Editors: Tom Whipple, Steve Andrews

Quote of the Week

“The downturn brought by the Covid-19 pandemic and the accelerating energy transition has created a new reality for the world’s oil and gas industry, whose production will peak lower and earlier [2028] than expected before the 2020 market crisis. Lower emission targets and demand for cleaner energy have significantly impacted the long-term production outlook for the majors.”

Rystad Energy analysis

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil: The severe winter storm that swept through the United States last week likely shut in between 2 million and 4 million b/d of US crude oil production, IHS Markit said in an analysis. The freeze, which started in Texas and moved east across much of the US, has also impacted almost 6 million b/d of refining capacity, including 5.2 million b/d along the Gulf Coast and 730,000 b/d in the Midwest. Issues with power outages, frozen pipes, roads, and personnel have resulted in a large volume of US oil and natural gas production being shut in. This storm is turning into a global problem. According to Citi estimates, the total lost US production by early March could reach 16 million barrels. Others, however, say the lost production could be twice as high.

Four of the largest refineries in Texas suffered widespread damage from the freeze and expect to be down for weeks of repairs, raising the potential for prolonged fuel shortages that could spread across the country. The cold snap and power outages affected more than 20 oil refineries in Texas, Louisiana, and Oklahoma.

Prices climbed early last week, with Brent reaching $65 a barrel on Wednesday and closing on Friday at $62.91. As the power came back in Texas, New York futures fell $1.28 on Friday to settle at $59.24, falling less than 1% over the week. There should be only a small and transitory impact on global oil prices from the freeze as the supply and demand implications of lower production vs. less driving somewhat offset each other.

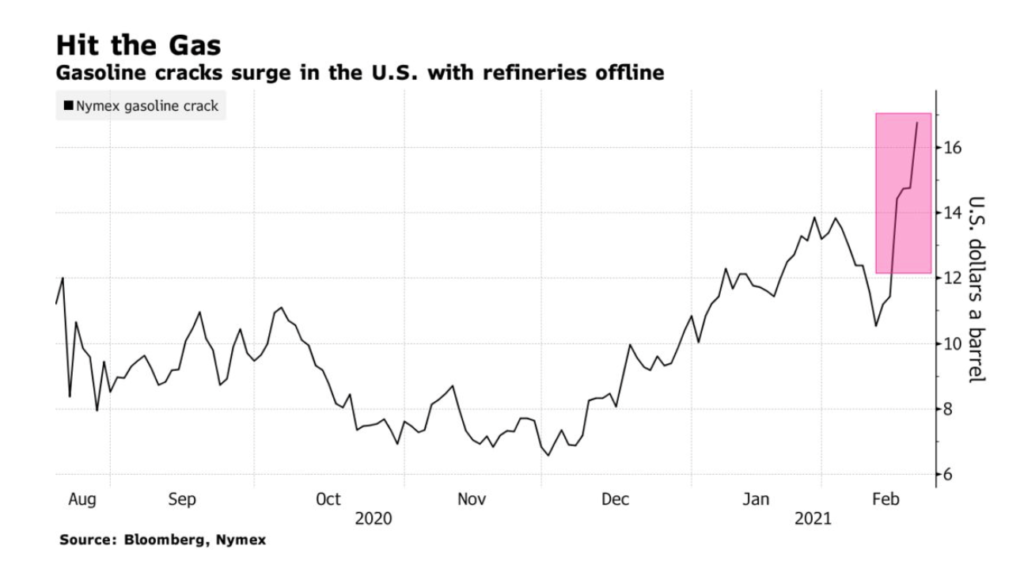

With so many US refineries impacted by the freeze, gasoline prices surged. Retail gasoline tracker says that pump prices could reach $3 a gallon in May when the driving season begins.

The EIA reported Thursday that crude oil inventories in the US dropped 7.3 million barrels in the week to Feb. 12th. This compared with an inventory draw of 5.5 million barrels for the previous week. The EIA also reported a build in gasoline stocks, at 700,000 barrels. Last week and this one will likely see further hefty gasoline inventory draws due to the refinery outages.

OPEC: Saudi Arabia plans to increase its oil output in the coming months, reversing a recent big production cut, a sign of growing confidence over an oil-price recovery. The world’s largest oil exporter surprised oil markets last month when it said it would unilaterally slash 1 million b/d of crude production in February and March to raise prices.

However in light of the recent recovery in prices, the Kingdom plans to announce a reversal of those cuts when a coalition of oil producers meet next month, the advisers said. The output rise won’t kick in until April, given the Saudis already have committed to sticking to cuts through March. The advisers cautioned the plans still could be reversed if circumstances change. The Saudis’ intention hasn’t yet been communicated to OPEC.

The global oil market is balanced, and the current oil price fully reflects this market situation, Russian Deputy Prime Minister Novak said in an interview last week. Novak, who was promoted from energy minister to deputy prime minister last year, is still in charge of coordinating Russia’s oil policy with OPEC and co-chairs the monthly OPEC+ panel meetings.

Shale Oil: Texas and New Mexico produce about 5.8 million b/d in normal circumstances, nearly half of the country’s total crude output. Early estimates said that as much as 1 million b/d of Permian production was forced offline by the freeze. The true extent will not be known for a while. Some estimates say as much as 4 million b/d of US production could have been affected.

Fracking in America’s biggest shale basin slowed markedly as 70% of US completion crews waited for the freeze to thaw out before they can return to work. Texas’s Permian and Eagle Ford plays, the SCOOP/STACK fields of Oklahoma, and the Haynesville Shale in Louisiana are all being affected, with the crews that blast water, sand, and chemicals underground to release oil and gas unable to operate. The four basins utilize almost three-quarters of the nation’s fracking crews. Fracking in the Permian Basin was expected to stay “almost entirely shut down” through the end of last week.

While the lights are back on in most Texas, numerous power plants are still out of service due to damage from the freeze and shortages of natural gas. The big problem petroleum operators face is their reliance on electricity from the grid to run pumps, compressors, and the electronics monitoring and reporting from the drilling pad. Lose power and you lose the flow, and that’s when lines freeze.

Restarting oil and gas wells closed by the extreme cold isn’t going to be quick or easy, even after the ice thaws and power is restored. Oil production nationwide has been cut by at least a third, and in the Permian Basin of Texas, the heart of America’s shale industry, output has plummeted by as much as 65%. But bringing flows back is likely to take much longer than it took for them to slump.

Most wells produce a mixture of oil, gas, and water, and it is the last of these that causes the problems. Although it may leave the well at boiling point, the water immediately comes into contact with steel outdoor pipes. That can cause the water to freeze, choking off the flow from the well and damaging the pipes. If the pipes aren’t carrying wastewater away, you can’t get rid of the water from the well and have to shut it down.

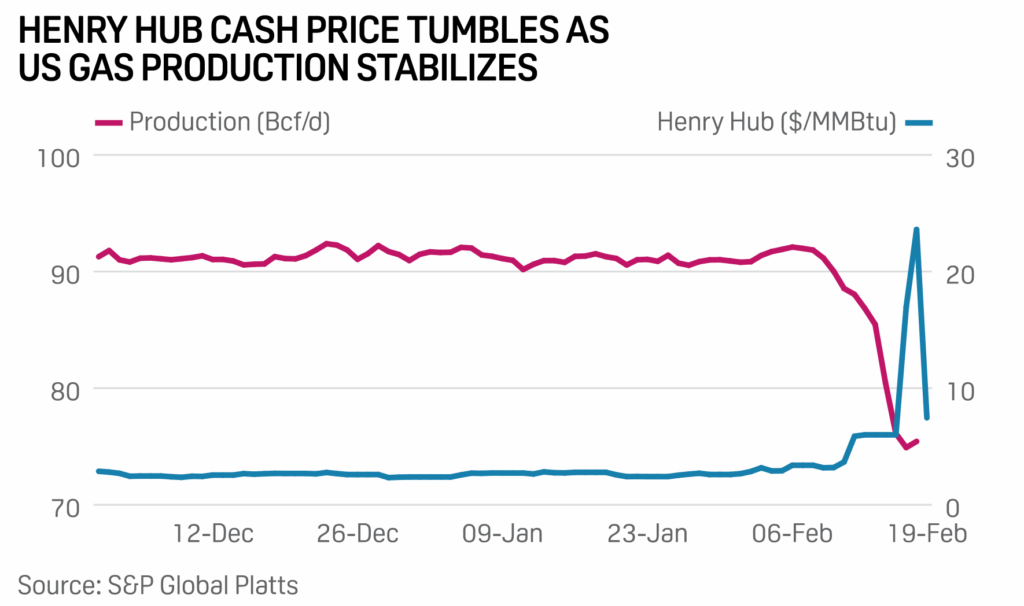

Natural Gas: Production in the Lower 48 states plummeted to a three-year low as frigid weather triggered blackouts and caused liquids to freeze inside pipes, forcing wells and processing plants to shut. Prices across much of the Central and Western US climbed swiftly. Still, they fell sharply by the end of the week, as domestic production stabilized, and heating demand continued to ease amid warming temperatures.

In the Midcontinent, cash markets dipped into the $6’s to low-$7’s per million Btu at the region’s benchmark location, NGPL Midcontinent. At Enable Gas and ONEOK, where cash markets have been the most volatile this week, prices were trading around $56 and $14 per million, respectively. Natural gas prices at one trading hub climbed 24,000% from a week ago.

Supply for next-day delivery at the Oneok Gas Transportation hub in Oklahoma traded at $999 per million Btu for a short time on Tuesday. That compares with $4.19 a week earlier. In East Texas, cash markets remained volatile, with Houston Ship Channel and Katy Hub trading around $44 and $63 per million Btu, respectively – down from levels ranging from $200 to over $350.

Texas Governor Greg Abbot ordered all sourced natural gas in Texas to be made available to local power generators before leaving the state. The mandate was in effect through Feb. 21st. No LNG tankers loaded at any of the six US export terminals for the first time since global demand for the super-chilled fuel crashed last spring. That’s a highly unusual situation for the world’s third-largest shipper and indicates how far the recent freeze has upended LNG trade flows.

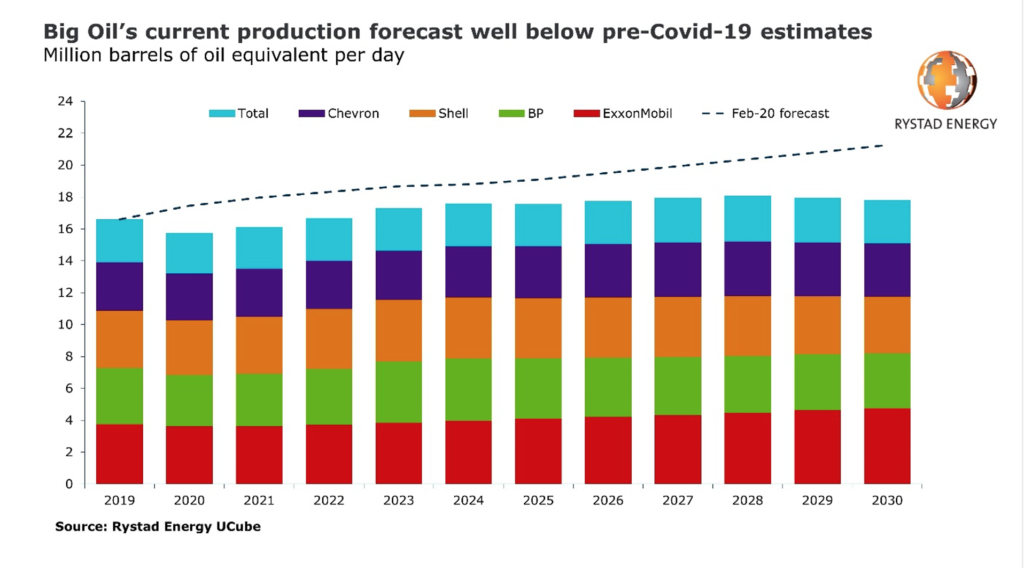

Prognosis: According to a Rystad Energy analysis, the downturn resulting from the Covid-19 pandemic and the transition to renewables due to climate change has created a new reality for the world’s oil and gas industry. The oil industry’s production will peak lower and earlier than expected before the 2020 market crisis. The five integrated supermajors – ExxonMobil, BP, Shell, Chevron, and Total – posted a combined record loss of $76 billion in 2020. Most of this loss, $69 billion, can be attributed to asset impairments and write-offs as the supermajors re-evaluated their strategy to focus on energy transition and become less dependent on petroleum. Their combined oil and gas output dropped by nearly 5%, or 0.9 million barrels of oil equivalent per day, in 2020 from the year before.

Lower emission targets and demand for cleaner energy have significantly impacted the long-term production outlook for the majors. Rystad Energy forecasts that the majors’ net production will be around 17.5 million boepd in 2025 and peak at approximately 18 million in 2028. For context, the forecast in February 2020 – before the shockwaves from Covid-19 – stood at 19 million boepd for 2025 and 20 million in 2028.

Before Covid-19 and the price crash, most companies had assumed an oil price in the range of $70 to $80 per barrel, which allowed them to pursue higher-cost projects. After the price slump and with continued uncertainty around future oil demand, companies have reduced their price assumptions to between $55 and $70 per barrel, making high-cost projects unviable to pursue.

At the end of the year, the total spending cuts stood at $26 billion, or 32% of the five majors’ initially announced guidance. Most Capex cuts are for greenfield development projects as the majors wait for a recovery in prices and demand before moving ahead with new projects. Rystad Energy estimates that the five majors approved $30 billion less in greenfield investment in 2020 than they did the year before – a decline of 90%.

2. Geopolitical instability

(These are the situations that reduce the world’s energy supplies or have the potential to do so.)

Iran: US and Iranian officials could hold nuclear discussions within weeks under a European Union plan to bring the two sides together. The move, potentially a first step toward reviving the 2015 international nuclear agreement, came after Secretary of State Blinken discussed the deepening atomic standoff with Britain, France, and Germany. “The United States would accept an invitation from the European Union …. to discuss a diplomatic way forward on Iran’s nuclear program,” a State Department spokesman said Thursday.

However, Iran’s foreign minister said they would “immediately reverse” actions regarding its nuclear program when US sanctions are lifted, reiterating Tehran’s position on Washington’s offer to revive talks. Tehran has been saying it would tear up much of the international monitoring of its nuclear activities this week if the US doesn’t lift economic sanctions immediately. This posturing is an effort to pressure the Biden administration to drop the sanctions before any talks begin. Iran had already indicated it would restrict United Nations atomic agency inspectors’ access starting later this month if sweeping US sanctions imposed on the country since 2018 by the Trump administration weren’t lifted.

Iraq: Baghdad boosted its crude oil exports by 4.4 percent to 3.44 million b/d in the first two weeks of February, according to data compiled by Bloomberg. The Iraqis pledged to restrain production to compensate for the previous non-compliance with the OPEC+ deal. Crude oil exports are not an exact measure of production, but if Iraq keeps the pace of its exports of 3.44 million b/d, it could bust its self-imposed production ceiling of 3.6 million b/d for February, considering the amount of oil it consumes domestically.

Iraq’s $2 billion oil prepayment deal with China’s state-owned Zhenhua Oil Co. is on hold pending government approvals. Baghdad selected Zhenhua Oil as the winner in a five-year oil supply deal that includes a one-year prepayment of $2 billion. Under the agreement Zhenhua is allowed to resell cargoes. The deal, which is for the supply of 4 million barrels per month, is the first such agreement to be introduced by federal Iraq’s oil marketer. Northern Iraq’s semi-autonomous Kurdistan region often has such deals with its traders.

On Monday, a rocket attack on US-led forces in northern Iraq killed a civilian contractor and injured a US service member in the deadliest such attack in almost a year. The barrage of rockets hit in and near a military airbase occupied by the US-led coalition at Erbil International Airport. The attack, claimed by a little-known group that some Iraqi officials say has links with Iran, raises tension in the Middle East while Washington and Tehran explore a potential return to the Iran nuclear deal.

Venezuela: During his 2020 election campaign, President Biden said he would pursue a different policy regarding Venezuela and is expected to take a more humanitarian and diplomatic approach focusing on targeted sanctions. There is speculation that Biden will show flexibility toward Venezuela, ease some sanctions and potentially even reinstate crude-for-diesel swaps by non-US companies. Venezuela is dependent on diesel for vital public transport and agriculture and fuel for back-up generators used by critical infrastructure during the country’s frequent blackouts. The State Department has said the President is not expected to negotiate directly with the Maduro regime.

3. Climate change

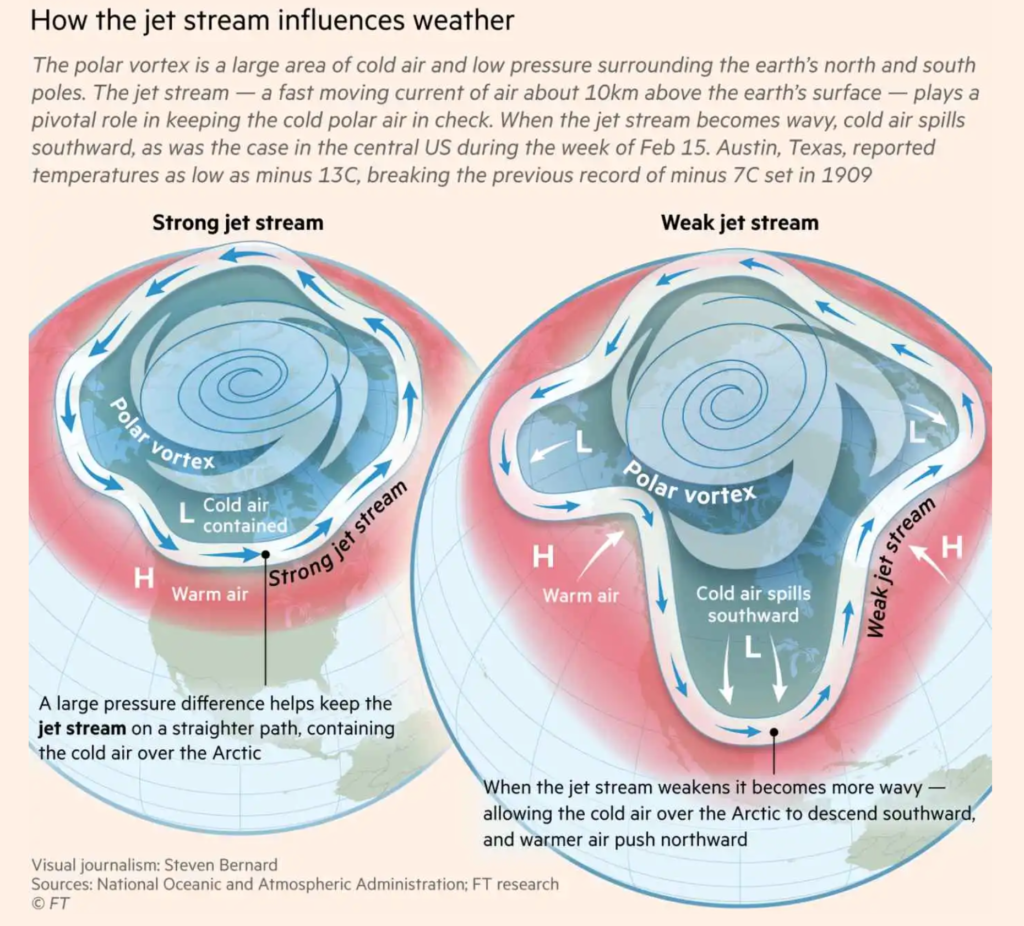

Increasing temperatures around the north pole have weakened the polar jet stream to the point that it is now letting enormous quantities of frigid air flow southward across the globe. In recent months East Asia, Russia, and Europe have suffered from abnormal temperature drops. Last week it was America’s turn. A blast of polar air flowed into the US, where the northern states were prepared, but the southern states were not.

When the deep freeze hit Texas, the demand for heat was so high that many power plants failed, so the state’s electric grid operator had to impose rotating blackouts that left nearly 3 million customers without electricity. On Tuesday, temperatures ranged from 28 to minus 8 degrees Fahrenheit, which damaged water systems, leaving many with little or no water. This situation brought the region, including much of the gas and oil industry, to a halt. There is no indication that stability of the polar jet stream will get any better, so that frequent outbreaks of frigid air may become more frequent in the years ahead.

Nobel laureate Joseph Stiglitz and Lord Nicholas Stern published a paper last week criticizing the US government—and many of their peers in economics—for methods used to estimate the cost of climate change. The warning from two influential economists that policymakers are understating the looming damage from warming temperatures comes just days before President Joe Biden’s administration is expected to release an interim report on what’s known as the “social cost of carbon.” Without a new approach to the social cost of carbon, the authors warn that the US is significantly underestimating the financial impact of carbon emissions and hindering President Biden’s efforts to steer the country toward a net-zero economy by 2050.

Congress established the independent Federal Energy Regulatory Commission in 1977 to regulate the United States’ energy landscape. FERC wields an enormous amount of power, overseeing the nation’s pipelines, natural gas infrastructure, transmission lines, hydroelectric dams, electricity markets, and, by association, the price of renewables and fossil fuels. It’s made up of up to five commissioners — no more than three members of the same party can serve at a time. Historically, the commission has taken climate change and environmental justice only marginally into account as it has approved and regulated energy projects across the US.

In January, President Biden appointed Richard Glick, formerly the sole Democratic vote on the commission, to chair FERC. Some of Glick’s priorities? Environmental justice and climate change mitigation and adaptation. Glick recently announced that FERC would create a senior-level position dedicated to assessing proposed projects’ environmental justice impacts. For the first time, the commission will consider how developments like natural gas pipelines affect surrounding communities to make sure they don’t “unfairly impact historically marginalized communities,” Glick said.

4. The global economy and the coronavirus

Studies are raising concerns that first-generation COVID-19 vaccines don’t work as well against a mutant that first emerged in South Africa as they mitigate other versions of the virus. The good news is that many of the new COVID-19 vaccines are made with new, flexible technology that is easy to upgrade. What’s harder is deciding if the virus has mutated enough that it’s time to modify vaccines. Many scientists say that annual revaccinations against the coronavirus may become a feature of life in the years ahead.

Last week, there was more good news when research showed that some vaccines provide strong, one-dose protection and that the Pfizer vaccine can be stored in regular freezers instead of ultra-cold ones. The findings could boost arguments in favor of delaying the second dose of the two-shot vaccine, as the UK has done. These developments could also have substantial implications on vaccine policy and distribution worldwide, simplifying the logistics of distribution.

Pfizer and BioNTech said they had asked US regulators to allow their vaccine to be stored and transported at temperatures consistent with standard freezing, around minus 20 Celsius, following successful internal stability testing. Similar filings were being prepared in other countries. Should Pfizer’s request be granted by regulators, it would mean its vaccine would vastly expand access in rural regions around the world, as well as pharmacies and physician offices, according to industry experts and officials.

United States: Newly reported coronavirus infections in the US continued their steep drop – down 69% since early January. Some 60 million vaccines have been administered. However, cases of the more contagious variant first identified in Britain are on the increase; they have doubled in the US every ten days, according to the Center for Disease Control and Prevention. These instances are still low but climbing.

Winter weather and power outages had a chilling effect on Texas’s vaccination effort, one large enough to drag down nationwide inoculation trends. Nationally, the seven-day average fell 2.6% on Thursday from a week earlier to 1.58 million daily doses, the worst such decline.

The number of Americans applying for unemployment aid rose to 861,000, evidence that layoffs remain painfully high despite a steady drop in the number of confirmed viral infections. Applications from laid-off workers rose 13,000 from the previous week, which was revised sharply higher. Before the virus erupted in the US last March, weekly applications for unemployment benefits had never topped 700,000, even during the Great Recession of 2008-2009.

China: New evidence is affirming what epidemiologists have long suspected. The coronavirus likely began spreading unnoticed around the Wuhan area in November 2019. Chinese authorities have identified 174 confirmed Covid-19 cases around the city from December 2019, said World Health Organization researchers who visited Wuhan. Chinese authorities declined to give researchers raw data on these cases and potential earlier ones. According to a Dutch virologist on the WHO team, there are indications of infections as far back as September.

China is exploring limiting the export of rare earth minerals that are crucial for the manufacture of American F-35 fighter jets and other sophisticated weaponry. Last month, the Ministry of Industry and Information Technology proposed draft controls on the production and export of 17 rare earth minerals from China, which controls about 80 percent of the global supply. The Trump administration tried to make it harder for Chinese companies to import sensitive US technology, as high-end semiconductors. The Biden administration has signaled that it would also restrict certain exports and work more closely with allies.

European Union: British government scientists are increasingly finding the coronavirus variant first detected in Britain to be linked to a higher risk of death than other versions of the virus. This devastating trend highlights the severe threats and considerable uncertainties of this new phase of the pandemic. The scientists said last month that there was a “realistic possibility” that the variant was not only more contagious than others but also more lethal. They now say in a new document that it is “likely” that the variant is linked to an increased risk of hospitalization and death. The reasons for an elevated death rate are not entirely clear.

Britain’s newly established quarantine hotels received their first guests last week as the government tries to prevent new coronavirus variants from derailing a fast-moving vaccination drive that has delivered more than 15 million shots in ten weeks. Security guards escorted passengers arriving at London’s Heathrow Airport to buses that took them to nearby hotels.

Passenger-car sales in Europe’s five biggest markets tumbled by more than a quarter last month after lockdowns to combat the pandemic shuttered dealerships, and consumers shied away from large purchases. Registrations fell 28% across Germany, the U.K., France, Italy, and Spain in January from the year-earlier period.

Russia: A 34-year-old book could offer clues to resolving one of the most significant diplomatic headaches bedeviling US-German relations. The book is Ally Versus Ally: America, Europe, and the Siberian Pipeline Crisis, written in 1987 by a then-obscure law student. Its author, Antony Blinken, is now US secretary of state. Blinken’s book looks at the row that broke out between the US and Europe in the early 1980s over a new pipeline from the Soviet Union’s Siberian gas fields to Europe. In 1981 the Reagan administration imposed sanctions on the project, leading to one of the worst crises in the Cold War’s transatlantic relations.

Experts in Berlin hope that Blinken’s arrival at the US Department of State could usher in a fresh approach to Nordstream 2 — and potentially a resolution of the stand-off. In his book, Blinken argued that it was more important for Washington to nurture its allies than dictate Moscow’s economic relations. The Biden administration is reviewing US policy toward a pipeline.

Construction on Nordstream 2 resumed in earnest on Feb. 6th, more than a year after it came to a halt in the face of opposition from the Trump administration and acts of Congress authorizing sanctions on companies and individuals involved in the project. The Biden administration hasn’t thus far imposed sanctions required by law, resulting in US lawmakers asking Blinken for a briefing on Nord Stream 2 pipeline

Saudi Arabia: President Biden plans a significant shift in US relations with Riyadh. He intends to conduct diplomacy through Saudi King Salman bin Abdulaziz rather than his powerful son, Crown Prince bin Salman, the White House said on Tuesday. White House spokeswoman Jen Psaki’s announcement was an abrupt reversal in US policy from Biden’s Republican predecessor, whose son-in-law and senior adviser Jared Kushner maintained steady contact with the crown prince. “We’ve made clear from the beginning that we are going to recalibrate our relationship with Saudi Arabia,” Psaki told reporters.

According to data from the Joint Organizations Data Initiative, Saudi Arabia’s crude stockpiles dropped to their lowest on record in December as the country continued to push out more exports. Stocks ended the month at 140 million barrels, down from 143.4 million at the end of November, the lowest since the data was first collected in January 2002. Exports reached 6.49 million b/d, the highest since the record 10.23 million b/d was set in April 2020.

The kingdom may soon sell more shares of its flagship oil company to finance projects to diversify its hydrocarbon-reliant economy. The plan underscores Saudi Arabia’s urgency to raise crude prices in the short term, analysts say, as uncertainty over the future of oil demand continues. Simultaneously, the world is grappling with the coronavirus pandemic that could hamper Aramco’s valuation in a share listing.

India: The IEA issued a new report last week forecasting that India will make up the most significant share of energy demand growth from now until 2040 – ahead of China. According to the IEA report, India’s energy consumption is expected to nearly double as its gross domestic product expands to an estimated $8.6 trillion by 2040 under its current national policy scenario (the equivalent of adding another economy the size of Japan).

According to a new report by UK-based clean energy group Ember, the use of coal in India may have peaked in 2018. That’s sooner than many experts have forecast. According to the report released on Tuesday, the share of India’s power mix’s dirtiest fossil fuel fell for the second year in a row in 2020 due to an economic slowdown in 2019 followed by a pandemic-induced recession. There’s a chance coal power never breaches 2018 levels again if the Indian government meets its renewable energy goals.

5. Renewables and new technologies

There’s both excitement and trepidation around the run of dramatic hydrogen announcements from Europe, Australia, and Chile in recent months. The European Union alone envisages spending $558 billion on green hydrogen by 2050. To shift the whole world in the same direction would cost at least twice as much. A viable green-hydrogen industry could power production of steel, cement, and fertilizers; fuel trucks, trains, ships, and aircraft; and balance wind- and solar-based power grids. Widespread use of hydrogen could eliminate roughly a quarter of the world’s carbon dioxide emissions.

Such a prospect would help decarbonize parts of the economy that wind and solar aren’t well-placed to reach. It would also provide a potent new source of demand for the zero-carbon electricity that powers electrolyzer cells, splitting water into oxygen and green hydrogen. Note that all these hopes for cost-effective hydrogen are predicated on technological breakthroughs that dramatically cut the cost of using electrolysis to break hydrogen free from water.

Renewable energy assets are in a bubble that has led to a string of deals with “crazy” valuations, according to the chief executive of Total, one of the world’s biggest oil and gas companies. The warning from Patrick Pouyanné comes as the industry’s heavyweights are caught between sustaining fossil fuel-based businesses that generate the bulk of both their profits and the cash for dividends while facing louder calls to increase investment in clean energy.

In Neom, a planned megacity of the future now taking shape in northwestern Saudi Arabia, the green hydrogen project investors think they can deliver the chicken and the egg. The initiative—a joint venture of Neom, US chemical company Air Products & Chemicals, and Saudi Arabia’s ACWA Power—will invest $5 billion to build the world’s largest green hydrogen production facility. Another $2 billion will be invested in distribution infrastructure in consumer markets worldwide, primarily to fuel industrial vehicles and public buses.

One of Neom’s main advantages in what could become a global race to develop green hydrogen is that the city’s location along the Red Sea possesses world-class solar and wind power. Solar will power the plant during the day, wind at night.

The U-turn of energy policies under President Biden sets the stage for a flourishing US offshore wind industry, as the federal government looks to speed up environmental reviews to make offshore wind a significant contributor to the new clean energy goals. In the US, offshore wind hasn’t taken off, with just two small offshore wind farms in operation with less than 50 megawatts of combined capacity. To compare, Europe has 113 offshore wind farms in 12 countries installed, with 25 gigawatts of total offshore wind capacity.

Several ammonia-fueled ships will likely hit the oceans well before 2030, with gas carriers likely to emerge, as international shipping gears up for the International Maritime Organization’s greenhouse gas emission targets. In April 2018, the IMO laid out its strategy on greenhouse gas, or GHG, to cut the shipping industry’s total GHG emissions by at least 40% by 2030 50% by 2050. Ammonia is already a global commodity and is available in hundreds of ports. A Suezmax tanker will be the first ammonia-fuel ready vessel in the world.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

Broader than oil: In a speech to his board of directors on Monday, Patrick Pouyanné, the CEO of French oil giant Total, announced that the company planned to change its name to TotalEnergies. He said the new name would anchor the company’s transformation into a “broad energy company”—another in a string of oil company makeovers. (2/16)

In Nigeria, the Dangote Refinery and Petrochemical complex under construction in Lagos’ Lekki Free Trade Zone, at an estimated cost of $15 billion, is expected to be Africa’s biggest oil refinery upon completion in December 2021. (2/16)

Two landmark rulings, in the UK Supreme Court and the Dutch appeals court, are a testament to decades of tireless campaigning by people in the Niger Delta and environmental activists. Both cases signal a shift in the onus of responsibility to the oil multinationals. (2/19)

South African coal shuttering: Komati Power Station’s sole remaining coal-fired generating unit—out of nine initially—is facing closure within two years under plans by state power utility Eskom Holdings SOC Ltd. to shut about a quarter of its coal-fired capacity by 2030. (2/16)

Mexico’s Pemex reported its oil production grew last year, for the first time in fifteen years. However, there’s a big catch—the increase was only a result of how the company now counts barrels; the new approach includes gas condensate. Without condensates, Pemex and its partners produced 1.66 million bpd of crude oil last year, down 1 percent in 2019. With condensates, oil production was 0.23 percent higher last year. (2/20)

In Mexico, over 2.5 million households in seven northern Mexican states were left without power as the winter storm that hit Texas over the weekend lowered the amount of natural gas available for export. (2/16)

The US oil rig count slipped by one to 305 last week while the gas rig count inched up by one to 91, Baker Hughes reported. This week marks the end of a twelve-week streak of increases to the number of oil and gas rigs that saw 87 more drilling rigs put into service. (2/20)

Gulf lease freeze: The Bureau of Ocean Energy Management has rescinded the Gulf of Mexico oil and gas lease planned for March, effectively canceling this auction as part of the Biden Administration’s review of new drilling activities on federal land and in offshore waters. (2/16)

The US officially rejoined the Paris climate change agreement on Friday, at the end of a 30-day notice period, as President Biden puts environmental policy at the center of his agenda and prepares to work with world leaders to cut global greenhouse gas emissions. (2/20)

The social cost of carbon: President Joe Biden has begun reactivating Obama-era approaches for building climate change into federal policy. This action may soon revamp environmental regulation by establishing a much higher dollar value for greenhouse gas emissions in the US. The White House will quickly revisit values for the “social cost of carbon,” a figure used in federal benefit-cost analyses to account for damage caused by fossil fuel, capturing impacts from pollution that aren’t reflected in the market prices of gas, oil, and coal. (2/20)

Ford is vowing to convert its entire passenger vehicle lineup in Europe to electric power by 2030 in just the latest sign of the seismic technological changes sweeping the auto industry. The announcement comes just a month after US rival General Motors said its entire global fleet would mainly be electric by 2035. (2/18)

More EV: Jaguar Land Rover’s luxury Jaguar brand will be entirely electric by 2025, and the carmaker will launch e-models of its entire lineup by 2030, it said on Monday, as it joined a global race to develop zero-emission vehicles. (2/16)

Tesla will set up a car manufacturing unit in India, as the US electric vehicle maker aims to enter one of the most promising car markets in Asia. (2/17)

EV batteries: QuantumScape Corp., an electric-vehicle-battery start-up pioneering solid-state lithium-metal batteries, said it could produce multilayer battery cells, a crucial stumbling block in taking the technology from the lab to the real world. (2/18)

Vestas Wind bought a minority stake in a Swedish start-up that builds turbine towers out of wood. The world’s largest wind turbine manufacturer’s move could help remove hard to recycle and fossil fuel-intensive materials like steel from the production process. (2/19)

A new kind of ship may be coming to the oceans of the world: zero-emission ships. Alternatives to vessels fueled by diesel or liquefied natural gas have only had limited success so far, which means that shipping will continue to rely on fossil fuels for the observable future. But solar and wind are being used to power vessels, and hydrogen is on the agenda, too. (2/16)

Geothermal: BP and Chevron announced plans to invest in geothermal energy through a new start-up. The new technology introduced by Canadian start-up Eavor provides a clean energy source directly from the earth’s heat. BP and Chevron have made a $40 million investment in Calgary-based Eavor, bucking the trend by developing an overlooked energy source. (2/19)

H2: Texas is well-poised to become a global hydrogen hub, given that it already has significant production, demand, and infrastructure. Texas already has more than 900 miles of dedicated hydrogen pipelines, or roughly 56% of the US’s total hydrogen pipeline system and produces approximately 34% of annual US output. The state has 48 hydrogen production facilities and significant storage potential due to numerous underground salt caverns. (2/19)

Hydrogen hype? Heating UK homes with just hydrogen could be mainstream in a few decades as the government expects technology costs to plunge just like they have for wind energy. Prime Minister Boris Johnson has already said he wants hydrogen to heat an entire town by 2030. It’s a risky strategy to put so much faith in a commercially unproven technology. (2/17)

Japan’s transport of liquefied hydrogen from Australia, which will be the first in the world, now looks to be taking place around July-August from a previous target of end-March because of delays caused by the former’s pandemic-led state of emergency restrictions. (2/19)

In South Africa, more than half of its residents are likely to have been infected with Covid-19, the chief executive officer of the country’s biggest health insurer said. (2/17)

Powerful pollution: A toxic-dust cocktail that has engulfed large swathes of India since October isn’t expected to lift until next month, prolonging the exposure of people to emissions that can dramatically reduce their lifespan. (2/17)

HCFC ban coming? In American supermarkets, a network of pipes transports compressed refrigerants that keep perishable goods cold. Most of these chemicals are hydrofluorocarbons — greenhouse gases thousands of times more potent than carbon dioxide — which often escape through cracks or systems that were not correctly installed. Once they leak, they are destined to pollute the atmosphere. The Biden administration now seeks to eliminate these chemicals. (2/16)