Editors: Tom Whipple, Steve Andrews

Quotes of the Week

“[D]emand for oil products will eventually decline. Whether it is this decade or next is anybody’s guess.”

De La Rey Venter, Shell’s head of Integrated Gas Ventures

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil fell last week in New York to $37.05 and Brent plummeted to $39.27, after President Trump’s positive Covid-19 diagnosis combined with labor market weakness led to heightened concerns over an economic recovery. The coronavirus is resurgent again in Europe and hasn’t been brought under control in big economies such as India, leading to forecasters scaling back their estimates for when oil demand will get back to pre-virus levels. Concerns are increasing that global crude supplies and demand could again fall more out of balance.

“Trump and the coronavirus news, along with the setback to the talks on the US stimulus package, are just triggers and a reminder that the global economy is in trouble at least for the next six months,” said the founder of Vanda Insights in Singapore. “What’s coming on top of that is the realization that there’s more supply coming into the market just as demand growth is weakening.”

US crude inventories unexpectedly declined in the week ended Sept. 25th as exports surged to a 20-week high. Commercial crude inventories fell 1.98 million barrels to 492 million, narrowing the surplus above the five-year average to 12.4 percent, the weakest supply overhang since late May. Some of the decline is due to the series of storms that have hampered oil production in the Gulf of Mexico in recent months.

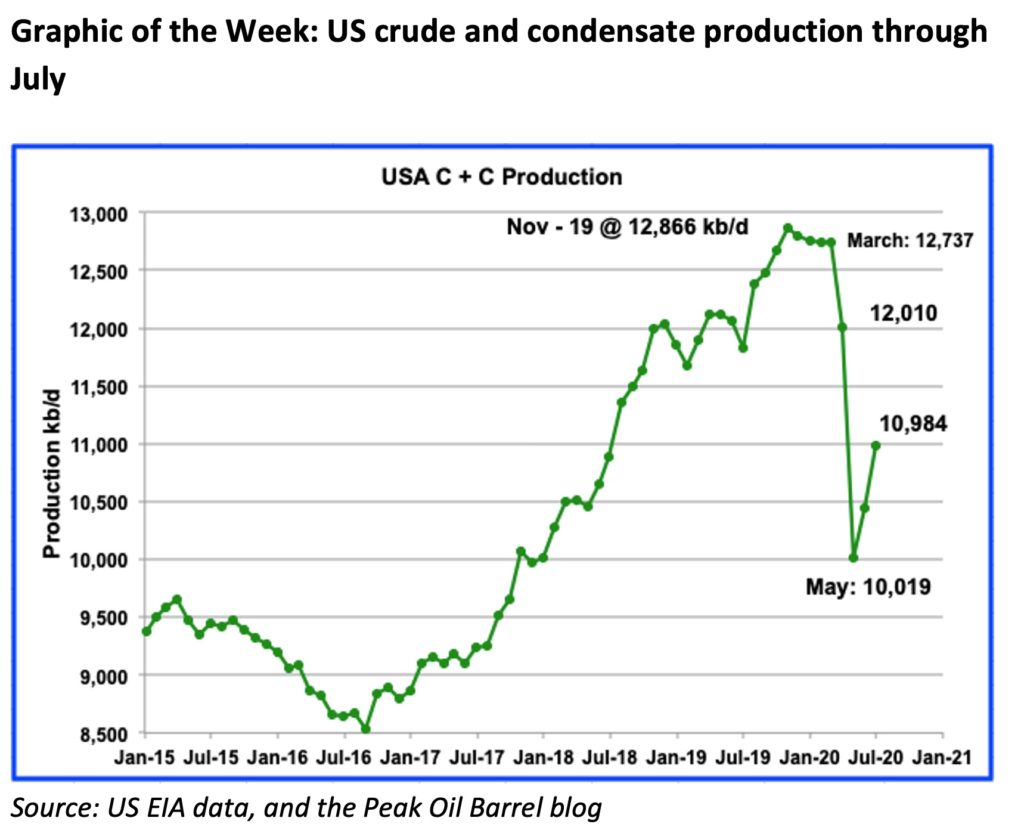

Preliminary well production data for July shows that after recovering by around 540,000 b/d in June, oil output for the lower 48 states, excluding the Gulf, posted a second monthly increase of more than 400,000 b/d in July. Rystad Energy estimates another rise of 230,000 bpd in August from the same regions, which would take the total for the month to a peak of 9.2 million b/d.

Shale Oil: The state of Texas and its taxpayers could be on the hook for paying up to $117 billion for the cleaning-up of abandoned wells as a growing number of US oil companies go bust. The guarantees for paying for the cleanup cover only 1 percent of estimated costs. The total taxpayer tab nationwide could hit $280 billion.

According to a new report from Carbon Tracker, only a tiny proportion of the costs of “plugging” America’s active wells are currently covered by insurance mechanisms. To drill a well, companies usually need a bond, which ensures that they either cover the cleanup costs or forfeit a certain sum at the end of its life. However, the amount paid in many states is significantly less than the cost of plugging the well. Current bonds would cover just 1 percent of the $280 billion costs of plugging the US’s 2.6 million active wells.

Eagle Ford producer Lonestar Resources filed for bankruptcy protection under Chapter 11 last week, becoming the latest casualty in the string of bankruptcies in the US shale patch this year. Oasis Petroleum also filed for Chapter 11 to reduce its debt by $1.8 billion. Dozens of shale producers have already filed for bankruptcy protection this year, with filings accelerating after oil prices crashed in March and US shale producers curtailed production in the following months.

Notable bankruptcies included Permian producer Rosehill Resources, California Resources, and Denbury Resources. Shale giant Chesapeake Energy also filed for bankruptcy at the end of June. According to law firm Haynes and Boone, which tracks bankruptcies, as of Aug. 31st, a total of 13 producers filed for protection in July and August. Combined with the rest of the filings this year, that represents a 62 percent increase over this time last year.

“It’s not quite the level of filings reached in 2016 but a disturbing trend, nevertheless. It is interesting to note that the total secured debt involved in 2020 producer bankruptcies to date already exceeds the total amount of secured debt for all producer filings in 2016,” Haynes and Boone said.

OPEC+: The expanded group, which includes exporters such as Russia and Kazakhstan, kept supplies near the lowest level in decades to offset an unprecedented plunge in fuel demand. Their efforts show mixed success, with signs of inventories piling up again and oil prices stuck around $40 a barrel.

The cartel’s crude output held steady last month as the United Arab Emirates pulled production back sharply to make up for months of oversupply. The Gulf sheikhdom drew a rare public rebuke from OPEC’s de facto leader, Saudi Arabia, last month for a production surge over the summer that violated its agreed quota. It has now moved closer to that limit again, with tanker-tracking data showing exports at their lowest in 23 months. Saudi Arabia, which boosted shipments by about 500,000 b/d last month, and Russia have pressured other countries to make compensatory output cuts if they over-produce.

OPEC and ten allies, including Russia, are in a historic production cut accord to help the oil market recover from the COVID-19 pandemic. The curbs initially started at 9.7 million b/d for May-July, before tapering to 7.7 million b/d from August through the end of the year.

The alliance has 2.375 million b/d of so-called “compensation cuts” due to making up for previous overproduction in violation of quotas. Still, not all members have submitted plans to implement the extra reductions. Of the 13 OPEC+ members required to make compensation cuts, only six have outlined their planned schedule of cuts, totaling 1.222 million b/d. A considerable reduction will come from Iraq, whose 698,000 b/d of catch-up cuts will be divided into 203,000 b/d in September and 165,000 b/d in October, November, and December. Russia, which had the second-largest excess output at 333,000 b/d, has not submitted a plan.

Coal: A report published by Fitch Solutions says that under a Biden presidency, the US is expected to see an acceleration in renewables development and an effort to reverse the loosening of emission restrictions made by the Trump administration. “A Biden presidency will likely accelerate the decline of coal production in the US as his policy platform moves the country towards other sources of power generation,” the report reads. Coal-fired power plants’ retirement has left fewer and fewer options for domestic producers to sell thermal coal. Additionally, export opportunities remain bleak due to US coal being less competitive than producers in countries such as Australia for Asian buyers who consume much of the exported coal.

Fitch’s report also looks at how the rest of the mining industry may fare if Biden becomes president. The analysis sees downside risks to production growth forecasts in the long run. “Given the Obama administration’s previous stance and Biden’s current policy platform which calls for protecting America’s natural treasures, we see scope for project development to slow as the Biden administration would more heavily scrutinize granting environmental permits on federal lands.”

Prognosis: The top executives at some of the world’s largest independent oil traders do not expect global oil demand to improve over the next six to nine months. Instead, they expect oil prices to remain stuck in a narrow range in the $40s at least until the middle of 2021.

Oil production from the US lower 48 states, excluding the Gulf of Mexico, peaked at 9.2 million barrels per day in August following back-to-back increases since June. This climb has helped push the nationwide total above 11 million b/d and is likely to keep it above that mark for the rest of the year, according to Rystad Energy estimates. A gradual decline in shale oil output may nevertheless have started in September as onshore drilling remains below the level required to maintain production in nearly all US oil basins. Rystad Energy projects US onshore production to begin rising again in the second half of 2021.

2. Geopolitical instability

Iran: With the 25-year energy deal with China now moving ahead, Iran has a buyer for all the crude oil it can produce, albeit at discounted levels. As the Iran-China trade does not pay much attention to Washington’s sanctions, which might be lifted next year, Tehran is pushing oil field development. This includes significant fields in the West Karoun cluster, where China has pledged to increase collective output by at least 500,000 b/d within the next two years, and the more challenging fields shared with Iraq.

Iraq: Despite promises to keep in line with the OPEC+ pact, Iraq – OPEC’s biggest laggard in implementing the cuts – slightly raised its crude oil exports in September compared to August. According to Iraq’s ministry of oil, crude exports totaled 78,388,619 barrels last month. Baghdad failed again to implement compensation cuts to make up for overproduction between May and July.

Iraq’s finance minister asked the Cabinet to fast-track a law to cover deficit spending through the rest of 2020. The stop-gap law is needed to cover monthly expenditures of about $6.8 billion on public sector salaries and other government operating expenses. Iraq has averaged less than $3 billion in oil revenues over the past six months, leaving a massive deficit.

The US granted Iraq a 120-day waiver to continue importing electricity and gas from neighboring Iran. Just after the new Iraqi Prime Minister’s visit to Washington last month, the waiver’s duration was cut in half as the administration was not pleased with Baghdad’s response to rocket attacks and roadside bombs against US and allied interests. Secretary of State Pompeo threatened to close the US embassy in Baghdad unless the Iraqi government takes more decisive action against Iran-backed paramilitary groups. By some accounts, the process of drawing down the embassy has already begun.

Libya: Oil production has more than tripled to 300,000 b/d since the port blockade was lifted last month and another oilfield restarted. The 200,000-b/d Sarir oilfield resumed operations on Tuesday but is currently pumping just 30,000 b/d.

According to a confidential UN report, the United Arab Emirates increased military supplies to Libyan warlord Khalifa Haftar this year. This action defied a UN arms embargo as the UAE tried to salvage the leader’s military campaign and check the influence of regional rival Turkey.

Nagorno-Karabakh: Armenia and Azerbaijan have declared martial law and mobilized their armed forces after clashes escalated over the disputed enclave of Nagorno-Karabakh last week. Both sides blamed each other for starting the fighting in the Caucasus Mountains, the latest flare-up in a decades-long conflict, and the worst since a five-day war in 2016 in which more than 100 people died.

The region is an essential corridor for European energy supplies via a pipeline that runs through Turkey, which sees itself as a “brother country” of Azerbaijan. Whenever fighting has erupted between Armenia and Azerbaijan over the disputed territories, Moscow has forced the two previously Soviet states to the negotiating table. However, this time, Russia’s calls to stop the escalating violence have so far fallen on deaf ears, thanks in part due to the rise of Turkey as a regional power allied to Azerbaijan.

France, Russia, and the US have called for an immediate ceasefire. Armenia’s foreign ministry says it “stands ready to engage” with France, Russia, and the US on halting the fighting, but Turkey said the three big powers should have no role in peace moves. France, Russia, and the United States are co-chairs of the Organization for Security and Cooperation in Europe’s Minsk Group, set up in 1992 to mediate in the decades-old conflict over the mountainous enclave in the South Caucasus.

Venezuela: Foreign currency revenues—almost all of which come from crude oil sales—have plunged by 99 percent since 2014, President Maduro said, blaming most of the losses on the “persecution and criminal blockade” of Venezuela’s oil exports. Iran has been receiving gold from Venezuela for the fuel cargoes Tehran had sent to Caracas, a commander at Iran’s Islamic Revolutionary Guard Corps (IRGC) said last week.

Reliance Industries, owner of India’s biggest refinery, has started buying Canadian heavy crude to replace Venezuelan imports on fears that the US could take sanction action against the company.

3. Climate change

Should there be a President Biden administration next year, rejoining the Paris Agreement would be both likely and straightforward. The Agreement allows members to set their own emissions targets. Under President Obama, the US pledged to curb greenhouse gas emissions by 26-28 percent from 2005 levels by 2025. Biden has said he would rejoin the Paris pact if elected, which would require only that the US notify the UN, with re-entry active 30 days later. The US also would need to submit a specific pledge to reduce emissions, known as a Nationally Determined Contribution

Biden has already proposed a sweeping climate plan that could lay the foundation for a new emissions pledge. His $2 trillion clean-energy-and-infrastructure proposal calls for an emissions-free electric grid in 15 years and includes a goal of net-zero emissions across the entire economy by 2050. It would be one of the most ambitious climate proposals globally, surpassing China’s recently announced goal of being carbon neutral by 2060.

President Xi Jinping’s surprise announcement at the annual UN climate meeting last week committed China to have CO2 emissions peak before 2030 and achieve carbon neutrality before 2060. That brings the third-biggest economy into a loose but essential consensus with the second largest (EU), fourth largest (Japan), and fifth largest (California). Two of the biggest economies remain outside of the consensus: India, at No. 6, and US No. 1.

As the world’s biggest emitter and energy consumer, China has an overwhelming influence on the prospects for limiting future warming. According to an analysis published in the journal Nature, for the world to fall short of the UN’s 1.5°C increase target by just half a degree would cost the world $20 trillion by 2100.

One of China’s top climate research institutes laid out a plan of increasing renewable and nuclear energy and ultimately phasing out coal power. The program, from Tsinghua University’s Institute of Energy, Environment, and Economy, outlines a gradual transition over the next decade and a half, with a rapid acceleration after 2035. According to the institute’s director, carbon emissions will peak sometime between 2025 and 2030, and total energy demand will start to decline around 2035. “We are trying to set the most cost-effective model to push every sector to realize the goal,” he said.

Under the plan, coal-fired electricity would be eliminated by 2050, and China’s energy mix would undergo a drastic transformation. China’s massive coal industry isn’t worried about the plan to drastically cut carbon emissions as it will likely be business as usual for years to come. With China adding new mines and power plants through 2025, the fuel will continue to dominate the country’s power sector, so coal consumption won’t see a significant hit.

The EU is drawing up a plan to ensure nations don’t undo its Green Deal environmental rules with weaker standards. The measure would penalize the greenhouse-gas pollution produced by factories outside the region that ship their products into Europe. The “Carbon Border Adjustment Mechanism” is meant to ensure that the Green Deal doesn’t hurt domestic industries most at risk from stricter climate policies.

The European Parliament voted last month to require that oceangoing ships pay for the pollution they cause when carrying cargo to and from Europe by bringing shipping under the EU Emissions Trading System. The plan is drawing sharp criticism from the shipping industry and raises the prospect of a broader conflict on trade. Any charges will add to the cost of moving goods through European seaports, making the carbon fee an effective tariff.

Another study of the Greenland icecap published in Nature shows the ice is on track to lose mass at about four times the fastest rate observed over the past 12,000 years. At its current rate, such melting would dump vast quantities of fresh water into the sea, raising global sea levels and disrupting ocean currents.

The layers of the world’s oceans aren’t mixing the way they used to due to climate change, potentially speeding up how fast the planet will warm in the coming decades. This new finding, contained in a study published Monday in the journal Nature Climate Change, finds that the reduction in the mixing of ocean layers is piling up warm water near the surface while cutting back on the circulation of cold, deep water.

4. The global economy and the coronavirus

The International Air Transport Association (IATA) downgraded its 2020 traffic forecasts after “a dismal end to the summer travel season.” The association, which represents 290 airlines, says it expects traffic to be 66 percent below the level it was in 2019. The IATA estimates that it will be at least 2024 before air traffic reaches pre-pandemic levels. Throughout the year major airlines, airports and tour firms have collectively announced thousands of job losses.

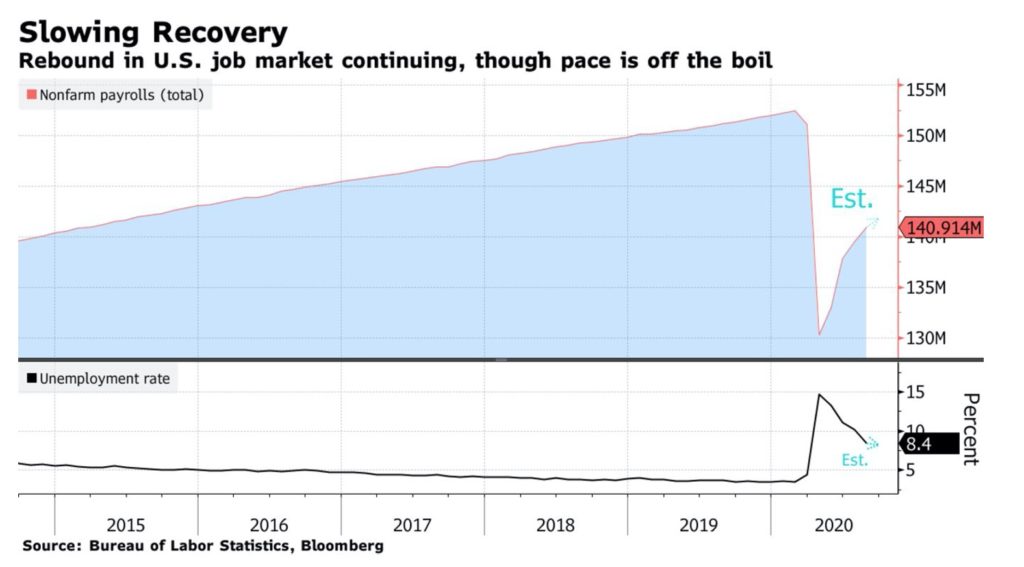

United States: Job growth slowed more than expected in September and the ranks of the permanently unemployed swelled, underscoring an urgent need for additional fiscal stimulus as the pandemic drags on and threatens the economy’s recovery. The Labor Department’s employment report on Friday was the last before Nov. 3rd presidential election. September’s employment gains were the smallest since the recovery of jobs started in May and left the labor market a long way from recouping the 22.2 million jobs lost in March and April, indicating slower growth heading into the fourth quarter.

A further slowdown in the labor market is likely. The House of Representatives on Thursday approved a $2.2 trillion rescue package; however, objections from top Republicans are likely to kill the plan in the Senate.

American and United Airlines, two of the largest US carriers, said they were beginning furloughs of over 32,000 workers on Thursday as hopes faded for a last-minute bailout from Washington. Both airlines told employees, however, that they stood ready to reverse the furloughs, which affect about 13 percent of their workforces before the pandemic. House Speaker Pelosi said Friday she is willing to move forward with aid for airlines as separate legislation or as part of a broader coronavirus relief deal. The California Democrat called on airlines to delay the job cuts as Congress crafted the legislation.

The economic effects of the coronavirus are battering the US commercial-real estate market, raising the question of the value of hotels, malls, and other buildings that act as collateral for mortgages. Wells Fargo estimates that US properties that have gotten into trouble are being written down by 27 percent on average.

China: The economic rebound showed signs of plateauing in September, weighed down by lackluster home and car sales, a weaker stock market, and worsening business confidence. This month’s aggregate index combining eight indicators tracked by Bloomberg slipped into contraction, compared to accelerated expansion in August. China has staged an uneven recovery, initially driven by strong industrial output yet with recent data showing signs that consumption has started to catch up. A broad and robust spurt in spending is needed for a more meaningful economic rebound.

There were some bright spots, however. China’s official manufacturing purchasing managers index rose to 51.5 in September, higher than both the 51.2 forecasts by economists and August’s reading of 51.0.

A new report from Bloomberg New Energy Finance says China is going all-out to capture the electric vehicle market, which seems to be emerging as the wave of the future. Bloomberg foresees that by 2040 the world electric vehicle fleet will be on the order of 500 million EVs and that the US had better get moving or it will lose a significant share of this market.

Volkswagen said last week it and three local joint ventures plan to invest around $17 billion in electric mobility in China, the world’s biggest car market, between 2020 and 2024. With Volkswagen’s investment and its three joint ventures, the German automaker will build 15 different battery-electric or plug-in hybrid models in China by 2025.

European Union: Unemployment rose for a fifth straight month in Europe during August and is expected to grow further amid concern that extensive government support programs won’t be able to keep many businesses afloat forever. The jobless rate increased to 8.1 percent in the 19 countries that use the euro currency, from 8.0 percent in July. The number of people out of work rose by 251,000 during the month to 13.2 million. While Europe’s unemployment rate is still modest compared with the spike seen in many other countries, economists predict it could hit double digits in the coming months as wage support programs expire.

Consumer prices in the 19-nation euro area fell more than economists forecast in September, keeping up pressure on the European Central Bank as it debates whether to add stimulus to support recovery from the coronavirus recession. The inflation rate came in at -0.3 percent, slightly below the median estimate in a Bloomberg survey. Prices for services were a particular drag in September, with some food and energy also cheaper than during the previous month. Core inflation fell to a record-low 0.2 percent.

The pound tumbled after a report that Brexit talks were failing to close differences and as the European Union planned legal action against the UK. The UK and EU remain split on state aid, a sticking point in the negotiations.

In what unions termed “a declaration of war,” Volkswagen announced that it would cut 9,500 jobs, more than a quarter of its workforce, and consider closing production sites across Germany and Austria. After a summer in which the country’s car industry remained in suspended animation, the protesting staff at the Nuremberg truck and bus factory are among tens of thousands of employees in the strategically important sector whose jobs are in jeopardy. Germany’s car industry supports more than 2 million domestic jobs and directly accounts for more than 5 percent of gross domestic product. It is concentrated in Bavaria, Baden Württemberg, and Lower Saxony, whose economies are likely to suffer most from car manufacturers’ attempts to slash costs.

Some 4.8 million Madrid residents will be barred from leaving the area this week, making it the first European capital back into lockdown due to surging coronavirus cases. Restaurants and bars in the Spanish capital and nine satellite towns will shut early and slash capacity by half in what has again become Europe’s worst infection hotspot.

Hospitals in the Paris and Marseille regions are delaying scheduled operations to free up space for COVID-19 patients as the French government tries to stem a rising tide of infections. As restaurants and bars in Marseille prepared to shut down Sunday night for a week as part of scattered new French virus restrictions, Health Minister Veran insisted that the country plans no new lockdowns.

Tighter restrictions have come into force in parts of northern England after a spike in coronavirus cases. It is now illegal to meet people indoors from other households in the Liverpool City Region, Hartlepool, Middlesbrough, and Warrington. More than a third of the UK is now under heightened restrictions.

Russia: The oil industry produced 9.93 million b/d crude and condensate in September, according to preliminary data released by the Russian energy ministry Oct. 2nd. Production was up 0.6 percent in the second month that quotas were increased under the OPEC+ agreement. Russia’s quota for crude output under the agreement was 8.492 million b/d for May-July and increased to 8.993 million b/d for August-December. The group will next meet to discuss market conditions and the deal Oct. 19th.

Russia expects a long and gradual revival of the oil market after the pandemic crushed energy demand. “The recovery won’t be fast, and it will take quite a while before the pre-crisis levels can be reached,” Russia’s Energy Minister Novak said last week. In 2020, on the back of coronavirus lockdowns, global oil demand is set to decline by as much as 10 percent compared to the previous year, he said in his address to a two-day online meeting of G-20 energy ministers.

Russia has the world’s fourth-highest number of Covid-19 infections. In the spring, government data showed a steady decrease in new cases since they peaked in mid-May. That decline encouraged the Kremlin to lift almost all quarantine measures imposed in March to limit the damage to the country’s already struggling economy. Still, a sharp increase in new infections over the past fortnight has raised fears that a new lockdown will be necessary.

“The first wave was bad, but this next one is coming right now, and it is going to be worse,” the chief executive of a Russian company said. “We learned a lot in March and April about how to control it … and we need to do the same “We all really do not want to return to the harsh restrictions of this spring,” Moscow’s mayor said. “Hopefully we can avoid this. But only if we take care of ourselves and people close to us.”

Any reimposition of widespread lockdown measures in Russia is politically sensitive, given president Vladimir Putin’s decision to lift the initial quarantine this summer and his championing of a Russian-developed Covid-19 vaccine. Note that Moscow is under-reporting the number of its coronavirus cases and deaths. With a population of about 42 percent that of the US, Russia is reporting officially only 15 percent of the US coronavirus case count and only 10 percent the number of deaths.

Saudi Arabia: Gulf nations led by Saudi Arabia have been putting on a brave face and touting the strength of their economies, claiming they can withstand any scale of shocks during the oil crisis. Unfortunately, a growing body of evidence indicates that the Gulf economies are in dire straits. With oil prices stuck at $40/barrel, the Gulf Cooperation Council central government deficits will reach about $490 billion cumulatively between 2020 and 2023, while government debt will surge by a record-high $100 billion in the current year.

Saudi Arabia’s economy contracted 7 percent year on year in the second quarter as the world’s largest crude exporter was battered by the coronavirus pandemic’s demand destruction. The historic drop illustrates the urgency behind Saudi Arabia’s efforts to lift and stabilize crude prices through OPEC’s alliance with Russia and other key producers. It also highlights the kingdom’s difficulties in diversifying its economy away from its oil industry, which contributes more than two-thirds of its revenues.

Latin America: The pandemic has ravaged the continent, killing more than 300,000 people, erasing years of social and economic gains, and plunging millions back into poverty. With only 8 percent of the world’s population, Latin America has accounted for a third of global deaths from Covid-19. As a result, epidemiologists believe that in some parts of the region so many people have been exposed to the virus that fewer are now susceptible to infection, contributing to the recent slowdown in new cases. This slowdown is raising cautious hopes that the hard-hit region might be turning a corner.

India: The epidemic shows no sign of abating. The total infected climbed to 6.47 million last week after a daily increase in cases of 79,476. India now has the highest rate of daily growth in infections globally and will soon surpass the US with 7.3 million. The death toll from the coronavirus rose past 100,000 last week, only the third country in the world to reach that number. As India’s official death toll is only half that of the US and its number of infections is climbing at twice the US pace, it seems likely that India’s actual death count should be on the order of 200,000.

The government imposed a harsh nationwide lockdown in March, a move that many experts say was poorly planned, devastating the economy while failing to stop the virus’s spread. Now, despite the climbing numbers, officials are lifting restrictions in hopes of easing the economic suffering. Cinemas will be allowed to reopen with limited capacity this month, for example, and some states are expected to reopen schools.

India will subsidize interest costs for small borrowers who had availed themselves of a six-month loan repayment holiday to survive as the pandemic devastated cash flows. The Modi government is attempting to provide relief to small borrowers after the prime minister’s spring lockdown that brought business activity to a grinding halt. That resulted in Asia’s third-largest economy contracting 24 percent in the quarter ended June.

5. Renewables and new technologies

For decades, hydrogen technology was considered too costly and impractical. It was relegated to niche corners of the economy. While most were thinking of the difficulties of producing and delivering compressed hydrogen for millions of fuel cell vehicles, the use of hydrogen as a substitute for coal in natural gas in heavy industry was not appreciated. Now Wall Street can’t stop talking about the enormous potential of the versatile gas to cut emissions from many hard to decarbonize sectors of the economy. The Bank of America says we have reached the tipping point of harnessing hydrogen effectively and economically and predicts that the gas marketplace will reach $11 trillion by 2050.

Increasingly cheaper wind power means that “green” hydrogen can be electrolyzed from water without the carbon emissions that occur when hydrogen is extracted from natural gas. With some modifications, existing natural gas networks can distribute hydrogen to industrial facilities such as steel mills and refueling points for large vehicles such as railroads and heavy trucks. Whether hydrogen can compete with electric vehicles remains to be seen.

According to an exploratory study commissioned by the Netherlands Ministry of Economic Affairs and Climate Policy, a hydrogen exchange, similar to those for electricity and gas, could act as a catalyst for a market for climate-neutral hydrogen. The report says a hydrogen exchange would create a win-win situation for all parties involved. As a result of the study, four Dutch port authorities are now arranging for a more detailed analysis to be carried out regarding the practical design of an exchange on which hydrogen can be traded freely.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

North Stream 2: Denmark cleared away the final hurdle to Nord Stream 2, potentially starting operations in Danish waters. The US continues its attempt to stop the Russia-led natural gas pipeline project. Meanwhile, US Secretary of State Mike Pompeo said the US was building a coalition to prevent the completion of the Nord Stream 2 pipeline. (10/2)

Russia’s Rosneft has warned that BP and Royal Dutch Shell are creating an “existential crisis” for oil supplies, leading to higher prices, attacking their shift towards renewables when demand is still growing. Rosneft’s comments illustrate a growing divide between state-backed oil companies and the energy majors that have helped shape the modern oil industry. (9/29)

UAE on peak demand: Global oil demand has another decade to grow until peaking in 2030, according to one of the largest state wealth funds of the United Arab Emirates. (9/29)

The UAE, Israel, and the US will pursue a joint energy strategy to improve the security of the region. They agreed to greater coordination in the energy sector, including renewable energy, energy efficiency, oil, natural gas resources and related technologies, and water desalination technologies. (10/3)

New Saudi fuel: The world’s first shipment of “blue ammonia” is on its way from Saudi Arabia to Japan, where it will be used in power stations to produce electricity without carbon emissions. Saudi Aramco produced the fuel, which it does by converting hydrocarbons into hydrogen and then S, ammonia, and capturing the carbon dioxide byproduct. (9/28)

Indonesia, the top buyer of gasoline in Southeast Asia, is likely to face sluggish motor fuel demand in the near term, as driving in significant cities dropped last month amid a renewed lockdown and travel curbs to combat the spread of the coronavirus pandemic. (10/1)

Africa’s oil and gas industry faces a financial onslaught due to a combination of COVID-19, activist shareholders, and the so-called Greening of IOCs such as Shell, Total, and BP. While the oil majors all seem to be preparing for an energy transition and peak oil demand, Nigeria’s parliament is discussing privatizing its national oil company. (10/2)

…yet in Nigeria, strong indications emerged Monday that hardship looms following the nation’s over-reliance on oil as Nigeria’s oil minister has raised the alarm that the days of crude oil are numbered. (9/29)

In Mexico: President Obrador’s pre-election pledges to increase crude production to 2.6 million b/d by 2024 have so far remained a pipe dream. Against all the challenges PEMEX has been and will potentially face, it would be a miracle if AMLO’s vows of resurrecting crude production work out. (9/28)

Mexico may have to rethink its own current hydrocarbon-focused energy strategy if Joe Biden wins the US presidency in November. Biden could hasten the country’s migration to more renewable energy by enforcing the Paris Agreement and the energy chapter under the US-Mexico-Canada Agreement. (10/2)

In Canada, Suncor Energy, the nation’s second-biggest oil company, said it would cut its workforce by up to 15 percent over the next 18 months, as pandemic travel restrictions crushed crude demand. The reductions will affect some 2,000 non-union jobs. (10/3)

The US oil rig count rose by 6 to 189 while the gas rig count decreased by 1, Baker Hughes reported on Friday. Total oil and gas rigs in the US are now down by 589 compared to this time last year. (10/3)

Hurricane Laura, which stormed through the US Gulf of Mexico at the end of August, forced shut-ins of an estimated 14.4 million barrels of crude oil during the two weeks of shut-down rigs—the largest production loss from a Gulf hurricane since Gustav and Ike in 2008. (10/3)

Exxon Mobil likely made a third consecutive loss in the last quarter, heaping further pressure on the energy giant’s ability to pay its $15 billion-a-year dividend, currently the third-highest in the S&P 500 Index. Exxon suffered losses in its refining division in the third quarter, while higher oil prices were likely not enough to push its production operations back into profit. (10/3)

Oil’s lobby group hits Biden: A month before the US election, the oil industry’s lobbying group, the American Petroleum Institute, is launching ads in some swing states, saying in one ad that “extreme environmental proposals” like a ban on new leases on federal land – a Joe Biden proposal – could cause hundreds of thousands of Americans to lose their jobs. (10/3)

Are they hiding the ball? A top US Geological Survey official has delayed for three months (and counting) the release of a study that shows how oil and gas drilling in Alaska could encroach upon 573 Alaskan polar bears’ territory. The bears are already struggling for survival as a warming planet melts their habitat. (10/1)

Layoffs: The largest US oil refiner, Marathon Petroleum, has started to lay off hundreds of employees at various refineries after the pandemic crushed fuel demand. Thin profit margins have been undercut by the need to operate plants at less than 80 percent capacity. (10/1)

Methane emissions have become an industry black eye, to the point that major players are now clamoring for regulations after the Trump administration recently finalized the rollback of Obama-era rules meant to reduce methane leaks from oil and gas. Major oil companies, including Shell, BP, and ExxonMobil, have spoken out against the existing rule’s repeal or even voiced support for new emissions rules. (10/2)

Tesla cut the starting price of its Chinese-made Model 3 sedans by about 8 percent to 249,900 yuan ($36,805), once Chinese subsidies for electric vehicles are taken into account. (10/1)

EV hit: General Motors Co. has scored a surprise hit in China with its local partners: a petite electric vehicle that sells for less than $5,000. The Hongguang MINI EV is currently the hottest in China. It can travel as 170 kilometers (106 miles) on a single charge. (9/28)

According to the US EIA, coal deliveries to US power plants rose to a six-month high 37.43 million st in July, up 14 percent from the previous month but 23.8 percent lower than the year-ago month. July shipments were the lowest in over eight years for the corresponding month and were also down 34.6 percent from the five-year average. (10/1)

Weekly US coal production was down 5.3 percent from the previous week, EIA data showed. Through the year so far, 39 weeks, production is about 397 million st, down 23.3 percent year on year. (10/2)

Fusion breakthrough after…..60+ years? A NASA research project may offer a pathway to making nuclear fusion commercial. The space agency has been releasing results from testing “lattice confinement,” which could transform production scale and bring costs way down for much-anticipated nuclear fusion energy. (9/29)

UK wind: National Grid Plc outlined a plan for an offshore grid that will link new wind parks and interconnectors, saving consumers 6 billion pounds ($7.7 billion) by 2050. Pairing multi-purpose interconnectors with wind capacity could bring a 50 percent reduction in how much grid infrastructure needs to be built out to 2050. (10/1)

Solar power could be Europe’s most significant energy source in terms of installed capacity by 2025 if the European Union stays on track for its net-zero targets, the head of the International Energy Agency said on Tuesday. (9/30)

Energy group Shell has revealed plans to back hydrogen fuel cells on the road to shipping’s 2050 decarbonization goals, tagging LNG bunkers as the bridging fuel between that and conventional oil-based bunker fuels. The International Maritime Organization has set a plan to cut greenhouse gas emissions by at least 50 percent by 2050. (10/3)

AlCan railway: US President Donald Trump is set to approve a 2,570-km, $22-billion freight railway project that will run between Fort McMurray, Alberta, and Fairbanks, Alaska, to transport a variety of commodities such as oil, ore, and potash, as well as container goods (9/29)

E-plane: Rolls-Royce has completed testing of the technology that will power the world’s fastest all-electric plane. All the technology has been tested on a full-scale replica of the plane’s core—called an ‘ionBird’—including a 500hp electric powertrain powerful enough to set world speed records and a battery with enough energy to supply 250 homes. (10/1)

The global aviation industry can slash its CO2 emissions in half by 2050 and reach net-zero emissions about a decade later, aviation industry group the Air Transport Action Group said Sept. 29. The plan will rely on a significant shift away from fossil fuels, introducing radical new technology and continued improvements in operations by the sector. (10/1)

Greenwashing? Exxon Mobil touts its investments in carbon capture technology—a method for reducing greenhouse gas emissions—as evidence addressing climate change. But at its Wyoming project, the carbon capture simply strips unwanted CO2 gas from produced natural gas and sells it to other producers who reinject it to enhance oil recovery. (9/30)