Editors: Tom Whipple, Steve Andrews

Quotes of the Week

“The world may be sleepwalking into a supply crunch, albeit beyond 2021. A recovery in oil demand back to over 100 million b/d by late 2022 increases risk of a material supply gap later this decade, triggering an upward spike in price.”

Simon Flowers, Chairman and Chief Analyst at Wood Mackenzie.

“The case for a near-term peak in oil demand is certainly more plausible than that of peak oil supply, but the widespread acceptance of it reflects a degree of exuberance not warranted by the data.”

Energy Policy Research Foundation, cited in Oil & Gas Journal, 2/12/21

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil: Prices in London climbed for a fourth straight week as efforts to clear an oil surplus are supporting oil prices until demand comes back to pre-pandemic levels. Brent futures surged the most since early January on Friday, while West Texas Intermediate crude flirted with $60/barrel for the first time in more than a year. Oil demand outlooks improved amid signs of progress on US COVID-19 vaccination distribution and Washington’s coronavirus stimulus package.

Oil storage tanks across the US are emptying as the rally in oil prices undermines the need to buy and stockpile crude. Gulf Coast terminal operators are offering to lease tanks at less than half the rate they were getting at the height of the storage boom last year. The tanks’ rapid draining underscores the remarkable turnaround in oil prices less than a year after West Texas Intermediate futures settled below zero for the first time.

US oil demand is starting to emerge from the pandemic’s grip, with Asia serving as the lone bright spot in oil demand. American refiners are processing the most oil since the economy ground to a halt in March in anticipation of a vaccine-driven boost in gasoline demand this summer. The uptick means that the refiners are competing for domestic barrels sent to more robust markets in Asia for months. Prices for cargoes of grades like West Texas Intermediate crude have picked up by at least 50 cents a barrel from earlier this month.

As domestic oil demand recovers, it could meet with supply shortages. Economic-driven output declines took about 2 million b/d of US crude off the market from the peak of 13.1 million after dozens of drillers slashed budgets and filed for bankruptcy. The US government sees production recovering to only 11.5 million barrels a day in 2022.

Major energy institutions are adopting a cautionary tone over oil demand in 2021, with the IEA and OPEC on Feb. 11th joining the US’s EIA in trimming their recovery estimates. The IEA’s monthly report still points to a tightening oil market this year. The “fragile rebalancing” will be aided by moderate demand growth along with careful OPEC+ market management and flatlining US output. IEA predicts global oil demand will recover by 5.4 million b/d this year.

The US EIA revised its crude price forecast higher in its monthly outlook amid tightened first quarter supply outlooks. The EIA now expects Brent crude prices to average around $53.20 per barrel in 2021 and $55.19 in 2022. The upward revision is due to higher prices in January which results from Saudi Arabia announcing Jan. 5th that it would unilaterally cut production by 1 million b/d in February and March.

OPEC: The cartel raised its estimate of 2021 global oil demand from last month, saying growth, especially for industrial fuels, in the second half will be led by positive economic developments supported by “massive stimulus programs.” OPEC says demand is expected to average 96.1 million b/d this year, up from the 95.91 million b/d forecasts last month.

OPEC+ will meet again on Mar. 4th. The group will likely agree to keep the same level of oil production through April. Saudi Arabia will continue making its extra voluntary cuts of a million b/day. While the oil market looks fragile in the first quarter, global oil stocks are expected to rapidly drawdown in the second half as demand rises. This should set the stage for OPEC+ to ease cuts even if higher prices tempt producers from outside the group to boost output.

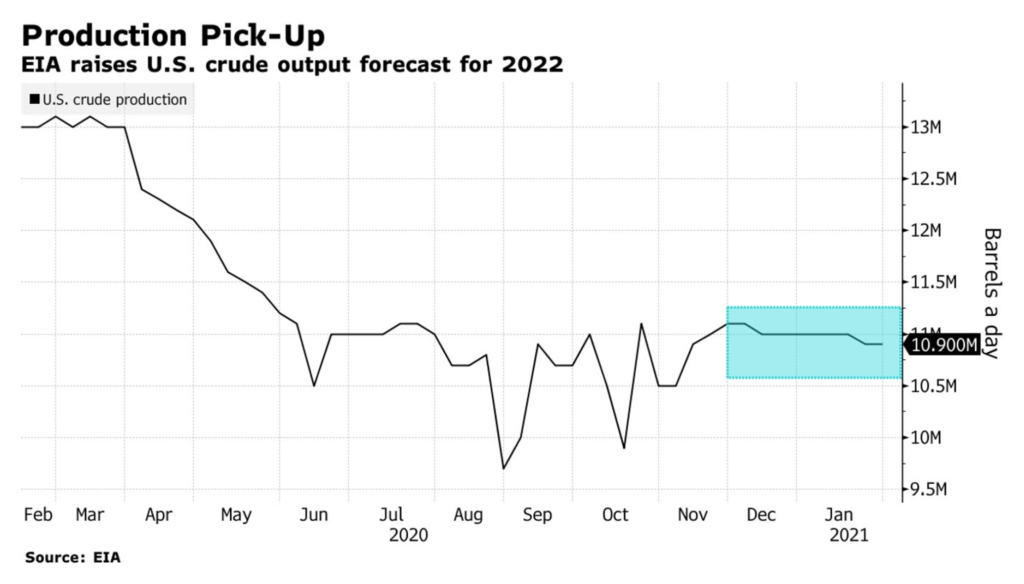

Shale Oil: The US will boost drilling and production later this year as crude prices are likely to stay above $50 a barrel. Supply from new wells will exceed declining flows from wells already in service, raising overall oil production for the second half of this year. The EIa increased its forecast for 2022 US crude output to 11.53 million b/d. Domestic oil production is currently hovering below 11 million b/d, down from a peak of 13 million reached in January of 2020.

Despite EIA’s expectation for rising production in the second half, the agency sees US output declining in the coming months, hitting 10.9 million barrels a day in June, with the number of active drilling rigs below year-ago levels. The agency estimates 2021 production at 11.02 million b/d this year, down from a previous forecast of 11.1 million. The EIA said it does not see domestic petroleum consumption reaching pre-pandemic levels this year or next.

US explorers typically need to drill new wells regularly to keep production up because shale well output declines quickly. The tussle between producers and contractors over the cost of drilling and fracking wells has taken on greater urgency in the past year. Explorers are under increasing pressure to cut spending and return cash to investors, and drilling is becoming more efficient as a result. In the Permian Basin, operators are now drilling the same number of wells with 180 rigs as they were with 300 rigs a year ago, according to industry data provider Lium.

The biggest provider of oil and gas rigs in the US is pushing a new pricing model as speedier drilling cuts into contractors’ revenue. Rigs are typically rented out at a daily rate for a few months, which has meant less money for oilfield service providers as drilling becomes quicker and more efficient. So, Helmerich & Payne Inc. is touting a new pricing model based on overall well performance, and almost a third of its US rigs are now being leased on that basis.

A sharp drilling slowdown in the Permian Basin last year failed to improve the region’s record on methane emissions, according to the Environmental Defense Fund (EDF). One in ten flare sites either malfunctioned or were unlit, releasing methane directly into the air, four aerial surveys of 1,200 sites carried out at different times of the year by the environmental group show. While flaring is a polluting practice, failure to ignite is much worse because unburned methane is a more potent greenhouse gas than the CO2 released when natural gas is burned.

EDF’S report comes as Texas regulators appear to be taking a stricter approach against flaring after growing pressure from environmental groups and investors. A coalition of Texas oil industry groups, the Texas Methane & Flaring Coalition, formed in 2019, is pledging to end routine flaring of natural gas from wells and other facilities by 2030 amid signs that state regulators may crackdown on the controversial practice.

Natural Gas: Prices across much of the Western US surged to record highs on Feb. 12th, trading as arctic weather fueled unusually high demand, pushing supply and deliverability to physical limits. Hubs across the Midcontinent led the surge in prices as weather forecasts predicted the coldest temperatures in more than a decade would hit the region over the upcoming holiday weekend. Hub prices at locations across Kansas, Oklahoma, and Eastern Arkansas were trading at single-day record highs between $200 to $500 per million Btu—30 to 80 times normal prices. Regional hubs, which typically serve only limited local demand, saw fierce competition among shippers, utilities, and end-users looking to meet weekend requirements.

As end-users across the Midcontinent compete for available gas, shippers moved quickly to cut transmissions to neighboring markets. On Feb. 12th, net, inbound shipments of gas climbed to 180 million cf/d – their highest on records dating back to 2005. In January, the Midcontinent region – which typically delivers gas to neighboring markets – saw net outbound transmissions average nearly 3.1 Bcf/d.

Spot locations in the east were unfazed by the arctic blast and kept on trading in the $5-$7 per million Btu range with cash Henry Hub at $6.00. Production in the Southeast was forecast to remain relatively insulated from freezes seen in the Permian, Midcontinent, and Rockies through the upcoming weekend. Gas markets in the Northeast also remained largely insulated from the Feb. 12th price frenzy, shrugging off frigid temperatures. Prices stayed in the single digits across most indexes except Algonquin city-gates and Dracut, where cash markets slipped more than $1 on the day to reach $10.59 per million Btu and $12 per million Btu, respectively.

The EIA increased its forecast for natural gas production in 2021 and 2022 amid expectations of more associated gas production in the Permian Basin and trimmed its gas price forecasts for the current year. In the February Short-Term Energy Outlook, they raised by 3.60 billion cf/d to 98.68 billion cf/d its total gas marketed production estimate for the US in the first quarter, and pushed up its Q2 forecast as well by 2.74 billion cf/d to 97.95 billion cf/d.

Prognosis: Uncertainties continue as to the pandemic’s course. Some see vaccinating until herd immunity is achieved as ending the pandemic in months and expect economic activity to return normal in the second half of the year. Others are worried about the mutations the coronavirus is undergoing and are warning that the pandemic and the need for restrictions on economic activity could last for years. While the change in the US administration has brought new efforts to decarbonize the economy, fossil fuel producers, their friends, and petro-states keep fighting against change, leaving an open question as to how fast fossil fuel consumption might shrink.

While oil remains an essential source of energy consumption, sustainable policies could decrease demand. Predictions as to when “peak oil demand” will arrive differ. While OPEC and other oil-export dependent states are optimistic about the long-term, several leading energy institutions are gloomier. Bernstein Energy, Rystad, and the IEA expect oil demand to peak in 2025-2030, 2028, and 2020-2030, respectively.

If the global economy continues to grow as widely forecasted for the rest of the decade, more oil and fossil fuel will be needed. Some see the availability of oil will be curtailed shortly. The US oil production is already down by 2 million b/d, and after a decade of steady financial losses it may be challenging to grow US shale oil production unless prices climb to demand-destroying levels. Most oil companies suffered extensive losses during 2020 and have slashed capital expenditures so that less oil may be produced in a few years.

France’s supermajor Total is warning that the world could find itself with a shortfall of 10 million b/d between now and 2025 due to continued industry underinvestment, the OPEC+ pact, and cracks in the US shale business model. “There is a risk of a supply crunch in the mid-term,” Helle Kristoffersen, President of Strategy, and Innovation at Total. Kristoffersen said “We have seen in 2020 how OPEC managed to bring back market discipline. We’ve seen the cracks in the US shale model, and we’ve seen continued underinvestment in the oil industry as a whole.”

2. Geopolitical instability

(These are the situations that reduce the world’s energy supplies or have the potential to do so.)

Iran: President Biden said the US won’t make the first move to restart negotiations with Tehran over the 2015 nuclear accord, indicating he will only lift sanctions if Iran stops enriching uranium beyond the limits of the nuclear deal. Iranian leader Ali Khamenei reiterated Iran’s stance that Washington must lift sanctions and come back into compliance with the nuclear accord. “If they want Iran to return to its JCPOA commitments, the US should lift all sanctions in action. “Once this is done, we will resume our JCPOA commitments.”

Iran’s natural gas production has reached a record high of 1.04 billion cm/d even as US sanctions caused major international exploration companies to scale back their activities in the Islamic Republic. Last April, Iran officially began the long-delayed development of phase II of the giant South Pars gas field. Output in early 2020 was 670 million cm/d. The original development contract signed in 2017 by France’s Total and China’s CNPC was taken over by leading Iranian contractor Petropars after US sanctions were tightened under former President Donald Trump.

With an official 58,469 deaths from coronavirus, Iran has the highest death toll of any country in the Middle East. Many in the Islamic Republic are desperate for vaccines. But despite the televised vaccinations of high-profile people, there is skepticism about Tehran’s strategy, which has been complicated by geopolitics. Iran’s Ayatollah Ali Khamenei has refused vaccines from the US or UK, voicing suspicions about western drugs being tested on Iranian citizens.

The ban on western-produced inoculations prompted a backlash from doctors on social media, as did the reliance on vaccines from Moscow. Russia’s Sputnik V vaccine has been shown to have 91.6 percent efficacy against coronavirus, a Lancet peer review has confirmed. But about 100 members of Iran’s Medical Council said last week that choosing the Russian vaccine was “unjustifiable and risky” and called on the government to buy the world’s “best vaccines.”

Tehran is already immunizing medical staff with the Russian vaccine and says it plans to source about a third of its needs from Russia, China, and India and from the World Health Organization’s (WHO) program for poorer countries, which does use western vaccines. The remaining two-thirds will come from Iranian producers.

Iraq is committed to the OPEC+ output cuts and will only boost its future crude production if there is demand from oil markets, a deputy oil minister told Iraqi News Agency. “The increase in oil prices results from the commitment of producing countries to the agreement.”

Oil Minister Ismail said Iraq needs crude oil to trade at $80 a barrel to be able to plug its budget holes. He said, “Iraq will export in 2021 about 1.1 billion barrels of crude oil. The state budget needs $96 billion. The price of $80 a barrel is the right price to make Iraq pay the budget dues.” Yet there is no chance of oil rising that high this year, Abdul Jabbar Ismail also said. Last December, the minister said Baghdad had budgeted for an average oil price of $42 a barrel for 2021, compared with $56 for 2019. He expects Brent to hit $60 a barrel this quarter, rising to $62-63 by the third quarter if Covid-19 vaccines become widely available.

Libya: Tripoli managed to restore its oil production to 1.25 million b/d, the level it was pumping before the eight-month-long oil port blockade in January 2020. Yet Libya has struggled to keep that level over the past month due to new strikes from the Petroleum Facilities Guard over unpaid salaries and the lack of funds to restore and maintain Libya’s oil infrastructure. There has been a halt in crude exports from the 230,000 b/d Marsa el-Hariga terminal, shipping and industry sources said Feb. 9. State-owned National Oil Corporation’s subsidiary, the Arabian Gulf Oil Company, which operates the fields that feed into export-grade Sarir/Mesla, have shut in almost 120,000 b/d of production in the last week, sources added. Shipping data showed that no Libyan crude was exported from the terminal since Jan. 21, nearly three weeks ago.

Venezuela: A partial easing of US sanctions on humanitarian grounds would increase cargoes into the Aframax and Suezmax markets, reviving the traditional local and long-haul Caribbean-loading routes. Uncertainty on the Biden administration’s approach to sanctioned oil-producing countries leaves the Americas dirty tanker market awaiting signals reversing previous policies. The sanctions on Venezuela, issued in six Executive Orders, effectively blocked all commercial transactions and property of Venezuela’s government. This suspended roughly 500,000 b/d of Venezuelan crude exports to US Gulf Coast refineries and shut down US exports of diluents to lighten Venezuela’s extra-heavy crude oil production in the Orinoco Belt.

Platts Analytics estimates that lifting sanctions on Venezuela could potentially release up to 500,000 b/d into the market, equivalent to 1.5 Aframaxes per day. Additional cargoes in the Americas market would be a welcome sign to shipowners, who continue to see record-low freight rates since June 2020. Yet a skyrocketing rebound in Venezuelan exports is not expected since Venezuela’s crude production infrastructure has deteriorated. Venezuela’s average crude production in 2020 was 1.84 million b/d lower than the average in 2015. Considering bipartisan opposition to Maduro’s regime, however, a full lifting of sanctions is unlikely. Platts Analytics forecasts only an additional 200,000 b/d increase out of Venezuela by December 2021 following an easing of sanctions.

3. Climate change

According to a World Meteorological Organization, the past six years have been the warmest on record since 1880, with 2016, 2019, and 2020 being the top three. The year 2020 was 1.2°C above pre-industrial era (1880) temperatures. The Organization says there is a 20% probability that temperatures will temporarily exceed 1.5°C as early as 2024. According to the Paris Agreement, Member States committed to limit global warming to well below 2°C, preferably to 1.5°C, compared to pre-industrial levels.

António Guterres, the United Nations Secretary-General, said 2021 was a critical year for climate, calling for multilateral action. He urged Member States to submit Nationally Determined Contributions to cut global emissions by 45 percent by 2030, compared with 2010 levels. Developed countries must fulfill their pledge to mobilize $100 billion annually for climate action in developing countries.

Negotiations at this year’s all-important climate change meeting, known as COP26, are likely to be just as fraught as in past years —with organizers facing the added reality that they may have to hold all or some of the sessions online if the coronavirus pandemic isn’t contained ahead of the November event in Glasgow, Scotland. “I hope it doesn’t have to be virtual,” said Anne-Marie Trevelyan, the U.K. minister in charge of climate adaptation issues at COP26. “The power of having people in a room together is unassailable when you’re trying to negotiate from lots of different positions.”

The Intergovernmental Panel on Climate Change says that to have a shot at achieving the Paris Agreement’s goal of limiting warming to 1.5° C above pre-industrial levels, every nation must cut its carbon-dioxide emissions in half by 2030. Eight of the ten largest economies have pledged to reach net-zero emissions by mid-century—nine once President Biden formalizes his campaign promise to do so. Twenty-nine countries, plus the European Union, have net-zero pledges for either CO₂ or all greenhouse gases, accounting for 14.5% of global emissions.

The Biden administration indicated Friday it would not try to resurrect the Clean Power Plan, the Obama-era policy that set climate pollution targets for every state’s electricity sector. Instead, the EPA said in a federal judicial filing that the Biden administration is seeking a court’s blessing to propose a new rule aimed at limiting greenhouse gas pollution from the nation’s power plants, which represent the second-largest source of emissions.

“As a practical matter, the reinstatement of the [Clean Power Plan] would not make sense,” Joseph Goffman, the acting assistant administrator for the EPA’s Office of Air and Radiation, wrote in an accompanying memo to the agency’s regional offices. He noted that the deadline for states to submit their plans had passed and that “ongoing changes in electricity generation” mean the Obama-era regulation goals had already been met.

The EPA did not detail what type of oversight it might pursue instead of the Clean Power Plan and declined to comment further Friday. But the Biden administration has made no secret of his intention to aggressively curb greenhouse gas emissions from the power sector.

New data released on Friday show that while emissions from the power sector continue to fall, declining 8.3% between 2018 and 2019, it remains the nation’s second-largest source of greenhouse gas pollution. The most significant source, transportation, has continued to climb. According to the draft report, its emissions rose by 1% between 2018 and 2019, while the carbon output of the country’s agricultural, industrial and residential sectors also increased.

Overall, US greenhouse gas emissions dipped just 1.7% between 2018 and 2019, according to the draft report. While carbon dioxide and nitrous oxide fell slightly, two other potent greenhouse gases rose — including methane, released by animals and oil and gas operations.

4. The global economy and the coronavirus

Vaccinations hold out the promise of curbing Covid-19. Still, governments and businesses are increasingly accepting what epidemiologists have long warned: The pathogen will circulate for years, or even decades, leaving society to coexist with Covid-19 much as it does with other endemic diseases like flu, measles, and HIV. The ease with which the coronavirus spreads, the emerging new strains, and poor access to vaccines in large parts of the world mean Covid-19 could shift from a pandemic disease to an endemic one. Lasting modifications to personal and societal behavior could occur, epidemiologists say.

Poorer countries worldwide are waiting to see if the multilateral Covax program will deliver the coronavirus vaccines they need to stem the pandemic. The scheme was set up in June by Gavi, a vaccine alliance to increase access to immunization in developing countries; the Coalition for Epidemic Preparedness Innovations; and the WHO. It aims to ensure the equitable global distribution of vaccines, initially by providing 2 billion doses to participating countries in 2021.

At least two-thirds of Covax’s doses will go for free to 92 lower-income economies, and Covax says it is on course to hit the target. But, more than two months after western countries started vaccinating their populations, Covax has yet to deliver its first doses, leaving many poorer countries without any vaccines with which to start injections.

Growing global momentum for global decarbonization could leave countries that largely depend on oil and gas revenues facing a $9 trillion drop in expected income over the next 20 years. Most vulnerable are some of the world’s poorest countries, including several OPEC members. Carbon Trackers’ report calls on petrostates to urgently restructure their economies and reexamine their planned investments in oil and gas projects that could become stranded.

United States: The more contagious variant of the coronavirus first found in Britain is spreading rapidly in the US, doubling roughly every ten days. After analyzing half a million coronavirus tests and hundreds of genomes, a team of researchers predicted that in a month, this variant could become predominant in the US, potentially bringing a surge of new cases and increased risk of death. The latest research offers the first nationwide look at the history of the variant, known as B.1.1.7, since it arrived in the US in late 2020.

Economists are ratcheting up their projections for US economic growth this year as Congress moves closer to another sizeable financial support package. However, America’s employers barely added jobs last month, underscoring the pandemic’s ongoing grip on the economy. The increase of just 49,000 positions in January made scarcely any dent in the nearly 10 million jobs that remain lost since the virus intensified almost a year ago. The tepid increase followed a decline of 227,000 jobs in December, the first loss since April.

President Biden promised US senators from both major parties to modernize the aging US infrastructure after his predecessor Donald Trump failed to win approval for a significant funding effort. Biden plans to ask Congress this month to invest heavily in infrastructure amid studies showing close to half of US roads are in poor or mediocre condition. More than a third of US bridges need repair, replacement, or significant rehabilitation.

Treasury Secretary Janet Yellen said Sunday the country was still in a “deep hole” with millions of lost jobs, but that President Biden’s $1.9 trillion relief plan could generate enough growth to restore full employment by next year. Republican senators argued that Biden’s proposal was too expensive. They cited criticism from Larry Summers, a Treasury secretary under President Bill Clinton, that passage of the measure could run the risk of triggering runaway inflation.

China: Beijing reported no new locally transmitted mainland COVID-19 case for the first time in nearly two months, adding to signs that it has managed to stamp out the latest wave of the disease. This marked the first time China has had zero local infections since Dec. 16th, suggesting that authorities’ aggressive steps managed to stop the disease from spreading further from major clusters in northeastern provices and the area surrounding Beijing.

China’s producer prices rose for the first time in a year in January, while core consumer prices posted the first decline in more than a decade, highlighting the economy’s unbalanced recovery. Rising commodity costs drove up producer price inflation by 0.3% last month, matching forecasts, the first gain in the index since January 2020. The consumer price index fell 0.3% last month from a year earlier, with the core measure, which strips out volatile food and energy costs, declining by the same magnitude. The two inflation measures’ diverging paths reflect China’s uneven economic recovery from the coronavirus pandemic, with industrial production outpacing consumer spending.

China’s January crude oil imports averaged 11.12 million b/d, up by more than 18%, or 1.74 million b/d, from the December average. Refinery intakes also remain strong, averaging more than 14 million b/d for eight consecutive months. Thanks to its economy’s fast recovery, China has been instrumental in the oil price rebound as the world’s biggest oil importer. Independent refiners remained significant importers as they added new capacity.

President Biden said that he would not handle relations between the US and China “the way Trump did.” He offered Chinese President Xi some praise but warned that things would be different under the Biden administration. “He’s very bright. He’s very tough. He doesn’t have — and I don’t mean it as a criticism, just the reality — he doesn’t have a democratic, small ‘d’, bone in his body,” Biden said.

European Union: Industrial production in Germany stagnated in December after seven consecutive months of gains. Factory orders dropping nearly 1.9% in December compared with November, nearly double the drop economists expected. The numbers reinforce the impression that the economy could contract again in the current quarter after eking out minimal growth of 0.1% in last quarter. Germany embarked on a limited shutdown on Nov. 2nd, closing restaurants, bars, sports, and leisure facilities. It then shut schools and non-essential shops on Dec. 16th after those measures failed to bring coronavirus infections down. The toughened lockdown remains in place.

French economic activity is running 5% below pre-crisis levels as the government resists imposing a full Covid-19 lockdown beyond the current curfew and closures in some sectors, the Bank of France said last week. After dipping to 7% below normal during November’s lockdown, the economy improved somewhat in December and is expected to remain steady through February, according to the central bank’s monthly survey of 8,500 companies.

The British economy suffered its most significant decline in more than 300 years in 2020 as the coronavirus pandemic closed shops and restaurants, devastated the travel industry, and curtailed manufacturing. The economy shrank 9.9% last year, more than twice the figure for 2009 during the global financial crisis. The drop was the largest since 1709 when a cold spell known as the Great Frost devastated what was then a mostly agricultural economy. The data comes as Britain’s economy remains shackled by restrictions designed to combat COVID-19. During the fourth quarter, a rebound in growth has been stifled by England’s third lockdown, which has closed schools, restaurants, and non-essential shops since mid-December.

Russia: Foreign Minister Sergei Lavrov said Moscow is ready to sever ties with the EU if the bloc hits it with painful economic sanctions, according to an interview posted on the ministry’s website. Relations between Russia and the West have come under renewed pressure over Kremlin critic Alexei Navalny’s arrest and jailing, which has sparked talk of possible new sanctions. European diplomats told Reuters that the EU was likely to impose travel bans and asset freezes on Russian President Vladimir Putin’s allies, possibly as soon as this month.

Rosneft reported a 79% drop in 2020 net profits to $2.2 billion. The company said its free cash flow had remained positive for the ninth year in a row in 2020 despite the challenging demand situation on global oil markets. It also boasted a fourth quarter decline in production costs to $2.60 per barrel of oil equivalent.

Saudi Arabia: Aramco is preparing a financing package of up to $10 billion that it could offer to buyers of its pipeline business unit as the oil giant seeks to extract value from its assets in an era of lower oil prices. The company is in talks with banks to provide “stable financing,” a financing package provided by the seller that buyers can use to back their purchase.

India: Energy demands will increase more than those of any other country over the next two decades, underlining the country’s importance to global efforts to combat climate change, according to IEA. “The choices made by the Indian government, by the Indian people, will affect the entire world,” Fatih Birol, the IEA’s executive director, told the Financial Times. India’s energy use has doubled since 2000, with most of that demand met by coal and oil. Energy demand is set to grow about 35% until 2030, down from 50% before the coronavirus pandemic. Birol said policymakers needed to ensure the next wave of growth is met with renewable energy sources such as solar. Prime Minister Narendra Modi has set ambitious targets for renewable energy growth, including expanding capacity to 450 gigawatts in the next decade.

Tens of thousands of angry farmers have set up camp on New Delhi’s outskirts in protest at the Modi government and its plans for a sweeping overhaul of India’s agricultural markets. “Modi said ‘save the country from external enemies,’ but now the country is being sold from inside,” said Rathi, who grows wheat, rice, and sugar on his 30-acre plot in Uttar Pradesh province.

With the agitation spreading nationwide, tapping a deep wellspring of rural discontent, the government’s challenge is to appease the protesters and defuse the ire that erupted into violence last month. “These [farmers] are dissenters who have numbers, resources, and organizational mobility, and are bound by a powerful sense of solidarity that enables them to endure a lot,” said Gilles Verniers, a political scientist Ashoka University. “Every farmer community everywhere is discussing these farm laws. It is not just a local or regional matter.”

5. Renewables and new technologies

New hydrogen projects are being announced so fast that some are proclaiming 2021 the year of hydrogen. The Hydrogen Council, a coalition of leading energy, transport, and industrial companies, has committed to 40GW of green hydrogen in Europe by 2030. Some say that when the cost of green hydrogen falls to $2 per kilogram, it will become competitive with other fuels. Should an expensive carbon tax be imposed, green hydrogen could quickly become an attractive energy carrier.

Snam, an Italian energy infrastructure firm, has partnered with Baker Hughes to develop a hydrogen-powered turbine that will compress and move hydrogen fuel blends through Snam’s transmission network. The new turbine, which will begin operating in Italy this year, is an essential piece of what will be required to adapt existing pipeline networks to 10% hydrogen or higher. Snam plays down the transportability challenge of hydrogen, insisting that much of the pipeline infrastructure now in place in Europe is fit for it. Snam’s pipeline network, which is the largest in Europe outside of Russia, is a quality of steel that can accommodate 100% hydrogen. If, in 2040, it costs $.08/kg to produce green hydrogen from solar power in North Africa, to move it to Germany by pipeline will cost in the range of $.02/kg. The low pipeline transport cost shows why hydrogen is a great opportunity.

Air Liquide and Siemens Energy signed an MOU to combine their electrolysis technology expertise. They intend to focus their activities on the co-creation of large industrial-scale hydrogen projects in collaboration with customers. This action would lay the ground for mass manufacturing of electrolyzers in Europe, especially in Germany and France.

Despite the coronavirus, the electric vehicle industry has remained strong. S&P Global reports that global EV sales expanded an eye-popping 43% in 2020 to reach 3.24 million units. In sharp contrast, global light vehicle sales are estimated to have tanked 20% last year, with sales in the US declining 14.7% to 14.5 million units, the lowest level since 2012. Yet, despite the robust growth, only 4.2% of new vehicles sold last year worldwide were of the electric type.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

Shell’s oil production peaked in 2019 at around 1.8 million b/d and is expected to recede by 1% to 2% each year, including divestments of oilfields and the natural decline of fields. Shell aims to reduce its net carbon intensity by between 6% and 8% from 2016 by 2023. The target rises to 20% by 2030, 45% by 2035, and 100% by the middle of the century. (2/11)

French supermajor Total reported a net loss of $7.2 billion for 2020, down from a profit of $11.27 billion for 2019, and said it would change its name to reflect its shift to renewable energy. (2/10)

Qatar Petroleum made the final investment decision to build what it says would be the world’s largest liquefied natural gas project in terms of capacity. The tiny Gulf nation and top global LNG exporter aims to raise its annual production by 40 percent by the end of 2025. (2/10)

In the Saudi desert, can a $5 billion project jump-start the demand for green hydrogen, an elusive energy source that could help eliminate carbon emissions from vehicles, power plants, and heavy industry? Plans call for the sprawling facility, which isn’t yet under construction, to produce 650 tons of green hydrogen a day starting in 2025. (2/9)

Australia’s fuel security is becoming an increasingly imminent challenge for the country as another refinery closes in Melbourne. With the country’s already high import bill climbing, experts are beginning to question Australian fuel’s future. (2/12)

In Nigeria, the International Monetary Fund projects that the new Dangote Refinery would provide an elixir for its economy when it is completed and starts production by 2022. The Fund raises the hope that the start of production from the refinery could help Nigeria improve its Current Account balance. (2/12)

In Argentina, the Vaca Muerta region’s output, which holds the fourth-largest shale oil reserves in the world, stalled during the coronavirus pandemic but hit a record high of 124,000 b/day in December as producers revved up wells with an eye on rebounding prices and a new export market. Analyst Daniel Dreizzen said that production in Vaca Muerta would continue to rise, but the macroeconomic conditions are not in place for a flood of investments to come. (2/11)

A recent deal between Argentina and Chile might provide another ray of hope for Argentina’s oil industry. The Argentinian government signed up to refurbish and recommission the Trans-Andean crude pipeline (TAP). The 115kbpd capacity crude conduit running some 425km from the Neuquen Basin to the Chilean city of Concepcion was commissioned in 1992. However, it shut down in 2006 after the Argentine government cut off the Chevron supply contract and decided not to continue with Argentinian crude exports towards Chile. (2/8)

The US oil rig count increased by 7 to 306, while the gas rig count slipped by 2 to 90 rigs, according to Baker Hughes. (2/13)

The Interior Department said Friday that it is postponing onshore and offshore oil lease sales planned for next month in line with President Joe Biden’s Jan. 27 executive order on climate change. The order requires a program review before oil and gas leasing continues. (2/13)

Chesapeake Energy Corp. has announced that it has successfully concluded its restructuring process and emerged from Chapter 11. The company now has a capital reinvestment strategy of 60 to 70 percent of cash flow and a commitment to achieving net-zero greenhouse gas (GHG) direct emissions by 2035. (2/12)

Total US propane supplied reached the highest level in recorded history by gaining 714,000 b/d in the week of Feb. 5. Propane demand reached the highest level since data for propane use was first released in April 2004. Propane stocks fell to the lowest level in two years. (2/11)

New gas plants: Duke Energy is considering building as many as 15 new natural gas units even as it commits eliminating carbon emissions by 2050. To still meet its climate target, the nation’s largest utility says it would retire plants early — after 25 years rather than the usual 40. (2/13)

US coal: The US is estimated to produce 589.2 million tons of coal in 2021, according to the US EIA. 2021 production would be 9.3% higher than the estimated 55-year low 539.1 million st produced in 2020. (2/10)

The share of energy generated from coal has dropped more sharply during the coronavirus pandemic than that of any other power source, according to a new report on Monday that looked at coal demand in some of the world’s largest emitters of greenhouse gases. (2/12)

In the UK, construction of a coal mine that threatened Prime Minister Boris Johnson’s claim to be a leader in the fight against climate change is under review after growing opposition. (2/10)

Amazon has reached a deal for its largest renewable energy project yet—one that will allow it to purchase 380 MW of wind energy. Hollandse Kust Noord is a wind farm in the Netherlands currently under development. (2/9)

Utility-scale batteries in the US had an efficiency of retrieving the stored electricity at 82% in 2019. Pumped-storage facilities—the largest energy storage resource in the US with 21.9 gigawatts (GW) of capacity accounting for 92% of total energy storage capacity as of November 2020—had a round-trip efficiency of 79%. As of Nov. 20, 2020, utility-scale batteries had 1.4 GW of power, with 4 GW of capacity scheduled to be installed this year. (2/13)

The renewable energy sector remains resilient to the ravages of Covid-19, with global energy transition investments in 2020 clocking in at a record $501.3 billion, suitable for 9% Y/Y growth. Solar, wind power, and EVs commanded the lion’s share of investments. One renewable energy source has continued to be conspicuous by its absence: Tidal and wave power. (2/12)

UAE’s solar push: The renewable energy capacity of the UAE, which until recently was nearly non-existent, concluded 2020 at 2.3 gigawatts. The share of renewable energy in the UAE’s power generation mix will increase from 7% in 2020 to 21% in 2030 and 44% by 2050. (2/11)

British Airways is partnering with LanzaJet for sustainable aviation fuel as part of the carrier’s plans to decarbonize by 2050, amid rising pressure on the aviation industry to cut emissions. The US startup will supply ethanol-derived fuel from its Freedom Pines Fuels facility in Georgia, and British Airways will use it to power some flights starting in late 2022. (2/9)

H2 air travel: A turboprop design is gaining momentum within Airbus SE as the solution to its challenge of developing a hydrogen jet by 2035. The propeller plane would carry around 100 passengers for about 1,000 nautical miles. (2/13)

Air taxis: We may soon be taking up to 60-mile rides in sleek, elegant, and perhaps most importantly, emission-free electric planes serving as taxis. A California-based startup called Archer has developed such a vertical takeoff and landing aircraft (EVTOL). (2/12)

United Airlines wants to fly you to the airport. United said Wednesday that it plans to buy up to 200 flying taxis from an electric aircraft startup, as the airline industry seeks new technologies to reduce its carbon footprint. The taxis would efficiently bypass traffic congestion. (2/11)

Tesla China, which is set to design a new compact $25,000 Tesla in Shanghai, will eventually sell the model worldwide, Teslarati reported on Tuesday. (2/10)

Mercedes-Benz will earn as much from electric cars as its luxury combustion engine models by the end of this decade, its chief executive said, becoming the first premium German automaker to provide a precise target for the turning point in profits. (2/8)

Chip short: General Motors Co on Wednesday said the global semiconductor chip shortage could shave up to $2 billion from 2021 profit, but the US automaker’s highly profitable big pickups and SUVs won’t suffer any production cuts. However, GM did acknowledge extending production cuts at three North American plants until at least mid-March. (2/10 and 2/11)

EV future: if the history-making shift from internal combustion to electric power goes as GM, Ford, and others increasingly envision, the assembly of lithium-ion battery packs will supplant jobs that now involve making and maintaining pistons, fuel injectors, and mufflers, electric motors, and heavy-duty wiring harness. (2/12)

The Trump administration deliberately pushed policies not based on environmental science—including not pushing the wearing of masks in the workplace—that caused hundreds of thousands of US deaths, according to a report in the British medical journal The Lancet. (2/11)

Pollution from fossil fuels causes one in five premature deaths globally, suggesting the health impacts of burning coal, oil, and natural gas may be far higher than previously thought, according to a study published on Tuesday. Parts of China, India, Europe, and the northeastern US are among the hardest-hit areas, suffering a disproportionately high share of 8.7 million annual deaths attributed to fossil fuels. (2/9)

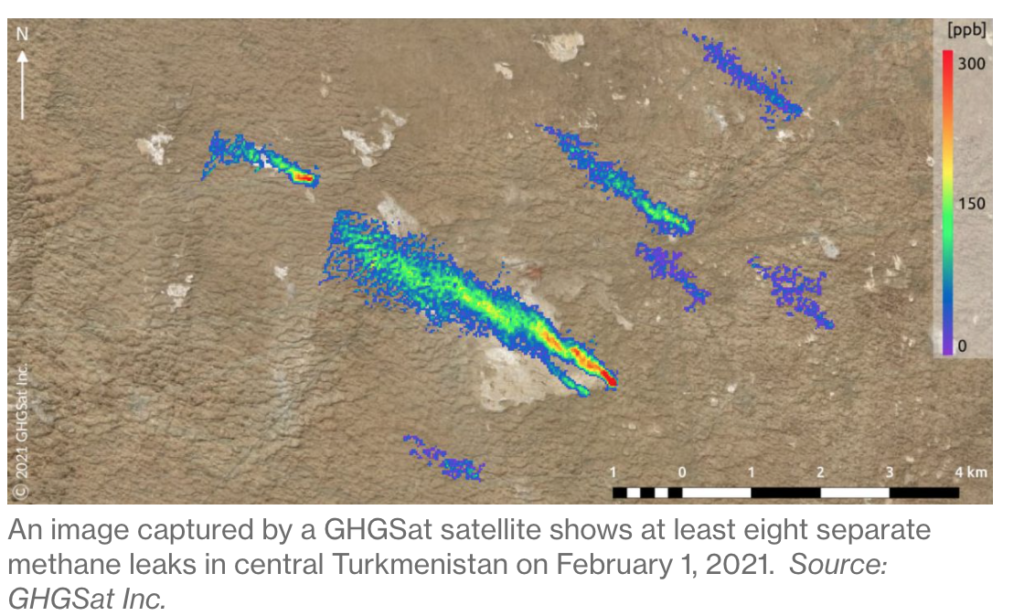

Methane leak detection: New satellite technology can pinpoint emissions from specific wells, pipelines, and mines. GHGSat launched its first satellite in 2016, but it wasn’t until last September that it had one in orbit capable of picking out individual wells. In the fourth quarter of 2020 alone, it detected hundreds of leaks. (2/13)

In Turkmenistan, methane leaks from at least eight natural gas pipelines and unlit flares earlier this month released as much as 10,000 kilograms per hour of the supercharged greenhouse gas. That amount of methane would have the planet-warming impact of driving 250,000 internal-combustion cars running for a similar amount of time. (2/13)

In India, part of a glacier that had dammed up water broke off in a mountain valley resulting in a torrent of water, ice, and rock that surged down the valley. As of last Monday, 12 bodies have been recovered, and 170 were still missing. The event is linked to the widespread melting of glaciers that is being blamed on climate change. (2/8)

Electric bills: Since the onset of the pandemic, millions of Americans have been struggling with paying rent and utility bills, putting a strain on power utilities’ revenues and raising the question about who and when will foot the bill for the billions of US dollars in energy bills arrearages. (2/8)