Editors: Tom Whipple, Steve Andrews

Quote of the Week

“This coming decade is critical for the world in the fight against climate change, and to drive the necessary change in global energy systems will require action from everyone.” [Context for the statement: is that BP said it will stop oil and gas exploration in new countries, slash oil and gas production by 40 percent and boost capital spending on low-carbon energy tenfold, to $5 billion a year.]

Bernard Looney, BP chief executive.

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Briefs |

1. Energy prices and production

Oil: Prices edged up to the highest since March last week on a larger-than-expected inventory draw, a slightly improved US jobs report, and hopes for a new stimulus package from Washington. However, fears of a second wave of COVID-19, increasing US-China tensions, and uncertainty about the US stimulus caused crude prices to retreat to a close of $41 in New York and $44 in London.

The world’s five largest oil companies collectively cut the value of their assets by nearly $50 billion in the second quarter and slashed production rates as the pandemic caused a drastic fall in fuel prices and demand. Global fuel demand at one point was down by more than 30 percent worldwide and remains below pre-pandemic levels. Several executives said they took the massive write-downs now because they expect demand to stay impaired for several more quarters as people travel less and use less fuel.

Of those five companies, only Exxon Mobil did not book sizeable impairments as yet. But an ongoing re-evaluation of its plans could lead to a “significant portion” of its assets being impaired. It reported and signaled the elimination of 20 percent or 4.4 billion barrels of its oil and gas reserves.

By contrast, BP took a $17 billion hit and said it plans to re-center its spending in the coming years around renewables and less on oil and natural gas.

Weak demand means oil producers must revisit business plans, said Lee Maginniss, managing director at consultants Alarez & Marsal. He said the goal should be to pump only what generates cash above overhead costs. “It’s low-cost production mode through the end of 2021 for sure, and to 2022 to the extent there are new development plans contemplated.”

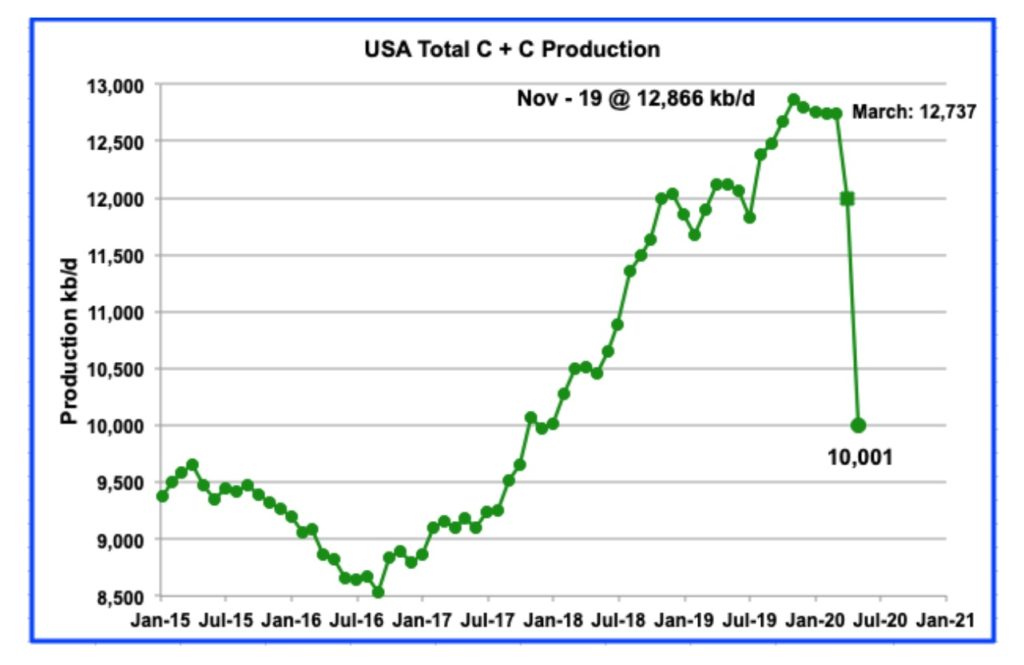

The EIAʼs Petroleum Supply Monthly contains a reasonably accurate picture of past US oil production with a two-month lag. The charts show US production in May falling by nearly 2 million b/d. US oil fields began a slow and steady decline from November 2019 to March 2020. March brought the combination of CV-19 and oil price drop that led to the sharp production plunges in April and May.

Natural Gas:

A massive wave of investment has poured into LNG export terminals worldwide in recent years, and nearly all of the projects have China at the center of their business plans. While China has been the largest source of LNG demand growth for quite some time, and will likely remain an essential buyer going forward, Chinese demand may not be high enough for all LNG projects on the drawing board.

The pain of the LNG supply glut has been felt most acutely by US exporters. The gas glut in Asia led to storage filling up in Europe, and ultimately the flexibility of American LNG translated into canceled cargoes from the US. Dozens of US cargoes were canceled in each of June, July, and August.

The Global Gas Report 2020, published by the International Gas Union, says that increased natural gas demand due to environmental concerns will continue after the pandemic is under control. The International Energy Agency sees global natural gas demand dropping by 4 percent in 2020, which would be the most significant demand drop for gas markets in recorded history. The consumption of natural gas is expected to drop by twice the amount it did after the 2008 financial crisis.

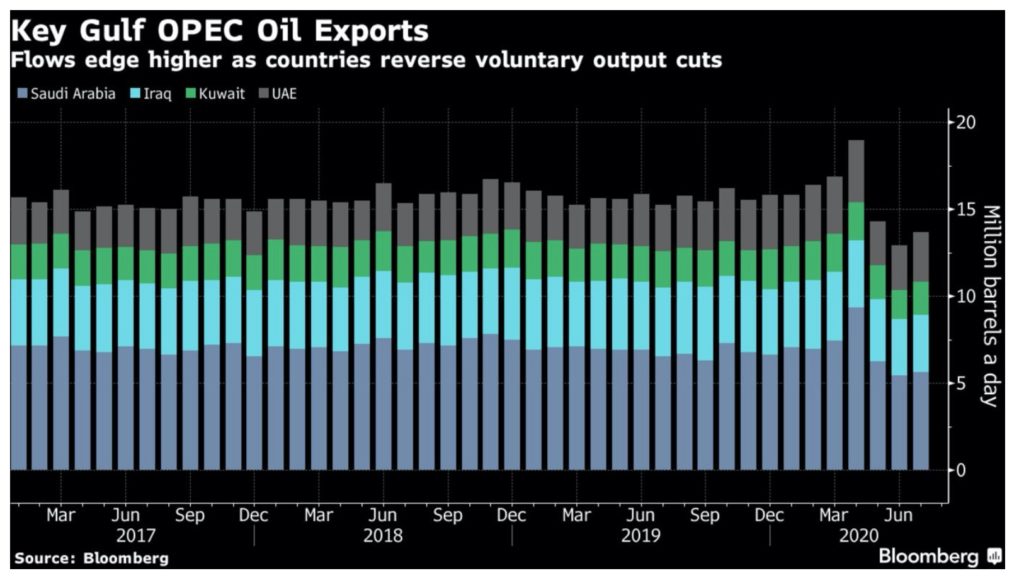

OPEC+: The Organization of Petroleum Exporting Countries and its allies agreed to start tapering their cutbacks from 9.6 million b/d in July to 7.7 million b/d from Aug 1st. Oil exports from OPEC’s Middle East producers rose in July after Saudi Arabia and critical Persian Gulf allies reversed the voluntary production cuts they had made the previous month. Saudi producers boosted shipments by 190,000 b/d, far less than its increase in production, suggesting that domestic crude use has soared with summer temperatures.

Russia slightly increased its oil production in July, ahead of OPEC+ plans to start easing record supply cuts. The nation’s producers pumped 9.371 million b/d and are above June levels when output averaged 9.329 million.

Moscow, which was often a laggard in previous OPEC+ production cut deals, showed almost full compliance in May and June. The nation’s crude oil output target for May-July was 8.5 million b/d, excluding condensate. We don’t have a breakdown, but if condensate production was at the same level as in May, then crude-only supply reached 8.571 million barrels a day in July.

Shale Oil:

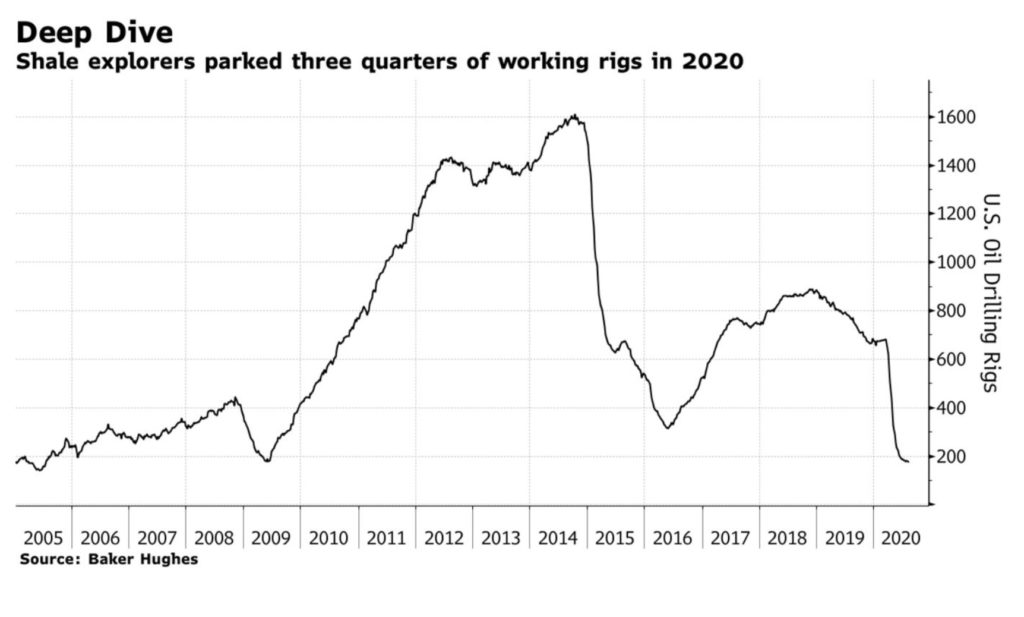

After slashing capex plans for 2020 by about 50 percent and idling hundreds of rigs, US shale drillers are still not ready to return to growing their production. Oil is too cheap for that, so they are staying in survival mode, maintaining production with no plans to start boosting it anytime soon.

The oilfield services companies that do everything from drilling producers’ wells and laying pipes to maintaining roads and operating software once reaped big rewards without taking the risks taken by drillers. But with the worst price crash in decades wreaking havoc on a sector that has booked tens of billions of dollars in write-downs over the past year, they are looking to turn away from working in the US in the most definitive sign yet that the shale oil’s glory days may be over.

More than $30 billion is the size of the collective debt of oil and gas companies that filed for bankruptcy protection in the first half of the year. Twenty-three companies declared bankruptcy, all but five of which filed during the second quarter when Covid-19 took hold. Now, with the resurgence of new cases and an equal resurgence in doubts about the outlook for oil demand, more filings are on the way. “It is reasonable to expect that a substantial number of producers will continue to seek protection from creditors in bankruptcy even if oil prices recover over the next few months,” Haynes and Boone said in its June report on oil and gas bankruptcies.

With oil prices stabilizing around $40 a barrel, Continental Resources is bringing back previously shut-in oil production, seeing flow rates in some fields double compared to the rates before the curtailment. In the middle of June, the company – which had shut in 70 percent of its output – said it expects to begin resuming production but still expects to curtail approximately 50 percent of its operated oil production.

Prognosis: The course of the coronavirus will determine much of what happens to the oil industry in the remainder of the year. Although Beijing is claiming that its economy is returning to normal, the rapid spread of the virus around the underdeveloped world and its worsening relationship with the US suggests that it will be a long time before its export-driven economy recovers. In the US, the lack of progress on a 2nd stimulus package and the continued spread of the pandemic has many saying the US economy is going to take a big economic hit this fall.

Jet fuel demand for commercial flights crashed in April, and although some demand has returned, jet fuel consumption in July was still nearly 70 percent down compared to the same month of 2019.

2. Geopolitical instability

Iran: A BBC investigation has found that the number of deaths from coronavirus in Iran is nearly triple what Iran’s government claims. Tehran’s records show that almost 42,000 people died with Covid-19 symptoms up to July 20th, versus 18,000 reported by its health ministry. The number of people known to be infected is higher than official figures: 451,024 instead of 326,000. Those official numbers make Iran the worst-hit in the Middle East.

Data released on July 26th by China’s General Administration of Customs indicates that China did not import any oil from Iran in June for the first time since January 2007. However, other sources say China is continuing to import many millions of barrels of crude from Iran every month and will continue to do so following the 25-year deal between the two countries. From June 1st to July 21st, China imported at least 8.1 million barrels of crude oil – 158,823 b/d – from Iran according to a senior oil and gas industry source who works closely with Iran’s Petroleum Ministry.

Tehran has several ways of getting oil to China without the transfer being listed in official records kept by Chinese customs. Iranian crude can be loaded on a ship bound for China while at sea, thus obscuring its origin. Another way to transfer oil originating in Iran is indirectly via Malaysia and to a lesser extent, via Indonesia, where the registration documents for the tanker and the provenance of the cargo are changed before the ship continues to China.

Another method of delivering Iranian oil to China is being developed by Tehran, together with Russia and China. This method uses Iran’s Caspian Sea ports to transfer oil into Russian pipelines used in the Eastern Siberia–Pacific Ocean pipeline. The Iranian crude can then be moved through Kazakhstan into China.

Iraq: The Middle East is enduring one of its hottest summers ever, but Iraqis have had it especially tough. In Baghdad last week, the temperature reached 125°F, the highest figure ever measured for the capital. Basra, the southern oil hub, reached 127°F, just one degree shy of the heat record for the country set in 2016. The stifling heat has forced many indoors during the day, while others have set up showers in the streets to cool off. The near breakdown of Iraq’s electricity grid has made matters far worse, as regular blackouts cut off air conditioning.

State coffers are low because the economic crisis is leaving little money for investment in maintaining Iraq’s aging electricity infrastructure. Importing additional power from Iran is tied up in politics. On one side, Iran demands overdue payments on natural gas and electricity they already provided. On the other, the US is pushing Baghdad to move away from Iran and strike energy deals with Gulf allies.

Baghdad’s nationwide crude exports fell 2 percent in July to 3.19 million b/d, their lowest monthly average since 2015, as the Oil Ministry continued to throttle back output under an OPEC+ production agreement. Global oil prices have risen in recent months due to various factors – including supply reductions, improved demand outlook, and relative weakness in the dollar. This helped boost the federal government’s oil export revenues to a five-month high of $3.5 billion, despite lower volumes.

Baghdad is being forced into compliance with the OPEC+ deal in August and September as the producer group loses patience, the country’s oil minister said last week. “This tolerance from OPEC won’t last long. We will be forced this month and next month to 100 percent compliance.”

Iraq’s chronic power shortages and its OPEC+ commitment to cut crude output have pushed the country closer to Iran when the US wants to isolate Tehran. Baghdad relies on associated gas production and Iranian gas to power a number of its plants and gets imports under waivers from the US. Iraq, which currently produces between 16 to 18 GW/day, imports up to 1.2 GW of electricity from Iran during peak demand. Iraq’s efforts to comply with OPEC+ output cuts are also making it more reliant on Iran imports.

Libya: With conflict escalating, the country’s crude oil exports are set to hit just 1.2 million barrels/month in August, a 40-percent decrease from July. This month, two terminals are set to ship a cargo of 600,000 barrels each. Most of Libya’s oil terminals and facilities are closed, and currently, oil production in the country is around 100,000 b/d. This is dramatically down from 1.2 million b/day at the start of the year, before paramilitary formations affiliated with the Libyan National Army of eastern Libyan strongman General Haftar occupied Libya’s oil export terminals and oilfields.

Venezuela: Venezuela is once again shuttering gas stations across the country as fuel shortages deepen due to ailing refineries and sanctions limiting imports. The deficit has increased since Iran sent five tankers with fuel in May and June to Venezuela, causing US officials to issue warnings to Tehran. No more shipments have been received since June. The gas-station shutdown is partially due to two of the country’s biggest refineries suffering serious breakdowns in recent weeks. Iran also sent technicians to help improve the reliability of the country’s aging refineries, to little avail.

According to Baker Hughes’ monthly international rig count, as of June 2020, Venezuela had one operational oil rig. However, after Chevron suspended its operations in Venezuela because of the US sanctions on the Maduro regime, Chevron’s contractor Nabors Industries shut it down.

A US glass manufacturer is trying to seize a Venezuelan oil tanker to secure the $500 million in arbitration compensation granted it by a court after Venezuela expropriated two plants. This is the latest in a series of companies’ attempts to collect payments granted after the sweeping nationalization of private businesses undertaken by Hugo Chavez. With few options available to creditors, Caracas’s fleet of oil tankers has attracted attention.

3. Climate change

A new study has found that the growing, but mostly unrecognized, death toll from rising global temperatures will come close to eclipsing the number of deaths from all infectious diseases combined. Rising temperatures will cause devastation in more deprived, hotter parts of the world that will be unable to adapt to unbearable conditions.

The economic loss from the climate crisis and the cost of adaptation will be felt worldwide, including in wealthy countries. In a high-emissions scenario where little is done to curb planet-heating gases, global mortality rates will be raised by 73 deaths per 100,000 people by the end of the century. This nearly matches the current death toll from all infectious diseases, including tuberculosis, HIV/Aids, malaria, dengue, and yellow fever.

Researchers from the GEOMAR Helmholtz Center for Ocean Research Kiel have found that considerable quantities of the greenhouse gas methane are escaping into the water from abandoned oil and gas wells in the North Sea. The study, published in the International Journal of Greenhouse Gas Control, confirms earlier studies based on a much-extended data set.

During expeditions to oil and gas reservoirs in the central North Sea in 2012 and 2013, scientists from the Center discovered methane bubbles emerging from the seabed around abandoned wells. The gas originates from shallow gas pockets, which lie less than 1,000 meters below the seafloor and were not the target of the original drilling operations. An initial assessment shows that these emissions could be the dominant source of methane in the North Sea.

Coastal flooding could damage assets worth up to $14.2 trillion by 2100 as rising seas inundate beachfront homes and infrastructure, according to new research published in Scientific Reports. Within the century, land area flooded will increase by 48 percent (roughly the size of France), the population impacted will increase by 52 percent (about 287 million people) and the infrastructure affected will increase by 46 percent which will comprise about 20 percent of global GDP, researchers warned.

BP said last week that it would transform itself by halting oil and gas exploration in new countries, slashing oil and gas production by 40 percent, lowering carbon emissions by about a third, and boosting capital spending on low-carbon energy tenfold to $5 billion a year. “This makes the BP the first supermajor to spell out, in detail, what the energy transition will entail, in practical terms,” said Pavel Molchanov, a senior energy analyst for the investment firm Raymond James.

Although BP announced earlier this year its broad strategy shift to comply with the 2015 Paris climate accord’s goals, last week’s earnings report specifically laid out for investors how much — and how soon — this would change the company. In February, before the pandemic hit, BP had vowed to reach net-zero carbon emissions by 2050, but the new details show significant impacts on its business by 2030.

Southern California Gas Co is suing the California Energy Commission over the state’s climate policy and its attempts to phase out natural gas as a heating and cooking source. The Energy Commission is promoting building efficiency and emissions-cutting rules for new construction, encouraging home developers to build all-electric buildings. It is pushing policies that could ban the hook-up of natural gas for all new homes.

Last year Berkeley, California, passed an ordinance requiring all new homes to be all-electric with no gas hook-ups beginning in January 2020. Berkeley’s primary motivation for the gas hook-up ban was to reduce greenhouse gas emissions and promote clean energy use. Climate activists say that natural gas is a fossil fuel responsible for a large part of emissions from buildings. “Natural gas and renewable gas are clean, affordable, resilient, and reliable sources of energy on which millions of California consumers and businesses depend,” Southern California Gas Co said in its lawsuit.

4. The global economy and the coronavirus

World food prices rose in July, led by vegetable oils, dairy products, and sugar, extending a rebound from the previous month following sharp falls triggered by the coronavirus pandemic. The Food and Agriculture Organization’s food price index measures monthly changes for a basket of cereals, oilseeds, dairy products, meat, and sugar, averaged 94.2 points in July versus a slightly revised June figure of 93.1 points.

The coronavirus-driven collapse in world tourism, which represents more than 10 percent of global economic output, may trigger the next pandemic crisis, in which we move from a public health emergency and mass unemployment to widespread insolvencies in myriad industries. Countries like Italy, Mexico, and Spain, which have some of the highest levels of tourism as a proportion of gross domestic product, will be hardest hit by the fact that few people are traveling across borders this summer.

United States: Most of the news coming from last week’s employment reports was not good. US hiring slowed in July as the coronavirus outbreak worsened. The government’s jobs report offered signs Friday that the economic damage from the pandemic could last far longer than many observers originally envisioned. The US added 1.8 million jobs in July, a pullback from the previous two months. At any other time, hiring at that level would be seen as a blowout gain. But after employers shed a staggering 22 million jobs in March and April, much more significant increases are needed to heal the job market. Hiring for the past three months has recovered 42 percent of the jobs lost to the pandemic-induced recession.

China: Its economy returned to growth in the second quarter, and factory activity has increased in each of the past three months. Factory activity in China expanded at its fastest rate in almost a decade in July, amid signs of a broader recovery from the coronavirus crisis in some of Asia’s biggest economies. The manufacturers purchasing managers’ index beat expectations to hit 52.8 in July, its highest level in more than nine years. The reading reflects a bounce-back of activity after a sharp contraction earlier this year when the country was under lockdown because of the coronavirus pandemic.

Exports rose by an unexpectedly strong 7.2 percent in July. Sales to the United States jumped 12.5 percent despite a drop in US economic activity and a lingering tariff war. Global exports accelerated from June’s 3 percent gain and exceeded forecasts of little to no growth. “There is an overall improvement in exports in July from June, not just medical supplies which had previously been the main contributor,” said ING in a report. Gains came in shipments of electronics, autos, and clothing. Imports weakened by 1.4 percent in financial terms due to falling commodity prices, but the total volume increased.

China imported 12.08 million b/d of crude last month, which was lower than the record-breaking import rate in June but 25 percent higher than the average for July 2019. The official data confirms OilX’s report released earlier last week, which said July imports were 3 percent below the June average. A lot of cheap oil bought in April, when prices were at their lowest, is only now arrived at Chinese ports, and delayed oil cargoes cleared customs only last month.

Beijing’s dependence on crude oil imports has been growing in recent years as internal demand increased while domestic production faltered. During the first half of 2020, China imported 73.4 percent of its oil needs. China has been buying record volumes of crude oil over the past months to bolster its energy security, especially when its relations with the US are deteriorating.

In June, it was reported that China had begun ramping up imports of US LNG ostensibly in a bid to fulfill the January trade agreement with Washington. According to Wood Mackenzie, China took in 10 LNG cargoes from US suppliers between April and May at the expense of its traditional suppliers, including Turkmenistan and Uzbekistan. Reuters reports that China’s imports of US energy products, including crude oil, liquefied natural gas, and metallurgical coal, was just $1.29 billion through June. The trade deal committed Beijing to purchase an extra $52.4 billion of US energy supplies over the next two years from a baseline of just $9.1 billion in 2017.

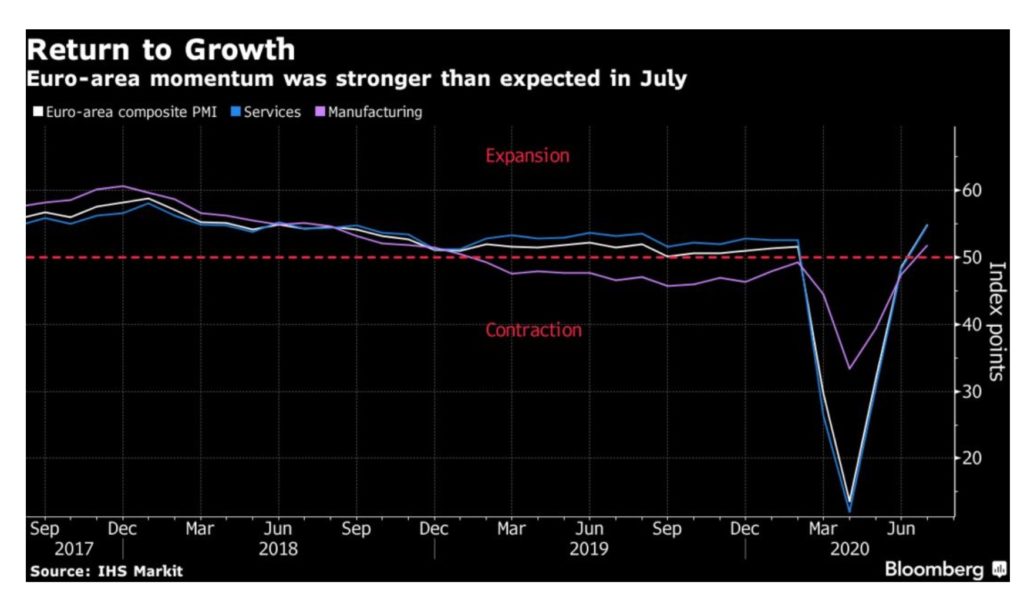

European Union: Businesses in the eurozone saw more robust growth than reported in July, with output expanding for the first time since coronavirus lockdowns hit the economy in March. Services providers and manufacturers both saw activity pick up. A composite purchasing managers’ index rose to 54.9, the highest level in just over two years. Orders increased for the first time in five months.

Europe has kept its coronavirus cases low after reopening. Measures like mask-wearing have been credited for the early success. However, young people are letting loose across Europe, fueling a surge in coronavirus infections that is imperiling the Continent’s hard-won gains against the pathogen. Towns along the coasts of France and Spain are grappling with outbreaks after young people piled into beach bars, ignoring social-distancing rules, and caught the virus. And thousands of young Europeans recently gathered at an illegal rave in a Berlin park, defying police efforts to shut it down.

Russia: Natural gas exports to Europe fell to a 2020 low in July, dropping to just 9.6 Bcm. Flows were hit by annual maintenance shutdowns on both the Nord Stream and Yamal-Europe lines. Gazprom opted to meet its customer obligations mainly with gas from its European storage sites rather than increasing flows via alternative routes. Russian exports to Europe via the four main corridors — Nord Stream, Yamal-Europe, Ukraine, and TurkStream — had hovered around 11.1 Bcm over the previous three months, around 25 percent lower year on year.

In Russia’s Dagestan region, the official coronavirus figures seemed suspicious to residents back in April. At that time, the entire region reported two to three fatalities a day from COVID-19, while some villages were holding five funerals a day. Officials were, and still are, listing the cause of death of coronavirus victims as pneumonia, heart failure, or anything other than the virus.

Moscow’s claims of a very low death rate are hailed as a tribute to Russia’s superior medical system and President Putin’s leadership. The figure the Kremlin touts most often is its low mortality rate, with only 15,000 deaths attributed to the coronavirus. That’s a 1.7 percent case fatality rate, well below Britain’s 15.2 percent. As a result of the seemingly low death rate, Russia has lifted most of its coronavirus-related restrictions, saying its infection curve has peaked.

However, a demographer who worked for Russia’s state statistics agency, Rosstat, until he was fired last month, has been publicly questioning that number since May. He suspects the real number of fatalities through the end of July is 50,000 rather than the official 14,000. This projection is based on the number of excess deaths Russia has had this year compared with the average of the past five years. If the demographer is right, that will put Russia behind only the US, Brazil, and Mexico for the most coronavirus deaths. However, other countries, such as India, cannot generate accurate statistics on the number of deaths.

To keep people from calculating the coronavirus death toll based on an above-average number of deaths, many of Russia’s regions have stopped sending their vital statistics publicly to Moscow. Some have stopped including deaths among the births and marriage numbers. The politicization of Russia’s death statistics is not helping the situation, and some jurisdictions are complaining about not receiving sufficient aid from Moscow to treat the virus. Moscow’s economy may be weaker than the Kremlin claims.

Saudi Arabia: Aramco’s profit plunged 73 percent in the second quarter of the year, as a slump in energy demand and prices due to the coronavirus crisis hit sales by the world’s biggest oil exporter. However, the company stuck with plans to pay $75 billion in dividends this year. Aramco said it expected capital expenditure for 2020 to be at the lower end of a $25 billion to $30 billion range. Net profit fell to $6.57 billion for the quarter to June 30.

With China’s help, the Saudis have constructed a facility for extracting uranium yellowcake from uranium ore, an advance in the kingdom’s drive to master nuclear technology. The facility, which hasn’t been publicly disclosed, is in a sparsely populated area in Saudi Arabia’s northwest. It has raised concern among the US and allied officials that the kingdom’s nascent nuclear program is moving ahead, and that Riyadh is keeping open the option of developing nuclear weapons.

The facility’s exposure is raising concerns in the US Congress, where a group of lawmakers has expressed alarm about Saudi nuclear energy plans. There are also concerns about Saudi Crown Prince bin Salman’s 2018 vow that “if Iran developed a nuclear bomb, we would follow suit as soon as possible.” The mining of uranium is also likely to cause fear in Israel.

The Saudi Energy Ministry said it “categorically denies” having built a uranium ore facility in the area described by some of the Western officials, adding that mineral extraction—including uranium—is a vital part of the country’s economic diversification strategy. The Saudi statement said the kingdom has contracted with the Chinese for uranium exploration in Saudi Arabia in certain areas. A spokesman declined to elaborate on the ministry’s statement.

India: The country hardest hit in Asia by the coronavirus pandemic reported on Friday a record daily jump in infections, taking its total number of cases over two million. It is the third nation to pass that milestone, lagging behind only the US and Brazil. With infections spreading further to smaller towns and rural areas, experts say the epidemic in India is likely to be months away from hitting its peak, putting more strain on an already overburdened healthcare system.

India is expected to end 2020 with its oil demand slipping into the red, a trend not seen for nearly two decades. India’s oil demand took a bigger hit in the first half of this year when it implemented a lengthy countrywide lockdown. According to S&P Global Platts Analytics, India’s oil demand is expected to be down 115,000 b/d, year on year in H2, and whole year demand will be down by 405,000 b/d, year on year.

5. The Briefs (date of the article in the Peak Oil News is in parentheses)

Big oil: trade or perish? Oil strategist Julian Lee wrote for Bloomberg Opinion last week that expanded in-house trading operations saved European Big Oil from the full impact of this year’s oil crisis.

Trading has managed to save European companies from the far more devastating fate that their production-focused US counterparts have suffered in recent months. Royal Dutch Shell even turned a profit in the April-June quarter despite their oil and gas production being down 7 percent for the year and 11 percent in the quarter, which was “offset by aggressive cost and capital-expenditure reductions, plus a ‘robust’ trading result.” (8/7)

Oil major slowly divesting. UK-based BP is preparing to sell a large chunk of its oil and gas assets even if crude prices bounce back from the COVID-19 crash because it wants to invest more in renewable energy, three sources familiar with BP’s thinking said. The strategy was discussed at a BP executives meeting in July. (8/7)

BP cut its dividend for the first time in a decade after a record $6.7 billion second-quarter loss when the coronavirus crisis hammered fuel demand. It sought to win over investors by speeding up its reinvention as a lower carbon company. All major oil companies suffered in the second quarter as lockdowns to contain the new coronavirus limited travel, and oil prices fell to their lowest in two decades. (8/4)

Exxon-Mobil Corp warned that low energy prices might wipe as much as one-fifth of its oil and natural gas reserves off the books. If depressed prices persist for the rest of the year, the equivalent of 4.5 billion barrels of oil may no longer qualify as proved reserves; the company said in a regulatory filing (8/6).

Israel is preparing for a massive roll-out of electric vehicles on its roads over the next decade. It is instructing its cities to build hundreds of charging points to accommodate what could be half of all new cars sold in the country in 2030. (8/4)

In the Eastern Mediterranean, the contest over newfound gas riches has triggered a slew of rival maritime claims, pushing the region’s leading powers—all of them America’s partners or allies—toward open confrontation. On one side is a budding alliance of Greece, Israel, Cyprus, and Egypt that benefits from the recent finds. On another is the Eastern Mediterranean’s biggest economy, Turkey, which is increasingly flexing its military muscles as it seeks to break its regional isolation. (8/3)

In a sleepy corner of Australia, a crucial battle over the future of fossil fuels and climate change will soon be decided. After a decade-long struggle pitting a mix of farmers, grandmothers, and activists against oil producers and local and federal governments, a panel will decide by early next month whether to greenlight a $2.6 billion natural gas project. (8/6)

Offshore Suriname, Apache Corp. announced a significant oil discovery at its 1.4-million-acre offshore tract. The Kwaskwasi-1 well located in the prolific Guyana-Suriname Basin encountered 912 feet of net oil and volatile oil/gas-condensate pay. The samples taken indicate that the API oil gravities are between 34 and 43 degrees. (8/3)

Guyana’s electoral authorities declared opposition candidate Irfaan Ali president Sunday, ending a five-month constitutional crisis that threatened to turn the South American nation into an international pariah. The decision eases fears that the country might erupt in violence, or cease to be a democracy, as rival factions fought for control of its fast-growing economy and its massive offshore oil riches. (8/4)

In Argentina, only two years ago, analysts were hailing its emerging shale oil boom. The US’s EIA estimates that the vast Vaca Muerta shale formation has technically recoverable resources of 16 billion barrels of oil and 308 trillion cubic feet of natural gas. However, Argentina’s dream of using it as a silver bullet to solve its troubled economy and energy woes is fading fast. Another economic crisis, driven by rapidly building debt, spiraling depreciation of the peso and sharp contraction of GDP, brought President Macri’s reformist pro-business agenda to an abrupt halt. (8/6)

The Mexican government may need to effect changes in the country’s constitution to strengthen its control of state oil giant Pemex, President Obrador said in a memo. Obrador came to power with a pledge to restore state control over Mexico’s energy industry, which effectively came down to a reversal of the previous government’s energy reform, which dismantled Pemex’s monopoly of the local energy market and encouraged foreign oil and gas companies to develop Mexico’s resources. (8/6)

The US oil rig count fell by four to 176, the lowest since 2005, according to Baker Hughes’s latest data. Gas rigs were unchanged at 69. (8/8)

The US imported 1.1 million tons of fuel oil from Russia last month, equal to more than 7 million barrels and a 16 percent increase over June. US refiners having to replace lost barrels of Venezuelan heavy oil, following US sanctions on Caracas, sometimes use fuel oil instead. The Venezuelan sanctions, along with OPEC+ production cuts, have created a severe shortage of heavy crude on the market, leading to higher prices—in some cases prohibitively high—and the closure of some refineries. (8/8)

Wyoming O&G project: After more than five years in the making, several producers moved a major regulatory step closer to developing a potential 5,000-well oil and natural gas project on federal land in Converse County, Wyoming—in the Powder River Basin—but current market realities present new risks. (8/4)

Range Resources Corp. sold its Louisiana shale fields for about one-tenth of what it paid for them just four years ago as depressed natural gas prices hammered the heavily indebted driller. The $335 million potential total value compares to the $3.3 billion Range originally paid in an all-stock deal for the fields. The biggest-ever deal for Range turned into a bust when the company’s geologists and engineers soured on the quality of the rocks in early 2018. (8/4)

A total of 103 coal-fired power plants were converted to natural gas or replaced by natural gas-fired plants in the United States since 2011, the Energy Information Administration (EIA) said on Wednesday. (8/6)

Coal’s continuing spiral: Peabody Energy has written $1.4bn off the value of the world’s largest coal mine, an acknowledgment of electricity generators’ permanent shift towards natural gas and wind. The open-pit North Antelope Rochelle mine in Wyoming’s Powder River Basin accounts for 12 percent of US production. But cheap gas prices coupled with falling costs for renewable power and state-level mandates for clean energy have accelerated the decline of coal-fired electricity nationwide. (8/6)

Illinois Basin coal production totaled 14 million st in the second quarter, down 27.2 percent from the previous quarter. From the year-ago quarter, output dropped 45.3%. (8/5)

In Japan’s southern island, known for its beaches and active volcanoes, Kyushu Electric Power Co. surprised analysts Friday by beating forecasts for quarterly earnings. It did so by running its giant, brand new coal plant and selling the electricity to other regions of the country. Despite growing international pressure, Japan has yet to kick its reliance on coal, which is expected to account for 26 percent of the country’s power generation in 2030, down from 32 percent in the year ended March 2019. (8/3)

TVA firing: President Trump said Monday that he had fired the chair of the Tennessee Valley Authority plus another member of TVA’s board, criticizing the federally owned corporation for hiring foreign workers. Trump threatened to remove other board members if they continued to hire foreign labor. (8/4)

New nuke: Belarus is expected to start up its first nuclear plant—built by Russia’s Rosatom—during the next couple of weeks – against a strung-up background of energy conflicts, elections-related ambiguity, and personal suspicion. (8/3)

Lufthansa does not expect air travel demand to return to pre-coronavirus crisis levels until at least 2024. The collapse in demand for air travel due to the COVID-19 pandemic meant the airline carried 96 percent fewer passengers between April and June than a year earlier. Tentative signs of a European recovery now appear threatened by new localized outbreaks and restrictions. (8/6)

Parisian heatwave: Paris is facing one of its worst heatwaves in more than a century, with daily average temperatures hovering around 86 degrees Fahrenheit over seven days and hitting a maximum of 102 degrees on Sunday. A 10-day heatwave during 2003 killed an estimated 15,000. (8/8)

A crop requiring less fertilizer: Climate-friendly plants are getting more attention from farmers and food companies as pressure mounts to find sustainable forms of agriculture—including Kernza, a new grain that’s already got powerful backers like General Mills and academia’s support. Kernza is a wheat-like grain that can be used in breads, cereals, or even served as a pilaf like rice. It’s also a perennial crop, which means it can be seeded once and grown for multiple years. It helps the environment by sequestering carbon in the soil through its deep root system, requires fewer chemical inputs, and restores organic matter in the land. (8/7)

The dramatic drop in greenhouse gases and air pollutants seen during the global lockdown will have little impact on our warming planet. Their new analysis suggests that by 2030, global temperatures will only be 0.01C lower than expected. But the authors stress that the nature of the recovery could significantly alter the longer-term outlook. A robust green stimulus could keep the world from exceeding 1.5C of warming by the middle of this century. (8/7)