Editors: Tom Whipple, Steve Andrews

Quote of the Week

“Hydrogen could represent a lifeline to Alberta’s oil and gas industry. Alberta has a lot of the building blocks in place to be able to compete in this space and develop a thriving hydrogen economy.”

Simon Dyer, deputy Ex. Dir. Pembina Institute, environmental think tank

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil: Prices squeezed out a small gain for the second straight week, but uncertainty around the US-China trade deal and fears of a resurgent pandemic limited the price rally. The International Energy Agency expects crude oil demand this year to be 8.1 million b/d lower than it was in 2019. It is a downward demand revision of 140,000 b/d in its latest Oil Market Report. Hopes are dimming for a stimulus package to relieve the US economy anytime soon, and coronavirus cases continue to increase globally.

The IEA reduced its demand estimate for almost every quarter through to the end of next year. Air travel remained two-thirds lower than last year in July, usually a peak month because of holiday flying. “Global oil demand is expected to be 91.9 million b/d in 2020, the first downgrade in several months, reflecting the stalling of mobility as the number of Covid-19 cases remains high [lead by] weakness in the aviation sector,” the IEA said.

US gasoline consumption recovered last week to where it stood just before the pandemic forced everyone inside. Still, uncertainty lingers for the oil industry as the driving season approaches its end. Last week diesel product supplied rose to its highest since April 3rd. Highway miles for trucks are up this year over 2019, with more shoppers turning to online orders.

“The fundamental news of crude oil depletion in the U.S. is met with increasing OPEC supply and diminishing demand estimates from bodies like the IEA,” said Tom Finlon of GF International. “It’s a lot of things pulling in different directions, and when that occurs, markets get range-bound.”

Natural Gas: On Friday, front-month natural gas futures hit their highest since the end of last year as air conditioning usage is expected to increase as people try to cope with the heatwave. The demand for natural gas will be particularly high in the southwest, where demand for power in general—and consequently natural gas—is expected to hit a record high. Natural gas prices hit $2.367, an increase of $0.185.

In July, the Henry Hub natural gas spot price averaged $1.77 per million British thermal units. EIA expects natural gas prices will generally rise to the end of 2021. The sharpest increases will be during this fall and winter when they grow from an average of $2.11 per million Btu in September to $3.14 in February.

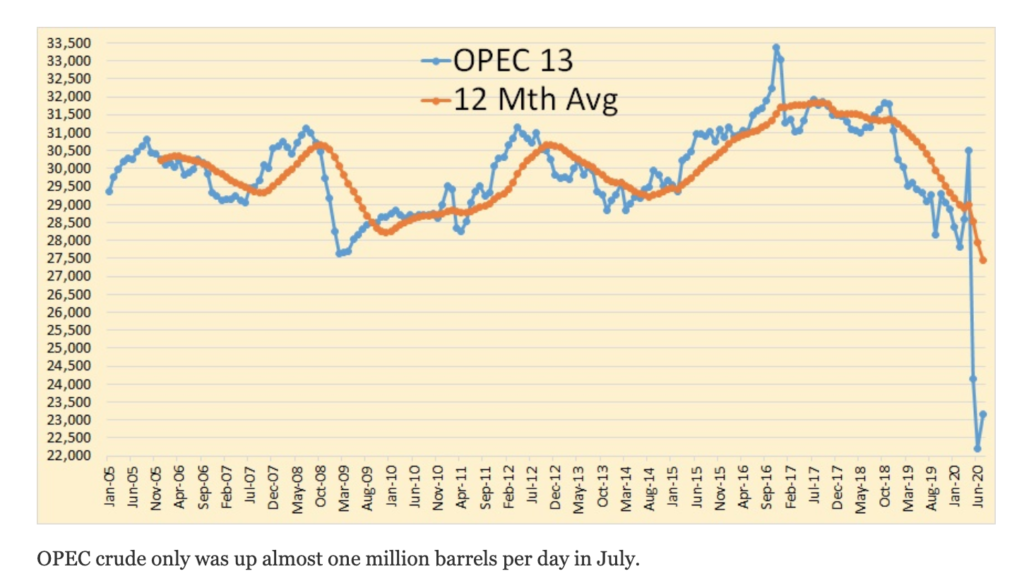

OPEC: The Joint Ministerial Monitoring Committee pushed back its next online meeting by a day to August 19th due to Russia’s request. The committee, co-chaired by Saudi Arabia and Russia, meets monthly and is tasked with adjudicating compliance with OPEC+ production quotas and analyzing market conditions. It can make recommendations for changes to the OPEC+ production cut agreement; however, Russian energy minister Novak said no significant recommendations were likely at the upcoming meeting.

The data below is from the August OPEC Monthly Oil Market Report and runs through July 2020.

Western Europe’s largest oil producer, Norway, which is not officially part of the OPEC+ coalition, is cutting its oil production because of the slump in demand and prices, which is likely to help reduce the Atlantic basin oversupply. In September, Norwegian oil loadings are set to drop by 261,000 b/d, with reduced loadings from the giant Johan Sverdrup oilfield accounting for two-thirds of those reduced volumes.

Nigeria’s full compliance with the OPEC+ deal hangs on a grade being treated as a condensate. Since OPEC+ allowed ultra-light oil to be exempt from its production cut deal, the West African nation’s “Agbami” has been a bone of contention. Nigeria’s oil ministry officials are asking international oil companies like Chevron and Equinor to reclassify Agbami as a condensate rather than a crude.

Shale Oil: Shale explorers parked more drilling rigs in the US last week as stagnant oil prices push the industry to further retrenchment. The number of active oil rigs in US fields fell by 4 to 172, compared to the 770 active oil rigs this time last year. That’s the lowest level of activity since 2005 before the shale boom kicked off. The Permian Basin alone lost five rigs last week and now has just 117 rigs, compared to 441 a year ago. Even worse may lie ahead, with the number of drilling permits last month dropping to the lowest since September 2010, according to industry consultant Rystad Energy. According to IHS Markit, US oil production will likely end the year about 20 percent lower than at the start.

According to the Petroleum Equipment and Services Association, job cuts accelerated in July, and the outlook may worsen as new Covid-19 cases stifle economic activity. The US oilfield-services sector shed 9,344 jobs last month, a 43 percent increase from June’s losses. That pushed the industry’s total job casualties since the pandemic emerged to 99,253. According to the report, Texas, Louisiana, Oklahoma, Colorado, and New Mexico were the hardest-hit regions for oilfield job cuts. Oilfield employment in American fields hasn’t been this low since March 2017. Industry analysts anticipate additional job losses as the pandemic continues and jobs supported by emergency measures such as the Paycheck Protection Program are threatened by congressional inaction.

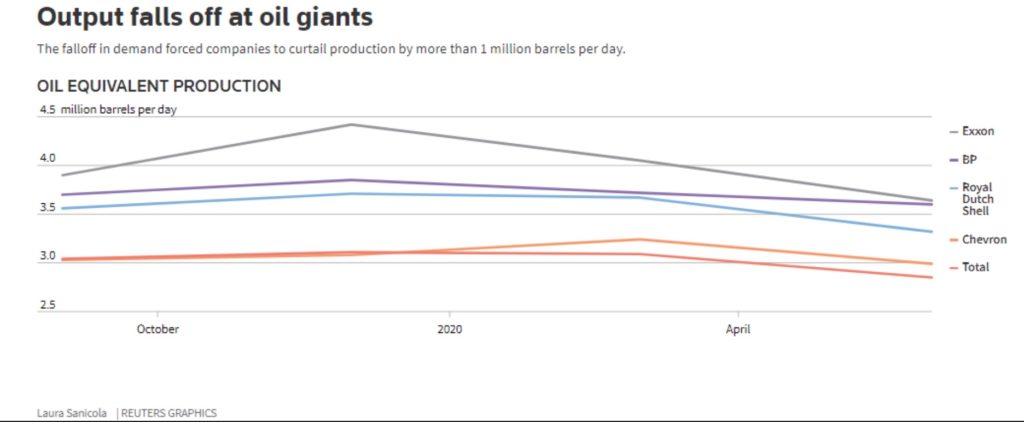

Prognosis: Seven of the largest oil companies in the world have written down a collective $87 billion from the value of their oil and gas assets over the past nine months, according to an analysis by think-tank Carbon Tracker. In the past three months alone, the companies Chevron, Shell, BP, Total, Repsol, Eni, and Equinor wrote down a total of $55 billion off the value of their assets. Of those five companies, only Exxon Mobil did not book sizeable impairments. But an ongoing re-evaluation of its plans could lead to a “significant portion” of its assets being impaired. The company reported and signaled the possible elimination of 20 percent or 4.4 billion barrels of its oil and gas reserves.

Norway’s Equinor announced on Monday that its incoming CEO has a mandate from the board of directors to accelerate its transition from an oil company to a broad energy company. “Equinor is entering a phase of significant change as the world needs to take more forceful action to combat climate change. The board’s mandate is for the new CEO to accelerate our development as a broad energy company and increase value creation for our shareholders through the energy transition.”

2. Geopolitical instability

Iran: The US said on Friday it had confiscated four Iranian fuel shipments that had been bound for Venezuela, thereby disrupting a supply line for Tehran and Caracas to defy US sanctions. The four tankers from which the cargo was taken were Greek-owned, and Washington convinced their owners that it was better to unload their shipments at sea rather than be sanctioned by the US. In retaliation, Iranian special forces seized a Greek-owned tanker for a few hours in international waters close to the UAE.

Tehran plans to start offering oil-backed securities to its citizens as part of the government’s efforts to boost state coffers hit by US sanctions and the coronavirus crisis. In April, the IMF said that Iran could run a budget deficit of nearly 10 percent this year from a 5.7 percent deficit in 2019. The plan would enable Iranians to buy from one barrel to 100,000 barrels of oil or more through Islamic “salaf” bonds. But analysts said that the scheme wouldn’t improve Iran’s long-term ability to fund its budget amid a collapse in oil revenues.

Iraq: Oil output in July, including production from the Kurdish region, remained steady compared with June as the country once again missed its target to comply with OPEC+ cuts. Baghdad must also make up for overproduction in May and June. Exports, including those from the Kurdish region, fell 0.75 percent to 3.194 million b/d from 3.218 million b/d in June. Saudi Arabia managed to get Nigeria and Iraq to agree to make up for any overproduction in May, June—and now July—by continuing to underproduce their quota in August and even beyond.

Iraq’s energy ties with the US, which were supposed to yield oil deals following the 2003 invasion, now are down to waivers for the import of Iranian electricity and gas. US energy companies did not benefit much from the Coalition Provisional Authority rule, and they seem unlikely to gain a foothold in the oil sector of a country fighting a resurgent Islamic State, grappling with protests and facing financial collapse from low oil prices.

Libya: Oil tanks at Libya’s oil export terminals pose a risk to local communities and the facilities themselves, the chairman of the National Oil Corporation, Mustafa Sanalla, warned last week. “The militarization of oil facilities, the presence of mercenaries, and the military escalation increase the risks that hydrocarbons and chemicals stored at oil ports pose to workers and the local population,” Sanalla said. “This may lead to a disaster that is more severe than Beirut’s port and a massive destruction that will cause Libya to be out of the oil market for so many years.”

Libya’s port blockade is set to keep the country’s oil off the market until at least the fourth quarter of 2020, which, as devastating as it will be for Libyan oil revenues, could help reduce the expected global production glut. Currently, oil production in Libya is around 100,000 b/d. This figure is dramatically down from 1.2 million b/d at the start of the year, just before paramilitary formations affiliated with eastern Libyan strongman General Haftar occupied Libya’s oil export terminals and oilfields.

Libya’s National Oil Corporation warned of worsening blackouts in eastern Libya due to the months-long blockade of oil and gas facilities. Interruptions and power cuts have been frequent for years in Libya but have usually been worse in the western part of the divided country. However, over the past ten days, cuts in eastern regions have sometimes lasted up to 12 hours. Natural gas supplies to power stations in the eastern cities of Benghazi and Zueitina, which had dropped to 160 million cubic feet (mcf) per day from 250 mcf per day, were expected to be suspended entirely by August 15th, the NOC said in a statement late on Wednesday. The imports of diesel to operate power stations have caused it “severe financial difficulties”.

Venezuela: Despite tightening US sanctions, Venezuela’s PDVSA has managed to increase its oil exports this month, with the daily average hitting 325,000 barrels — the highest in four months. The increase comes thanks to diesel-for-crude swaps, which are not covered by US sanctions for the time being. Meanwhile, production has continued to fall, to a bit over 100,000 b/d, compared with some 2 million b/d Venezuela produced three years ago.

The country’s oil exports are suffering another problem — the quality of the crude being loaded on tankers is so poor that purchasers’ agents are not accepting it. The delays at PDVSA’s main export terminal are due to excessive water and other impurities and metals, which has forced pumping to stop several times during a loading operation. These problems have forced exports to the lowest levels in 80 years during the past two months. Venezuelan exports of crude and oil products combined were 388,100 b/d in July, flat compared to June.

PDVSA is planning to restart the gasoline-producing unit at its CRP refining complex within two weeks, following restart of two crude distillation facilities earlier this week. Venezuela is currently producing gasoline from one unit at the Amuay refinery and another unit at the Cardon refinery. Together the two refineries are processing up to 135,000 b/d, “but that level of production has to be sustained and other units needed for gasoline production, including the fluid catalytic cracker, must be restarted,” according to a manager at PDVSA.

Venezuela’s 1.3-million-b/d refining capacity is mostly offline, due to the cash crunch at PDVSA and years without adequate maintenance and repairs. The lockdown to curb the coronavirus pandemic in a country already in severe economic collapse has reduced gasoline demand, but shortages persist.

A joint venture between Venezuela and China fell apart, resulting in Caracas losing three supertankers when foreign shippers were reluctant to carry its oil. According to documents from a Singapore court, PetroChina, PDVSA’s partner in the Singapore-based joint venture, CV Shipping, took control of the three tankers between January and February. The original purpose of the venture was to ship Venezuelan oil to China and other export destinations. However, the transfer of very large crude carriers (VLCC) came after US sanctions on PDVSA left the vessels without insurance. PDVSA’s loss of the tankers, which carry each up to 2 million barrels of oil, comes as it is more dependent than ever on its in-house fleet.

Cyprus: Turkish President Erdogan alleged on Thursday that its oil and gas exploration vessel, the Oruç Reis, has come under attack, in what is an alarming escalation of the tensions in the Eastern Mediterranean. The Greek-Turkish standoff over hydrocarbon exploration rights near the Greek border has been brewing for some time. Undeterred by Greece’s claim over the area, Turkey sent the Oruç Reis out this week to conduct seismic tests in its quest for energy resources, complete with a naval escort. Greece, who alleges Turkey is exploring for resources in an area over its continental shelf, responded by deploying naval ships of its own.

President Macron ordered French forces to the area to provide military assistance to Greece, raising the stakes in France’s growing regional confrontation against an increasingly assertive Turkey. Macron’s decision announced late Wednesday injects France into a maritime dispute over potential gas and oil fields in the Eastern Mediterranean. Turkey has made claims on what Greece and Cyprus consider their exclusive economic zones.

3. Climate change

Lethal heatwaves, droughts, floods, and typhoons will become more common in the Asia-Pacific region, which faces more severe potential impacts from climate change than many parts of the world, according to McKinsey & Co. Asia is particularly at risk because it has such a high number of poor people, who tend to do outdoor work, living in areas most vulnerable to extreme increases in heat and humidity.

McKinsey’s projections are based on a scenario in which the world fails to cut greenhouse gas emissions and Asia warms by 2 degrees Celsius. They show that by 2050, between 500 million and 700 million people living in places like India, Bangladesh, and Pakistan could experience heatwaves that exceed the survivability threshold. During those times, the loss of outdoor labor could shave off 7 to 13 percent of GDP in those three countries, resulting in losses of $2.8 trillion to $4.7 trillion.

The ice that hangs off Antarctica’s edge and floats on the ocean is melting faster than it is being replenished, even in pockets of East Antarctica typically thought to be less vulnerable to climate change. As a whole, the ice shelves have shed close to 4,000 gigatons since 1994. Thinning ice shelves, however, do not contribute directly to sea-level rise because the floating ice has already displaced its equivalent volume of water. But there is an indirect consequence. If the shelves are weakened, the land ice behind can flow more quickly into the ocean, leading to sea-level rise. This is happening and has been measured by satellites.

Greenhouse gases are punching holes in Arctic sea ice, leading it to crumble at a rapidly increasing rate. Last spring, ponds of meltwater on the ice sped the melting of the glossy shield that reflects incoming heat from the sun back to space. By July, the ice had dwindled to a record low extent for that month. It could disappear as soon as 2035, scientists said this week, as they released a study showing how the formation of melt ponds on the surface of the sea ice drove it to melt away about 130,000 years ago completely.

A storm packing hurricane-force winds tore across the US Midwest last week, causing widespread property damage in cities and rural towns and leaving more than half a million homes and businesses without power. The storm compounded troubles for the US farm economy already battered by extreme weather, the US-China trade war, and, most recently, the disruption caused to labor and consumption by the pandemic. Winds as high as 100 miles per hour hit eastern Nebraska, Iowa, Wisconsin, and parts of Illinois in the widespread storm classified as a “derecho” (straight-line winds) by the National Weather Service. It toppled grain bins in dozens of counties and tore into livestock farms in Iowa, the nation’s top hog and corn producer. Bin losses, ahead of this fall’s harvest, could leave some farmers scrambling to find storage for their crops, said agronomists.

4. The global economy and the coronavirus

OPEC has revived from oil’s historic drop. However, prices near $40 are still far too low for most members as they grapple with weak economies, unstable governments, restless young populations, and the ravages of climate change. As the legacy of the pandemic and the switch to cleaner energy threatens to keep crude prices lower for longer, consequences are looming for the way oil-rich countries are run.

The “shaky six” of OPEC — Algeria, Iran, Iraq, Libya, Nigeria, Venezuela — are facing an uncertain political and economic outlook. OPEC’s revenue is down about 50 percent from a year ago, and members’ long-running financial ailments are coming to the fore. Even Saudi Arabia isn’t immune, rolling out numerous austerity measures last quarter while contending with the tripling of its budget deficit to $29 billion. Last year, popular revolts forced the resignation of Iraqi Prime Minister Mahdi and ended the 20-year rule of Algeria’s Abdelaziz Bouteflika.

The prospects for petrostates have dramatically shifted from just a decade ago. Oil prices were around $100 a barrel then, and consumers were worried about supplies running out. Now, OPEC increasingly has to reckon with the prospect of peak demand, when consumption starts to decline as wind and solar power become more cost-efficient, especially when the costs of climate change are considered. The IEA anticipates a marked slowdown in the growth of oil consumption after 2025.

While poorer countries experienced a slower run-up in cases and deaths from the coronavirus, they now seem stuck on a long, deadly plateau stretching on for months. That contrasts with the trajectory of the disease in much of Europe and New York, where lockdowns and other measures pushed infection levels and deaths down by 90 percent within weeks after a sharp initial increase.

With new cases and deaths remaining high, many countries have been forced to go slow in reopening, deepening an economic downturn. The pandemic is also straining underfunded health systems in poorer nations, sucking up scarce personnel and resources away from other chronic diseases like diabetes and malaria. According to the WHO’s Global Fund, some 80 percent of programs designed to fight HIV, tuberculosis, and malaria—which kill millions each year—have been disrupted due to the pandemic.

United States: Even with nearly a fifth of the labor force collecting unemployment benefits in July, Americans continued spending, driving retail sales back towards pre-coronavirus levels as they shifted to shopping online, brought their food home, and stocked up on new appliances. American industry continued to regain lost ground, but production remains well below where it was before the pandemic struck. The Federal Reserve reported that industrial production — including output at factories, mines, and utilities — climbed 3 percent in July after surging 5.7 percent in June. Still, production remains 8.4 percent below its level in February before the outbreak began.

However, it was extra government money that people spent last month, and that is now drying up. A recent spate of unexpectedly upbeat economic data – including a larger-than-expected rise in payrolls last month — took the pressure off Congress to renew the unemployment benefit supplement and business loan programs that have ended.

China: The US and China postponed talks planned for last weekend to review progress at the six-month mark of their phase-one trade agreement. A sharp escalation in tensions with the US has stoked fears in China of a deepening economic war that could result in it being shut out of the global dollar system – a devastating prospect once considered far-fetched but now not impossible.

In recent months, Chinese officials and economists have been unusually public in discussing worst-case scenarios under which China is blocked from dollar settlements, or Washington freezes or confiscates a portion of China’s massive US debt holdings. Few US companies doing business in China view President Trump’s Phase 1 trade deal as worth the cost of tariffs incurred during the two-year trade war, according to a new survey by the US-China Business Council. The trade group said that just 7 percent of respondents to its annual membership survey noted that the benefits from the Phase 1 agreement outweigh the costs of tariffs incurred along the way.

China’s factory output rose just under 5 percent last month from a year earlier, while retail sales fell slightly, suggesting the country’s recovery from the pandemic remains muted. The data show that despite a rebound in Chinese exports, domestic demand is still lackluster. Massive flooding across much of the country’s southern region has also hurt both production and consumer demand and sharply increased food prices.

For decades, Chinese leaders embraced foreign investments and exports to power China’s economy. With the world in a recession and US-China tensions deepening, President Xi is laying out an initiative to accelerate China’s shift toward more reliance on its domestic economy. The new policy is gaining urgency as Chinese companies, including Huawei Technologies, face increasing resistance in foreign markets. Foxconn, a key supplier to Apple and a dozen other tech giants, plans to split its supply chain between the Chinese market and the US, declaring that China’s time as a factory to the world is finished because of the trade war.

European Union: New flareups of the coronavirus are disrupting the summer vacation season across much of Europe. In some countries, authorities are re-imposing restrictions on travelers, closing nightclubs again, banning fireworks displays, and expanding mask orders even in chic resort areas. The surges have spread alarm across Europe, which suffered mightily during the spring but appeared in recent months to have primarily tamed the coronavirus. In addition to clubs and alcohol-fueled street parties, large family gatherings – usually abounding with hugs and kisses — have been cited as sources of new outbreaks in several European countries.

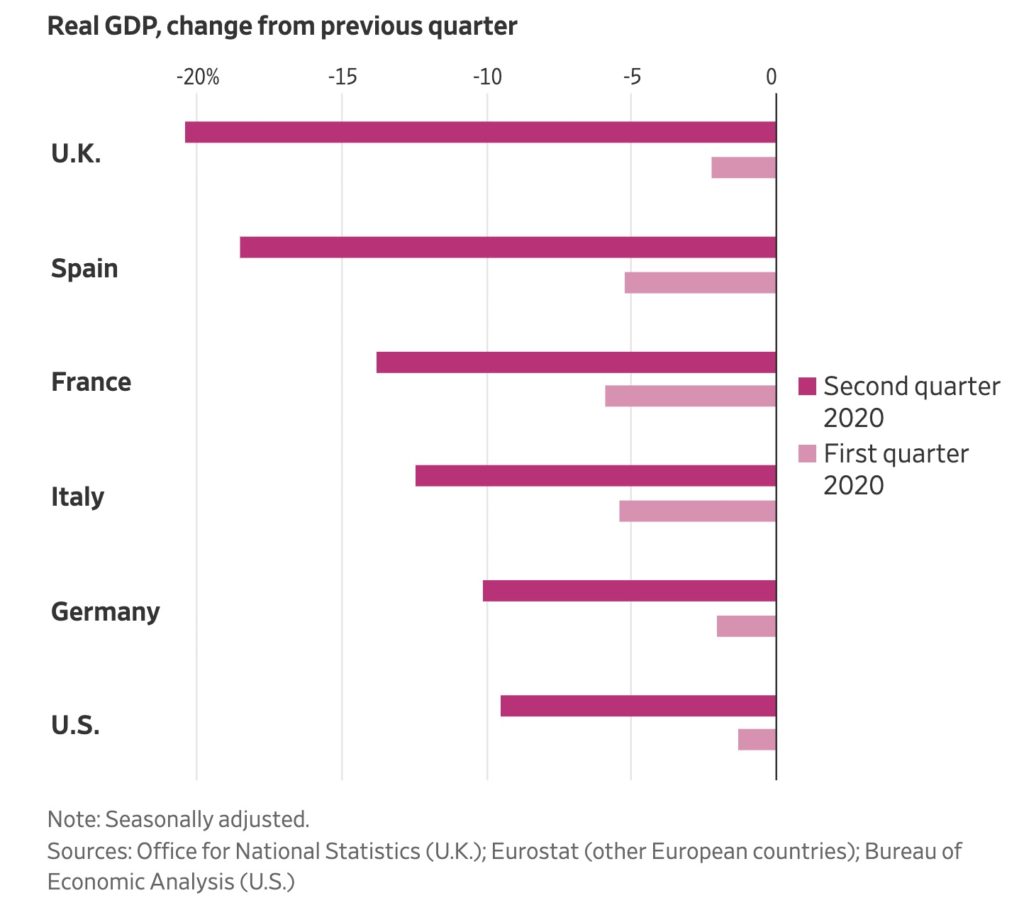

The UK economy suffered more than any major European nation during the coronavirus lockdowns, piling pressure on the government to ensure the withdrawal of its support programs doesn’t derail the nascent recovery. Gross domestic product plunged 20.4 percent in the second quarter, the most since records began in 1955 and roughly doubled that of Germany and the US. It also pushed Britain into its first recession since 2009. The report followed massive job losses since the start of the pandemic, and Chancellor of the Exchequer Rishi Sunak acknowledged that more pain is to come.

The pace of France’s economic recovery is slowing, the country’s central bank said, confirming expectations of a prolonged period before output catches up with pre-crisis levels. In its monthly report, the Bank of France said economic activity was 7 percent below normal levels in July after a 9 percent gap in June. Indicators for August suggest a similar shortfall as last month or only a slight improvement.

Russia: President Putin declared victory in the global vaccine race on Tuesday, announcing that the country has become the first to approve a coronavirus vaccine. Officials have pledged to vaccinate millions of people, including teachers and front-line health-care workers, with the experimental coronavirus vaccine developed by the Gamaleya Institute in Moscow this month. Outside scientists have criticized the aggressive strategy from a country eager to declare a victory amid one of the worst outbreaks in the world. They worry that shots could be harmful or give people a false sense of security about their immunity. China has already authorized one vaccine for use in its military, ahead of definitive data that it is safe and effective.

“This is changing the rules. This is cutting corners,” said J. Stephen Morrison, senior vice president at the Center for Strategic and International Studies. “It’s a major development, and it starts with Putin. He needs a win. It’s hearkening back to the Sputnik moment and the glory days of Russian science; it’s putting the Russian propaganda machine into full gear. I think this could backfire.”

Central to Russia’s hydrocarbons-related power is its Arctic oil and gas reserves. These comprise over 35,700 billion cubic meters of natural gas and over 2,300 million metric tons of oil and condensate, principally located in the Yamal and Gydan peninsulas. Putin says the next 10-15 years will witness a dramatic expansion in the extraction of these Arctic resources, and a build-out of the Northern Sea Route to send these resources to the global markets. Last week saw the announcement of a joint venture between Russia’s Gazprom Neft and Royal Dutch Shell. The joint venture will focus on the exploration and development of oil and gas resources along the Gydan peninsula.

Saudi Arabia: Aramco’s CEO, Amin Nasser, has confirmed that the company is moving ahead with its plans to boost its oil production capacity from 12 million b/d to 13 million, causing concern in a market that is already reeling under the weight of excess inventory. This could be construed as curious, given that Saudi Arabia’s production quota over the next few months falls well under that 13 million b/d mark.

Saudi Aramco is reducing its capital expenditure spend for 2020 due to market conditions. The company expects global oil demand to recover to 95 million b/d by the end of the year, Aramco’s CEO Amin Nasser said in the company’s second-quarter results call. Capital expenditure was $6.2 billion in Q2 and $13.6 billion for the first half of 2020. Aramco said it is continuing a capex optimization and efficiency program, which will see it at the lower end of the $25 billion to $30 billion range for 2020.

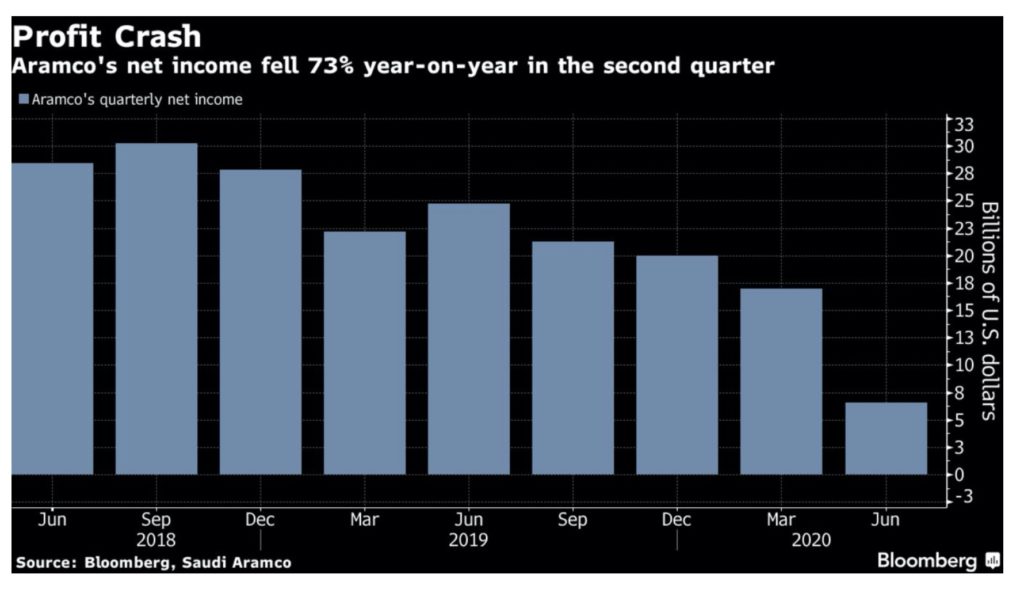

However, Aramco will be pressing ahead with a plan to pay $75 billion in dividends this year despite sliding profit and a surge in debt. The kingdom battles a widening budget deficit. Net income for the three months ending in June fell to $6.6 billion, down 73 percent from a year earlier, after crude prices collapsed. Aramco will pay a dividend of $18.75 billion for the quarter, most of it to the government, which owns around 98 percent of the company’s stock. According to Chief Executive Officer Nasser, Aramco’s performance and energy demand will probably improve over the rest of the year as nations ease coronavirus lockdowns.

India: Its 1.5 billion people have access to only about 4 percent of the world’s water resources, and farmers consume almost 90 percent of the groundwater available. As global temperatures rise and overuse of water depletes existing resources, the threat to lives and businesses is projected to grow. Water shortages are already acute: nearly half the country’s population faces high to extreme water stress, and almost 200,000 die each year due to inadequate access to safe water. Prime Minister Modi’s government is trying to turn around decades of established farming practices and convince the country’s most powerful voting bloc to change the crops they plant. Water-guzzlers like rice and wheat are out.

5. Renewables and new technologies

Last month, the Australian government endorsed the Australia-ASEAN Power Link, which may be the most ambitious renewable energy project underway anywhere. The plan is to generate electricity from the sun in Australia’s Outback, store it in giant batteries, and then transmit it to Singapore along a watermelon-width 2,800-mile cable buried in a deep trench.

The project’s backers believe that Australia eventually can supply cheap solar power to a pan-Asian electricity grid, reducing the region’s dependence on coal and natural gas. Scheduled to start operating in 2027 at the cost of about $16 billion, the project would combine the world’s largest solar farm, the most massive battery, and the longest submarine electricity cable. It would produce three gigawatts of power, the equivalent of 9 million rooftop solar panels.

The longest submarine power cable currently under construction is the 435-mile Norway-to-Britain North Sea Link, which is scheduled to start operating next year, according to Griffin. Sun Cable would be six times as long. Over the total distance, some 4 to 10 percent of the electricity would be lost.

The New South Wales government approved the eastern Australian state’s first hydrogen gas facility last week to supply hydrogen to greater Sydney by 2025. The facility is costing A$18 million ($12.83 million) and will be operated as a trial project over the next five years. If successful, the facility would provide green gas to homes, vehicles, and businesses across Sydney, the government said. The NSW government wants hydrogen to contribute 10 percent of the state’s gas network by 2030. The project’s construction is due to start within three months to convert tap water and grid electricity from renewable sources into hydrogen gas.

The US nuclear power industry is in trouble as cheaper solar and wind energy gain an increasing share of US electricity production. One solution is creating “clean renewable gas,” such as hydrogen, using its existing nuclear reactors. Although producing hydrogen using electrolyzers at nuclear plants is not yet cost-competitive, the industry is engaging in research to improve the economy.

Nuclear industry officials have said they see opportunities to keep atomic reactors in competitive power markets operating by adapting them to produce hydrogen for internal use, for sale, or potentially for power generation to help in balancing the grid and keeping them economically competitive. Exelon expects to announce by the end of March which of its boiling water reactor plant sites will host a 1-MW electrolyzer to demonstrate hydrogen production for on-site use.

According to a press release from Argonne National Laboratory, researchers at the lab, working with partners at Northern Illinois University, have discovered a new electrocatalyst that converts carbon dioxide and water into ethanol. The reaction takes place with very high energy efficiency, high selectivity for the desired final product, and low cost. Ethanol is a particularly desirable commodity because it is an ingredient in nearly all US gasoline and is widely used as an intermediate product in the chemical, pharmaceutical, and cosmetics industries.

China’s foremost battery manufacturer, CATL, said last week it is working on a new technology that will allow battery cells to be integrated with an electric car’s chassis, shedding traditional casings that make battery systems bulky. Integrating cells directly into an electric vehicle’s frame would allow more cells to be loaded into a car and extend its range. With the new technology, EVs could travel over 500 miles without refueling. The company aims to launch the technology before 2030, which is a long time, considering the pace at which the electric vehicle industry moves.

The state of Michigan plans on building or assigning dedicated lanes for automated vehicles on a 40-mile stretch of highway between Detroit and Ann Arbor. Organizers say the project will begin with a two-year study to determine whether existing lanes or shoulders could be used, or new lanes need to be built. Eventually, autonomous buses and shuttles would run along the Interstate 94 corridor, linking the University of Michigan to Detroit Metropolitan Airport and the city’s downtown.

Much of the project will be bankrolled by companies funded by Google parent Alphabet Inc., which hopes to make money by duplicating the technology for other large metro areas. The project is being led by a company called Cavnue, which will start the study by running autonomous vehicles with human backup drivers along I-94 and US 12 to collect data.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

BP plans the most massive downsizing of office locations and properties in its history amid remote work and office job cuts. The company is currently reviewing the need for office locations in the UK and abroad because of the growing work from home trend amid the pandemic. Over time, BP could nearly halve the office space it uses. In June, BP said it would cut 10,000 jobs or around 15 percent of its workforce. (8/13)

Bully Turkey? There is almost no conflict in Turkey’s near abroad where the aspiring regional power is not involved. The fundamentals of Ankara’s clashes were years in the making before a trigger unleashed the current tensions. (8/12)

Bully Turkey: A week ago, it seemed Turkey might back down on its ambitious oil and gas exploration aims in the eastern Mediterranean amidst global pressure, especially coming from the EU and the US. But President Erdogan is defiant once again, announcing Friday the resumption of energy exploration work that Greece and Cyprus says violates their territorial waters. (8/11)

In Mozambique, fighters linked to Islamic State took control of a northern port town that’s been a key logistics link for a $23 billion natural-gas project being built by Total. It’s the third time this year the insurgents have seized Mocimboa da Praia, located about 60 kilometers (37 miles) south of the LNG project and the closest harbor. About three months ago, fighters that first pledged allegiance to IS in 2018 occupied it for as long as three days. (8/14)

In Nigeria, Africa’s largest oil refinery, which is anticipated to be the biggest single-train structure, is set to be opened early next year. The Dangote Oil refinery is under construction in Lagos. The facility will have the capacity to process 650 000 barrels of crude oil daily. (8/11)

In Argentina, ExxonMobil has been awarded a 35-year concession for another block in Vaca Muerta. This massive shale play has been driving the company’s growth in oil and natural gas production in that country. Two test wells will have 1,200-meter (3,937-feet) horizontal laterals and 20 frac stages, while the subsequent 44 wells will have 3,000-meter laterals and 50 frac stages each. ExxonMobil’s total oil production in Argentina reached 5,510 b/d in March from 1,227 b/d in the year-earlier month. (8/15)

Canadian oil sands to H2? The idea of producing cleaner-burning hydrogen to rid the world of fossil fuels is gaining traction in an unlikely place: Alberta, home of dirty oil sands. The oil-rich Canadian province has attracted a growing group of researchers and entrepreneurs, betting that the region’s vast resources can turn it into one of the world’s largest hydrogen suppliers. And they’re about to get some backing from federal and local governments. (8/14)

More Louisiana LNG: McDermott International Ltd. reported that Train 3 at Cameron LNG had begun commercial operation. Trains 1 and 2 began commercial operations in August 2019 and February 2020, respectively, noted Cameron LNG. (8/11)

Politics and drilling: While many US oil and gas producers have slowed drilling activity to a bare minimum in response to low prices, operators holding federal permits have boosted activity ahead of a potential ban expected if presumptive Democratic presidential nominee Joe Biden wins November’s election. These drillers’ efforts to beat the election clock can be seen in the latest data on drilled-but-uncompleted wells, which show a rising share of DUCs on federal versus private land. (8/13)

Refinery regret: Delta Air Lines, to save money on jet fuel, tried a bold experiment: It bought an oil refinery in 2012 outside Philadelphia, the first such purchase by a major U.S. airline. After up-and-down years, in 2018, Delta announced that it was interested in finding a partner to own and operate it jointly; it never found any takers. Now, as the coronavirus has hammered demand for air travel, it has become a liability for Delta. Delta’s refinery Monroe Energy, in Trainer, Pa., lost $114 million in the second quarter, and its future appears bleak. (8/11)

US refiners see economic opportunity in getting greener as consumption remains depressed during the coronavirus pandemic, and the prospect of more government regulations increases. Phillips 66 said it plans to transform a San Francisco-area oil refinery into a plant that produces fuels from products such as vegetable oil and animal fat. This is one of several similar projects proposed in recent months, as US refiners re-evaluate their businesses in light of Covid-19 and tightening environmental regulations. (8/13)

Phillips 66 plans to reconfigure its San Francisco Refinery in Rodeo, California, to produce renewable fuels by 2024. The plant would no longer produce fuels from crude oil but instead would make fuels from used cooking oil, fats, greases, and soybean oils. At a conversion cost of $800 million, the Phillips 66 Rodeo Renewed project would produce 680 million gallons annually of renewable diesel, renewable gasoline, and sustainable jet fuel — the world’s largest facility of its kind. (8/14)

Six former US EPA chiefs called for a “reset” at the environmental agency after President Trump’s regulation-chopping, industry-minded first term, backing a detailed plan by former EPA staffers that ranges from renouncing political influence in regulation to boosting climate-friendly electric vehicles. (8/13)

Under the Renewable Fuel Standard (RFS), oil refiners must blend growing amounts of renewable fuels into gasoline and diesel or purchase renewable fuel credits. The price of corn-based ethanol fuel credits has jumped five-fold so far this year. The rise in the price of credits, together with depressed refining margins amid the demand slump, has made life harder for US refiners this year. (8/12)

Ugandan EV buses: In Kampala, state-owned Kiira Motors Corp. plans to have an initial manufacturing capacity of 5,000 electric vehicles per year, including buses, starting in July 2021. Hopes for the project include providing good jobs for locals and helping cut air pollution in a city ranked among the dirtiest in the world. (8/12)

Western Europe’s EVsales pulled ahead of China’s last month after countries including Germany and France boosted government subsidies to stimulate demand that had been decimated by the pandemic. Europe’s roughly 500,000 plug-in hybrid and battery-electric vehicles during the first seven months of 2020 exceeded China’s sales by about 14,000. (8/14)

EV garbage trucks: Nikola Corp. said it secured an order for 2,500 electric garbage trucks from refuse giant Republic Services Inc., with the announcement coming less than a week after analysts complained about a lack of clarity on the business plan and order bank. For several years, the electric-vehicle company has touted robust interest in the electric and fuel-cell trucks it plans to mass-produce and sell. (8/11)

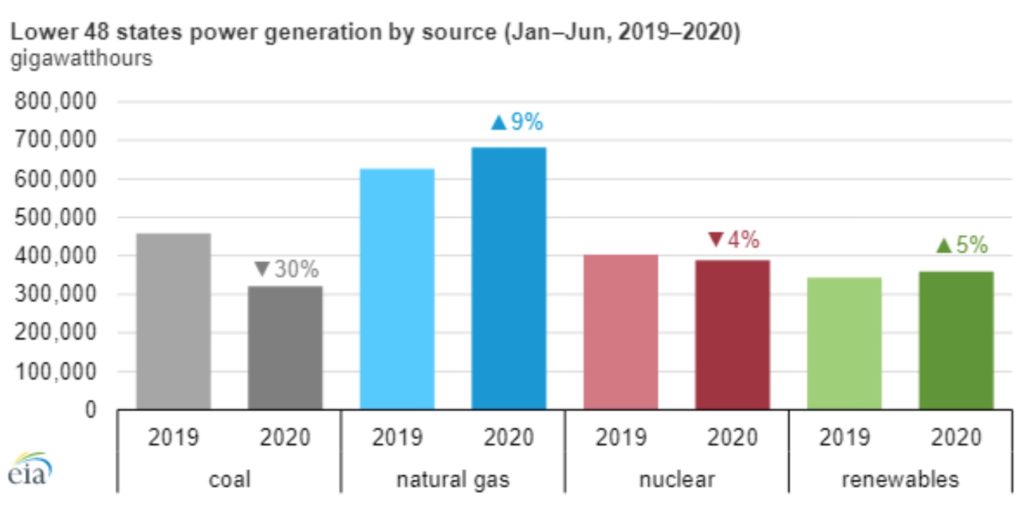

Coal estimate: The US is expected to produce 502.2 million tons of coal in 2020—the lowest since 1963—the US EIA said. Such a 2020 production total would be 28.8% lower than the 705.3 million st produced in 2019, while 2021 production is forecast to rise to 564.1 million st. (8/12)

Northern Appalachia coal production in the second quarter fell to over a 25-year low, as the coronavirus pandemic led to a decrease in power demand and cutbacks from miners. (8/14)

US offshore wind has the potential to become a major industry over the next decade, unlocking billions of dollars of investment and creating thousands of jobs. The reasons for slower offshore wind development so far in America, vs. Europe and Asia, extend beyond the costs of technology. The regulatory and political background has also played a role in the US, having just 42 megawatts of installed offshore wind capacity as of today. Smoother processes of leasing and permitting of offshore wind projects could facilitate up to US$166 billion in offshore wind investment in the US by 2035, Wood Mackenzie said. (8/14)

Rolling blackouts in CA: California’s grid operator is warning of possible rolling blackouts and calling on the state’s utilities to start cutting power to some customers. On late Friday, the California Independent System Operator declared a Stage 2 emergency for the first time since 2006. (8/15) [Editor’s note: Stage 3, with rolling blackouts, was declared later on Friday; those rolling blackouts are planned to last a one-hour duration.]

Big Congo hydro: Chinese and Spanish developers that want to build Africa’s biggest hydropower plant in the Democratic Republic of Congo agreed to form a single consortium in an accord the country says is a key step to realizing the plan. The $14 billion dam is part of a long-delayed project known as Grand Inga that’s eventually intended to harness as much as 40,000 megawatts of power from the Congo River. (8/10)

H2 patent: Proton Technologies has patented a method of igniting an oil well and using a palladium alloy filter in the well bore that traps the carbon emissions in place while allowing pure hydrogen to flow to the surface. (8/14)

Pandemic #s: Nationwide, 200,000 more people have died than usual since March. This number is about 60,000 higher than the number of deaths that have been directly linked to the coronavirus. As the pandemic has moved south and west from its epicenter in New York City, so have the unusual patterns in deaths from all causes. That suggests that the official death counts may be substantially underestimating the overall effects of the virus. (8/13)

Britain has suffered the deepest recession among the world’s top economies this year, shrinking by a fifth in the second quarter alone when much of the economy was mothballed as part of efforts to contain the coronavirus pandemic. The 20.4% quarterly drop is the worst since records began in 1955. The country faces a tough time in coming months, with unemployment likely to spike as the government phases out a support program that has effectively kept nearly 10 million workers on company payrolls. (8/13)

Japan’s pandemic-hit economy shrank last quarter by the most in records going back to 1955, with a resurgence of the virus threatening to slow a fragile recovery now under way. Analysts see GDP contracting at an annualized pace of 27 percent in the three months through June. That means the world’s third-largest economy will have declined in size for three straight quarters, hit first by trade wars and a sales tax hike, then by the virus. (8/14)

Tropical Storm Dolly spun up southeast of Nova Scotia, becoming the Atlantic’s fourth named storm of 2020, marking the third-fastest start to a storm season in more than a century. The storm is drifting into the Atlantic Ocean away from land in North America. Only 2016 and 2012 produced four Atlantic storms quicker than this year in records going back to 1851. (8/14)

The Atlantic hurricane season, already on a record pace, will become more frenetic when it reaches its peak in a few weeks. The odds the equatorial Pacific will remain neutral or even spin up a La Nina — when the sea surface temperature becomes cooler than usual — have risen in the last month. In either state, the weather patterns over the Pacific actually decrease hurricane-killing wind shear across the Atlantic, allowing more Atlantic storms to form and strengthen. (8/14)

Greenland’s ice sheet may have shrunk past the point of return, with the ice likely to melt away no matter how quickly the world reduces climate-warming emissions. Scientists studied data on 234 glaciers across the Arctic territory spanning 34 years through 2018 and found that annual snowfall was no longer enough to replenish glaciers of the snow and ice being lost to summertime melting. (8/15)

In China, the “Clean Plate Campaign” comes after Mr. Xi highlighted that Covid-19 had “sounded the alarm” on food waste. He added that China had to “maintain a sense of crisis about food security”. It also comes after weeks of mass flooding across southern China which left farms wrecked and ruined tons of produce. (8/13)

In the Midwest, Monday’s derecho across the Corn Belt destroyed more than 10 million acres of Iowa’s corn and soybean crop, devastating farmers and capping off what has already been a difficult few years of farming for many. Up to 43 percent of the state’s corn and soybean crop has suffered damage from the storms that brought winds exceeding 100 miles per hour at times, a severe blow to a $10 billion industry. (8/13)