Editors: Tom Whipple, Steve Andrews

Quotes of the Week

“Taking account of scientific advice and current technological progress, as well as varying transition challenges across Member States, the [European] Commission considers there is a role for natural gas and nuclear as a means to facilitate the transition towards a predominantly renewable-based future.”

Statement from the European Commission on January 1, 2022

“It’s clear for Austria: neither nuclear power nor fossil gas have been excluded from the [EU’s] proposed taxonomy. If these plans are implemented as is, we will sue…Greenwashing atomic energy and fossil gas is completely unacceptable.”

Leonore Gewessler, Austria’s Climate Protection Minister

“I am not for pissing off the French … however, the unvaccinated, I really want to piss them off. I’m not going to throw [the unvaccinated] in prison. I’m not going to get them vaccinated by force. … We put pressure on the unvaccinated by limiting their access to social activities as much as possible.”

French President Emmanuel Macron

Kate Abnett and Simon Jessop, Reuters

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil: Prices climbed to a seven-week high as supply constraints from OPEC+ to North America offset concerns about the impact of a Covid-19 outbreak in China. Futures in New York rose 2.1% to the highest closing price since Nov. 16th and traded above $80 a barrel during Friday’s session. A deep freeze in Canada and the northern U.S. is disrupting oil flows, boosting prices just as American stockpiles decline. Output from OPEC+ member Kazakhstan’s giant Tengiz oil field has been temporarily adjusted amid unrest in the Central Asian country. A growing premium for prompt barrels suggests that supply troubles across the OPEC+ coalition — which was able to provide only part of last month’s planned production increase — are delaying the onset of an anticipated oversupply in global markets.

Real-time transportation data globally suggests that worldwide there has not been any significant impact on oil demand so far from Omicron. That’s what Rystad Energy’s head of oil markets said in a report, adding that, for now, the Omicron risk remains exactly that, a risk. “Market balances will remain somewhat tight for January and February and keep oil prices supported, especially with supply side concerns and a disciplined OPEC+.”

U.S. crude oil stockpiles fell last week while gasoline inventories surged by more than 10 million barrels, the biggest weekly build since April 2020, as supplies backed up at refineries due to reduced fuel demand at the end of the year. Analysts attributed the surprising gasoline build to steady refining production, combined with a fall-off in demand due to the coronavirus Omicron variant.

Currently, the price of a gallon of gasoline in California is $4.65, according to AAA, compared to the national average of $3.285 per gallon. Despite the recent surge in demand, GasBuddy showed that US gasoline demand was “incredibly weak” last week, with the week over week change -13.7% as of Wednesday.

According to a new study published by GasBuddy last week, gasoline prices could reach $6 per gallon in San Francisco, with Los Angeles and Sacramento reaching $5.50 per gallon. For some cities in California, this would be the highest nominal average ever paid.

International Energy Agency: The IEA is suggesting that it could make all its data and analyses free and available to all, Quantum Commodity Intelligence reported on Thursday. Last year, the IEA received criticism from academics that hiding data behind steep paywalls could impede the free exchange of climate-related data. The IEA is currently funded by member countries, including the United States, Japan, and some European countries, but sales of information support a quarter of its $8.1 million budget.

OPEC: The OPEC+ alliance this week stuck with a scheduled output boost of 400,000 b/d for February, but the group is unlikely to meet that threshold as some members struggle to achieve their targets. The Organization added just 90,000 b/d in December. A boost by Saudi Arabia was offset by losses in Libya and Nigeria, according to a Bloomberg survey. Output in Libya has declined amid militia unrest, while Russia also failed to boost output last month.

OPEC+ expects the surplus on the oil market in the first quarter of 2022 to be 1.4 million b/d, or some 25% lower than it forecast in early December, Bloomberg reported on Monday, citing internal OPEC+ research. Lower expected oil supply from non-OPEC+ producing nations was the key reason for a downgrade in the surplus estimate.

Shale Oil: On December 27th, a 4.5-magnitude earthquake struck Texas, with the epicenter in the Permian. The tremor followed a series of weaker ones, spurring the Texas Railroad Commission into swift action. The Commission suspended the injection of wastewater from well-drilling and fracking into deep underground reservoirs. Oil producers in some of the most prolific parts of the Permian could lose up to half of their disposal wells. According to a Rystad report, companies including ConocoPhillips, Diamondback Energy, Chevron, Coterra Energy, and Rattler Midstream could lose up to half of their wastewater storage.

Major shale-oil drillers are dreading the prospect of $100-a-barrel crude on fears it will tempt rivals to expand output and create a new supply glut. With an expectation that global crude demand may outpace production as soon as this year, Pioneer Natural Resources CEO is bracing for oil to range from $75 to $100.

U.S. crude has been above $75 for the past week and a half and briefly rose to almost $85 in late October. “I hope it stays there,” Sheffield said during a Goldman Sachs Group Inc. energy-conference. Prices approaching $110 or $120 “is not going to help our industry.” Oil executives expressing anxiety over triple-digit oil prices may seem counterintuitive but it’s emblematic of a new mantra that favors stable cash flows and greater shareholder returns.

Natural Gas: European benchmark natural gas prices rose on Wednesday for the third day in a row, as gas deliveries from Russia via Ukraine and Poland continue to be low while another cold snap is headed for Europe. Natural gas prices at the Dutch TTF hub, the benchmark for European gas, rose by 6% by mid-day, following a 30% jump on Tuesday. European gas prices reflect growing concerns that Russian natural gas flows to Europe via Ukraine and Poland have been abnormally low in recent days. Russian gas supply to Europe via Ukraine dropped earlier this week to the lowest daily volume since January 2020. Daily gas transit flows from Russia westward to Europe via Ukraine on Monday were half the amount Russia had booked for that day.

The salt caverns, aquifers, and fuel depots that hold Europe’s stockpiles of natural gas have never been so empty at this point in winter. Just four months after Amos Hochstein, the U.S. envoy for energy security, said Europe wasn’t doing enough to prepare for the dark and cold season ahead, the continent is grappling with a supply crunch that’s caused benchmark gas prices to more than quadruple from last year’s levels.

Residents in the Groningen area in the Netherlands have voiced their anger at a plan by the Dutch government to potentially double this year natural gas production from the Groningen gas field, which has been hit by earthquakes in the past. The Dutch government said on Thursday that it might need more gas to be pumped at Groningen, once Europe’s biggest gas field, which the Netherlands has pledged to phase out this decade after frequent earthquakes in the past damaged homes in the area.

The final US weekly gas draw of 2021 looks to measure less than half the five-year average, mimicking most of the heating season thus far, as inventories continue to gain on historical norms. Recent growth in Permian Basin gas production appears to be keeping downward pressure on the East Texas market. In recent trading, cash basis at locations like Houston Ship Channel, Katy Hub and Transco Zone 1 have fallen to a more-than-40-cent discount to the Henry Hub, down from year-ago levels at just 4 to 5 cents behind the benchmark, S&P Global Platts data shows.

A cold snap in Western Canada has driven record demand and sharp production freeze-offs over the past 10 days. Exports to the US Midwest fell dramatically, to as low as 2.2 billion cf/d from 3.8 billion prior to the cold snap. The Chicago prompt-month basis contract quadrupled as this happened, as traders feared a cold snap in the Midwest could send Chicago prices shooting skyward.

Electricity: Rising fuel costs, especially those of natural gas, drove up wholesale electricity prices in all US regions during 2021. This year, power prices were already above $200/MWh in New York, Independent System Operator, ISO New England and eastern PJM Interconnection territory on Jan. 7 as a storm dropped several inches of snow and cooler weather expected over the next week could lead to an extended period of elevated prices.

New York Governor Hochul is throwing her support behind building electrification as part of her administration’s climate agenda. On Jan. 5, Hochul announced a plan to accelerate the decarbonization and electrification of the Empire State’s sprawling building stock, which encompasses 7.3 million households and another 370,000 commercial and institutional buildings.

Prognosis: Oil prices could reach $95 if Iran doesn’t return to the market this year, while commodities overall are set for a supercycle that could potentially last a decade, according to Goldman Sachs, which is “extremely bullish” on the whole commodity complex. Currently, we are seeing record dislocations in energy markets, metals markets, and agriculture markets, Jeff Currie, global head of commodities research at Goldman Sachs, told Bloomberg. There is still a lot of money in the system, while investment positions in commodities are very low, which is setting the stage for further upsides in oil prices and the prices of other commodities, Currie said.

2. Geopolitical instability

(These are the situations that reduce the world’s energy supply or have the potential to do so.}

Ukraine: A divided EU has demanded a role in next week’s negotiations with Russia over the Ukraine crisis and broader issues of European defense after Vladimir Putin succeeded in sidelining the bloc in favor of talks with the US and NATO. EU officials are expressing frustration at the way negotiations in Geneva and Brussels were arranged — with Russian officials to discuss the security of Ukraine and the whole European continent with counterparts from both Washington and the US-led military alliance. The EU’s top diplomat has warned Russia and the US against creating “spheres of influence” in Europe ahead of talks between the two countries next week.

NATO’s secretary-general has ruled out creating “second-class” members of the military alliance to appease Moscow ahead of a week of high-stakes diplomacy between the Kremlin and Western powers that aims to avoid a feared Russian invasion of Ukraine.

Russia, which has stoked fears of a potential military attack on Ukraine, has demanded the US and NATO agree to security pledges that would ban former Soviet states from joining the western military alliance and restrict US troops stationed in eastern Europe.

Russia has resumed its natural gas supply to Romania through the Ukrainian gas transit system. Gazprom suspended gas transit to Romania via Ukraine in April last year and supplied the gas to Romania via the Turkish pipeline. The volume of Russian gas transported via Ukraine to Europe fell 25% in 2021, reducing a significant revenue stream for Ukraine’s struggling economy at a time of heightened tensions with Russia.

Iran: Given ongoing high and steady crude oil sales to China and other Asian countries, Iran announced plans last week to boost oil production from its supergiant South Azadegan oil field to at least 320,000 b/d by the middle of 2023, from the current 140,000 b/d.

Iraq: Baghdad is attempting to take over ExxonMobil’s operating stake in the West Qurna 1 oil field rather than approve a sale to international investors. In a Jan. 5th statement, the Oil Ministry said the Iraqi Cabinet had “approved the Iraqi National Oil Company’s acquisition of ExxonMobil’s share in West Qurna 1.” The field is currently producing over 460,000 barrels per day, more than one-tenth of the country’s overall output. ExxonMobil had filed an arbitration case against Iraq’s state-owned Basra Oil Company over the US oil major’s stalled attempt to sell its stake in the giant oil field.

Total oil exports rose to 3.677 million b/d in December, from 3.660 million b/d. Federal exports rose to 3.277 million b/d in December, up from 3.273 million b/d in November, while Kurdish exports increased to 400,000 b/d, a 3.3% uptick from November. In December, Iraq’s OPEC+ quota rose to 4.237 million b/d from 4.193 million b/d in November.

Libya: Elections for Dec. 24th were canceled. Political stability hangs in the balance, with no clarity on when elections may occur. The North African producer is pumping around 700,000 b/d at the moment, a fall of approximately 500,000 b/d from mid-December.

Venezuela: Oil exports from Venezuela doubled in December from a year earlier as the country raises production of revenue-generating hydrocarbons in defiance of US sanctions. Shipments averaged 619,000 b/d in December. Iran’s support boosted the supply of a critical ingredient that aids production. Output touched 1 million barrels on a single day in December. However, production averaged 625,000 barrels a day during the entire month of November.

Kazakhstan: Bloody clashes between anti-government protesters and security forces appeared to have largely subsided overnight Friday, though the streets of Almaty, Kazakhstan’s largest city, remain littered with debris and burned cars that serve as a reminder of the deadly unrest that has embroiled Central Asia’s largest economy for the past week. Almaty airport, Kazakhstan’s busiest and now under the control of Russian and Kazakh forces, was closed to civilian aircraft. At the same time, checkpoints set up during the nationwide state of emergency hindered domestic travel via rail and road. There were long lines at gas stations and worries of food shortages in Kazakhstan’s economic hub

On Wednesday, President Tokayev called on the Moscow-led Collective Security Treaty Organization to intervene in Kazakhstan, marking the first time that the group of six former Soviet states has dispatched military forces in response to domestic unrest. Tokayev and CSTO allies, such as Belarusian leader Alexander Lukashenko, have sought to portray protesters as foreign-funded “terrorists,” though there is no substantive evidence to back the claim.

The crisis coincided with a power struggle within the government, fueling talk that the people fighting in the streets were proxies for feuding factions of the political elite. There is also feverish speculation about Kremlin meddling and a host of other murky possible causes. The only clear thing is that the country’s convulsions involve more than a straightforward clash between protesters expressing discontent and the heavy-handed security apparatus of an authoritarian regime.

Kazakhstan is a major oil producer, hitting 1.6 million barrels b/d in recent months, and has rarely seen production disrupted by unrest or natural disaster. Chevron, the largest foreign oil producer in Kazakhstan with a 50% stake in the Tengizchevroil (TCO) joint venture, said that production operations continue. “However, there has been a temporary adjustment to output due to logistics.”

Protestors at the oilfield have disrupted the trains used to export oil, sources told Reuters. TCO produces around 700,000 b/d. It was not clear how much output had been reduced. Other top fields in Kazakhstan are onshore Karachaganak and offshore Kashagan. In a statement, Tengizchevroil said it “has been notified that some contractor employees have gathered at the Tengiz field in support of meetings taking place in Mangistau oblast. TCO and Business Partner Industrial Relations teams are working together to resolve this situation as soon as possible. This incident has not impacted TCO production operations.”

3. Climate change

The European Union proposal to classify investment in some natural-gas and nuclear projects as sustainable exposed deep divisions among member states, underscoring the bloc’s challenges as it reaches for an ambitious climate-neutrality goal. Green politicians in Austria, Spain, and Luxembourg criticized the draft measure, saying it could damage the credibility of the new rulebook and threaten to divert investment away from renewables. Germany opposed the nuclear component of the draft while supporting the natural gas component. A majority in the European Parliament threw its weight behind the plan, saying it would help accelerate emissions reductions.

Opponents are pressuring the European Commission to modify its plan, knowing they face a difficult task in trying to block it at a later stage. The commission uses a particular scrutiny procedure that would require at least 20 member states — representing at least 65% of the EU’s population — to collectively reject the rule in the coming months, which is very unlikely.

For the first time since the unveiling of the Paris climate agreement in 2015, banks earned more fees arranging green-related bond sales and loans than they did helping fossil-fuel companies raise money in the debt markets. To be sure, the final tally for 2021 was incredibly close. Overall, banks pocketed an estimated $3.4 billion from green-labeled debt deals, compared with $3.3 billion from their work with oil, gas, and coal companies, according to data compiled by Bloomberg.

According to a new Washington Post analysis of federal disaster declarations, more than 4 in 10 Americans live in a county that was struck by climate-related extreme weather last year, and more than 80% experienced a heatwave. In the country that has generated more greenhouse gases than any other nation in history, global warming is expanding its reach and exacting an escalating toll.

At least 656 people died amid the onslaught of disasters. According to the National Oceanic and Atmospheric Administration, the cost of the destruction tops $104 billion, even before officials calculate the final toll of wildfires, drought, and heatwaves in the West.

4. The global economy and coronavirus

United States: The US set a global record of almost 1 million new coronavirus infections reported last Monday, nearly double the country’s peak of 505,109 hits just the week before, as the highly contagious Omicron variant shows no sign of slowing. The number of hospitalized COVID-19 patients has risen nearly 50% in the last week and now exceeds 100,000, the first time that threshold has been reached since the winter surge a year ago.

The US unemployment rate dropped significantly in December, prompting investors to increase their bets on the Federal Reserve moving quickly to raise interest rates and withdraw the stimulus it put in place to support the economy at the start of the pandemic. Economists and investors expect the central bank to press ahead with tightening monetary policy despite unexpectedly slow jobs growth in December, when employers added 199,000 jobs, down from a gain of 249,000 in November. The headline figure was well short of the 444,000 expected by economists.

Since the pandemic began, efforts to relocate manufacturing back to the US from abroad have accelerated, said Claudio Knizek, global leader for advanced manufacturing and mobility at EY-Parthenon, a strategy consulting firm. “It may have reached a tipping point,” he added. Decades of dependence on Asian factories, especially in China, have been upended by delays and surging freight rates — when shipping capacity can be found at all. In addition, backups at overwhelmed ports and the challenges of obtaining components and finished products in a timely way have convinced companies to think about locating production capacity closer to buyers.

The US trucking industry is set to be transformed by a handful of states adopting zero-emission vehicle requirements. Oregon, Washington, New York, New Jersey, and Massachusetts followed California in approving the Advanced Clean Truck (ACT) rule late last year, requiring a growing percentage of all medium- and heavy-duty trucks sold to be zero-emission starting in 2025.

Manufacturers must increase their zero-emission truck sales in those states to between 30 and 50% by 2030 and 40 to 75% by 2035. The new sales mandate will fill the country’s coastal highways and corridors with an expanding number of electric-powered large pickups, buses, garbage trucks, and tractor-trailers in the years to come. Oregon also approved the Heavy-Duty Omnibus rule, which toughens tailpipe standards on sales of new trucks that still use fossil fuels and makes them 90% cleaner once fully implemented.

Europe: France’s parliament approved President Emmanuel Macron’s plans for a vaccine pass to help curb the spread of the Omicron variant after a tumultuous debate whipped up by Macron’s comments that he wanted to “piss off” the unvaccinated. Macron told Le Parisien newspaper that he wanted to make the lives of those refusing the COVID-19 vaccine so complicated by squeezing them out of public places that they would end up getting vaccinated.

Power prices in Europe fell last week after weather forecasts signaled that warmer than usual and windier weather conditions would prevail in northwest Europe in the coming weeks. As a result, the power price for February in Germany, which serves as a benchmark for Europe, has dropped by nearly 10% this week, according to estimates from Bloomberg. However, year-ahead power prices in Germany have jumped by the same percentage this week, suggesting that electricity prices in Europe will continue to be high even a year from now.

Industrial output in the euro area’s two largest economies unexpectedly contracted in November as supply constraints lingered, even before the coronavirus’s omicron variant hit the continent. France saw substantial declines in transport materials and equipment, while energy output and construction weighed Germany’s production. However, German factory orders rose in November, giving the economy cause for optimism after another quarter characterized by record numbers of Covid-19 infections.

The UK government believes it has until April to find a solution to ease the burden of surging natural gas and energy prices on utilities and households, although no immediate fixes have been adopted. As a result of the energy crunch, homes in the UK will face much higher electricity prices beginning in April, as the government prepares to raise the cap on utility bills. The UK’s energy regulator Ofgem is expected to announce the new price cap on energy prices in early February.

France is considering allowing electricity producers to burn more coal after the nation’s grid operator warned of possible power shortages. The government may raise the annual cap on running coal-fired power stations, plugging a potential gap in supply as an unusually high number of nuclear reactors halt for maintenance just as the coldest months get underway. According to a draft decree on the Ecology Ministry’s website, the country’s three remaining coal units may be permitted to operate for about 1,000 hours over the first two months of 2022. That’s 300 hours more than the annual cap set in 2019 to help curb carbon emissions.

China: Beijing’s ability to control the virus has come a long way since the pandemic started. It has inoculated nearly 1.2 billion people and set up a nationwide electronic health database for contact tracing. Yet it has continued to rely on the same authoritarian virus-fighting methods from early 2020, including strict quarantines, border closings, and lockdowns. These have led to food and medical shortages and growing questions about how much longer its zero-Covid strategy, the last in the world, can continue. “The district security guards are like prison guards, and we are like prisoners,” said Tom Zhao, a Xi’an resident.

The Xi’an epidemic is the most serious after Wuhan was shut down,” said Zeng Guang, a Chinese epidemiologist who visited Wuhan in the early days of the pandemic. Xi’an has reported 1,800 cases in its latest outbreak, stunningly low compared with the daily case count in the United States. And as the world struggles to contain the spread of Omicron, in China officials have reported only a few local cases of the variant and none in Xi’an.

Tens of thousands of people have been relocated to centralized quarantine facilities to stop the spread. Several top city officials have been fired, and the head of Xian’s big data bureau was suspended. Despite the frustration, the authorities in Xi’an declared the city’s battle with the virus a victory.

Even big multinational companies in the city have been affected. Two of the world’s largest memory chip makers, Samsung, and Micron, said they have had to adjust operations at their manufacturing bases in Xi’an because of the restrictions, potentially roiling the already fragile global supply chain.

The Beijing Winter Olympics and the Lunar New Year holiday are a few weeks away and China’s vaccines appear less effective than their Western competitors, particularly against variants. In addition, the country has yet to approve mRNA technology for its vaccines. While booster shots are now widely available, their take-up in the country has been slower than the initial vaccinations.

The manufacturing sector continues to recover in H1 2022, but concerns remain on overseas demand in H2 2022. The Chinese manufacturing purchasing managers index continued to rise in December at 50.3 points, with several steel market sources expecting China’s manufacturing activity to continue improving in the first half of 2022.

Chinese banks rushed to meet their annual state-imposed lending quotas last month by buying up low-risk financial instruments rather than issuing loans, a surge that bankers and analysts said reflected financial institutions’ wariness about the country’s slowing economy

China reduced the allowances for fuel exports in the first export quota batch for 2022, signaling its intention to limit fuel sales abroad and curb excessive refinery output. In the first quota distributions for this year, the overall volume of the permitted gasoline, diesel, and jet fuel exports was more than halved—slashed by 56% compared to the first batch of export quotas granted in 2021.

Russia: The average daily crude and condensate output rose by 2.4% on year to 10.52 million b/d in 2021, as OPEC+ increased quotas in line with recovering demand as pandemic lockdown measures eased globally. December oil and condensate output together totaled 10.90 million b/d. OPEC+ crude quotas were the key driver of Russian production volumes in 2021. Analysts see quotas as the most influential factor affecting output in 2022.

Russia may be nearing its oil production capacity limit. Bloomberg reported that the country’s December oil and condensate was flat from November to December, suggesting it used all its available production capacity. The report notes it assumes a flat production of condensates, which are included in Russia’s total oil output, which would mean that crude oil output alone was 37,000 b/d below Russia’s OPEC+ quota for the month. At the same time, Reuters reported that analysts expected Russia to fall short of its target of returning to pre-pandemic levels of oil production by May this year. Yet the analysts added the country could boost its spare capacity and production alike later in the year.

India: New Delhi has tightened its Covid-19 restrictions as a surge of infections threatens the country’s robust economic rebound from last year’s devastating outbreak of the Delta variant. The country’s daily new infections have more than doubled in three days to 117,100 as of Friday morning, while the number of active cases has soared nearly 73% to 371,363.

The surge followed a busy period of social occasions in India, including important religious festivals and holidays and the country’s wedding season. As a result, new Delhi and several states have imposed night and weekend curfews and restricted capacity at hotels, restaurants, malls, and cinemas. But authorities have backed off from introducing measures as onerous as during previous lockdowns, believing the Omicron variant is less life-threatening.

Despite the surge of infections, India’s political leaders, including Modi, have defied some of these guidelines and traversed cities in a massive campaign trail ahead of crucial state polls, addressing packed rallies of tens of thousands of people without masks.

India’s demand for diesel, the most used fuel, rose in December 2021 from a month earlier but was still 2% lower than the pre-pandemic demand in December 2019. Demand for jet fuel also rose in December from November and from the low levels of December 2020 but was still lagging the consumption trend from December 2019, just before COVID-19. As a result, jet fuel demand was down by 27% compared to December 2019. Meanwhile, India’s gasoline demand stood at 692,000 b/d in December 2021 (compared to about 9 million in the US), up by 13% from December 2019. After lockdowns in India started to ease last year, gasoline demand rose and exceeded pre-COVID levels as more people prefer driving in their vehicles to public transit.

5. Renewables and new technologies

New York state will spend $500 million building up ports and manufacturing infrastructure for offshore wind farms in a bid to become home base for the nascent industry. The investments will focus on building the supply chain for offshore turbines.

Governor Kathy Hochul said in the statement that New York also plans to initiate its next bidding process this year for companies interested in building offshore wind farms. The process is expected to authorize enough turbines to power 1.5 million homes.

6. The Briefs (date of the articles in the Daily Energy Bulletin is in parentheses)

The recent talks between Oman and Iran may mark a new phase in the already deep and broad relationship between Oman and Iran, and in the Sultanate’s drift into the Iran-China axis. China already accounts for around 90 percent of Oman’s oil exports and the vast majority of its petrochemicals exports. (1/6)

Offshore Guyana, ExxonMobil has made two more discoveries in the Stabroek block, which add to the previously announced 10 billion oil-equivalent barrels recoverable resource estimate for the block. Since 2015, when it first struck oil offshore Guyana, Exxon has made more than 20 discoveries in the waters of the South American nation. (1/6)

The US oil rig count inched up by 1 to 481, with gas rig counts also up by 1 to 107, according to Baker Hughes. Primary Vision’s Frac Spread Count, which tracks the number of completion crews finishing off previously drilled wells, shows that completion crews fell by 10 this week to 234 for the week ending December 31, for the fifth dip in a row. The frac spread is now down 40 over the last five weeks. (1/8)

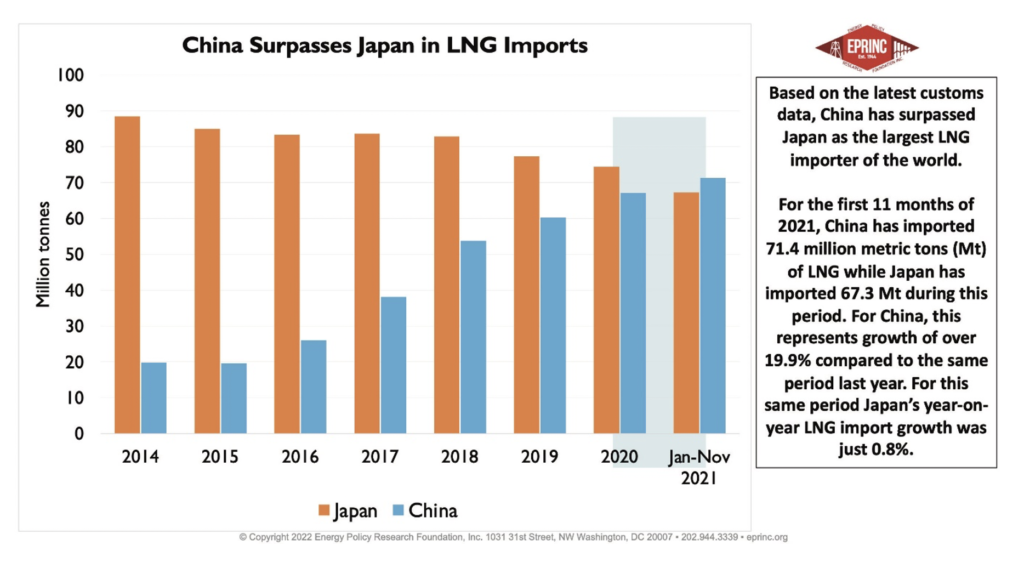

The U.S. dethroned Qatar as the top LNG exporter in the world after a substantial jump in LNG production from Cheniere Energy’s Sabine Pass plant, which in turn followed the launch of a new liquefaction unit. A veritable fleet of U.S. LNG cargo carriers sailed for Europe last month as the price differentials between the continent and Asia became more favorable to Europe. (1/6)

The Biden administration on Wednesday said more than half of U.S. states intend to apply for a portion of the $4.7 billion carved out in the new infrastructure law for cleaning up abandoned oil and gas wells. (1/6)

Power demand in New York State is expected to increase by 65% to 80% by 2050 while fossil fuel-fired power generation is simultaneously shut down through a strategy that relies on accelerating renewable energy growth, enhancing power markets, and exploring technology solutions. (1/5)

Indonesia, the world’s biggest thermal coal exporter, sent shockwaves through global energy markets this week by suspending exports of the fuel in January due to critically low coal supplies at domestic power plants. (1/7)

Silicon Ranch Corp, the U.S. solar project developer backed by Royal Dutch Shell, on Thursday said it raised $775 million in equity capital from new and existing investors. The announcement comes as renewable energy, and in particular solar, is experiencing a dramatic expansion in the US. (1/7)

Indiana’s big solar: Among vast fields of corn and soybeans in rural northwest Indiana, construction workers broke ground in October on what will be the largest solar farm in the United States. The project, known as Mammoth Solar, will cover 13,000 acres, spread across two counties, with 60 landowners involved in an area with deep ties to the fossil fuel industry. (1/6)

Battery boom: The next decade will be defined by a massive increase in utility-scale storage. GM, Ford, Tesla, SK Innovations and LG Energy Solutions are among the builders of new gigafactories. 13 new battery cell gigafactories are expected to come online in the U.S. by 2025. Utility-scale battery storage power capacity could exceed 2,500 MW by 2023, or a 180% increase, assuming currently planned additions are completed (1/7)

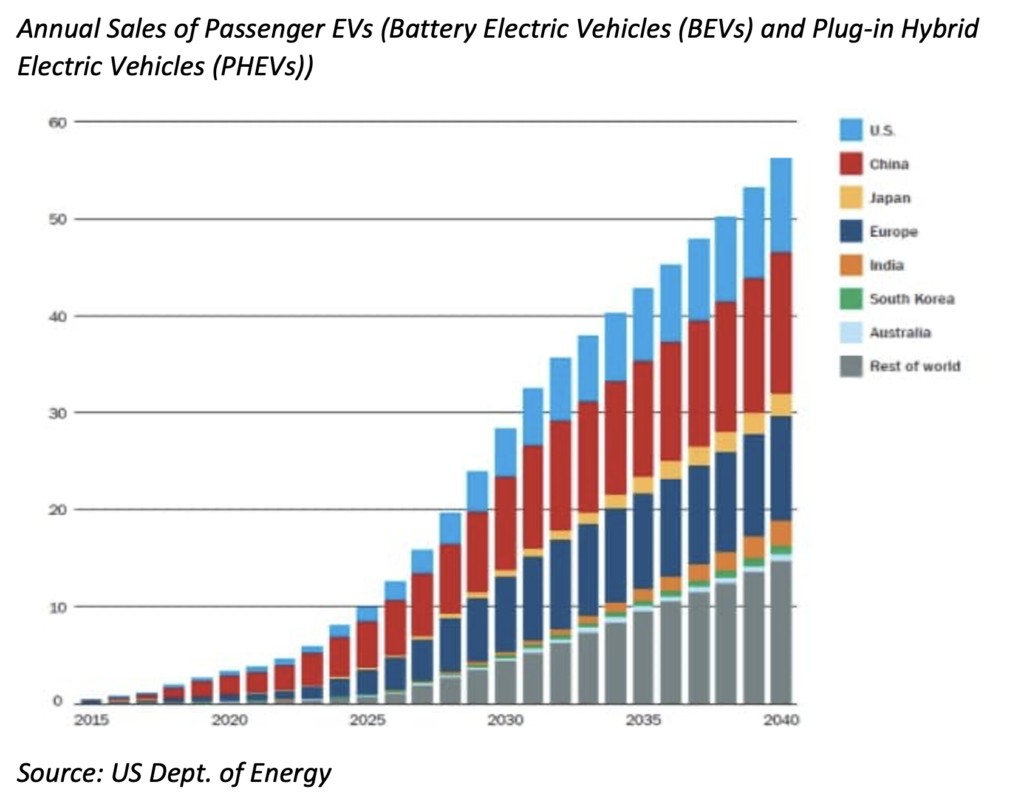

Annual Sales of Passenger EVs (Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs))

Ford Motor Co. plans to raise production of the F-150 Lightning pickup at the Rouge Electric Vehicle Center in Dearborn to 150,000 trucks per year to meet high demand. Within 24 months, Ford will have the global capacity to produce 600,000 battery electric vehicles annually. (1/5)

The stock price for electric truck company Rivian fell below the price of its initial public offering after Amazon said it would also buy electric delivery vans from Chrysler owner Stellantis. (1/7)

Sony Group Corp. said it would create a car unit and explore entering the electric-vehicle market, in another sign of how the electronics and car businesses are overlapping. (1/5)

Switzerland-based shipping firm MSC has overtaken Denmark’s A.P. Moller-Maersk on Jan. 5 to become the world’s largest container shipping line. (1/6)

Arctic hot spot: The Siberian town of Verkhoyansk can officially claim to be the hottest spot in the Arctic. The northeast Russian community known for its extremely cold winters reached a record-setting Arctic temperature high of 100.4 degrees Fahrenheit (38 C) on June 20, 2020. (1/5)

False solutions to cutting planet-warming carbon emissions aren’t new. But the number of people hawking those answers, and the money being spent on them, has grown substantially in the last few years.