Europe, by 2070 up to 3 billion people out of the projected world population of about 9 billion could be exposed to temperatures on par with the hottest parts of the Sahara today. The new report highlights how most humans live in a very narrow mean annual temperature band of 11oC-15oC (52oF-59oF). Furthermore, researchers noted that people lived primarily in these climate conditions for several thousand years despite all innovations and migrations.

In recent years, tens of thousands of people have fled Central American countries like Guatemala and Honduras, leaving not just because of gang violence but also drought and extreme weather conditions that have made it impossible to grow crops. In Bangladesh, hundreds of thousands of people are displaced yearly by more extensive and unpredictable monsoon floods, a trend throughout the region. In West Africa’s Sahel region, heavy floods and food shortages have combined with violence and instability to drive people to other areas. In the Caribbean, massive hurricanes regularly push residents out of their homes.

According to a World Bank report, more than 200 million people are likely to migrate over the next three decades because of extreme weather events or the slow degradation of their environments. Most are displaced with their home country. But experts say that about one-fourth of the people who flee will cross borders, seeking a better life in a different land.

Last week the Glasgow conference saw a host of significant new initiatives put forth, including measures to ban the use of coal; stop methane emissions; halt deforestation; establish a global carbon market; and control the flow of capital to finance new fossil fuel projects. While these measures received the support of many countries attending the Conference, very few of those countries produce or consume significant amounts of fossil fuels. Their chief interest is voting for measures to keep the world from getting too hot.

On the plus side, countries representing almost 65% of the global gross domestic product have stepped up to meet the goal of holding the rise in warming to 1.5 degrees Celsius since preindustrial times. Those countries include the 27 that make up the European Union, Britain, Canada, South Korea, Japan, and South Africa. The notable absences are the US, China, and Russia, large producers and consumers of fossil fuels.

Inside, the Glasgow Conference was made up mainly of older men, many of whom fear the consequences of energy shortages and economic upheavals during their time in office. Outside the hall, most were women demonstrators who were worried about what would happen to their progeny. On Saturday some 100,000 people demonstrated outside the conference to halt global warming.

After a parade of announcements tackling everything from coal to methane and protecting forests, the question was what the agreements meant. For example, a day after COP26 organizers celebrated the pledge to protect the world’s forests, one of the most important signatories said it didn’t actually sign up to end deforestation by the end of the decade. Indonesia, the top producer of palm oil, said it only agreed to keep its forest cover steady over the period — meaning trees could still be cut down and replaced. Brazil, another key member, said it would only target “illegal” deforestation. Indonesia also signed up to a pledge aimed at ending coal use, but a closer look at the terms shows it will be able to continue building coal plants at home.

The UK highlighted Poland as a prominent signatory of that same deal, but Warsaw said it won’t phase out coal until the 2040s — the same timescale it was already planning — casting doubt on how much value the new accord adds.

The most prominent theme to have come from COP26 so far has been the division between the Global North and the Global South and between energy producers and energy consumers. While some limited successes have been achieved, it is very doubtful that a significant breakthrough will happen as the Conference progresses.

In a rare moment of good news coming from last week’s Conference of the Parties climate summit, more than 100 nations have pledged to cut global methane emissions by 30% or more between now and 2030 to curb global warming quickly and significantly. Key countries that still haven’t said they would join include Russia, China, and Brazil — some of the world’s biggest methane emitters.

Climate negotiators have made progress toward a deal to establish the foundation of an international carbon-trading system, putting within reach a long-stalled agreement that many businesses hope will kick-start a global carbon market. Brazilian officials, who have made a series of demands blocking a deal in the past, say they are now ready to make significant concessions. According to a person familiar with the matter, Chinese officials feel they have smoothed out any formal differences with Washington over the issue.

4. The global economy and coronavirus

Pfizer announced on Friday that its pill to treat Covid-19 had been found in a key clinical trial to be highly effective at preventing severe illness among at-risk people who received the drug soon after they exhibited symptoms. The antiviral pill is the second of its kind to demonstrate efficacy against Covid. It appears to be more effective than a similar offering from Merck, which is awaiting federal authorization.

Global food costs jumped last month, extending a march toward a record, and piling more inflationary pressure on consumers and governments. A UN index tracking staples from wheat to vegetable oils climbed 3% to a fresh decade high in October, threatening even higher grocery bills for households that have already been strained by the pandemic. Bad weather hit harvests around the world this year, freight costs soared, and labor shortages have roiled the food supply chain from farms to supermarkets. An energy crisis has also proved a headache, forcing vegetable greenhouses to go dark and causing a risk of bigger fertilizer bills for farmers.

United States: The economy added 531,000 jobs in October, a sharp rebound from the previous month and a sign that employers are feeling more optimistic as the latest coronavirus surge eases. The October gain was an improvement from the 312,000 jobs added in September — a number that was revised upward on Friday, along with the August figure, providing a more upbeat picture of the last few months. The unemployment rate declined to 4.6%, from 4.8%. The increase in employment was broad, with sizable gains at restaurants and bars, as well as in factories and offices. And in another sign that conditions are gradually returning to normal, the proportion of employed people who worked remotely at some point last month fell to 11.6%.

A critical, often-overlooked link in the supply chain is emerging as a stubborn choke point in the freight-backlog mess: trucking. Trucks haul more than 70% of domestic cargo shipments. Yet many fleets say they can’t hire enough drivers to meet booming consumer demand as the US economy emerges from the pandemic.

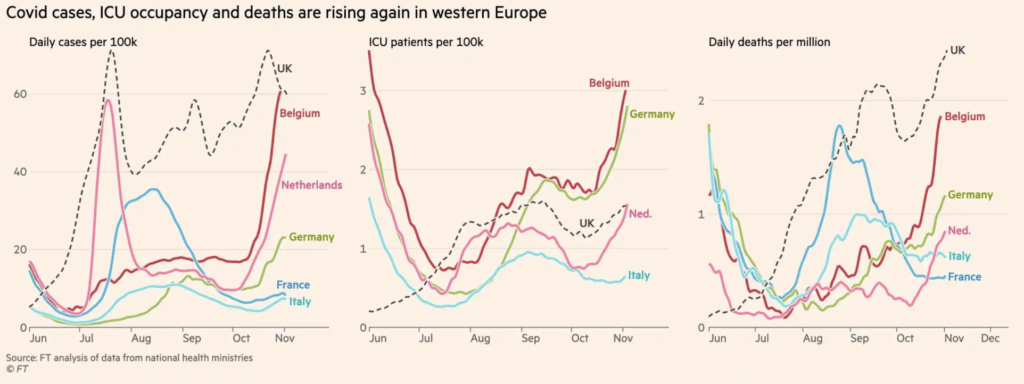

Europe: The continent is experiencing a surge in coronavirus infections to levels not seen in months, alarming health officials and sparking fears that the continent could be engulfed by a new wave of the pandemic this winter. Hans Kluge, regional head of the World Health Organization, said the pace of transmission across Europe, as well as Central Asia, was a “grave concern”, adding that the region was moving back to the “epicenter” of the health crisis. “Today, every single country in Europe and Central Asia is facing a real threat of Covid-19 resurgence, or is already fighting it,” he said.

Germany on Friday reported 37,120 new infections, its largest daily increase since the start of the pandemic. The incidence of infection now stands at 169.9 per 100,000 people — a level not seen since the peak of the third coronavirus wave in the spring. The number of Covid patients being treated in German intensive care wards is the highest since May. Explaining the sharp rise, experts said the onset of colder weather had prompted people to spend increasing amounts of time indoors, where the virus can spread more easily. They also cited stubbornly high vaccine hesitancy and waning immunity among those who had been inoculated.

Germany’s energy consumption in 2021 is likely to rise by nearly 3% and the country’s carbon dioxide emissions are set to increase by at least 4% as more coal is burned, industry statistics group AGEB said last week. The rise in energy demand is mainly due to a pickup in economic growth and cold weather at the start of the year, although higher prices of energy and carbon pollution allowances have tempered growth in demand. Slow wind speeds meant that more coal was used this year to offset shortfalls of renewable power.

China: More provinces in China are fighting Covid-19 than at any time since the deadly pathogen first emerged in Wuhan in 2019. The highly infectious delta variant is popping up across the country despite the increasingly aggressive measures that local officials have enacted in a bid to thwart it. More than 600 local infections have been found in 19 of 31 provinces in the latest outbreak.

As the rest of the world shifts to a strategy of living with the coronavirus, China has remained the last country chasing full elimination, for the most part with success. The government claims it has recorded fewer than 5,000 virus-related deaths, and in parts of the country without confirmed cases, the outbreak can feel like a hazy memory.

But the residents of Ruili — a lush, subtropical city of about 270,000 people before the pandemic — are facing the extreme and harsh reality of living under a “Zero Covid” policy when even a single case is found. In Ruili, the past year has consisted of extended paralysis, with people confined to residential complexes for weeks at a time. Even during the gaps between official lockdowns, residents have not been allowed to dine in at restaurants. Many businesses remained closed.

China’s economy showed signs of further weakness in October as power shortages and surging commodity prices weighed on manufacturing, while strict Covid controls put a brake on holiday spending. The official manufacturing purchasing managers’ index fell to 49.2, the National Bureau of Statistics said Sunday, the second month it was below the key 50-mark that signals a contraction in production. The non-manufacturing gauge, which measures activity in the construction and services sectors, dropped to 52.4, well below the consensus forecast.

The energy shortage, China’s most severe in many years, has forced the government to curtail operating hours at factories and cut power in some cities. The shortage is due to factors including stronger-than-expected demand for its factory exports as the global economy rebounds from the pandemic, increased movement toward gas from coal to fight pollution, and a lack of rain in parts of the country that has hindered its hydroelectricity supply.

The Chinese government told families to keep daily necessities in stock in case of emergencies, after COVID-19 outbreaks and unusually heavy rains that caused a surge in vegetable prices raised concerns about supply shortages. Beijing shoppers stocked up on cabbage, rice, and flour for the winter on Wednesday, though the government assured them there were sufficient supplies after some panic buying.

China has released reserves of gasoline and diesel to increase market supply and support price stability in some regions. The release of the reserves was made in accordance with the recent supply and demand situation in the domestic oil product market. Sinopec, China’s largest oil refiner, plans to fully utilize domestic refining capacity in November and boost diesel supply by 29% from a year earlier to ensure filling stations do not run out of stock.

China’s coal supplies have notably increased through joint efforts from coal producers, logistics and downstream users, while coal prices have also stabilized, the state planner said. The most-traded January thermal coal futures contract fell 9.26% to 925.2 yuan ($144.48) per ton early on Monday. A slew of cooling measures announced by China has led the futures prices plunging more than 53% since its high of 1,982 yuan on Oct 19th. Since July the government has approved capacity expansions at hundreds of coal mines across the country amid a widespread power shortage partly due to insufficient supply and has rolled out a raft of measures to tame runaway coal prices.

At the height of the trade war in 2019, China all but cut off imports of US liquefied natural gas. Today, China is buying more gas from the US than ever. LNG prices have surged in response. Benchmark rates for spot deliveries into Asia hit $56 per million British thermal units early in October, more than 10 times where they were at the same point a year earlier. Prices have since fallen but a cold winter could cause them to jump again, industry analysts say.

China’s natural gas needs are already very large and growing steadily as it pledges to cut demand for coal and seeks to hit a peak of carbon emissions by 2030. China is likely to overtake Japan this year as the world’s biggest importer of LNG. Natural gas accounted for around 8% of China’s total energy in 2020, up from around 3% in 2009.

China’s indebted developers are struggling to meet Beijing’s tighter financing rules. A liquidity crisis at China Evergrande Group has roiled markets, with the nation’s real estate sector making up almost half of the world’s distressed dollar-denominated debt. Speculative-grade yields briefly topped 20% in October — the highest in a decade.

Russia: The country has recorded 753,000 excess deaths during the coronavirus pandemic, one of the highest tolls in the world, according to analysis of government data by the Financial Times. The number highlights the stark impact of the disease as the country imposes fresh restrictions to curb its spread. The figure, used by demographers to measure the real impact of pandemics, covers the period to the end of September. It is calculated by comparing total mortality figures collected by statistics agency Rosstat since the emergence of Covid 19, with historical trends. It shows that Russia ranked second to the US in terms of absolute number of excess deaths and third behind Peru and Bulgaria on a per capita basis

On Tuesday auctions, Gazprom declined to book extra capacity to ship more gas to Europe from January, a step that would have helped ease prices in a market haunted by worries about Moscow’s intentions. The Kremlin said Russia remained committed to start pumping additional gas to Europe once domestic storage tanks were replenished, in line with an order given to Gazprom last week by President Putin. Though Putin has insisted that Russia is not using energy as a political weapon, many EU leaders disagree. Russia has a history of limiting or outright cutting the supply of energy to political rivals in Europe. Russia provides a third of Europe’s gas and its supply intentions are critical at a time when spot prices across the continent have surged.

Moldova declared a state of emergency last month after Gazprom cut supplies by a third to the eastern European nation following the expiration of a long-term contract and demanded Moldova pay more than double the previous price to keep gas flowing. Gazprom had pushed for political concessions from Moldova’s new pro-EU government in exchange for cheaper gas. Gazprom denied this and said that the talks were “exclusively on commercial terms”. The two sides signed a new long-term supply contract on Friday, but the agreement suggests Moldova made geopolitical concessions. Moldova’s gas crisis was a warning to Europe of the risks of being too dependent on Russia’s Gazprom, according to the chief executive of Poland’s state-controlled gas group.

Russian oil and gas condensate output rose to 10.84 million b/d last month from 10.72 million bpd in September, according to Reuters calculations. Last month’s level was the highest since the 11.34 million bpd pumped in April 2020.

Saudi Arabia: The kingdom recorded its first quarterly budget surplus in more than two years as higher crude prices boosted the kingdom’s finances. The Gulf nation’s surplus during the third quarter was about 6.7 billion riyals ($1.8 billion), trimming the year-to-date deficit to 5.4 billion riyals. Oil revenue was about 148 billion riyals (US$40 billion), an increase of 60% from the same period last year, while non-oil income decreased 22% on an annual basis to 95 billion riyals. Oil revenue so far this year is up 25% compared to a year ago. Non-oil revenue year-to-date has risen 33% compared to 2020.

India: New Delhi was blanketed by toxic air on Saturday as pollution levels remained dangerously high for a second day after revelers defied a fireworks ban during a major Hindu festival and farmers in nearby states burnt stubble. New Delhi’s overall Air Quality Index stood at 456 on a scale of 500, indicating “severe” pollution conditions that can affect healthy people and seriously impact those with existing diseases.

India has an ace up its sleeve to help reach zero out emissions by 2070: some of the world’s cheapest renewable power. Abundant land, cheap labor and reliable sunshine and breezes make India home to the lowest-cost solar power and second-lowest onshore wind among 54 countries covered by BloombergNEF’s analysis of levelized costs of electricity. The South Asian nation is forecast to be the third-biggest installer of new solar capacity this year, and number four for wind.

5. Renewables and new technologies

Interior Secretary Deb Haaland challenged nations to join the United States in setting aggressive goals to expand electricity production from offshore wind. The Biden administration has moved swiftly this year to support a nascent offshore wind industry in the US, a crucial part of its plan to decarbonize the power sector by 2035 and address global warming.

The first China-developed hydrogen fuel cell locomotive has started trial runs on a railway line for coal transport in north China’s Inner Mongolia Autonomous Region. The hydrogen fuel cell hybrid locomotive has a design speed of 80 km/h. It can run with 700 kW of continuous power for 24.5 hours.

Energy Vault, a company developing grid-scale gravity energy storage solutions, has entered into an energy storage system agreement with DG Fuels, a renewable hydrogen, synthetic sustainable aviation fuel, and diesel fuel developer. Under the terms of the deal, Energy Vault agreed to provide 1.6 gigawatt-hours (GWh) of gravity energy storage to support DG Fuels across multiple projects, with the first project slated for 500-megawatt hours in Louisiana. DG Fuels expects to complete its Louisiana project by mid-2022. This initial project will be followed by additional projects in British Columbia and Ohio. Energy Vault’s advanced gravity energy storage solutions are based on pumped hydroelectric energy storage, but replace water with custom-made composite blocks, or “mobile masses,” which do not lose storage capacity over time.

QuantumScape Corporation, a developer of next-generation solid-state lithium-metal batteries for use in electric vehicles, released an independent third-party laboratory testing report on the performance of its solid-state lithium-metal battery cells. QuantumScape’s single-layer cells were tested by Mobile Power Solutions, a separate battery lab. They met automotive-relevant conditions. The company believes that the results from the tests, covering a group of three single-layer cells, are consistent with those initially reported by QuantumScape in December 2020.

6. The Briefs (date of the articles in the Daily Energy Bulletin is in parentheses)

Offshore Norway, Equinor has made an oil discovery estimated to hold up to 62 million barrels of crude. The discovery was the state-controlled firm’s sixth find in domestic waters, mainly in areas contiguous to existing fields. (11/1)

Turkey may renew a natural gas deal with Russia with an increased amount from the beginning of 2022. This year, Turkey’s record demand for natural gas forced it to step up purchases on a surging spot market as it scrambles to renew long-term contracts expiring this winter. (11/4)

Offshore West Africa, several major international players have shown interest, hoping to develop the region’s oil industry before the global demand for oil decreases. The favorable response to a recent discovery in the Ivory Coast by Italian oil giant Eni, the first significant find in the country in two decades, suggests that many African states are not yet ready to give up on fossil fuels and shift to renewables. (11/1)

Offshore West Africa was hit especially hard by the pandemic. A combination of plunging jet fuel demand, a lack of investment, and security issues have sent West African oil production crashing. Nigeria and Angola, the two largest producers in the region, are unlikely to recover any time soon without new oil discoveries. (11/5)

Nigeria, Africa’s biggest oil producer, has come under fire from the International Monetary Fund and World Bank for the heavy financial burden in providing subsidies for fuel and kerosene. The criticism is rooted in the belief that the money could be better spent on other essential services, such as healthcare and education. (11/5)

Mexico is in the process of locking in its income from next year’s oil production in what is one of the most closely watched deals among the world’s energy traders. The country has been purchasing put options, which grant the right to sell at a predetermined price, at a price range of about $60 to $65 a barrel. (11/3)

Airlines are back to hedging the fuel price to protect themselves from higher oil prices next year, although the hedges are less risky and for shorter periods as uncertainty remains over when airline travel returns to pre-COVID levels. During the pandemic, the industry is estimated to have lost around $5 billion in total on forward hedges of the price of fuel, which hardly anyone needed last year with international flights grounded. (11/6)

In Alaska, only six bids were submitted for onshore tracts in the central North Slope, and no bids were submitted for tracts in the Beaufort Sea or the Brooks Range foothills, the Alaska Division of Oil and Gas reported. It was the fewest bids submitted for a North Slope auction since 1999. (11/4)

Exxon Mobil on Wednesday said for the first time some of its oil and gas properties might face impairment due to climate change, according to a securities filing. The company’s board will test assets for climate impairments “in the context of overall enterprise risk” during the annual asset review by its board of directors. (11/4)

CO2 injection: US shale oil firm EOG Resources said on Friday it aims to begin a carbon dioxide injection program by late 2022 to reduce greenhouse gases from its oil and gas production. The company set a net-zero emissions target by 2040 and is dedicating 2% to 3% of its spending budget to environmental, social, and governance issues. (11/6)

Tesla and Hertz are negotiating over how quickly Hertz will receive deliveries from a bulk order of 100,000 Tesla electric cars for its rental fleet. (11/5)

Cheap batteries have been the critical factor for the mass adoption of electric cars for a while now. Until recently, battery costs were on a steady downward curve as technology improved and efficiency increased. But then the pandemic came and wrought havoc on every single industry and supply chain. Lithium prices are now running to record highs. (11/3)

China’s battery manufacturer and stock-market darling Contemporary Amperex Technology is close to overtaking a state-owned lender to become the nation’s second-largest listed company. CATL is the world’s largest manufacturer of power batteries and materials supplies. (11/1)

Canadian Pacific will significantly expand the scope of its hydrogen locomotive program with a $15-million grant announced by Emissions Reduction Alberta (ERA). The grant enables CP to increase the number of hydrogen locomotive conversions in the project from one to three and add hydrogen production and fueling facilities. (11/2)

Coal clampdown: China has enacted for years a range of draconian-sounding measures to tamp down its air pollution, including suspending factory production for weeks on end, allowing cars in Beijing to drive only every other day, and now, raids on household coal stashes used for heating, especially in its colder climates. (11/3)

South Africa is negotiating with a handful of wealthy nations about overhauling its ailing electricity sector to become a model of climate finance for other countries heavily dependent upon coal plants. The showcasing plan, which could cost as much as $15 billion, would provide financial support for the state-owned utility and back broader economic and social change — known as a “just transition” — in a deeply divided and unequal society. The plan could help persuade other developing nations, mainly in Asia, to shelve plans to build as much as 243 gigawatts of new coal plants. (11/2)

BHP Group’s exit from thermal coal looks less certain as record prices and shifting investor attitudes put the brakes on its planned retreat from the dirtiest fuel. (11/2)

GOM wind: This week, the US interior department called on companies to express interest in leasing in a 30m-acre area in waters off Louisiana and Texas, part of a push to build 30 gigawatts of carbon-free offshore wind power up and down the US coastline by 2030. As in the North Sea in Europe, new spending on wind could offset declining investment in oil megaprojects. Yet gulf projects are likely to fall behind the wind development queue on the Atlantic and Pacific coasts. One reason is weaker wind speeds in the gulf and lower average electricity prices in Texas and Louisiana. (11/4)

Decarbonization moon shot: Late Wednesday night, Ithaca, NY, voted to electrify and decarbonize its buildings. It’s the first such initiative of its kind in the country. The city of about 30,000 people consists of some 6,000 homes and buildings. Decarbonization would involve looking at everything from how a building is heated to what appliances it uses to move away from the consumption of fossil fuels such as oil and natural gas. (4/11)

US decarb goal: US President Joe Biden’s administration on Friday set a goal for driving down the cost of removing carbon dioxide from the atmosphere as part of a US plan to decarbonize the economy by 2050. The Department of Energy’s Carbon Negative Earthshot seeks to slash the cost of carbon removal to $100 a ton by the end of the decade, either through Direct Air Capture (DAC) or helping forests and other natural systems capture and store the gas. That’s far below the current price of $2,000 per ton. (11/6)

The global shipping industry produces between 2% and 3% of the world’s carbon emissions, and the push to decarbonize the industry is now well and truly underway. The solutions being considered at the moment are ammonia fuel, electric batteries, and efficiency improvements. This transition is likely to cost trillions of dollars, but companies worldwide are now throwing their weight behind it. (11/5)

H2 from a nuke: Exelon Corp. received a grant from the US Energy Department to “explore the potential benefits of onsite production” of hydrogen at its Nine Mile Point facility north of Syracuse. (11/4)

Hot! The year 2021 is now expected to qualify among the hottest seven in history, all of them recorded since 2014, according to an early estimate by the United Nations World Meteorological Organization. (11/2)

Hurricanes: There have been so many storms in the Atlantic Ocean this year that the National Hurricane Center has used up all 21 available names, the third time in recorded history that has happened. Subtropical storm Wanda, which formed this weekend and isn’t expected to make landfall, was the last name on the list. The previous two times all names were used were last year and in 2005. (11/2)

Climate denial: On Tuesday, the head of a US House panel subpoenaed four major oil companies and two lobbying groups for documents related to their actions on global warming as part of a year-long probe into potential climate deception by the energy industry. (11/3)

Wheat surged to $8 a bushel in Chicago for the first time since December 2012 as strained global supplies collided with robust demand. World wheat reserves are ebbing after extreme weather battered crops in critical exporters. Dryness is again spreading in North America and the Black Sea region, with plantings for the 2022 harvest underway. (11/2)

Herd immunity? Scientists with the world’s top climate organization made reducing meat consumption an official policy recommendation in 2019, echoing what environmentalists had urged for years: Eating less meat, particularly beef, reduces the large volume of emissions attributed to livestock. That guidance has only accelerated efforts by the beef industry to discredit the notion that strip steaks and cheeseburgers are climate culprits. (11/3)

Palm oil’s problem: Seventeen climate summits ago, one of the world’s first sustainability efforts in global food production was set up to stop palm oil plantations from destroying the rainforest. Yet more than 80% of the market remains untouched by the effort because no one wants to pay for it.