Editors: Tom Whipple, Steve Andrews

Quotes of the Week

“Liquids production in Southeast Asia has been on the decline for almost 20 years due to a lack of discoveries and project sanctioning activities in the region. While new government incentives may help, the region looks set to experience declining production levels well into the future.”

Prateek Pandey, upstream vice president, Rystad Energy

“A draft of the [European] Commission’s proposal…would label nuclear power plant investments as green if the project has a plan, funds, and a site to safely dispose of radioactive waste. To be deemed green, new nuclear plants must receive construction permits before 2045. Investments in natural gas power plants would also be deemed green if they produce emissions below 270g of CO2 equivalent per kilowatt-hour (kWh), replace a more polluting fossil fuel plant, receive a construction permit by Dec. 31, 2030, and plan to switch to low-carbon gases by the end of 2035. ‘…under certain conditions, solutions can make sense that do not look exactly ‘green’ at first glance,’ a Commission source told Reuters, adding that gas and nuclear investments would face ‘strict conditions.”

Kate Abnett and Simon Jessop, Reuters

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil: Prices jumped more than 1% on the first trading day of the new year ahead of an OPEC+ meeting on Tuesday to discuss production policy. Futures in New York topped $76 a barrel after toggling between gains and losses earlier. Libyan output is expected to decline to the lowest level in more than a year as workers try and fix a damaged pipeline less than two weeks after militia shut down its biggest field.

Crude oil prices rose last Wednesday morning after the Energy Information Administration reported an inventory draw of 3.6 million barrels for the week to Dec 24th. At 420 million barrels, crude oil inventories remain 7% below the five-year average—compared to 8% below the five-year average last week. Gasoline inventories decreased by 1.5 million barrels in the reporting period, which compared with a build of 5.5 million barrels for the previous week. In middle distillates, the EIA estimated an inventory draw of 1.7 million barrels for the week to Dec 24th, compared with an increase of 400,000 barrels for the previous week.

According to Gasbuddy, gasoline prices could rise to almost $3.80 per gallon before peaking this coming May. That’s considerably higher than what the federal government projects for prices at the pump. Earlier in December, the EIA forecast in its Short-Term Energy Outlook that the average retail price for gasoline would fall to $2.88.

OPEC: The 23-nation alliance led by Saudi Arabia and Russia is likely to proceed with another modest monthly hike of 400,000 b/d as it restores production halted during the pandemic. Several national delegates also said they expect the boost — due to take effect in February — will go ahead. OPEC and its partners see global demand continuing to recover this year, taking only a mild hit from the omicron variant. Their confidence is being validated as heavy traffic across key Asian consuming countries and dwindling crude inventories in the US buoy international prices near $80 a barrel.

OPEC agreed to appoint Haitham al-Ghais, a former Kuwaiti governor to OPEC, as its new secretary-general, to succeed Nigeria’s Mohammad Barkindo. He will take over the role on Aug. 1st. The secretary general-elect said on Monday that global oil demand should return to its pre-pandemic levels by the end of 2022.

As the world races towards a greener tomorrow, OPEC+ officials have noted that the energy transition, if not managed well, could lead to underinvestment in oil and gas, which could mean even higher prices. OPEC+ did some surprising things in the past two years. First, it broke up at the start of the pandemic with its two leaders—Saudi Arabia and Russia—turning on each other because of differences of opinion on how the crisis needed to be handled. Then the two made up, and the group united around the deepest production cuts in the history of OPEC in response to the demand destruction caused by the pandemic, also unprecedented.

Shale Oil: Drillers in the biggest US fields are shouldering record costs at the same time that some banks are increasingly reluctant to loan money to the sector, according to the Federal Reserve Bank of Dallas. Equipment, leasing, and other input costs for oil explorers and the contractors they hire surged to an all-time high during the current quarter, the Dallas Fed said in a report released last week. Drillers also saw the universe of willing lenders shrink in the Eleventh Federal Reserve Districts. “The political pressure forcing available capital away from the energy industry is a problem for everyone,” an unidentified survey respondent said. “Banks view lending to the energy industry as having a ‘political risk.’ As a result, the capital availability has moved down-market, and it is drastically reducing the size and availability of commitments regardless of commodity prices.

Internal rates of return (IRRs) have fallen this month across the US’s oil and dry gas basins, yet the rig count has increased steadily throughout December despite lower commodity prices. The average 12-month forward curve for the US domestic crude price benchmark, West Texas Intermediate, decreased by $4.93/barrel in December to $70.29/barrel. Returns within the major oil basins fell as a result. Three plays–the Permian (Delaware), Eagle Ford, and Bakken–hold IRRs just below 50%, according to S&P Global Platts Analytics. The dry gas basins also declined this month, as the average 12-month forward curve for Henry Hub settled at $3.74/million Btu, a decrease of 40 cents. The Marcellus Wet has the highest return of any gas basins at 45% IRR. The Utica Dry, Marcellus Dry, and Haynesville are all above 30%.

Natural Gas: European gas prices slumped last week, the longest losing streak in more than a year, as cargoes of the liquefied fuel head to the continent just as industrial shutdowns and warm weather curb demand. Futures fell as much as 9.9% on Wednesday as a flotilla of US LNG cargoes headed to the region, while several vessels sailing to Asia have now diverted to Europe. More supplies are coming after record prices earlier this month forced factories to halt or slow output, curbing demand just as the continent faces unseasonably warm temperatures. European gas prices surged more than 400% this year, with Russia limiting extra flows when demand was rebounding. While prices have slumped over the past week, they are still more than five times higher than the past five years’ average.

The Yamal-Europe pipeline, which usually sends Russian gas west into Europe, flowed east from Germany to Poland on Sunday for the 13th straight day. Flows at the Mallnow metering point on the German-Polish border showed eastbound volumes at almost 5.4 million kilowatt-hours (kWh/h). The pipeline is a major route for Russian gas exports to Europe.

The operator of the Nord Stream 2 gas pipeline from Russia to Germany said it had completed filling the second 27.5 billion cm/year string of the link with gas. The entire Nord Stream 2 pipeline was completed in September, but commercial operations are yet to begin as the operator waits for regulatory clearance. In the meantime, the operator, Nord Stream 2 AG, continued the necessary technical preparations for the pipeline ahead of its launch and started filling the second string with gas.

US natural gas futures rose last week as colder weather with snow is coming into parts of the country. Although substantially lower than Asian or European gas prices, US January futures for natural gas rose by 1.7% to $4.12 per million British thermal units. A day earlier, the contract gained 8.8% in the steepest one-day rise since October, again because of the weather forecast. According to the Weather Prediction Center, this winter will bring heavy snowfall, freezing temperatures, and strong winds to the northern and western parts of the United States. For early January, the forecast is for more cold weather that may even affect natural gas production, according to NatGasWeather.

Electricity: US grid operators are expected to add more solar capacity in 2022 than other generation sources as states and utilities take it upon themselves to drive the clean energy transition. New capacity from wind, solar, and batteries is expected to surpass 30 GW in 2022, according to S&P Global Platts. Across the US, additions during 2022 are expected to be comprised of 15.5 GW of new solar, 11 GW of new wind, and 4.2 GW of batteries. Clean energy targets set by states and individual companies drive the energy transition, not federal regulation.

Prognosis: The fast-spreading Omicron variant is clouding the outlook for oil markets after a rapid recovery in demand pushed prices to their highest levels in years. Oil marched higher for much of 2021. Orders increased as economies revved up, while producers in the Middle East and elsewhere kept millions of barrels of crude each day in the ground. As a result, the global benchmark, Brent crude prices, climbed over 50% to $77 a barrel.

Most US oil and gas firms expect to raise their capital expenditures during 2022. Yet, capital available to the industry is constantly shrinking as banks continue to shun the sector due to ESG pressures. Moreover, the Biden Administration, with its green agenda and anti-oil policies, is discouraging many in the shale patch from boosting capital budgets beyond the bare minimum.

Investment bank analysts seem to overwhelmingly expect higher prices because of strong demand and not-so-strong supply. This year will see even more robust oil demand than 2021, even with a temporary dip during the first quarter. Oil demand suffered a severe blow during 2020 when the coronavirus in China spread worldwide and started prompting lockdowns. Then the wave receded, and oil demand began to rebound, much faster than most expected. Despite the green transition, demand will continue to recover this year and those after it. Many forecasters, including BP, in 2020 argued that peak oil was already past us and what we had to look forward to was a more renewable energy mix. And then Covid-19 case numbers in critical markets began to decline, and oil demand rose.

According to analysts, more deep-water exploration and project sanctions in the US Gulf of Mexico could be in store for the E&P sector during 2022 assuming robust oil prices hold up. The roughly 12 deep-water US Gulf discoveries in 2021 could expand by a couple more this year, and several fields that have patiently waited out years of price volatility may finally be greenlighted, said a senior energy analyst for S&P Global Platts Analytics. “We could potentially see more finds and final investment decisions next year [2022].” US Gulf operators still have a healthy appetite for exploration, particularly as crude prices remain high.

2. Geopolitical instability

(These are the situations that reduce the world’s energy supply or have the potential to do so.}

Ukraine: The US and its allies are prepared to respond “decisively” should Russia invade Ukraine, President Joe Biden told his Russian counterpart Vladimir Putin on Thursday amid mounting tensions at the border. The telephone call between the leaders, which was arranged at Moscow’s request, marked the latest in a string of diplomatic efforts to defuse what has been described as a “moment of crisis” as Russia amasses roughly 100,000 troops on Ukraine’s eastern frontier. It also preceded negotiations between Washington, Moscow, and NATO member states planned for early January, when Russia intends to press for “security guarantees” to limit NATO’s expansion in Europe.

Iran: Indirect talks between Iran and the US on salvaging the 2015 Iran nuclear deal resumed on Dec 27th. Tehran focused on one side of the original bargain, lifting sanctions against it, despite scant progress on reining in its atomic activities. The seventh round of talks, the first under Iran’s new hardline President Ebrahim Raisi, ended ten days ago after adding some new Iranian demands to a working text. Western powers said progress was too slow, and negotiators had “weeks, not months” left before the 2015 deal became meaningless.

Iran will prioritize an agreement to legitimately return to exporting its oil during the new round of talks. “The most important issue for us is to reach a point where, firstly, Iranian oil can be sold easily and without hindrance,” Iran’s Foreign Minister Amirabdollahian was quoted as saying. “The most important issue for Iran is to be able to sell its oil easily and receive the money in its banking accounts without any obstructions, and the country can use all economic advantages stated in the nuclear deal.”

Iran said Thursday it launched a rocket with a satellite carrier bearing three devices into space, though it’s unclear if any objects entered orbit around the Earth. Previous launches have drawn rebukes from the United States.

The immediate focus for Iran in further developing its gas output will be on the fields initially earmarked for development by Russian companies. As great as Iran’s oil reserves are, its gas reserves are even more significant, with official estimated proven natural gas reserves of 33.78 trillion cubic meters. Reserves of this size are second only to Russia, 17% of the world’s total and more than one-third of OPEC’s. If the newfound reserves in the Chalous field are added, Iran could have total natural gas reserves of 40.9 trillion cubic meters (bigger than Russia’s).

For the second time this year, Tehran ordered a shutdown of authorized cryptocurrency mining centers as part of efforts to ease the strain on the country’s power plants and avoid blackouts. The ban will free up 209 megawatts of power consumption in the household sector. Authorities are also cracking down on illegal mining carried out by individuals at home and larger-scale industrial units. These unlicensed operators account for the largest share of crypto mining in the country, consuming more than 600 megawatts of electricity.

Iraq: The Federal Supreme Court upheld the results of the country’s October parliamentary elections, resolving a dispute that had stalled the formation of a new government. The court certified the victory of Muqtada al-Sadr, the influential Shiite cleric who is regarded as a possible ally, if a wary one, for the United States in Iraq. His party won 73 of the 329 seats in Parliament, more than any other and up from 54 in 2018. Moreover, it handily beat an alliance of Iran-aligned militias led by the Fatah coalition. For Fatah and its allies, al-Sadr’s victory upset the traditional balance of the Shiite powers that have dominated Iraqi politics since the fall of Saddam Hussein almost 20 years ago and threatened to dent Iranian influence in Parliament.

Libya: The National Oil Company expects its oil production to drop by another 200,000 b/d over the next week as workers try to fix a damaged pipeline. The latest outage comes less than two weeks after militias shut down the biggest field, Sharara, causing output to fall by around 350,000 b/d. Together, the closures will reduce Libyan production to about 700,000 b/d, the lowest in more than a year.

Efforts to win power in Libya by Saif al-Islam Qaddafi, the son of the country’s late ousted dictator Moammar Qaddafi, won’t succeed, according to the man who’s been at the center of Kremlin-backed efforts to support him. Maxim Shugaley acts as a political consultant for Yevgeny Prigozhin, a Russian tycoon close to President Putin. He spent 18 months in a Libyan jail accused by the government of plotting to interfere in Libya’s presidential elections in Qaddafi’s favor. The Kremlin got him released. In recent years, Moscow has been using mega-rich oligarchs and Russian mercenaries to meddle in places where Russian diplomats and armed forces would not be welcome.

Venezuela: This year, the country almost doubled its oil production from last year’s decades-low number as PDVSA struck deals that let it pump and process more extra-heavy crude into exportable grades. The surprising reversal began as state-run Petroleos de Venezuela got help from small drilling firms by rolling over old debts and later obtained steady supplies of a critical diluent from Iran. The two factors lifted output to 824,000 b/d in November, well above the first three-quarters of the year and 90% more than the monthly average a year earlier.

Whether it can continue to ramp up production is unclear. Years of unpaid bills, mismanagement, and, more recently, US sanctions have cut its ability to produce oil. PDVSA reported more than 1 million barrels of daily output. The figure appeared to represent a specific 24-hour period rather than the typical metric of a monthly average — an important distinction.

China-India: High in a corner of the Himalayas, a tense standoff between the Chinese and Indian armies is spurring a flurry of infrastructure and military buildups that are transforming one of the world’s remotest and most inhospitable regions. On the Chinese side of the unmarked border, new helicopter pads, runways, and railroads have been laid on the Tibetan plateau.

On the Indian side, officials are rushing construction on the Zoji La tunnels, upgrading several strategic roads, and unveiling new cellphone towers and landing strips. In addition, both countries have deployed more military force to the border, with India diverting nearly 50,000 mountainous-warfare troops there, according to current and former Indian military officials. In recent months, both militaries have publicized combat-readiness drills to practice airlifting thousands of soldiers to the front lines at a moment’s notice.

Following 13 rounds of inconclusive negotiations between military commanders since June 2020, the standoff is entering a second winter, an unprecedented development stretching logistics and budgets — especially for India. But the result, observers say, is a normalization of a hardened border and an uneasy stalemate between two Asian powers that could last for years.

3. Climate change

According to a new study, ten of last year’s most destructive weather events worldwide cost a combined $170 billion in damages. Hurricane Ida, a tropical storm that pummeled much of the eastern US with lashing rain in August, killed at least 95 people and cost the economy $65 billion. A month earlier, floods in Europe caused 240 deaths and an economic loss of $43 billion, according to research published by UK. charity Christian Aid. In July, floods in China’s Henan province killed more than 300 and cost more than $17 billion.

According to a leading government think tank, carbon emissions in China could peak two years earlier than planned as the economy slows and Beijing prioritizes renewable energy. Chinese authorities have asked that state companies reduce their energy consumption and carbon dioxide emissions by 2025 compared to 2020 levels as part of China’s plan to have its CO2 emissions peak before the end of this decade. State-controlled firms in China must slash their energy consumption per 10,000 yuan ($1,570) of output value by 2025 to 15% below the levels seen in 2020,

China is responsible for over a quarter of global emissions. Its reluctance to set more ambitious targets, particularly around coal use, was a point of contention at the recent Glasgow climate talks. However, weaker economic growth could brake emissions, which fell in the third quarter, and China’s GDP growth may slow to 5.5% next year.

In Alaska, a slew of temperature records has tumbled in the wake of extreme warmth, with highs up to 45 degrees above average. The ongoing spate of heat is tied to a sprawling dome of stagnant high pressure banked southeast of the Aleutians in the northeastern Pacific. Reinforced by unusually warm ocean waters north of Hawaii, that high-pressure “heat dome” induces sinking air that brings about additional warming.

Last week, the Kodiak tide gauge station hit 67 degrees. In addition to being a local record, it set a monthly record for the entire state for December. Nearby, Kodiak Airport recorded 65 degrees and beat its previous daily record by 20 degrees, surpassing the 45-degree record reading last set on Dec. 26, 1984, by leaps and bounds. Even more remarkable is that the same 65-degrees would have set a record for November, January, February, and March, too; those months haven’t seen readings above 59, 54, 56, and 57 degrees, respectively.

ExxonMobil has announced that it has agreed to work with Scepter Inc to deploy advanced satellite technology and proprietary data processing platforms to detect methane emissions at a global scale. The agreement has the potential to redefine methane detection and mitigation efforts. In addition, ExxonMobil noted in a statement posted on its website that it could contribute to broader satellite-based emission reduction efforts across a dozen industries, including energy, agriculture, manufacturing, and transportation. In the first phase of the project, ExxonMobil said the companies would design and optimize satellite placement and coverage plans. This will initially focus on capturing methane emissions data from ExxonMobil operations in the Permian Basin.

4. The global economy and coronavirus

The head of the World Health Organization said Wednesday that he’s worried about the omicron and delta variants of COVID-19 producing a “tsunami” of cases between them. The winter surge in Covid-19 cases prompts economists to downgrade the US and the global growth expectations in the early part of 2022 as businesses struggle with absenteeism and consumers stay home to avoid getting sick.

Wild weather worldwide wreaked havoc on markets for raw materials, lifting prices for everything from electricity and heat to houses and breakfast cereal. In addition, policymakers and investors have debated fiscal and monetary policy effects on inflation. Still, a big reason for rising prices during 2021 was factors that neither lawmakers nor central banks can do much about. Prices for natural gas, lumber, corn, soybeans, wheat, and other building blocks of modern commerce surged to multiyear highs—in some cases records—because of fire, freezes, flood, drought, hurricanes, and some of the hottest weather ever.

Despite those issues, the world economy still is set to surpass $100 trillion for the first time in 2022, two years earlier than previously forecast, according to the Centre for Economics and Business Research. The continued recovery will lift global gross domestic product from the pandemic. However, the London-based think tank said it might be hard for policymakers to avoid tipping their economies back into recession if inflation persists.

United States: With a caseload nearly twice that of the worst single days of last winter, the US shattered its record for new daily coronavirus cases. This milestone may still fall short of describing the actual toll of the Delta and Omicron variants because testing has slowed over the holidays. President Biden’s chief medical adviser warned on Sunday that the number of Americans infected with Covid-19 was likely to “go much higher” before easing off.

Europe: Last week, France saw new infections above 200,000 per day, making it one of the epicenters as a wave of infections sweeps across Europe. President Macron said the next few weeks would be difficult as the country headed into subdued New Year celebrations after registering 232,200 new COVID-19 cases on Friday, its highest-ever recorded total. France will force its citizens to work from home for most of January to contain the spread of the omicron variant. Workers that have the option to stay away from the office must do so a minimum of three days and, if possible, four days a week to help reduce social contacts. However, the government refrained from ordering a curfew for New Year’s Eve or pushing back to school after the holidays.

Germany is contemplating further measures to contain Covid-19 as the omicron variant threatens to become the dominant strain in the country by mid-January. Europe’s biggest economy is currently in what some officials have termed a “lockdown for the unvaccinated,” with wide-ranging limits on the size of public events and on access to non-essential stores.

Health experts urged the Italian government to relax COVID-19 quarantine rules, saying that the country otherwise risked paralysis as the highly infectious Omicron variant spreads. Under current regulations, people who have come into close contact with a COVID-19 sufferer have to self-isolate for seven days if they are vaccinated and for ten days if they have not had a shot.

Rising power costs in Europe have reduced output at Europe’s largest aluminum smelter. Most aluminum plants, especially those using in-house power, suffered losses from late October to November due to surging electricity costs and high prices for raw and auxiliary materials. Losses there ballooned to $22 million during November as natural gas prices quadrupled.

China: In the central Chinese city of Xi’an, 13 million people are dealing with one of the world’s strictest coronavirus lockdowns. Residents have been ordered to stay in their homes since the beginning of last week, with city officials rushing truckloads of vegetables from one apartment complex to the next to try to keep people supplied with food. The severe containment measures underline China’s determination to stick to a “zero covid” policy designed to stamp out infections, even as the country’s vaccination rate exceeds 85%. However, the approach comes at a cost, especially given the specter of more-transmissible variants. According to state media, all nonessential production has been suspended in Xi’an, and US chipmaker Micron and Korean electronics giant Samsung have warned of disruptions as their facilities in the area have been affected.

Beijing’s commitment to step up US goods and services purchases under a 2020 trade pact expired Friday. China is expected to miss its targets by a wide margin, creating a dilemma for the Biden administration. The White House could potentially reinstate certain tariffs that were cut as part of the trade deal, but that could backfire if China cut back US purchases or took measures against American companies doing business there. Alternatively, the US could ignore the shortfall, signaling Beijing that it won’t face the consequences.

Oil prices eased on Thursday after China cut the first batch of crude import allocations for 2022, offsetting the impact of US data showing that domestic fuel demand had held up despite soaring Omicron coronavirus infections. Crude oil demand in China is set to peak in 2030, driven by robust petrochemical demand. This is a revision on 2020 research from the same organization, CNPC Economics & Technology Research Institute, which at the time saw oil demand peaking at 730 million tons annually in 2025. Now, the institute expects demand to peak at 780 million tons. Fuel demand, however, will peak years before crude oil demand.

Coal consumption will peak around 2030, the research organization also forecast, seeing the peak at about 3.6-4.0 billion tons. China, which is under fire for approving new coal power stations as other countries try to curb greenhouse gases, has completed the first 1,000-megawatt unit of the Shanghaimiao plant, the biggest of its kind under construction in the country. The plant’s technology was the world’s most efficient, with the lowest coal and water consumption rates. Located in the coal-rich northwestern region of Inner Mongolia, the plant will eventually have four generating units and is designed to deliver power to the eastern coastal Shandong province.

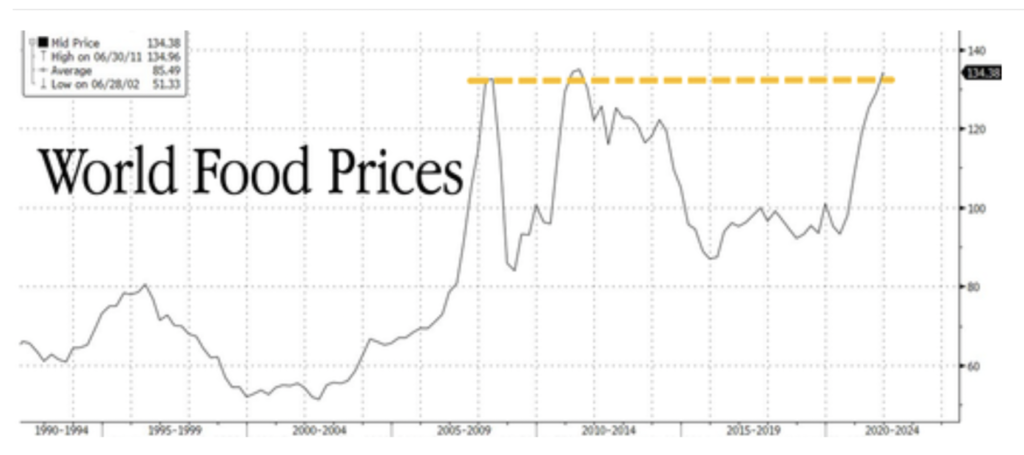

Beijing has managed to stockpile more than half of the world’s maize and other grains, resulting in rapid food inflation, and triggering a famine in some countries. The Chinese government has always been very big in planning, and it appears that they have decided that now is the time to hoard food, gold, and other commodities. China maintains “historically high levels” of beans and grains stockpiled at central Chinese state-owned food processor storage facilities in the northeastern part of the country.

Russia: The country has overtaken Brazil to have the world’s second-highest official death toll from the COVID-19 pandemic. The new figure is based on Russia’s state statistics service and Reuters calculations. The statistics service, Rosstat, said 87,527 people had died from coronavirus-related causes in November, making it the deadliest month in Russia since the start of the pandemic. Russia’s overall pandemic death toll reached 658,634, according to Reuters calculations based on Rosstat figures up to the end of November and data from Russia’s coronavirus task force for December, shows the toll overtaking Brazil, which has recorded 619,300 deaths. According to a Reuters tally, the death toll in the United States is higher, at 825,663 people, but its population is more than twice as big as Russia’s. Reuters calculations also showed Russia recorded more than 835,000 excess deaths since the beginning of the outbreak in April 2020, putting it about the same as the US.

So far, Russia’s death toll has not been affected by the Omicron variant and was caused mainly by a surge of infections in October and November, which health authorities blamed on the Delta variant and a slow vaccination campaign.

Russia’s annual oil production rose by more than 2% last year thanks to the easing of output cuts by the OPEC+ group of leading oil producers after a pandemic-induced decline in 2020, data showed on Sunday. Russian oil and gas condensate output rose to 10.52 million barrels per day (bpd) last year, according to energy ministry data cited by the Interfax news agency and Reuters calculations, from 10.27 million bpd in 2020.

Russian inflation rose faster than analysts forecast in December, staying near the six-year high that has prompted the central bank to warn more key-rate increases may be needed to tame price growth. Annual inflation came in at 8.39% this month from 8.4% in November, the Federal Statistics Service reported late Wednesday, citing preliminary data. Irina Lebedeva, an economist at Uralsib Bank in Moscow, said. “The Bank of Russia will most likely raise the key rate again in February, I expect by 50 basis points.”

Saudi Arabia: Exports soared in October as the Saudi’s benefited from higher crude prices. The value of exports jumped to 106.2 billion riyals ($28 billion) from 55.9 billion riyals a year ago, according to the kingdom’s General Authority for Statistics. As a result, the share of oil in total exports rose to 77.6% in October from 66.1% in October 2020. Saudi Arabia’s economy has rebounded this year as oil prices soared and the impact of the coronavirus pandemic eased. This month the kingdom boosted its revenue forecast for next year, with higher crude output and prices poised to deliver the first budget surplus in eight years and the fastest economic growth since 2011.

India: The country may see a spurt in the Covid 19 growth rate within days, and head into an intense but short-lived virus wave as the highly infectious omicron variant moves through the crowded nation of almost 1.4 billion. Paul Kattuman, professor at the University of Cambridge, and his team of researchers, developers of the India Covid tracker, are seeing a sharp rise in infection rates across India.

In November, India’s crude imports reversed a declining trend to hit its highest level in 10 months as refiners build inventories in anticipation of higher runs. Still, analysts continued to keep a close eye on developments around the omicron variant of the coronavirus to see if it impacts inflows in the coming months. As average run rates have risen to 100% across all Indian refineries, they are accelerating crude purchases on expectations of a sustained increase in demand for products, with demand for transport fuels such as gasoline having recovered to pre-pandemic levels. As a result, India imported an average of 4.5 million b/d of crude oil in November.

5. Renewables and new technologies

The Japan Atomic Energy Agency (JAEA) and Mitsubishi Heavy Industries will cooperate with the US and Bill Gates’ venture company to build a high-tech nuclear reactor in Wyoming. In addition, the parties will sign an agreement for JAEA and Mitsubishi Heavy Industries to provide technical support and data from Japan’s advanced reactors. TerraPower, an advanced nuclear power venture founded by Gates, plans to open its Natrium plant in Wyoming in 2028. The US government will cover half of the $4 billion project.

The Sumitomo Corporation will launch a full-scale project to jointly design and develop an ammonia-fueled dry bulk carrier with Oshima Shipbuilding. The ship is expected to be 229 meters in length, with a beam of 32 meters and a deadweight of 80,0000-81,000 tones. In 2018, the International Maritime Organization (IMO) adopted a strategy to reduce greenhouse gas emissions from international shipping. In this strategy, the IMO set a target of improving the average fuel efficiency of ships used for international shipping by 40% relative to the 2008 level by 2030 and halving the total GHG emissions from the vessel by 2050.

6. The Briefs (date of the articles in the Daily Energy Bulletin is in parentheses)

LNG carriers boast the highest day rates of any cargo vessel type. Shippers can afford to pay eye-watering high freight because the profit on moving cargo can be enormous: In mid-November, cargo could be bought for $20 million in the US and sold for $120 million in Asia. (12/28)

BP and Maersk Tankers, with support from the Danish Maritime Authority, have completed trials using biofuel-blended marine fuel in product tankers. This demonstrates that sustainable biofuels can be used as a marine drop-in fuel to help reduce carbon emissions in shipping. (12/27)

Pakistan’s natural gas shortage is hurting its most important export industry, putting even more stress on an economy already struggling with accelerating inflation and a weakening currency. About $250 million of textiles exports were lost last month after mills in Punjab were forced to shut for 15 days. (1/3)

In Southeast Asia, the Covid-19 pandemic has marked the end of an era for the region’s combined oil and gas production, pushing output in 2021 to below 5 million barrels of oil equivalent per day for the first time since 1998, a threshold that is not likely to be exceeded again in the future despite new project start-ups in coming years, a Rystad Energy analysis shows. (12/27)

A South African court ordered Royal Dutch Shell to temporarily halt an offshore seismic survey after local communities took legal action to block the project. The claimants argue the activity will harm local marine life and disrupt fishing, while Shell maintains the practice has been safely used for decades to search for oil and gas. (12/30)

The Parliament of Guyana, where more than 10 billion barrels of oil equivalents have been discovered over the past half-decade, voted this week to amend its Natural Resource Fund Act that will govern a sovereign wealth fund managing the proceeds from oil. The Parliament also passed the so-called local content bill requiring foreign companies to ensure they use Guyanese individuals and companies for everything from catering services to accounting by the end of next year. (1/1)

In Colombia, rising security risk and rural violence, fueled mainly by the vast profits generated by the cocaine trade, is a crucial deterrent to attracting onshore oil investment. Despite these risks, the Andean country’s 2021 bid round found some success. (12/27)

Indonesia, one of the world’s top exporters of thermal coal, is pausing exports of the fuel in January to secure dwindling supplies for domestic power plants. A month-long halt is needed to prevent shutdowns at about 20 power plants. (1/1)

Mexico’s Pemex said it plans to halt oil exports by 2023 altogether. This year it will drastically reduce planned crude exports, from 1.019 million to 435,000 barrels per day, as the state oil company works to meet the government’s target of refining all of its oil domestically. (12/29)

The US total drilling rig count remained unchanged for the week at 586 according to Baker Hughes Co. Primary Vision’s Frac Spread Count, which tracks the number of completion crews finishing off previously drilled wells, shows that completion crews fell by 12 this week to 244 for the week ending December 23, for the fourth dip in a row. The frac count has been up by roughly 100 since the start of the year. (1/1)

SPR update: The US Department of Energy said it had approved a release of two million barrels of crude oil to Exxon Mobil Corp from its Strategic Petroleum Reserve. This will push the total released to roughly seven million barrels to boost the nation’s fuel supply. (1/1)

Methane leak: Williams Cos., one of the biggest transporters of natural gas in the U.S., said an intentional release of a powerful greenhouse gas detected by satellite was caused by work on one of its pipelines. The cloud of methane was spotted over Georgia on Dec. 14 by a European Space Agency satellite. (1/3)

Tesla Inc. said that it delivered more than 936,000 vehicles globally in 2021, up 87% from nearly half a million the previous year. The company leveraged its Silicon Valley roots to overcome computer chip shortages that have plagued the global auto industry. (1/3)

Battery boom: The most prominent names in the auto industry are racing to build battery plants in the United States. The Department of Energy’s Vehicle Technologies Office has listed 13 new battery plant projects scheduled to be completed within the next five years. (12/30)

EV school buses: The New Jersey state Senate approved legislation Monday that would require developing and implementing an electric school bus program. It would fund the purchase of new electric school buses and the necessary charging infrastructure in a minimum of 18 New Jersey school districts for three years. (12/29)

Swedish battery maker Northvolt assembled its first lithium-ion battery cell at its Swedish Ett gigafactory, making it the first European company to design, develop and assemble a battery in Europe. (12/30)

H2 hub: It is widely thought that a future low-carbon hydrogen industry will arise in industrial clusters. The emphasis is on ports, where concentrations of basic industries, pipelines, and shipping will support large scale production and efficient supply. In the US, the region that appears best equipped for widespread adoption of clean H2 is the Texas Gulf Coast centered on Houston. (1/3)

Air pollution research: Ammonium is one of the specific components of fine particulate matter (PM 2.5) linked to a higher risk of death than other chemicals found in it, according to a new study in the journal Epidemiology.