Editors: Tom Whipple, Steve Andrews

Quotes of the Week

“Two-thirds of oil and natural gas executives who responded to a recent survey by the Federal Reserve Bank of Dallas said they think US oil production peaked earlier this year around 13 million barrels a day.”

David Hodari and Rebecca Elliott, The Wall Street Journal

“A growing number of banks are making the obvious business decision not to finance more drilling in the Arctic because it would threaten their bottom line and expose them to numerous risks. The idea that this constitutes discrimination is ludicrous.”

Ben Cushing, Sierra Club financial advocacy campaign leader

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil: Prices gained 9 percent last week, settling at $42.85 in London and $40.60 in New York — the first increase in three weeks and the biggest weekly rise for Brent since June. Futures climbed earlier last week due to concerns about the strike in Norway and hurricane Delta headed for the US Gulf Coast. Norwegian oil firms struck a bargain with labor on Friday, ending a 10-day strike that had threatened to cut the country’s oil and gas output

Hurricane Delta churned through the Gulf’s prime oil-producing area making landfall on coastal Louisiana. Delta dealt the most significant blow to the US Gulf of Mexico energy production in 15 years, halting most of the region’s oil and nearly two-thirds of natural gas output. Extensive damage to the electrical grid will hamper recovery and the production and use of fuels in the area.

The pandemic has stalled a once-furious race among energy companies to build deepwater oil export terminals off the Texas coast, amid permitting delays and rising environmental opposition. Only three out of an initial dozen offshore US Gulf Coast oil export proposals remain before federal regulators. They are being slow walked as the coronavirus has slashed global fuel demand, and the gusher from US shale fields ebbed.

EIA estimates that global consumption of petroleum and liquid fuels averaged 95.3 million b/d in September, down 6.4 million b/d from September 2019. However, it was up from an average of 85.1 million b/d during the second quarter of 2020 and 93.9 million b/d in August. The EIA forecasts that global consumption of petroleum and liquid fuels will average 92.8 million b/d for all of 2020, down by 8.6 million b/d from 2019, before increasing by 6.3 million b/d in 2021. EIA’s forecast for consumption growth in 2021 is 0.3 million b/d less than in September.

Natural Gas: Rollercoaster moves in the US natural gas market over the past few weeks are underscoring traders’ uncertainty about whether a frigid winter, muted output, and rebounding demand will send prices higher in the coming months

The EIA’s October Short-Term Energy Outlook for October reports that in September, the Henry Hub natural gas spot price averaged $1.92 per million Btu, down from an average of $2.30 in August. The lower spot prices reflected declining demand for natural gas from the electric power sector due to cooler-than-normal temperatures during the second half of September and lower demand for US LNG exports amid hurricane activity in the Gulf of Mexico.

The administration expects that rising domestic demand for natural gas and demand for LNG exports heading into winter, combined with reduced production, will cause Henry Hub spot prices to rise to a monthly average of $3.38 per million Btu in January 2021. EIA expects that monthly average spot prices will remain higher than $3.00 per million throughout 2021.

OPEC: Saudi Arabia is considering canceling a planned relaxation of OPEC oil production cuts that would go into effect next January. OPEC and its partners, led by Russia, agreed in April to reduce their combined oil production by 9.7 million barrels daily in response to the demand slump following the coronavirus outbreak. The cuts were to be relaxed by 2 million b/d from July and then by another 2 million b/d from January 2021. However, prices have not recovered to pre-crisis levels despite the cuts as demand remains sluggish and the pandemic continues.

Sliding compliance by Russia, which is now the largest crude producer in the coalition, could emerge as a growing concern. Russia produced 9.10 million b/d last month, 110,000 b/d above its quota. Seaborne exports from the country saw a steady rise, and production has also recently increased due to more domestic demand. In early March, Russia and OPEC clashed over production cuts leading to a dramatic oil price war. But Russia’s influence in the deal remains vital.

Overall, OPEC and its allies improved their output quota compliance to 99 percent in September, led by the Gulf states, but discipline from Russia and some African producers continued to slip. Compensation cuts by 13 producers that had previously violated their quota levels remain scant, putting pressure on the alliance to do more to prop up the oil market. OPEC’s 13 members produced 24.34 million b/d in September, a fall of 30,000 b/d from August, while its nine partners, including Russia, produced 12.72 million b/d, an addition of 50,000 b/d.

The cartel continues to be optimistic about the long-term prospects for oil and rejects any notion that demand for crude will peak in the foreseeable future. According to OPEC’s latest World Oil Outlook, oil demand is projected to increase from nearly 100 million b/d in 2019 to around 109 million in 2045. The cartel is counting on the non-OECD countries to increase demand. The 2020 report forecasts that oil demand in non-OECD countries will rise by 22.5 million b/d over the next few decades, from nearly 52 million in 2019 to 74 million in 2045.

India is expected to be the largest contributor to incremental demand in coming years, adding around 6.3 million b/d between 2019 and 2045. Oil demand in OECD countries, which are taking climate change seriously, is predicted to plateau at about 47 million b/d during 2022-2025 before starting a longer-term decline towards 35 million by 2045.

Shale Oil: EIA reported that US crude oil production averaged 11.0 million b/d in July (the most recent month for which good data are available), up 500,000 b/d from June. In May, US crude oil production reached a two-and-a-half-year low of 10.0 million b/d, resulting from curtailed production amid very low oil prices. Since then, US production has increased mainly because shale oil operators have brought wells back online in response to rising prices.

For September, the EIA estimates that total US production rose to 11.2 million b/d. However, EIA expects US production to generally decline to an average of 11.0 million b/d in the second quarter of 2021 because new drilling activity will not generate enough production to offset declines from existing wells. The EIA expects drilling activity to rise later in 2021, contributing to US crude oil production returning to 11.2 million b/d in the fourth quarter of 2021.

On an annual average basis, the EIA expects US crude oil production to fall from 12.2 million b/d in 2019 to 11.5 million b/d in 2020 and 11.1 million b/d in 2021.

Large pipeline operators are reducing fees to keep their customers shipping crude from the Texas oilfields to the US Gulf Coast amid a decline in demand. For example, Kinder Morgan is offering a discount of around 50 percent for some of its current customers on its pipeline from the Eagle Ford shale play.

Prognosis: The November 3rd election is likely to have more impact on US energy policy than any in living memory. Should President Trump be reelected, US policies would likely be a continuation of the last four years. These include denial of climate change, cutting environmental regulations, support for the fossil fuel and nuclear industries, and efforts to stop oil production by perceived enemies such as Iran and Venezuela.

If Biden becomes the next president, and especially if the Democrats take control of the Senate, much change would be likely to occur. Biden has already released a $1.7 trillion clean energy plan, focusing on research and development of new clean energy solutions to the climate crisis. Biden’s climate plan envisages incentives for consumers to switch from gasoline and diesel cars to EVs and get more of their electricity from solar and wind installations.

Biden has also promised his voters he would stop offering new offshore oil and gas leases and would ban new drilling on federal land. He stopped short of promising a ban on fracking as many environmentalists have urged. Federal leases accounted for more than a fifth of the US’s oil and gas production last year. Gulf of Mexico production accounted for 64 percent of oil output from federal lands.

2. Geopolitical instability

Iran: The US put fresh sanctions on Iran’s financial sector last week, targeting 18 banks to choke off Iranian revenues further. The move freezes blacklisted financial assets and generally bars Americans from dealing with Iranian banks while extending secondary sanctions to those who do business with them. This action means that foreign banks risk losing access to the US market and the financial system for doing business with the Iranians. The new sanctions were imposed in defiance of European allies who warned that the move could have devastating humanitarian consequences on a country reeling from the novel coronavirus and an ongoing currency crisis.

In response, the Treasury Department said the prohibitions did not apply to transactions to sell agricultural commodities, food, medicine, or medical devices to Iran, saying it understood the need for humanitarian goods. However, Iranian Foreign Minister Zarif accused the US of targeting Iran’s ability to pay for necessities during the COVID-19 pandemic.

Mask wearing has become mandatory in public in Tehran, and violators will be fined, President Hassan Rouhani announced on Saturday. The daily death toll from COVID-19 reached a record of 239 this week in Iran, the worst-hit country in the Middle East. It has been obvious for months that Iran reports only a fraction of its pandemic cases and deaths.

Iraq: The government sent a new emergency finance bill to parliament last week in a last-ditch attempt to pay its bills amidst the financial crisis, pandemic, and bloated public sector workforce. The proposed law is supposed to act as a stopgap measure after the government withdrew the draft 2020 budget from parliament, which leaves the government unable to pay its bills. The financial situation risks continued delays in civil servant pay and potentially ends budget transfers to the Kurdistan region.

Libya: The National Oil Corp. lifted force majeure on the western Sharara oil field on Sunday and instructed its operator to resume production. The field will initially pump 40,000 b/d before reaching its capacity of almost 300,000 b/d in 10 days. That would roughly double Libya’s overall output to about 600,000 b/d. This move is a new headache for OPEC+ as the alliance tries to curb global supplies.

Exports are also on the rise at the three terminals that eastern-affiliated forces allowed to reopen last month. The Brega terminal is likely to see some 1.8 million barrels exported this month, divided into three cargos. In comparison, the Hariga terminal has already loaded two shipments of one million barrels each.

The central bank has called for the increase of oil production to 1.7 million b/d as soon as possible as its economy continues to struggle amid its seemingly never-ending civil war. “We need to raise the production to 1.7 million b/d to cover the country’s spending,” Bank Governor Sadiq Al-Kabir said, adding that production outages since 2013 had resulted in losses of some $180 billion.

Venezuela: It is challenging to assess Venezuela’s actual crude production considering the last year for which PDVSA has issued any official numbers was 2015. However, there are hints that in the past several months’ production has crept up. Media reports citing internal PDVSA documents put the August 2020 crude production at 380,000 b/d, following an uptick in crude exports that has allowed filled-up storage to clear.

The exports bottomed out in June with only 7 million barrels leaving the ports. Since then, each month has surpassed the previous one, and preliminary numbers for September are indicating that Venezuela’s exports hit 690,000 b/d. The third of three Iranian fuel tankers arrived last week, in the latest sign of cooperation between the two countries amid protests over shortages. These tankers bring fuel for motor vehicles and power plants and dilutants, which allows oil which is too heavy to transport to be processed into exportable crude.

The import of diluents from Iran has allowed PDVSA to boost its crude oil blending operations to a six-month high after some upgraders came back online. Upgraders are used for blending Venezuela’s super-heavy crude to make it flow and be ready for export. One day last week, an upgrader, part of a venture with Chevron, produced 115,000 barrels of Hamaca crude. Another upgrader, in partnership with China National Petroleum Corporation, produced 158,000 barrels exportable crude the same day. It is unclear how long PDVSA can sustain the upgraders amid a lack of maintenance and investment and operational issues such as power outages.

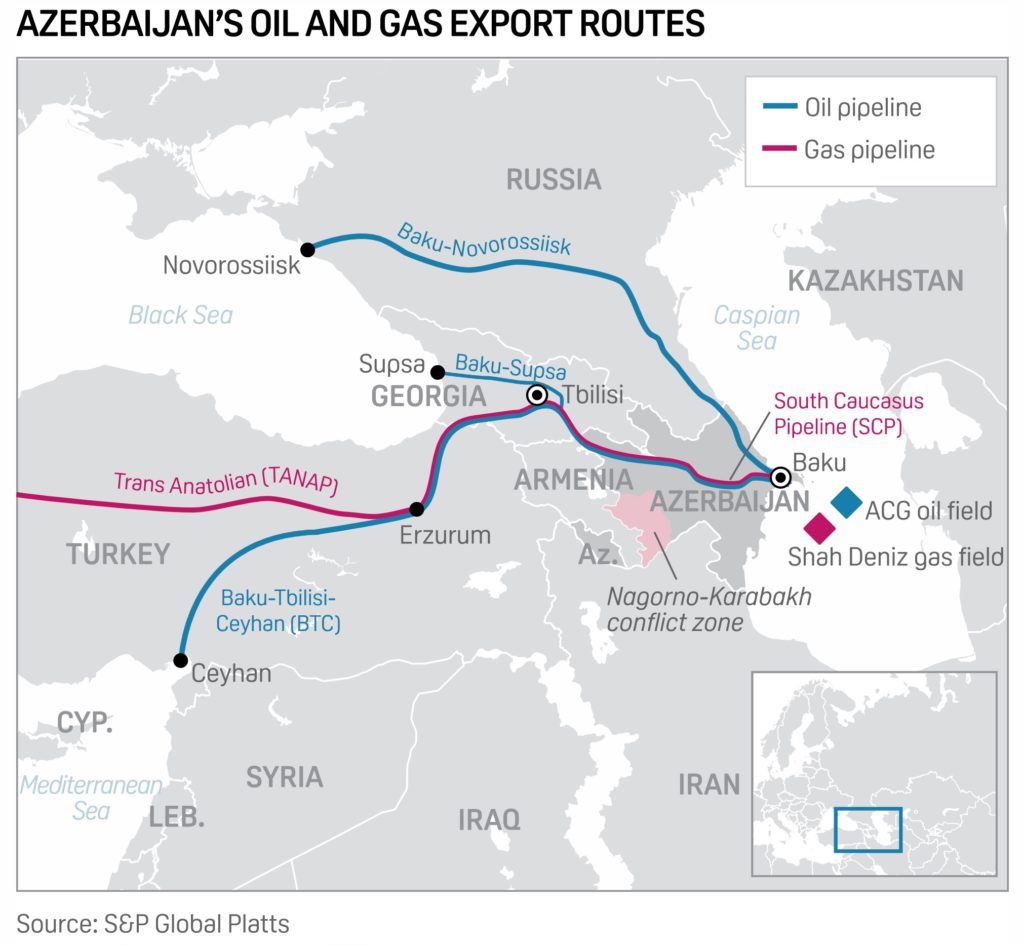

Nagorno-Karabakh: The conflict centers on a district (Nagorno-Karabakh) inside Azerbaijan inhabited by ethnic Armenians. The conflict began in 1988 when the Karabakh Armenians demanded that the district be transferred from Soviet Azerbaijan to Soviet Armenia. The conflict grew into a full-scale war in 1992. Sporadic clashes between the two sides have been continuing with the recent fighting beginning last month. The district is some 25 miles from the South Caucasus Oil and Gas pipelines, which currently move some 600,000 b/d and associated gas to market. The loss of this gas and oil would be a significant blow to Azerbaijan.

Last week Azerbaijani officials said that Armenian forces had fired a cluster rocket, which struck close to the oil and gas pipelines; however, they remained operational. BP, which owns the pipelines, says it will boost security at its operations in Azerbaijan.

The situation is complicated because Russia still has a military base in Armenia able to provide supplies to the Armenians while President Erdogan’s strongly backs Azerbaijan in the conflict. Talks to settle the war are going on in Moscow, and on Saturday Russia’s foreign minister said that a ceasefire had been arranged.

3. Climate change

Presidential candidate Biden is considering creating a special White House office led by a climate “czar” to coordinate efforts to fight global warming if he is elected president. Among those being discussed to head the operation is former Secretary of State Kerry, who helped broker the landmark Paris climate accord, and Jay Inslee, the governor of Washington, who ran for the Democratic nomination on climate issues.

Biden has proposed a sweeping climate plan that calls for an emissions-free electric grid in 15 years and includes a target of net-zero emissions across the entire economy by 2050. The project was put together in consultation with representatives from various sectors of the economic, political, and climate advocacy worlds. While every part of this coalition is invested in the Democratic candidate’s vision, some want to see the country move more quickly toward renewables. In contrast, others think it’s more important to conserve and create jobs, and still others are more concerned with political feasibility than anything else.

Bloomberg points out that the confirmation of Judge Amy Coney Barrett to the Supreme Court could make it harder for future administrations to adapt laws that have been on the books for decades to meet challenges such as climate change. Barrett’s confirmation would strengthen a conservative bloc of justices who take a narrow view of federal agency power — potentially stopping efforts to write regulations to slow greenhouse gas emissions and promote environmental justice.

The massive amount of nitrogen used as fertilizer in agriculture is leading to an increase in nitrous oxide emissions. This lesser-known greenhouse gas contributes to climate change and the depletion of the ozone layer. According to a study published in Nature, nitrous oxide emissions are increasing at a rate of about 2 percent per decade, and in 2018 the gas’s concentration in the atmosphere was about 22 percent above pre-industrial levels.

The landmark law to strengthen EU climate policies and make the 2050 goal of climate-neutrality irreversible risks falling off a fast-track approval process. The bloc’s leaders have stopped to review the economic impact of a massive economic overhaul during the deepest recession on record. According to a draft of their joint communique, EU heads of government plan to discuss the draft measure at their two-day gathering this week but may stop short of supporting a more ambitious intermediate target for 2030. Their political endorsement, key for ministers to reach an agreement on the law’s technical details, and a stricter emissions-reduction goal for the next decade may come in December.

A well site in the Permian Basin owned by a bankrupt shale producer has spewed polluting gases into the atmosphere for ten months, despite being investigated by Texas regulators. Infrared video footage collected from November 2019 through September show “continuous intense and significant” emissions from faulty valves and tank hatches at MDC Energy’s Pick Pocket location in West Texas. Environmentalists are calling on the Texas Commission on Environmental Quality and the Texas Railroad Commission to rescind permits for MDC.

4. The global economy and the coronavirus

The World Health Organization reported a record one-day increase in global coronavirus cases on Thursday. Total cases rose by 338,779 in 24 hours, led by a surge of infections in Europe. The previous WHO record for new patients was 330,340 on October 2nd. The agency reported a record of 12,393 deaths on April 17th.

According to International Monetary Fund estimates, governments worldwide spent freely in their initial efforts to blunt the economic hit from the global pandemic, setting up roughly $10 trillion in spending plans through June. Central banks increased further with rate cuts, bond purchases, and a raft of other credit programs. This time around, officials are betting the virus can be suppressed without reverting to broad lockdowns, ideally allowing a global economic recovery to proceed. Their gamble will determine whether the world heads into 2021 poised for recovery and able to take full advantage of any successful vaccine – or needing to climb from an even deeper hole.

New estimates from the US Department of Agriculture show that tighter crop supplies could worsen the food-inequality crisis worldwide. The report suggests that global food prices could keep climbing, making adequate nutrition more expensive as millions are thrown out of work and economic woes deepen.

United States: According to economists, President Trump’s move last week to cut off talks on another government aid package will further weaken the economy. For roughly 25 million laid-off Americans who are receiving unemployment aid, weekly payments, on average, have shrunk by two-thirds since a $600-a-week federal benefit expired more than two months ago.

Economists are dialing back their forecasts for US economic growth this year as prospects fade for a renewed round of government stimulus. Economists expect to see more workers facing permanent layoffs and a wave of business closures rather than the temporary shock and quick bounce-back that some policymakers envisioned earlier this year.

The number of Americans seeking unemployment benefits fell for a second week while remaining elevated, as the labor market makes little progress amid risks of further weakness without additional federal stimulus. One reason layoffs remain high is that many companies held on to workers when the recession began. Yet as the recession has drug on, more companies have given up and cut jobs.

New coronavirus cases in the US continued to climb last week, driven by renewed outbreaks in several states, as the nation’s total number of cases topped 7.7 million. Unlike during the spring and summer, when clusters drove sharp increases in case numbers in a handful of cities and regions, the current surge in new cases reflects simmering outbreaks spread across more than 20 states. The US reported more than 56,000 new cases for Thursday, the highest daily total since mid-August. More than 213,000 people in the country have died.

Treasury Secretary Steven Mnuchin made a $1.8+ trillion offer to House Speaker Pelosi Friday in a renewed search for an economic relief deal. However, agreement remained elusive as Pelosi said her terms still weren’t met. “Of special concern is the absence of an agreement on a strategic plan to crush the virus.” Senate Majority Leader Mitch McConnell said the differences are likely too significant. The time is too short for Congress to agree on a new comprehensive stimulus package before the election, despite President Donald Trump’s renewed interest in striking a deal.

China: Crude oil imports averaged 11.52 million bpd in September, up by 3.1 percent from August, slowly returning to historical levels and easing congestion at Chinese ports. Compared to September last year, Chinese crude oil imports jumped by 24.4 percent, or by 2.26 million b/d.

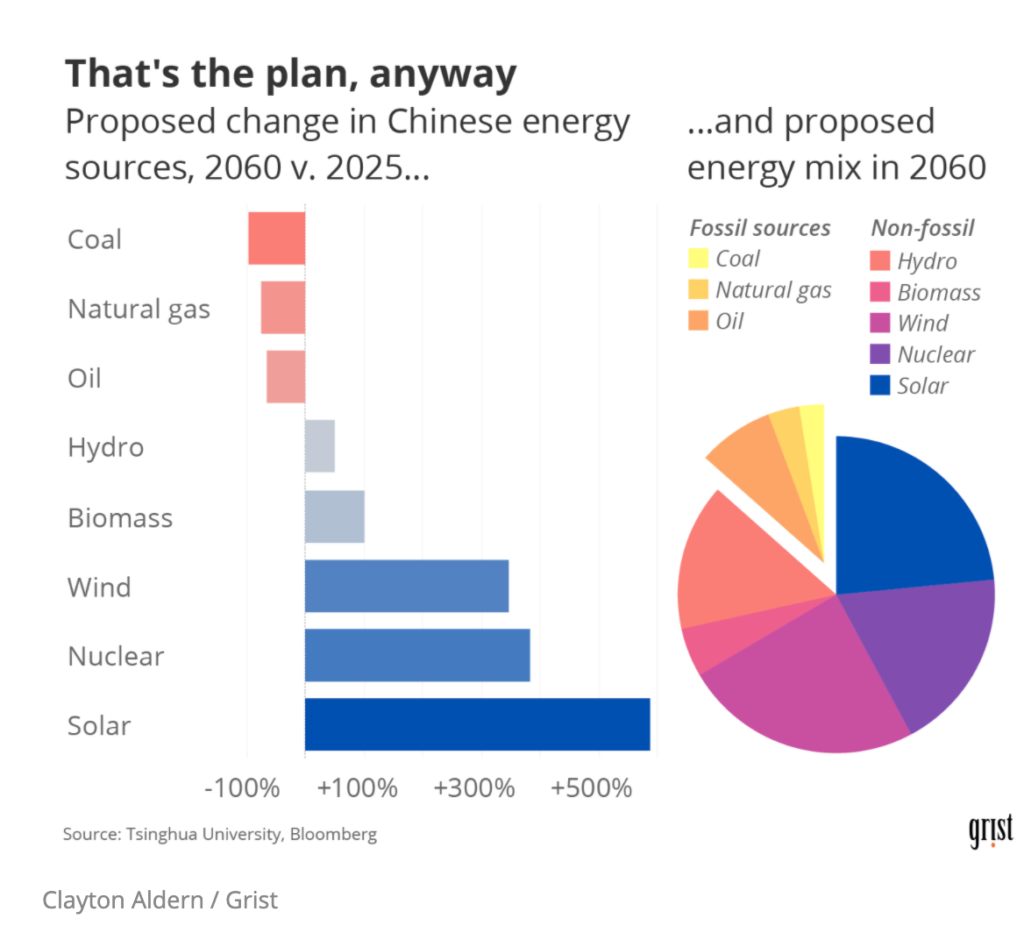

Chinese President Xi’s recent announcement that his country aims to reach peak carbon emissions before 2030 and become carbon-neutral by 2060 has raised many questions. In the words of a scholar at Columbia’s Center on Global Energy Policy, “It would be the most herculean thing ever accomplished in human history. If the United States were to go to net-zero by 2050, it would be great, but it would be far less impressive than China going net-zero by 2060.”

In 2018, China emitted twice as much CO2 into the atmosphere as the US did. To go to net-zero, its economy and energy system would have to undergo changes on a different order of magnitude than any other country. Answers to the “how” came to light last week with the release of a blueprint for the country’s energy transition. Tsinghua University’s Institute of Energy, Environment, and Economics, which works closely with the Chinese government’s Ministry of Ecology and Environment, released a report outlining how its energy mix will change by 2060. And the changes are enormous.

China’s plan to reach carbon neutrality by 2060 could end up costing it $5 trillion, Wood Mackenzie analysts have said in a new report. “The hefty bill is the total sum required for additional power generation capacity to accommodate the growth in electrification by 2050,” they noted. Given that the world’s governments have just spent $10 trillion in six months keeping parts of their economies going, an expenditure of $5 trillion over 40 years to save the planet from overheating sounds like a good deal.

European Union: Europe surpassed 100,000 daily COVID cases for the first time on Thursday, after countries such as Russia and the UK saw no respite in the mounting number of infections every day in the past five days. Cases throughout Europe have been steadily rising over the past week. The epicenter of the outbreak in the European region has moved to the United Kingdom, Russia, Spain, and France, which have reported over 10,000 cases each in the last three days.

Rising hospitalizations and deaths are prompting governments to impose more restrictions, from travel bans in Madrid to the closure of bars in Paris. Confirmed cases in France, Spain, and the UK are now higher on an average day than at the peak of this spring’s emergency, although the trend also reflects better detection of the virus. Infections also have accelerated in Italy and Germany in recent days. The health crisis isn’t as acute as in March and April when hospitals in the worst-hit regions of Italy and Spain didn’t have enough intensive-care beds to treat all severely ill Covid-19 patients. But European authorities are worried that the strain on hospitals could return.

Whatever hopes remained that Europe was recovering from the economic catastrophe delivered by the pandemic have disappeared as the virus has resumed spreading rapidly across much of the continent. After sharply expanding in the early part of the summer, Britain’s economy grew far less than anticipated in August — just 2.1 percent compared with July, adding to worries that further weakness lies ahead.

Earlier in the week, France, Europe’s second-largest economy, downgraded its forecast for the pace of expansion for the last three months of the year from an already minimal 1 percent to zero. Overall, the national statistics agency predicted the economy would contract by 9 percent this year. The surge prompted President Emmanuel Macron to announce new restrictions, including a two-month shutdown of cafes and bars in Paris and surrounding areas.

The European Central Bank’s chief economist cautioned on Tuesday that the 19 countries that share the euro currency might not recover from the disaster until 2022, with those that are dependent on tourism especially vulnerable. In a report this week, Oxford Economics analyzed data across the eurozone, noting that much of the improvement in the late summer resulted from factories springing back to life after shutdowns. For expansion to continue, people have to buy the products wich factories are making. The willingness to spend is influenced by confidence — whether people feel safe enough to move about, whether they fear they could lose their jobs. By September, as coronavirus cases climbed anew, consumption was falling off.

Russia: Moscow reported its highest daily coronavirus cases on Friday since the previous record in May, prompting Moscow authorities to mull closing bars and nightclubs.

Constrained by the OPEC+ production cuts and the necessity to balance its 2020 federal budget, Russia has started to play with one of the most dangerous policy instruments it has at hand – upstream taxation. In September, the Russian parliament has approved the first reading of a Finance Ministry-masterminded bill that would seek to abolish tax breaks that Moscow deems superfluous, along with paving the way for the oft-promoted profit-based taxation system.

Poland’s antitrust authority fined Gazprom $7.6 billion over the Nord Stream 2 pipeline, opening a new front in the bitter political battle over the natural gas project. The authority said Gazprom and its partners failed to get its approval for a joint venture to finance the pipeline. Completing the project makes European gas customers more dependent on a single supplier, Gazprom, and may increase Polish customers’ gas prices, the authority said. It also ordered the companies to terminate their financing agreements for the pipeline.

The Polish decision can’t block the entire pipeline project, and its effects might remain purely financial for Gazprom, but it creates a further hurdle. According to analysts, Poland has no jurisdiction to halt the gas pipeline’s construction, which is almost complete because the gas link doesn’t cross the nation’s territorial waters or its exclusive economic zone.

Saudi Arabia: Aramco doesn’t fear peak oil demand as it doubles down on boosting oil production to beat its competitors, many of which are pledging significant investments in low-carbon energy. In a statement, Aramco said: “We expect oil demand growth to continue in the long term, driven by rising populations and economic growth. Fuels and petrochemicals will support demand growth. Speculation about an imminent peak in oil demand is simply not consistent with the realities of oil consumption.”

The Finance Ministry is budgeting for oil prices to be around $50 a barrel for the next three years, according to a Goldman Sachs analysis of the kingdom’s fiscal plans. “Using our estimates for the breakdown of government revenues, we calculate that the numbers presented in the budget statement are based on an average oil price of around $50 a barrel between 2020 and 2023,” said a London-based analyst at Goldman.

If Democrats win the White House and the Senate in November, US-Saudi relations would likely fray, Washington-based energy analysts predict. The Democratic Party’s priorities of climate action, ending US support for the war in Yemen, and holding Saudi Arabia accountable for the killing of journalist Jamal Khashoggi will make it difficult for a Biden administration to appear anything but tough with Riyadh. A Biden White House “standing behind the Democrats on this means a reckoning is coming.”

The massive $75-billion annual dividend of Saudi Aramco cannot fund the widening budget gap of Saudi Arabia if oil prices remain low beyond 2021, Moody’s said in a report this week. The Saudi budget depends to no small extent on the royalties, taxes and the dividend from Saudi Aramco, which pledges to pay $75 billion in annual dividends to its shareholders, the largest of which is the Kingdom of Saudi Arabia with 98 percent.

India: India’s confirmed coronavirus toll crossed 7 million on Sunday with the number of new cases dipping in recent weeks, even as health experts warn of mask and distancing fatigue setting in. The Health Ministry registered another 74,383 infections in the past 24 hours. India is expected to become the pandemic’s worst-hit country in coming weeks, surpassing the U.S., where more than 7.7 million infections have been reported.

The government is considering a proposal that would force some of its dirtiest coal plants to close, as policymakers in one of the world’s top polluters start to focus on climate change. The plan under consideration by the power ministry would cap plants’ so-called heat rate, which is a measure of how much coal energy is needed to produce each unit of electricity. Power stations totaling 10 gigawatts have been identified as breaching the proposed benchmark, and more could be added. That would account for roughly 5 percent of India’s coal power capacity, the world’s second-biggest consumer of the fuel after China.

5. Renewables and new technologies

According to a new Wood Mackenzie report, energy storage is in for spectacular growth similar to that of renewables over the past decade. The report says the global market for electrical energy storage facilities is set for a 31-percent compound annual growth rate by 2030. Growth will likely accelerate in the late 2020s, to enable more sustained production when combined with intermittent resources such as wind and solar.

Researchers at MIT and a startup, Commonwealth Fusion Systems, spun out of MIT, are working on a nuclear fusion experiment. The researchers claim to be reasonably confident they will soon be able to create a plasma that would produce more energy than consumed by the device called SPARC. According to Martin Greenwald, deputy director of MIT’s Plasma Science and Fusion Center, work is progressing smoothly and on track to begin SPARC’s construction around June 2021. This timeline could mean that the team could start experimenting with SPARC to create net fusion energy as early as 2025. “One of the conclusions is that things are still looking on-track. We believe it’s going to work,” Greenwald said.

Developing safe and cost-effective storage and transportation methods for hydrogen is essential due to the massive increase in the use of the element planned for the coming decades. Storing and moving hydrogen is complicated by the element’s tendency to cause brittleness in metals, including ferritic steel used in pipelines and industrial equipment. Researchers say that in the last decade considerable advances have been made in studying hydrogen embrittlement. As new experimental techniques are refined, it is expected the field will continue to develop at a remarkable pace.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

In Norway, six offshore oil and gas fields were shut on Monday as more workers joined a strike over pay, companies, and union officials said. The strike will cut Norway’s total output capacity by just over 330,000 oil-equivalent barrels per day, or about 8 percent of total production. (10/6)

In the Netherlands, natural gas output at Groningen, Europe’s largest onshore local gas field, fell by half in as production quotas became progressively stricter. (10/10)

In Nigeria, the rehabilitation of the government’s refineries and the completion of a $15 billion refinery and petrochemical complex owned by Aliko Dangote will reduce the nation’s dependence on crude-for-fuel swaps near-term and eliminate those swaps by 2023. (10/7)

Namibia’s Kavango Basin: If there’s one thing three of the world’s most prominent geologists, geochemists, and drill completion experts agree on, it’s this: Namibia’s Kavango Basin could end up being the last significant onshore oil discovery on Earth. That said, Namibia has yet to produce a barrel of oil. (10/7)

While Colombia has experienced significant economic development over the last two decades, with annual GDP growth peaking at 7.4 percent in 2011, there are signs that the resource curse is weighing heavily on its future. The term ‘resource curse’ is used to describe the well-documented phenomenon of bountiful natural resources sharply impacting a country’s governance, stunting its economic diversity, breeding corruption, and fueling conflict. (10/7)

Petroleos Mexicanos returned to capital markets Thursday for its first debt sale–$1.5 billion in bonds—since January as the embattled oil producer seeks to tap improved demand from investors. The sale went off without a hitch, despite the company boasting the heaviest debt burden among oil majors and dealing with one of the worst Covid-19 outbreaks of any company in the world. (10/9)

According to Baker Hughes’ weekly report, the US oil rig count rose by 4 to 193 while the gas rig count dipped by 1 to 73. (10/10)

O&G jobs: Almost three-quarters of the pandemic-driven jobs losses in the US petroleum and chemical sectors may not come back before the end of next year, according to Deloitte LLP. The collapse in oil demand and prices spurred the fastest rate of oil- and chemical-industry layoffs in history, with about 107,000 jobs eliminated between March and August. (10/6)

Spinoff job losses: Wisconsin doesn’t produce a drop of oil or gas, but there has been an O&G related jobs bust there, too, as there has been along with the entire industrial ecosystem that supported fracking. Dozens of idled open-pit sand mines dot the farmland near where Wisconsin, Minnesota, Iowa and Illinois meet along the Mississippi River. Hundreds of mineworkers in the sparsely populated region have lost jobs. (10/9)

Gas generation this winter: As natural gas storage surpasses five-year maximum levels in the US Midwest, a swath of coal and nuclear power plant retirements look to boost gas’ share of generation winter over winter, helping balance a towering inventory. (10/8)

Boeing is lowering its expectations around the demand for new planes over the next decade as the coronavirus pandemic continues to undercut air travel. The company on Tuesday predicted that the world would need 18,350 new commercial airplanes in the next decade, a drop of 11 percent from its 2019 forecast. (10/7)

Fewer lobbying $: Political spending from petroleum producers is down during this election cycle. The drop-off is another sign of how fewer Americans driving their cars or flying in planes during the pandemic have crushed the demand for gasoline and other petroleum products. (10/7)

ExxonMobil will cut up to 1,600 jobs in Europe as the significant oil company struggles with the destruction to demand caused by the coronavirus pandemic. The job cuts amount to more than a 10th of the company’s European workforce. (10/6)

Chevron overtook Exxon Mobil as the largest oil company in America by market value, the first time the Texas-based giant has been dethroned since it began as Standard Oil more than a century ago. The reordering of the oil giants says more about Exxon than Chevron. The company has been struggling to generate enough cash to pay for capital expenditures, leaving it reliant on debt and putting pressure on its $15 billion-a-year dividend. Exxon’s shares have tumbled more than 50 percent this year, and its second-quarter loss was its worst of the modern era. (10/8)

NextEra Energy, the world’s biggest producer of wind and solar power, has now surpassed the oil majors, leading a spectacular rally in power stocks as much of the world shuns fossil fuels to fight climate change. (10/9)

Romanian nuke deal: Romania’s economy ministry will sign cooperation and financing agreements with the US on Friday regarding the construction of two nuclear reactors at its plant on the river Danube. The firm has two 706 megawatt reactors, which account for roughly a fifth of Romania’s power production, and it wants to add two more. (10/9)

Electric trash trucks: more efficient trash pickup is a reality that is hitting a few neighborhood streets with a lot less noise. Expect more to follow. (10/8)

Tesla’s Elon Musk said on Wednesday the company would produce Model Y with new structural battery design and technology at its Berlin factory next year, and that could result in a “significant production risk”. (10/8)

Lithium. Chile, the nation sitting on half the world’s lithium reserves, has a calming message for electric car makers: stricter environmental oversight won’t threaten future metal production used to make batteries. (10/10)

US thermal and metallurgical coal exports were down 15.6 percent in August from the previous month. From the year-ago month, exports declined by 41.3%. Over the eight months, exports were 44.6 million st, down 31 percent year on year. (10/7)

UK wind: The United Kingdom aims to become a global leader in offshore wind energy, powering every home in the country with the wind by 2030, Prime Minister Boris Johnson said on Tuesday. The UK’s seeks a green-energy recovery from the pandemic to help it become a net-zero economy by 2050. (10/7)

UK’s H2 move: The world’s first double-decker hydrogen buses—15 of them—arrived on Wednesday in Aberdeen, Scotland, giving the city one of the world’s biggest fleets of hydrogen buses. Hydrogen is already making progress in public transport. Last week the first hydrogen-powered trains were trialed in Britain. They could be carrying passengers by 2022. (10/7)

US H2 potential: Hydrogen could help meet 14 percent of US energy demand by 2050, the equivalent of more than 2,468 TWh or 8.4 billion MMBtu per year, according to a new study by the Washington-based Fuel Cell and Hydrogen Energy Association. (10/6)

US H2 vis nukes: The US Department of Energy has provided funding to two projects worth $26 million seeking to advance hydrogen generation by nuclear reactors, starting with a facility at an Xcel Energy plant. The projects are designed to enable atomic plants to switch between electricity production and hydrogen generation depending on market conditions. (10/9)

Green ammonia: Orsted A/S, the world’s biggest developer of offshore wind farms, plans to use its latest Dutch installation to make green ammonia for use in fertilizer. The Danish utility will work with the fertilizer giant Yara International ASA to use wind power to create hydrogen and turn it into ammonia. As with most new green projects, the companies said they’ll need government support to get off the ground. (10/6)

The UK’s National Health Service has set a target to reach net-zero greenhouse gas emissions by 2045, making it the world’s first health service to establish such an ambitious climate goal. Two early steps include investing in electric ambulances and building greener hospitals. (10/7)

Hyper-inflation: Venezuela has begun to import banknote paper and is mulling plans to print bills with larger denominations as hyperinflation causes shortages of cash. The central bank is considering new bills starting with 100,000 bolivars, the people said. It would be the highest denomination yet, but still worth only $0.23. (10/6)

Record warmth: Climate scientists warned 2020 could be the world’s hottest year on record, with September temperatures eclipsing previous highs and Arctic ice retreating. Global year-to-date temperatures show little deviation from 2016, and the warmest calendar year recorded so far. (10/8)

East Africa floods: The number of people hit by seasonal flooding in East Africa has increased more than fivefold in four years, according to UN figures. Nearly six million people have been affected this year, with 1.5 million of them forced from their homes. Parts of the region are recording the heaviest rains in a century. (10/7)