Editors: Tom Whipple, Steve Andrews

Quote of the Week

“Saying no to a gas peaker plant and yes to battery-stored energy has provided our community with a nonpolluting power plant, increased our tax base, and created good jobs and ultimately better health for the people. This project is truly a testament to Oxnard’s determination and resilience to modernize and better our community.”

Carmen Ramirez, Ventura County (California) District 5 Supervisor

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil: Prices fell last week for the first time since May after days of volatile trading in the wake of OPEC+’s stalemate over a production increase. Futures in New York declined 0.8%, although the US crude benchmark closed higher on Friday amid a broader market rebound. Prices whipsawed during the week amid ambiguity over the future of the OPEC+ alliance and swings in the US dollar. However, Brent prices remained about $3 a barrel below Monday’s close, as traders remained worried that global crude supplies might swell following the collapse of OPEC+ negotiations.

US crude and gasoline stocks fell, with gasoline demand reaching its highest since 2019. Crude inventories fell by 6.9 million barrels in the week to July 2nd to 445.5 million barrels, the lowest since February 2020. Gasoline supplied, a proxy for demand, rose to 10 million barrels a day, the highest in data going back to 1990. While the US recovery quickens, the world’s largest oil producers can’t agree on how to supply the market. Saudi Arabia is advocating for tempered supply increases, given the potential headwinds that still exist, while the UAE wants the cartel to lift production restrictions.

US oil production has not reacted sharply to the recent jump in prices, as investors continue to demand capital discipline that prioritizes shareholder returns over production growth. However, the EIA said it sees that changing if prices remain above $60, a level that led to robust activity among US operators in the past.

The increasing number of orphaned and abandoned wells in the US is growing costlier by the day. Texas currently counts about 6,200 orphaned, unplugged wells, while the Interstate Oil & Gas Compact Commission says there are about 57,000 documented orphan wells nationwide. As a result, the White House aims to inject money into well-plugging activities. New groups in Texas, such as Commission Shift, have sprung up this year to help lobby and draw attention to the ticking time bombs of orphaned or undocumented wells.

OPEC: The cartel’s 13 members pumped 26.19 million b/d in June, up 480,000 b/d from May, primarily due to Saudi Arabia’s continued unwinding of its voluntary extra production cut. The group’s nine non-OPEC partners, led by Russia, produced 13.27 million b/d, a rise of 60,000 b/d from May. The coalition has added 970,000 b/d to its production in the past two months as part of its plans to relax its output quotas to meet the growing demand for its oil.

However, a bitter feud between emerging rivals Saudi Arabia and the UAE could put the proposed deal to raise output by 2 million b/d between August and December in jeopardy. The dispute, which a week of negotiations has so far failed to resolve, could cause the OPEC+ alliance to leave quotas flat after July, potentially squeezing an already tightening market through the rest of the summer. It could also lead to sliding compliance, if not an outright price war, if the dispute escalates.

Saudi Arabia and the other 23 members of OPEC+ want to increase production by a modest 400,000 b/d each month from August to December. They would then extend the current baseline cuts from the scheduled end in April 2022 to December 2022. UAE bristles at the oil output cut schedule. The Emirates say they suffered from around 35% of its current production capacity being shut in for two years now, compared with an average of about 22% for others in the agreement.

There are several areas where the once close allies have diverged in the last couple of years. For example, the UAE pulled its support to Saudi Arabia in the Yemen war with Houthi rebels in 2019. In addition, the UAE normalized its relationship with Israel last year.

Shale Oil: OPEC’s sudden disarray would seem to be an opportunity for US shale producers to lock in profits, with oil prices near multi-year-highs, but sources at those companies say they are not taking chances with the market’s volatility.

In its latest monthly outlook, the EIA said that US crude oil production is not expected to pick up significantly, at least until the end of this year. As a result, the Administration expects American crude oil production to average 11.10 million b/d in 2021. This is a slight increase of 20,000 b/d compared to EIA’s projection for 2021 production in June. However, if the current 2021 forecast pans out, American oil production would have dropped by 200,000 b/d compared to the average 2020 output of 11.31 million b/d, which included two months of the record-high output that touched 13 million b/d just before markets crashed in March and April 2020.

Natural Gas: European prices rose to record highs this summer, driven by factors ranging from low inventories and outages to an Asian buying spree. The increase signals a further rise in the coming months that means higher household bills this winter. At the Dutch TTF hub, the front-month contract, a critical European benchmark, hit 38.65 euros ($45.77) per megawatt-hour on Tuesday, the highest since Refinitiv Eikon began keeping records. The British front-month contract reached a record 93.35 pence per therm on Monday.

The US EIA lowered by 1.78 billion cf/d to 72.16 billion its natural gas demand estimate for the US in the third quarter of 2021. In addition, the July Short-Term Energy Outlook also lowered its full-year 2021 demand forecast by 0.53 billion cf/d to 82.32 billion.

Lower temperatures, increased gas-to-coal switching, and additional inflows from the West will boost Midwest storage injections in July. June’s temperatures across North America were above average, with the Midwest 1.7 degrees Fahrenheit higher than the five-year average.

.

Coal: Just five Asian countries are now producing most of the region’s coal, with little intention of reining in production as numerous companies plan to invest in new coal plants. According to a study released in June, China, India, Indonesia, Japan, and Vietnam produce around 80 percent of all Asian coal, with plans to develop over 600 coal power units. Together, the projects are expected to produce around 300 gigawatts of energy.

The continued reliance is surprising considering the many alternative energy projects that could be more financially appealing. The cost of building new coal plants is exceptionally high considering global aims to reduce reliance on coal power. Carbon Tracker, the London-based think tank that published the report, claims solar and wind power generate significantly cheaper energy, with costs around 85 percent lower than existing coal production.

The surging US economy is driving an unexpected boom in coal, the latest sign that demand for the dirtiest fossil fuel remains resilient. American coal production this year will swell 15% to meet a more robust market for electricity at home and abroad, according to the EIA’s July outlook. That would be the most since at least 1990, and nearly double the 8% increase projected in May when the economic rebound was still in earlier stages of recovery.

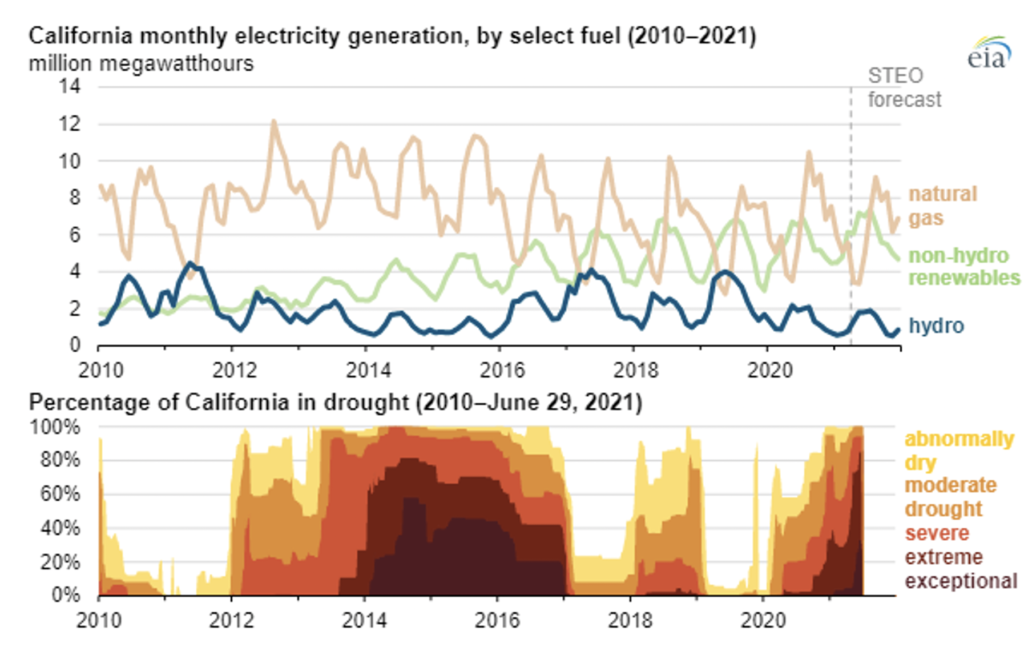

The shift underscores the vicious circle of climate change as more extreme temperatures drive power demand just as extensive drought cuts output from hydropower dams. That prompts utilities to burn more of the dirtiest fossil fuel, in a pattern also exacerbated by high natural gas prices. At the same time, critical exporters including Australia and Colombia face supply problems that have helped lift global prices to a 10-year high and added international demand for US coal exports.

Prognosis: BP, in collaboration with the Oxford Institute for Energy Studies, has published a 20-page study entitled Peak Oil Demand and Long-Run Oil Prices.

The study contains some novel conclusions. It holds that digitalization of the oil industry will bring forth large quantities of exploitable oil so that the idea of peak oil supply will be no longer important. The authors conclude that arguing about when peak oil demand will arrive (2025, 2030, 2035?) is not a meaningful focus as there are simply too many unknowable issues involved.

They say, “Rather, the significance of peak oil is that it signals a shift in paradigm – from an age of (perceived) scarcity to an age of abundance – and with it is likely to herald a shift to a more competitive market environment. This change in paradigm is also likely to pose material challenges for oil-producing economies as they try both to ensure that their oil is produced and consumed, and at the same time diversify their economies fit for a world in which they can no longer rely on oil revenues to provide their main source of revenue for the indefinite future.”

“The extent and pace of this diversification is likely to have an important bearing on oil prices over the next 20 or 30 years. It seems likely that many low-cost producers will delay the pace at which they adopt a more competitive ‘higher volume, lower price’ strategy until they have made material progress in reforming their economies. More generally, it seems unlikely that oil prices will stabilize around a level at which many of the world’s major oil-producing economies will be running large and persistent fiscal deficits. As such, the average level of oil prices over the next few decades is likely to depend more on developments in the social cost of production across the major oil-producing economies than on the physical cost of extraction.”

While authors may be right that oil will be abundant in coming years and that the oil demand will continue into the distant future, they gloss over disruptions caused by the rapidly changing climate. Recent developments suggest that the global economy will be so severely hurt by the climatic conditions shortly that radical changes will have to take place in the consumption of fossil fuels.

2. Geopolitical instability

(These are the situations that reduce the world’s energy supplies or have the potential to do so.)

Iran: Oil Minister Zanganeh said his country has taken “many measures” to ensure it can raise crude production in “a very short time” if US sanctions are lifted. After a three-year layoff, Iran could be poised to officially rejoin the oil exporters’ ranks–maybe as early as 2021–if Tehran and Washington can strike a new nuclear deal.

Tehran informed the International Atomic Energy Agency that it has begun producing enriched uranium metal to develop fuel for a research reactor. But uranium metal could also be used to make the core of a nuclear bomb. European powers said Iran’s move breached a nuclear deal and threatened talks to revive it. The US called it an “unfortunate step backward.”

Iran’s sole nuclear power plant was brought back online after an emergency shutdown two weeks ago due to a “technical fault.” The Bushehr plant and its 1,000-megawatt reactor had been “fixed,” allowing the plant to resume power generation and be reconnected. The government also urged Iranians to help the country’s overburdened grid by minimizing power consumption as weather forecasts predicted rising temperatures in the coming days.

Iraq: Oil output fell to 3.86 million b/d in June. Total oil production, including flows from the semi-autonomous Kurdistan region, fell slightly from a month earlier, signaling tighter compliance with its OPEC+ quota, which rose in the previous month.

Iraqi Oil Minister Ihsan Abdul Jabbar said that BP was considering withdrawing from Iraq. Russia’s Lukoil had sent a formal notification saying it wanted to sell its stake in the West Qurna-2 field to Chinese companies. Abdul Jabbar said the investment environment in Iraq was unsuitable for retaining significant investors.

When the Bush Administration invaded Iraq in 2003, there were allegations that the US’s core interest was Iraq’s immense oil bounty. While US-based oil services companies certainly significantly profited from Iraq’s opening to international investment, upstream-focused companies failed to find themselves in the hoped-for oil bonanza. After less than 20 years, there seems to be an almost complete departure of US oil companies from Iraq – demotivated and eager to exploit other opportunities. ExxonMobil is on its way out of Iraq, unable to agree on a future course that would accommodate both the interests of the US major and those of Iraqi authorities.

At least 14 rockets hit an Iraqi airbase hosting the US and other international forces on Wednesday, wounding two American service members. In contrast, Kurdish-led forces in Syria said they thwarted a drone attack in an area where US forces also operate. Analysts believed the attackers were part of a campaign by Iranian-backed militias. Iraqi militia groups aligned with Iran vowed to retaliate after US strikes on the Iraqi – Syrian border killed four of their members last month.

Venezuela: PDVSA has started producing two upgraded crude grades for domestic refining, aiming at restarting the country’s much-needed output of motor fuels. Years of under-investment in PDVSA’s 1.3 million b/d refining network and US sanctions since 2019 have led to an intermittent scarcity of cooking gas, gasoline, and diesel, making the nation more dependent on imports. Moreover, Venezuela’s refineries were built initially to process medium to light crudes. However, PDVSA’s increasingly heavy oil output no longer meets the facilities’ needs, forcing the company to decide every month whether to refine its limited stocks of light oil or use it as a diluent for its flagship exportable grade, Merey.

3. Climate change

The extraordinary heatwave that scorched the Pacific Northwest two weeks ago would almost certainly not have occurred without global warming, an international team of climate researchers said last week. Temperatures were so extreme — including readings of 116 degrees Fahrenheit in Portland, Ore., and a Canadian record of 121 in British Columbia — that the researchers had difficulty saying just how rare the heatwave was.

Overlooked in much of the coverage was an even more significant number of daily records set by a different — and potentially more dangerous — measure of extreme heat: overnight temperatures. On average, nights are warming faster than days across most of the United States, according to the 2018 National Climate Assessment Report. As a result, sweltering summer nights can lead to a significant number of deaths because they take away people’s ability to cool down from the day’s heat.

Reservoir levels are dropping throughout the West as drought tightens its grip on the region, and intense summer heat further stresses water supply and the surrounding landscape. The drought crisis is perhaps most apparent in the Colorado River basin, which saw one of its driest years on record, following two decades of less-than-adequate flows. The nation’s largest reservoir, Lake Mead near Las Vegas, is at its lowest level since the lake filled after the construction of the Hoover Dam in the 1930s; it currently sits at 1,069 feet above sea level, or 35% of its total capacity

Now the West is bracing for another heatwave, albeit not quite as severe, that could challenge records and bring dangerously hot temperatures from California and the Desert Southwest to the Great Basin and Oregon.

At his international climate summit in April, President Joe Biden vowed to cut US greenhouse gas emissions in half by 2030. The goal will require sweeping changes in the power generation, transportation, and manufacturing sectors. It will also need a lot of land. Wind farms, solar installations, and other forms of clean power tend to take up more space on a per-watt basis than fossil-fuel facilities. A 200-megawatt wind farm, for instance, might require spreading turbines over 13 square miles. A natural gas power plant with that same generating capacity could fit onto a single city block. Achieving Biden’s goal will require aggressively building more wind and solar farms, in many cases combined with giant batteries. To fulfill his vision of an emission-free grid by 2035, the US needs to increase its carbon-free capacity by at least 150%.

China’s top economic planning body has been put in charge of devising a plan to cut greenhouse gas emissions, indicating that climate policies are gaining a more central role in the nation’s long-term development strategy. According to people familiar with the matter, the country’s top officials told the National Development and Reform Commission a few months ago to lead the drafting of a national roadmap to reach peak carbon emissions. A spokesperson said the NDRC now houses the office for a “small leading group” of officials working on China’s zero-emissions policies. The NDRC had overseen China’s climate policies until 2018 when the government transferred its climate change department and related responsibilities to the organization now known as the Ministry of Ecology and Environment, or MEE.

4. The global economy and the coronavirus

The fast-spreading Delta variant of the coronavirus is driving up infections in developing countries that are dangerously short on Covid-19 vaccines. As the variant sweeps the world, researchers track how well vaccines protect against it and get different answers. In Britain, researchers reported that two doses had an effectiveness of 88 percent protecting against Delta. A study from Scotland concluded that the vaccine was 79 percent effective against the variant, and researchers in Canada pegged its effectiveness at 87 percent. However, last Monday, Israel’s Ministry of Health announced that the effectiveness of the Pfizer-BioNTech vaccine was 64 percent against all coronavirus infections, down from about 95 percent in May, before the Delta variant began its climb to near-total dominance in Israel.

Although the range of these numbers may seem confusing, vaccine experts say it should be expected because it’s hard for a single study to pinpoint a vaccine’s effectiveness accurately. In clinical trials, it’s relatively easy to measure how well vaccines work. But once vaccines hit the real world, it becomes much harder to measure their effectiveness.

A top Federal Reserve official warned that the spread of the Delta coronavirus variant and low vaccination rates in some parts of the world pose a threat to the global recovery as she urged caution in removing monetary support for the US economy. “I think one of the biggest risks to our global growth going forward is that we prematurely declare victory on Covid,” said Mary Daly, the president of the Federal Reserve Bank of San Francisco. “We are not through the pandemic; we are getting through the pandemic.”

United States: More than 183.8 million have been vaccinated, including more than 159 million with two shots. Job openings rose to a fresh record high in May, underscoring persistent hiring difficulties and reflecting more vacancies in the health care, education, and hospitality industries. The number of available positions climbed to 9.21 million during the month from a downwardly revised 9.19 million in April. The availability of vaccines paired with a broader reopening of the economy has spurred a snapback in economic activity in recent months, but consumer demand has largely outpaced businesses’ ability to hire.

The rapid run-up comes at a delicate moment for the US economy, which was already experiencing the fastest inflation in years amid resurgent consumer activity and supply-chain bottlenecks. Asked about oil prices at a White House news conference on Tuesday, Jen Psaki, the press secretary, suggested that the president had limited control over gas prices.

The recent bout of higher oil prices is unlikely to make much of a dent in the global recovery, according to economists who say strong growth and flush consumers in advanced economies will help the world absorb much of the blow from costlier crude. One indicator to watch is the oil burden, or the cost of oil as a proportion of gross domestic product, which is a bellwether for oil’s impact on growth. According to Morgan Stanley, that indicator is expected to rise to 2.8% of global GDP for 2021, assuming an expected average oil price of $75 a barrel this year. That, though, remains below the long-term average of 3.2%.

The European Union: The fast spread of the Covid-19 Delta variant in Spain and some other parts of Europe is prompting authorities to reintroduce restrictions, fueling fears that a new wave of infections could disrupt the region’s summer reopening. The threat is putting pressure on European countries to accelerate their vaccination campaigns—particularly among young people, the primary vector of contagion in countries such as Spain.

The Union will require countries to renovate energy-guzzling buildings faster and meet more challenging targets to save energy as part of its drive to meet climate change goals. Buildings produce more than a third of EU CO2 emissions. Moreover, they account for 40% of the bloc’s energy consumption, making the sector a pivotal threat to Europe’s plan to reduce planet-warming emissions.

German manufacturers unexpectedly saw demand decline in May, suggesting a rough start to the country’s economic recovery. Orders fell 3.7%, worse than all estimates in a survey. The Economy Ministry said the slump was driven by weak export demand for cars following a steep rise the previous month. Domestic orders rose 0.9%. German companies are battling unprecedented supply-chain problems because of a sudden surge in global activity following the end of coronavirus lockdowns. Volkswagen warned that the worldwide shortage of semiconductors affecting car production would worsen over the next six months, joining a chorus of auto companies that have dialed down their outlook for the rest of the year.

China: After a yearlong run-up that pushed producer inflation to the highest level in more than a decade, China’s factory-gate prices rose at a slightly slower pace in June.

The moderate increase raised hopes among economists that inflation may have hit a turning point. China’s producer-price index rose 8.8% in June from a year earlier, edging down from May’s year-over-year surge of 9.0%. It was the first time the figure declined from the previous month since last October.

On Friday, China’s central bank said it would lower the funds that banks have to set aside, effectively freeing up $154 billion for banks to lend. Since April last year, the decision marks the first such action when Beijing made a similar move near the peak of the Covid-19 pandemic’s impact on the economy. Moreover, the new liquidity signaled by China’s central bank indicates that Beijing may be pivoting toward supporting the economy after a sharp drawdown in credit earlier this year.

Last month, China’s crude oil imports rose by 8.81% month-on-month to an average of 10.54 million b/d. However, that number was still 2.45 million b/d lower than last year’s June average. What’s perhaps more interesting is that China’s crude oil in storage has been on the decline. Since April, oil in storage, as calculated through satellite data readings, has fallen from 436 million barrels to 414 million.

China’s establishment last October of a national pipeline network, PipeChina, is creating a shift in China’s oil and gas industry; it aims to create greater competition and encourage new players in the sector. PipeChina acquired the oil and gas pipeline assets, storage facilities, and import terminals of the three giant state-run oil firms to make the industry more efficient.

China’s banning Australian coal imports might be one of the most peculiar commodity stories of 2021. When commodity prices were climbing, Chinese authorities decided to drop Australian coal, leading to a surge in worse-quality alternatives just as regional demand peaked. Meanwhile, China’s aim of punishing Australia for calling for an investigation into the origins of Covid has primarily failed as Australian producers simply rerouted their cargoes towards India. On the other hand, China was forced to buy increasing amounts of Indonesian and Russian coal to accommodate domestic demand, triggering a more than 25% price hike compared to January levels. China is self-sufficient in coking coal yet needs substantial amounts of thermal coal for its vast metallurgical industry.

A massive plume of methane, the potent greenhouse gas that’s a key contributor to global warming, has been identified in China’s most significant coal production region. The release in northeast Shanxi province is one of the largest attributed to the global coal sector and likely emanated from multiple mining operations.

When the first gas from CNOOC’s new ultra-deep field in the South China Sea started flowing in late June to the world’s largest customized floating platform 1,500 meters above the seabed, it marked a crucial phase in China’s gas drive. The output from one of Asia’s deepest gas fields proved the company had the engineering to complete its first wholly-owned project on schedule and make significant strides towards its target of gas making up half its output portfolio by 2035, from 21% currently.

Saudi Arabia: Aramco is planning to raise tens of billions of dollars by selling more stakes in its businesses. The firm created a new team to review its assets last year, soon after the coronavirus pandemic triggered a plunge in energy prices and strained its balance sheet. As a result, Aramco raised $12.4 billion by selling leasing rights over oil pipelines to a US-led group of investors in April. The sales will continue in the next few years “irrespective of any market conditions,” and Aramco aims to generate “double-digit billions of dollars.

While the Saudis continue to develop their oil industry, it is not shying away from alternative energy options, with state-owned Aramco now heavily investing in hydrogen technology. Aramco Chief Technology Officer Ahmad Al Khowaiter explained last week, “Today we’re showing that the technologies for the use of hydrogen are mature and commercially available, and we see this kind of as an inflection point in the hydrogen market.” The announcement comes as Saudi Crown Prince Mohammed bin Salman launched a national strategy for transport and logistics to increase the sector’s contribution to annual non-oil revenues to $12 billion by 2030.

India: Newly appointed Petroleum Minister Hardeep Singh Puri plans to boost domestic production of oil and gas and increase the role of natural gas in the country’s energy mix. Since 2015, India’s domestic crude oil production has fallen from 35.5 million tons to just over 29 million tons in 2020-2021 due to aging oilfields and, more recently, the pandemic lockdown.

The government received no bids for 48 of the 67 mines up for sale as part of its plan to open up coal mining to private companies, reflecting little investor appetite for a sector clouded by environmental concerns and low margins. Prime Minister Narendra Modi last year offered financial incentives to the private sector. It removed restrictions on the end-use of the fuel in a bid to reduce imports and make India a net coal exporter. India has the world’s fourth-largest coal reserves and is the second-largest coal consumer, importer, and producer.

East Asia: Several countries around Asia and the Pacific experiencing their first significant surges of the coronavirus rushed to impose harsh restrictions. Faced with rapidly rising numbers of infections in recent months, authorities in such countries as Thailand, South Korea, and Vietnam announced or imposed measures Friday that they hope can slow the spread before health care systems are overwhelmed.

Australia’s New South Wales reported its most significant daily rise in locally acquired cases of COVID-19 this year as officials struggle to stamp out a growing cluster of the highly infectious Delta variant. After two weeks of a hard lockdown in Sydney, Australia’s largest city, the spike in cases raised the prospect of a further extension in restrictions, with officials blaming illegal family visits for a continuing rise in infections.

Deaths in Indonesia from Covid-19 rose sharply on Wednesday as the fast-spreading Delta variant of the coronavirus overwhelmed the country’s healthcare system. Public-health experts have for weeks warned that Indonesia, the world’s fourth most populous nation, could face a surge like the one that caused India’s hospital system to collapse in April and May. Around 5% of Indonesia’s 270 million people are fully vaccinated, and infections have been rising for days.

South Africa: Excess deaths, seen as a more precise way of measuring total fatalities from the coronavirus, rose to their highest level since January in South Africa as the delta variant spread to all nine provinces. In the week ended June 27, the country recorded 5,228 deaths compared with 1,729 official deaths from the virus, the South African Medical Research Council said in a report Wednesday.

5. Renewables and new technologies

Wind and solar power capacity expanded rapidly in 2020 while global energy demand cratered because of the pandemic. However, this did not reflect a “decisive shift” towards meeting UN-backed climate goals, BP said in its annual energy review. “Importantly, there was no sign of the decisive shift envisaged” by the less than 2 degrees Celsius scenario, BP’s Chief Economist said in remarks ahead of the release of the review, seen as a benchmark for the industry. “There is a good chance that much of that dip proves transitory,” he said, adding that changes in 2020 were induced by the pandemic and the world still needed “tangible, concrete differences” to meet climate targets.

Hydrogen has been receiving a lot more attention recently and even US energy companies are beginning to experiment with it. Green hydrogen has been touted by the EU and the IEA, among others, as an indispensable part of the energy transition. Because hydrogen can be used as a fuel and as an energy carrier, it is a valuable addition to any energy transition plan. Unfortunately, the production of green hydrogen on any meaningful scale is currently prohibitively expensive.

Proposed electrolyzer projects due online by 2024 in the EU amounted to 5.2 GW at the start of July. There is a larger shortfall between the EU’s 2030 target of 40 GW of installed electrolyzer capacity and the 22 GW of announced proposals, though the more distant time horizon gives plenty of scope for an acceleration in project developments in the meantime.

Natural gas-based production of hydrogen with carbon capture and storage (known as blue hydrogen) runs a distant second in Germany’s strategy to production via electrolysis mainly using renewable electricity, but many support blue hydrogen as a bridging technology. That would help meet near-term demand for low carbon hydrogen and allow for a transition in existing energy trading partnerships.

The US Department of Energy is awarding $52.5 million to fund 31 projects to advance next-generation clean hydrogen technologies and support DOE’s recently announced Hydrogen Energy Earthshot initiative to reduce the cost and accelerate breakthroughs in the clean hydrogen sector..

It’s getting faster and cheaper to embed a wind tower the size of the Washington Monument into the sea floor. South Korea is cutting the time it takes to construct and install an offshore turbine, from as long as three months to just a matter of days, thanks to a large flat-bottomed ship for hauling the structure and a “bucket suction” method for affixing it to the seabed. The innovations could chop an estimated $3 million from the process. State-owned utility Korea Electric Power Corp. on Wednesday showcased what it says is the first vessel that can haul a fully constructed wind plant. A crane on the 1,500-ton ship, lifted a 140-meter-high (459 feet) wind tower built in the water near the western port of Gunsan.

Innovations to cut costs and installation times promise to help spur a global expansion of offshore wind power that’s already forecast to deliver an 11-fold increase in capacity through 2035, according to BloombergNEF. Annual installations are expected to rise to a record 11 gigawatts this year and hit 32.5 gigawatts by the end of the decade, as nations add more renewable energy to phase out fossil fuels and curb carbon emissions.

6. The Briefs (date of the articles in the Daily Energy Bulletin is in parentheses)

H2 for rail: Deutsche Bahn has selected Wystrach—a specialist in the transport and storage of gases—to provide a plug-and-play hydrogen refueling station for the joint H2goesRail project—a green hydrail mobility solution. Hydrogen generated from green electricity will replace diesel fuel. (7/8)

In Russia, Lukoil said on July 5th that it had signed an agreement to acquire a 50% operator stake in the Mexican shallow-water Project Area 4. The acquisition adds to its involvement in blocks 10, 12, 14, 28, and Amatitlan in Mexico, which the company sees as a strategic region for its international upstream development. (7/6)

Turkey’s state-owned energy company TPAO has applied for a license to explore crude oil in the eastern Mediterranean. According to a Turkish map database, the three areas where TPAO plans to explore are in Turkish territorial waters. (7/9)

A critical mining region in Australia, the world’s top exporter of metallurgical coal used in steelmaking, is producing vastly more methane emissions than global competitors, according to a new analysis. For every ton of coal produced in the Bowen Basin region in Queensland state, an average of 7.5 kilograms of the potent greenhouse gas is released, said Kayrros SAS, a geoanalytics firm that studied satellite observations from the European Space Agency. That’s 47% higher than the average global methane intensity estimated by the IEA. (7/6)

In Nigeria, on July 1st, the Senate passed the long-awaited Petroleum Industry Bill, PIB. According to the auditing and advisory firm KPMG, previous attempts in 2009, 2012, and 2018 failed to pass the bill “because of factors such as lack of ownership, misalignment of interests between the National Assembly and the Executive, perceived erosion of ministerial powers, stiff opposition by the petroleum host communities and push back by investors on the perceived uncompetitive provisions in those versions of the bill.” (7/6)

Total Nigeria has described the tax regime proposed in the new national energy bill as “globally uncompetitive,” warning that it would hurt several deep offshore investments in the country. (7/8)

Nigeria’s pipeline vandals: Between January 2019 and September 2020, 1,161 pipeline points nationwide were vandalized. It took millions to repair the vandalized pipe joints. Nigeria recorded 4,919 oil spills between 2015 to March 2021. Roughly 400,000 barrels of crude oil are lost daily to theft. Some 4.5 trillion barrels of oil were stolen over four years. (7/6)

In Namibia’s Kavango Basin, ReconAfrica–a small Canadian oil explorer–published initial results that pointed to the potential of a significant oil discovery. Namibia has never produced a barrel of oil in its history, so ReconAfrica’s work there could put it on the global oil map for the first time. (7/9)

Guyana is continuing to build its reputation as the new oil hub of the Americas, with more oil firms seeking a stake in the country’s oil fields. It seems discoveries are being made almost every month as exploration activities continue. Exxon alone claims to have made 20 discoveries, expected to contain around nine billion barrels of recoverable oil equivalent resources. (7/5)

Mexico’s President Andres Manuel Lopez Obrador said on Wednesday that his government would create a new business within the state oil company PEMEX to distribute liquefied petroleum gas (LPG) directly to consumers. (7/8)

The Mexican government launched a quest against foreign oil companies operating in the country pretty much from day one in office. Recently the government has awarded Pemex operatorship of the most extensive private discovery of oil in Mexico. The Zama field in the Campeche offshore basin was discovered by a private consortium led by US Talos Energy in 2015. (7/8)4

TC Energy, the Canadian pipeline operator that was building the Keystone XL project, has filed a notice of intent to initiate a claim against the Biden administration for the project’s suspension, seeking $15 billion in damages. According to the notice, the US administration violated the North American Free Trade Agreement with its decision to kill the $9-billion project. (7/6)

The US oil rig count rose by two this week to 378, while the number of gas rigs increased by two and now sits at 101, according to the Baker Hughes Inc. weekly count. That brings the total rig count to 479, up 221 from the same time last year. Oil and gas rigs in Canada now sit at 138 active rigs, up 2 for the week and up 120 on the year. (7/10)

Total US consumption of petroleum, natural gas, and coal slumped by 9% in 2020, reaching the lowest level since 1991 and marking the most significant annual decrease in US fossil fuel consumption in absolute and percentage terms since 1949, the EIA said this week. (7/8)

AAA said on Tuesday that gas prices were expected to increase another 10 to 20 cents through the end of August. The average price of a gallon of regular in the United States has risen to $3.13, up from $3.05 a month ago. A year ago, as the pandemic kept people home, a gallon of gas cost just $2.18 on average. (7/7)

EV charging: Researchers at Oak Ridge National Laboratory (ORNL) have developed a nationwide modeling tool to help infrastructure planners decide where and when to locate electric vehicle charging stations along interstate highways. The goal is to encourage the adoption of EVs for cross-country travel. (7/7)

Battery beats peaker: A new 142-Tesla Megapack project has been turned on in California’s Ventura County to create a giant new battery replacing a gas peaker plant. The project is called the Saticoy battery storage system. It came about when the local community in Oxnard fought against having a new gas-powered peaker plant to help respond to the energy demand during peak times. (7/12)

Growth in large-scale US solar capacity is projected to exceed that of wind next year for the first time. The US EIA estimates wind and solar capacity will reach 15% of US generation by 2022 from 11% last year. EIA forecasts 17 gigawatts of solar capacity in the electric power sector will be added in 2022, compared with 6 gigawatts for wind. It attributed the slowing growth in wind capacity to the scheduled expiration of the federal production tax credit. (7/8)

Offshore Maryland, Denmark’s wind farm developer Orsted on Wednesday said it had submitted a bid to develop the Skipjack Wind 2 offshore wind farm. The world’s largest offshore wind farm developer, which is already developing the 120-MW Skipjack Wind Farm 1 off the Maryland-Delaware coast, said the project could be up to 760 megawatts in size. (7/8)

Vestas Wind Systems booked a pre-order for what will be the world’s largest wind turbine. German utility EnBW Energie Baden-Wurttemberg AG is set to be the first customer to use the massive Vestas machine at a project off the coast of Germany. Vestas unveiled the 15-megawatt machine earlier this year amid an overhaul of its offshore wind business. (7/10)

Oil and wind mixing: Eni has agreed to buy one of the largest onshore wind portfolios in Italy from fund manager Glennmont Partners as part of plans to expand its green energy business. The Italian energy group will buy a 315-megawatt portfolio comprising 13 plants, taking its overall wind capacity in Italy to 350 MW. (7/9)

Amtrak, the US rail system operator, has signed a mammoth contract with manufacturing company Siemens Mobility for 83 new train sets, part of a $7.3 billion plan to upgrade its rolling stock over the next decade. Under the plan announced Wednesday, Amtrak will replace nearly 40% of its rail car fleet by 2031 and invest $2 billion in facilities upgrades systemwide. (7/8)

Plastics: Four years ago, the UN declared plastic pollution a global crisis, decades after discovering the Great Pacific Garbage Patch –a collection of marine debris 2x the size of Texas. Today, with a significant freeze on capital spending that might take years to return to pre-crisis levels, weak economies, stiff public opposition, the plastic and petrochemical industries are standing on sinking sands. (7/8)

In the Suez Canal, the container ship that blocked shipping for days earlier this year is set to sail Wednesday after its owners reached a multimillion-dollar compensation deal with Egyptian authorities for its release, ending a months-long saga involving passage through a critical global trade route. A preliminary agreement calls for $200 million (from an insurer) in compensation. (7/7)

EU forest fuss: A European Union strategy to boost forest protection has turned a simmering scientific debate into a full-blown firestorm, pitting one of the bloc’s oldest industries against a perceived power grab by technology-driven regulators. More than two-fifths of Europe is covered by woodlands, which play a pivotal role in capturing and storing greenhouse gases, as well as employing many who harvest timber annually. (7/7)