Editors: Tom Whipple, Steve Andrews

Quotes of the Week

“Demand for oil falls over the next 30 years. The scale and pace of this decline is driven by the increasing efficiency and electrification of road transportation.”

BP’s Energy Outlook 2020

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Briefs |

1. Energy prices and production

Oil: Prices climbed $4 a barrel last week, closing at about $43 in London and $41 in New York. They were lifted by hurricane Sally in the Gulf of Mexico, which took more than 500,000 b/d offline and left production 30 percent below normal by week’s end. A second storm is already forming in the western Gulf, which threatens to lower output still further.

Oil posted its largest three-day advance since May after Saudi Arabia forcefully renewed calls for OPEC+ members to adhere to their production quotas. During the OPEC+ Joint Ministerial Monitoring Committee meeting, Saudi Arabia’s Prince Abdulaziz bin Salman condemned cartel members who cheated on production quotas. The prince went as far as to warn short sellers not to challenge the kingdom’s resolve. “I want the guys in the trading floors to be as jumpy as possible,” he said. The Saudis hinted they’re prepared for new production cuts. Prices briefly fell as much as 1.6 percent on Friday following an announcement from Libyan military commander Khalifa Haftar that he will allow crude production and exports to resume.

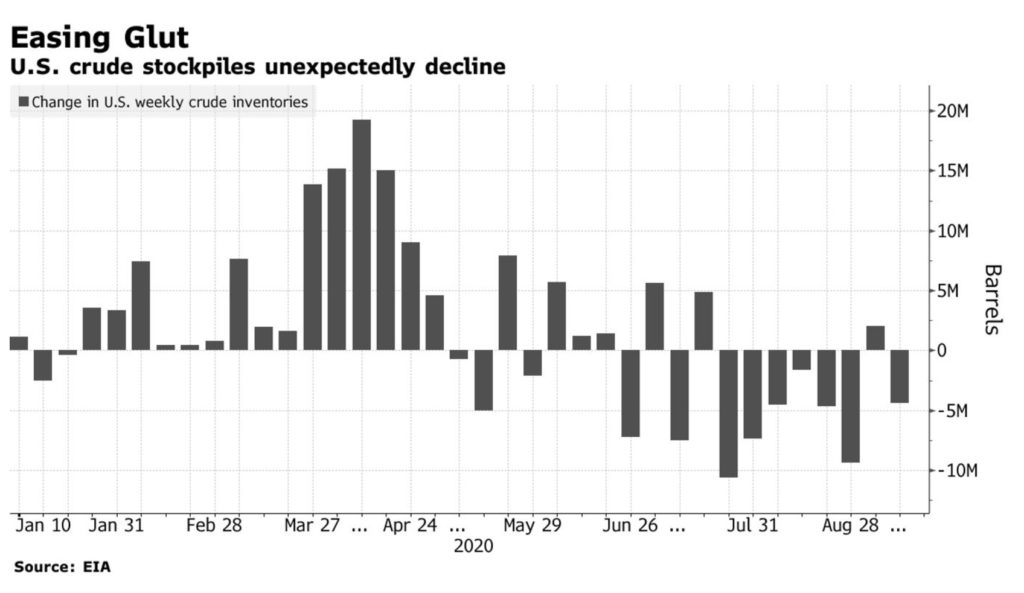

US inventories fell last week to the lowest level since April, according to the weekly stocks report. Meanwhile, the Federal Reserve signaled it would keep interest rates near zero for at least three years, although Chair Powell said he’s unsure if the “robust” recovery will continue.

Oil traders are rushing to book tankers to store a glut of refined petroleum products on the world’s oceans. The interest in floating storage of fuels, one of the most apparent signs of oversupply, will be viewed with concern by many of the world’s oil refiners dealing with the worst market in years. Torm A/S, the world’s fifth-largest owner of oil-products tankers, says inquiries for storage are increasing, while firms analyzing tanker movements say the amount of fuel being held at sea is rising.

A resurgence of coronavirus cases in many parts of the world over the next few months will be the main hurdle to the global demand for gasoline and diesel recovering to pre-pandemic levels by the end of 2021, according to senior executives at oil firms and commodity traders. “A second wave or a continued set of outbreaks that has an impact on demand is … the most likely shock that the oil market needs to be considering in the next 12 to 24 months,” the head of research at oil trader Vitol, said. Many executives expect diesel and gasoline demand to return to pre-COVID-19 levels by the end of next year, but how the pandemic will pan out is the major unknown in forecasts and a significant risk to the downside.

Shale Oil: The EIA forecasts that production is set to decline by 68,000 b/d next month, with every play registering declines in output except the Permian. While production in the Permian is expected to increase by 23,000 b/d to 4,173 million barrels daily, production in the Niobrara shale play alone will offset this with an equal decline. In the Eagle Ford, production is set to decline by 28,000 b/d while production in the Anadarko, Bakken, and Appalachia falls by 20,000 b/d, 19,000 b/d, and 1,000 b/d, respectively. This means total shale oil production in October could average 7.64 million b/d daily next month, down from 7.71 million in September.

North American shale producers far outspent their revenue in the second quarter despite making deep spending cuts. Operators idled rigs, sacked workers, and even temporarily stopped some output as the pandemic hit demand. However, it was all “too little, too late”, analysts at the Institute for Energy Economics and Financial Analysis (IEEFA) said last week. The 34 oil and gas producers in an IEEFA study spent $3.3 billion more on drilling and other projects during the second quarter than they earned by selling oil and gas, the sector’s worst performance in years. “In financial terms, companies in the center of the US fracking boom have been performing terribly for years,” said the report’s lead author. “But last quarter was particularly dismal, characterized by low prices, falling revenues, collapsing investment, and declining investor sentiment.”

Revenue across the group fell 64 percent compared with the previous quarter. In response, companies slashed capital expenditure by an average of 45 percent. EOG Resources, one of shale oil’s most prominent producers, cut its CAPEX by 70 percent but still spent $360 million more than it generated during the second quarter. Continental Resources, led by Trump ally Harold Hamm, spent $334 million more than it earned.

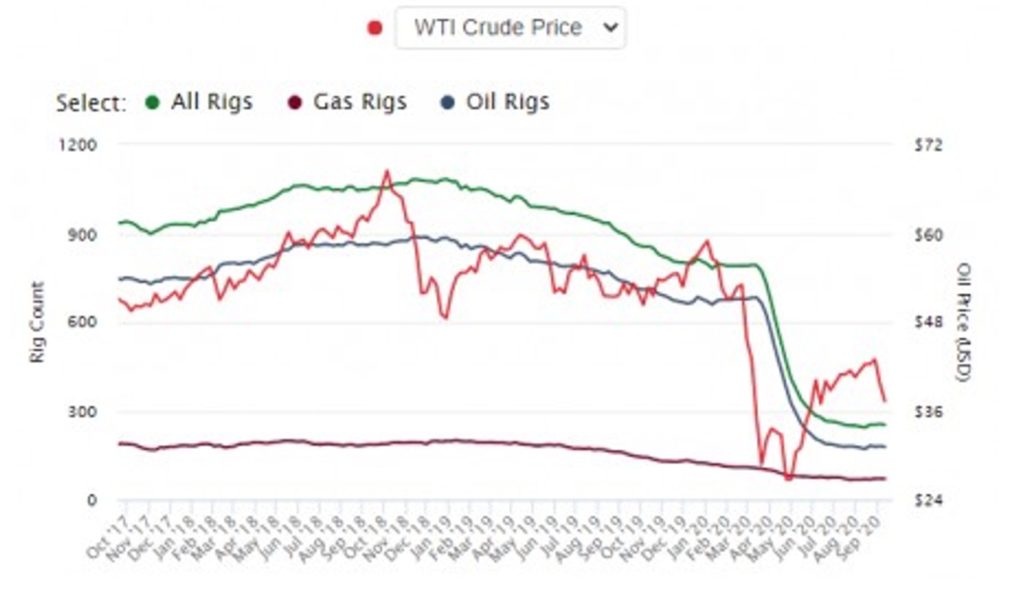

US oil output, which hit a record high near 13 million b/d early this year, was less than 11 million b/d in July. Oil sector job losses have exceeded 100,000, according to consultancy Rystad Energy, as activity has stalled. The number of operating rigs in the US is about 70 percent below its level a year ago.

Another 16 upstream US oil and gas companies – producers and service providers – went under in August, the same number as in July, according to law firm Haynes and Boone. More prominent drillers such as Chaparral and Valaris have joined a pile-up that has seen companies with a combined $85 billion worth of debt file for protection from creditors over the past eight months. “We’re continuing to see a steady stream of oil and gas producer bankruptcies and oilfield service bankruptcies. And we do not anticipate any immediate interruption in that steady stream, especially on the oilfield service side,” said a partner at Haynes and Boone.

If oil prices stay around current levels – with West Texas Intermediate trading in the region of $40 a barrel – the number of operators expected to file for Chapter 11 by the end of 2022 could hit almost 190, according to Rystad Energy.

OPEC: The coalition saw its overall compliance-with-the-production-cuts rate at around 101 percent in August. The group has given the non-compliers, such as Iraq, until the end of September to cut more production on top of their share of the cuts. The panel could extend the period in which non-compliant members should compensate for their overproduction. Saudi energy minister Prince Abdulaziz bin Salman delivered yet another warning to OPEC+ compliance laggards, saying at a Sept. 17th monitoring committee meeting that failing to execute pledged production cuts was undermining the alliance’s efforts to rebalance the oil market.

OPEC revised down by another 400,000 b/d its forecast for global oil demand this year, expecting consumption to shrink by 9.5 million b/d over 2019, cutting estimates for the second month in a row. In its Monthly Oil Market Report, OPEC said that it expects global oil demand to average 90.2 million b/d this year. In last month’s report, OPEC expected the world’s oil demand to drop by 9.1 million b/d in 2020, which was also a larger demand loss than the cartel had previously expected.

The original OPEC+ agreement led by Riyadh and Moscow in 2016 was very much a marriage of convenience, and the commitment from the producer group’s leaders was decidedly one-sided. Saudi Arabia was prepared to overlook Russia’s cheating, as long as it kept up the appearance of commitment to the relationship. But it took the Covid-19 pandemic to convince both partners how much they needed each other. The world’s biggest-ever oil demand slump was too much for OPEC to deal with by itself. Renewing and strengthening its vows in the OPEC+ partnership has put Russia’s commitment on an equal footing with Saudi Arabia’s.

Coal: Headlines this summer for the coal industry have been uniformly doom-and-gloom. While coal has been on the decline for a long time in the US and Europe, its demise has been much slower in Asia, where coal exporters have managed to keep opening up new markets. China and India have continued to depend on coal for a considerable amount of their respective domestic energy mixes.

However, the Asia Times said last week that “Asian thermal coal exporters are fighting an uphill battle even in new markets.” Exporters that have historically relied on China and India for the bulk of their sales are now facing a future in which the two push to develop their coal industries. They thereby become less reliant on imports, while also making plans to turn away from coal and towards cleaner alternative energies.

China and India are not the only major coal importers on track to significantly reduce their reliance on foreign coal. “South Korea has been the third-largest thermal-coal export destination for Australia, Indonesia, and South Africa. However, this month President Moon Jae-in announced that 30 coal-fired power plants would be closed by 2034, and wind and solar capacity tripled by 2025. Meanwhile, Japan is now planning the closure of 100 coal-fired power units by 2030 as it gears up for its push into offshore wind.”

Prognosis: The IEA trimmed its 2020 oil demand forecast on Tuesday, citing caution about the pace of economic recovery from the pandemic. The Agency cut its 2020 outlook by 200,000 b/d to 91.7 million in its second downgrade in as many months. “We expect the recovery in oil demand to decelerate markedly in the second half of 2020, with most of the easy gains already achieved,” the IEA said in its monthly report. “The economic slowdown will take months to reverse completely … besides; there is the potential that a second wave of the virus (already visible in Europe) could cut mobility once again.”

Commodity trading giant Trafigura Group believes the oil market is about to go back into surplus as the demand recovery stagnates. “We expect crude stocks to build into the year-end,” said the co-head of oil trading at Trafigura. “Headline oil prices were a bit higher than they needed to be: $40 a barrel Brent is more sensible, and my gut feeling is that we will drift into the high $30s.” Trafigura has a vantage point over the global oil market as the world’s second-largest independent energy trader, behind only Vitol Group. It was among the first to forecast the magnitude of the demand collapse in March and April. Now, the trading house is betting the oil market is about to enter another bearish phase despite the efforts of the OPEC+ alliance to balance supply and demand.

Vitol Group, the world’s largest independent oil trader, expects global oil inventories to continue drawing down for the rest of the year, unlike its rivals and many analysts who see a growing glut on the market. The world’s stockpiles of oil have diminished by around 300 million barrels since peaking at 1.2 billion barrels early this summer and are expected to decline by another 250 million-300 million barrels between September and December, Vitol’s chief executive told Bloomberg in an interview. Refineries that have bought a lot of cheap oil in the past few months are expected to play a critical role in drawing down global oil inventories. Gasoline demand could falter in the winter, but diesel demand could offset it, while jet fuel consumption still “looks bad,”

Goldman Sachs is bullish on oil, expecting the market to be in a deficit of around 3 million b/d by the fourth quarter. The firm expects Brent Crude prices to recover to $49 a barrel by the end of this year. According to a new report from Goldman analysts, the recent floating storage of oil is more “transient inventory allocation dynamics” instead of a signal of a new glut.

Global oil demand may have already peaked, according to BP’s latest long-term energy outlook, as the pandemic kicks the world economy onto a weaker growth trajectory and accelerates the shift to cleaner fuels. Oil demand will be the biggest casualty of lower energy demand in the coming three decades as weaker economic growth and a faster transition to renewable energy accelerate the demise of oil-based transport fuels, BP said in its Energy Outlook 2020. Global demand for liquid fuels, including oil and biofuels, will almost halve to less than 55 million b/d by 2050.

2. Geopolitical instability

Iran: President Trump plans to issue an executive order allowing him to impose US sanctions on anyone who violates a conventional arms embargo against Iran. Sources said the executive order was expected to be issued soon and would allow the president to punish violators with secondary sanctions, depriving them of access to the US market. US sanctions have deterred all but Iranian tankers from delivering gasoline to Venezuela.

Iran has increased oil production from the oilfields it shares with Iraq from 70,000 b/d to 400,000 b/d during the past seven years, according to Iranian Oil Minister Zangeneh. The oilfields that Iran shares with Iraq include five significant ones. Iran plans to significantly boost production and exports from the West Karoun cluster, estimated to contain at least 67 billion barrels of oil in place.

Tehran has canceled plans to enable members of the public to invest in the country’s oil production via Islamic bonds. President Hassan Rouhani first announced the plans in August as part of efforts to control the money supply and parry the impact of both US sanctions and the coronavirus on Iran’s ailing economy. Iranian media reported at the time the plan would involve the pre-sale of barrels of oil on Iran’s energy exchange, or IRENEX, through Islamic “salaf” bonds, which are similar to futures.

Iran’s supreme leader has blocked any significant retaliation for US actions according to American officials briefed on new intelligence reporting. Tehran also abandoned plans it had to deliver an election season surprise, such as an attack on Persian Gulf shipping or Middle Eastern oil production that might help President Trump’s chances of re-election.

Iraq: Baghdad is exporting more crude so far in September than it shipped last month, a sign that the country is falling further behind in efforts to comply with its OPEC+ production limit. A long-time laggard, Iraq already owes its partners in the producers’ group compensation cuts to make up for pumping too much in past months. With these extra reductions that Iraq promised for August and September, its production goal would be about 3.4 million barrels a day. In the first 15 days of September, Iraqi exports alone reached 3.26 million barrels a day, 8 percent higher than last month’s daily average, according to tanker tracking data compiled by Bloomberg. Adding as much as 650,000 b/d to account for Iraqi refinery use would put OPEC’s second-biggest producer well over its production limit.

The Ministry of Oil and Ministry of Industry and Minerals held a series of meetings over the past week to kick-start the multi-billion-dollar Nebras petrochemical plant development project, originally agreed in principle with Shell in 2012. The legal and contractual terms should be finalized by the end of this year. This sort of announcement, however, has been made before, and no progress has been made. It remains to be seen whether this time a refinery will be built.

Libya: Last week, protesters turned out in the eastern towns to demonstrate against deteriorating living conditions that include lengthy power cuts and a severe banking crisis. The protesters set fire to the eastern-based government’s headquarters in Benghazi, leading to the resignation of the eastern government. Libya’s internationally recognized Prime Minister, Fayez al-Sarraj, announced a decision to step down by the end of October. General Haftar announced he would lift the blockade on oil production after reaching an agreement with the Government of National Accord (GNA) on “fair distribution” of energy revenue. “We are ready to open oil fields, to secure the future of Libya, for one month,” Haftar said in a statement. The GNA’s Deputy Prime Minister Ahmed Maiteeq reached the accord last week at a meeting in Sochi, Russia, with military commander Khalifa Haftar’s son and representatives from eastern Libya. They also agreed to form a special commission to resolve conflicts.

Libya’s National Oil Corp. said it wouldn’t lift force majeure provisions until Russian mercenaries who support Haftar withdraw from oil installations. Despite having Africa’s largest crude reserves, Libya may struggle to ramp up production quickly. Its oil industry is crumbling after more than nine years of neglected maintenance amid a civil war that has killed thousands and destroyed towns across the country. Any additional supplies from Libya would enter the market when OPEC+ is curbing production to bolster oil prices. Libya was exempt from the OPEC+ cuts because of its strife.

Venezuela: An oil tanker discharged Iranian condensate for Venezuela as both countries continue to find ways around the US sanction. The ship, identified as Honey, turned off its satellite signal and took the long route around Africa before unloading about 2 million barrels of South Pars condensate at Venezuela’s state-controlled port of Jose last week.

Caracas is preparing to ramp up its crude oil production using diluents imported from Iran. PDVSA produced just 336,000 b/d of crude last month, down from almost triple that a year earlier, as US sanctions and long-term deterioration stifled the industry. US sanctions also significantly reduced the number of parties willing to buy Venezuelan crude and ship owners ready to provide the transport for this crude. Lack of diluents for the superheavy oil in the Orinoco Belt was one of the main contributing factors to the slump in production, as Venezuela used to import most of its diluents from the U.S.

An uptick in coronavirus cases amid the most severe gasoline shortages exacerbates the crisis. The least pessimistic scenario accepts that drivers will have to spend three or more days in long queues. Meanwhile, cases of coronavirus are on the rise. Nicolás Maduro’s regime admits an average of 1,000 new infections per day.

Turkey-Greece: After weeks of tensions in the eastern Mediterranean, Greece and Turkey have signaled a willingness to start talks to resolve a long-standing sea dispute tied to potentially lucrative offshore gas deposits. Greek Prime Minister Kyriakos Mitsotakis welcomed the return of a Turkish survey ship to port Sunday from a disputed maritime area at the heart of the s standoff between Greece and Turkey over energy rights. Mitsotakis said he was ready to restart long-stalled talks, signaling that the two countries could be inching toward negotiations after weeks of increasingly bellicose rhetoric. Exploratory talks between Greece and Turkey over the continental shelf and exclusive economic zone rights were last held in 2016. However, Turkey is extending its oil and gas drilling operations offshore Cyprus until October 12th, with three additional Turkish vessels joining the Yavuz drillship which is already in place in the area.

EU foreign policy chief Josep Borrell warned the bloc’s relations with Turkey had reached a “watershed” over Ankara’s continued exploration work in the East Mediterranean. Borrell, speaking to the European Parliament, said the world would go “one side or the other depending on what is going to happen” in the coming days. Turkey’s state-owned TPAO has drilled a handful of wells offshore Cyprus in the past year, and a seismic vessel has spent the past month surveying a large area in disputed waters between Cyprus and the Greek island of Crete. Turkey is hoping to replicate significant East Mediterranean discoveries such as Egypt’s Zohr field and offshore Israel.

3. Climate change

The Energy Transitions Commission is a coalition of 45 leaders from energy producers, energy-intensive industries, financial institutions, and environmental advocates. In a new report last week, ‘Making Mission Possible,’ the coalition said that “it is undoubtedly technically feasible and economically affordable for the whole world to achieve net-zero GHG emissions by mid-century, with all developed economies meeting that objective by 2050 and all developing economies within the following ten years.” The cost of this effort is estimated to require an annual investment of $1 trillion – $2 trillion, or up to $60 trillion over the next 30 years.

The European Union’s chief executive, Ursula von der Leyen, said last week that the bloc should commit to deeper emissions cuts over the next decade, and pledged to use green bonds to finance its climate goals. Von der Leyen said the EU should set a target to cut its greenhouse gas emissions by at least 55 percent by 2030, against 1990 levels, confirming plans laid out in draft Commission documents.

In the past few years, there has been a debate among US politicians and analysts about whether the US should “decouple” from China by severing the supply chains, trade relationships, and financial links that bind together the world’s two largest economies. This discussion, however, usually ignores climate change. The risks posed by catastrophic environmental damage for the two countries are great. Some observers say it will be better in the long run if the two remain economically linked so that they can use their combined leverage to mitigate climate change together.

When Congress last pushed for comprehensive climate legislation, much of corporate America was either neutral or hostile. As the climate deteriorates, however, the Business Roundtable, one of the US’s most prominent business groups, is throwing its support behind broad-based measures to cut greenhouse gas (GHG) emissions. In a statement of principles released last week, the group said it “supports a goal of reducing net US GHG emissions by at least 80 percent from 2005 levels by 2050.”

There’s a chance water levels in the two largest human-made reservoirs in the US could dip to critically low levels by 2025, jeopardizing the flow of Colorado River water that supplies more than 40 million people. After a relatively dry summer, the US Bureau of Reclamation released models last week suggesting looming shortages in Lake Powell and Lake Mead — the reservoirs where Colorado River water is stored — are more likely than previously projected.

The west coast wildfires are sending into the atmosphere tens of millions of tons of carbon dioxide that will only drive global temperatures higher. Scientists estimate that the fires in California this year through mid-September burned enough forest to put about 90 million metric tons of carbon dioxide, the most important greenhouse gas, into the air. For perspective, that’s some 30 million tons more than the total CO2 emissions from providing power to the entire state.

Oil and gas wells never really die. Over the years, the miles of steel pipes and cement corrode creating pathways for underground gases to reach the surface. The worst of these is methane, which captures 86 times more heat than CO2. There are more than 3.2 million deserted oil and gas wells in the US and an estimated 29 million worldwide. There is no regulatory requirement to monitor methane emissions from inactive wells, and until recently, they were not even considered in estimates of greenhouse gas emissions. Today well owners can idle or plug their wells and walk away without any responsibility for the damage they may be doing.

Two Antarctic glaciers are increasing the threat of large-scale sea-level rise. Located along the coast of West Antarctica, the enormous Pine Island and Thwaites glaciers already contribute around 5 percent of global sea-level rise. The survival of Thwaites has been deemed so critical that the U.S. and Britain have launched a targeted multimillion-dollar research mission to study the glacier. Loss of Thwaites could trigger the collapse of the entire West Antarctic ice sheet, which contains enough ice to raise seas by about 10 feet eventually.

The Geological Survey of Denmark and Greenland reported last week that the Northeast Greenland Ice Stream had lost more than 19 square miles for the second year in a row. The giant glacier has now been reduced by 60 square miles in the past two decades.

4. The global economy and the coronavirus

United States: The labor market’s recovery shows signs of losing momentum as applications for unemployment benefits show layoffs remain historically high despite summer hiring. Weekly initial claims for jobless benefits fell by 33,000 to a seasonally adjusted 860,000 in the week ended Sept. 12. The number of people collecting unemployment benefits through regular state programs, which cover most workers, decreased by 916,000 to about 12.6 million.

The rebound in US retail sales slowed by more than expected in August as federal relief for jobless Americans and small businesses dried up. The value of overall sales increased 0.6 percent after a downwardly revised 0.9 percent increase the prior month. The Federal Reserve on Tuesday said industrial production—a measure of output at factories, mines, and utilities—rose a seasonally adjusted 0.4 percent in August from July, following a revised 3.5 percent rise in July. Despite several months of advances, output remains far below its level before the coronavirus pandemic hit in the spring.

The fires consuming the forests of California and Oregon are also damaging a regional economy already suffering from the coronavirus outbreak. Wildfires are destroying property, running up huge losses for property insurers, and putting a strain on economic activity in the region that could linger for years. The credit rating agency A.M. Best estimates that insured losses from the blazes in California could top the unprecedented $13 billion recorded in 2017 when the state was hit by three of the five costliest fires in US history.

The US economic recovery is in danger of being weaker and more uneven if Congress and the White House disagree on a new round of fiscal stimulus, according to mounting warnings from Wall Street and academic economists. Last week there were signs that a compromise amongst the Democrats and Republicans in Congress and the White House on another stimulus bill may come before the November election. However, voting is already underway in some states.

China: China’s imports of crude oil have been trending much lower in September than in the past four months. The rest of Asia is also significantly slowing imports this month with demand still under pressure, IHS Markit said on Friday. Crude oil discharged at Chinese ports in the last two weeks were below 8 million barrels per day (bpd), at levels similar to what China imported in March and April. In the third quarter, China’s crude oil imports have stayed strong, with high congestion at many major oil ports. Much of this may be due to Beijing’s purchase of so much cheap oil in the second quarter that it could not be unloaded until the third quarter. Activity so far in September suggests that China’s oil terminals have been absorbing much less than a month ago.

A drive to cut electricity prices for end-users has prompted Beijing to reduce gas-fired power plant tariffs, which has threatened the survival of many of them. “The new regulations will cause at least a 5 to 6 percentage point decline in the already poor margins of gas power plants,” said Wood Mackenzie. “Delivered fuel costs at most gas power plants have only declined by 10 to 13 percent, while revenues have been cut by 16 percent to 28 percent due to the new regulations. Most projects are now loss-making or barely breaking even.” Power tariffs in the country have declined by an average of 25 percent over the past three years, while gas-fired power plant tariffs fell by between 16 and 28 percent.

Washington announced it will ban WeChat and video-sharing app TikTok from US stores starting on Sunday night, which will block Americans from downloading the Chinese-owned applications over concerns they pose a national security threat. The move follows President Trump’s imposition of additional tariffs on Chinese goods and curbs on Huawei Technologies last year. In retaliation, China’s commerce ministry on Saturday issued a list of “unreliable entities,” saying it will target foreign firms and individuals endangering China’s sovereignty and security.

European Union: On Thursday, the World Health Organization announced that 300,000 new infections were reported in Europe last week alone. “We have a dire situation unfolding before us.” Some European countries, including the UK and France, have recorded their highest daily tallies in months. Testing capacity has increased across Europe since the pandemic began, meaning that cases are now more likely to be identified and recorded. The new figures also showed “alarming rates of transmission across the region.” Hospital admissions and deaths have not yet seen a similar rise, although Spain and France see an upward trend.

Britain’s health minister said on Friday that coronavirus cases are accelerating across the country, with hospital admissions doubling every eight days, but refused to say if another national lockdown would be imposed. Health Secretary Matt Hancock said that a nationwide lockdown was a last resort, but that the government would do whatever it takes to slow the virus.

Germany’s economic recovery slowed recently due to weaker demand in the auto sector and declining machinery output, according to a government report Monday. “The recovery in the German economy continues but has recently weakened,” the Economy Ministry said in its latest monthly news. “In the course of the year, recovery should proceed, but the pre-crisis level from late 2019 will only be reached by early 2022.”

Russia: Gazprom says design and survey work on the 50 billion cu m/year Power of Siberia 2 natural gas pipeline is continuing as anticipated. Work on the line, which would deliver gas to western China via Mongolia, began earlier this year. Preparations to start the line’s Mongolian section have also begun. Gazprom says the project will expand gas infrastructure in Eastern Siberia and the Transbaikal Territory and create a new export corridor for delivering gas from Yamal to Asian markets.

The company is also expanding its domestic distribution network, building 2,350 km of a pipeline bringing gas to 319 localities by the end of 2020. It says that by the end of the year, 71.4 percent of Russia will have access to natural gas.

Saudi Arabia: Saudi Arabia’s monarch, King Salman bin Abdulaziz, has been at odds with his son, Crown Prince Mohammed bin Salman, over embracing the Jewish state. The king is a longtime supporter of the Arab boycott of Israel and the Palestinians’ demand for an independent state. The prince wants to move past what he sees as an intractable conflict to join with Israel in business and align against Iran.

Saudi Arabia saw its crude oil exports rise to 5.734 million b/d in July, up from a historic low of below 5 million in June when OPEC’s de facto leader cut its oil production by an additional 1 million b/d on top of its share of cuts. Riyadh’s s crude exports in July rose from the 4.98 million b/d exported in June, which was the lowest in the data series going back to 2002.

India: The world’s third-largest oil importer purchased much less crude between April and July 2020 compared to the same period last year. Because of the slump in international oil prices, India’s oil import bill was $12.4 billion in April-July, the first quarter of India’s fiscal year. For this sum, India imported 57.2 million tons of crude oil, compared to imports of 74.9 million tons worth US$36.2 billion for the same period of 2019.

5. The Briefs (date of the article in the Peak Oil News is in parentheses)

Oil tanker market’s “dead-cat bounce”: On Monday, spot rates for Very Large Crude Carriers stood at $27,900 per day. That’s a lot lower than the $68,000 in average freight rates for the first half of the year, and yet it was a massive, 124 percent improvement over Monday last week. Demand for floating storage is helping tanker owners reach breakeven. But it may take a while to get any better than that. (9/17)

Global ethanol markets are not expected to recover fully until 2022 from the demand shock caused by the coronavirus pandemic, which led to a 20 percent cut in annual global production expectations after more than 250 ethanol plants were seen shutting down globally. (9/16)

A significant explosion near Kyiv has rocked the massive Kyiv-Western Ukraine-1 natural gas pipeline that moves gas from fields in Eastern Ukraine to underground storage facilities near the border with the EU. (9/15)

Israel’s energy star rising: The imprisonment of Egypt’s Morsi, the civil war in Libya, and the discovery of gas deposits in the Eastern Mediterranean have worked in favor of Israel and its strategic value. The recent normalization of relations between Israel, the UAE, and Bahrein could finalize an anti-Turkey coalition that will define politics in the region for decades. The trans-Israel Eilat-Ashkelon pipeline could be a massive asset that would cement those expanded ties. (9/16)

Oman’s flagship project: Last week, a contract was signed for two large-scale polyolefin plants that will be integral to the US$18 billion combined Duqm Refinery and Duqm Petrochemicals projects. This US$18 billion figure was a marked increase on the previous estimates from Oman’s officials but is in line with the Sultanate’s plans to increase downstream production capacity from its current 15 million tons to 24 million tons by 2030. (9/15)

Kuwait aims to open what will be the Middle East’s largest import terminal for liquefied natural gas in March, according to two people familiar with the project. The Al-Zour plant will almost double the region’s capacity. The global trade in LNG will probably increase to more than 1,000 bcm annually by 2035 from roughly 425 bcm today, according to BP Plc. (9/16)

India, the world’s third-largest oil importer, will be the biggest source of energy demand growth through 2050 in any scenario. However, India may not be as key a driver of global oil demand growth as previously thought. This was one of the messages in the BP Energy Outlook 2020. The supermajor said that global oil demand might have peaked last year as oil consumption may never recover to the pre-pandemic levels. (9/17)

China, the world’s largest automotive market, is dropping considerations to have a firm deadline for banning the sales of new gasoline and diesel vehicles, according to policymakers advising the government on car market policies. (9/17)

In Mozambique, President Filipe Nyusi and Total’s CEO Patrick Pouyanné met to discuss an intensifying Islamic State-linked insurgency in the country’s north, where the French oil giant is building a massive natural-gas project. For more than a month, militants have occupied a town about 60 kilometers (37 miles) south of where Total is spending $20 billion to extract natural gas offshore and export it to European and Asian customers. (9/19)

In Namibia, Nick Steinsberger—the petroleum engineer who pioneered slick-water fracking in the Barnett shale—is tasked with proving up billions of barrels of oil in the Kavango Basin. Some say it offers significant discovery potential within of one of the few unexplored onshore sedimentary basins. Steinsberger is upbeat about the possibility of a shale boom repeat. (8/17)

In Canada, a vicious one-two-three punch that started with a gloomy long-term future outlook due to rampant fossil fuel divestments, climate change policies, and decarbonization, as well as severe shocks from the COVID-19 crisis, has thrown Canada’s most important export industry into an existential crisis. Meanwhile, the drumbeat of exits by foreign oil firms bailing on the unprofitable tar sands has added an extra layer of gloom for an industry responsible for a fifth of Canada’s exports. It, therefore, comes as little surprise that Canada’s oil and gas producers are scrambling to merge as they hope to survive to see another oil boom. (9/18)

The US oil rig count fell by 1 to 179 while the gas rig count increased by 2, according to Baker Hughes’ weekly report. Total oil and gas rigs in the US are now down by 613 compared to last year. Oil and gas rigs in Canada are now at 64 active rigs, down 55 years on year. (9/19)

In Alaska, Shell has submitted plans to drill for oil in the waters along the National Petroleum Reserve-Alaska in the coming years. The company says it needs five years to secure a partner and analyze the area’s development potential. Shell holds a 100 percent working interest in 18 leases covering more than 122 square miles. (9/19)

GM and aerial cars?!? Like an elderly man wobbling into a party and trying to fit in with young kids by using “hip new lingo,” General Motors said it would explore options in the “aerial taxi” market. This is, of course, a market that hardly exists. (9/18)

US ethanol production averaged 926,000 b/d for the week ended Sept. 11, a decrease of 15,000 b/d on the week and down 77,000 b/d year on year, according to the US EIA. (9/17)

Ethanol fix? President Donald Trump promised to allow higher-ethanol gasoline to be distributed using existing filling station pumps, a move designed to bolster support among corn farmers and biofuel producers in Iowa and other Midwestern swing states. (9/15)

The Ultium batteries GM developed for EVs and now produces in partnership with LG Chem can deliver up to 400 miles of range, fast charging, and low price. GM’s batteries cost less than $100 per kWh — a breakthrough in an industry that has worked hard to improve affordability. The Ultium can be charged wirelessly, allowing GM to collect data on every individual battery over the long term. This makes for a valuable database that would allow the car giant to improve its battery technology much more quickly than would otherwise be possible. (9/16)

EVs in the UK: New rules proposed could see electricity distributors switching off electric vehicle chargers at home connected to the smart meter system to prevent grid overloads in case of ‘emergency’ peak electricity demand. The action will only be taken as a last resort in the event that market mechanisms fail or do not deliver to the extent anticipated. (9/18)

Weekly US coal production fell to a seven-week low in the week ended Sept. 12, down 3.3 percent from a week earlier and 26.4 percent lower than the year-ago week, according to an EIA report. (9/18)

Coal prices in Europe show little sign of getting the usual uplift into the winter heating season thanks to a groundswell of rising pollution costs, cheap natural gas, and high renewables output. Power demand crippled by Covid-19 has made it even more difficult for the industry to compete economically, with coal generation down 44 percent among seven major European utilities in the first half of 2020 as renewables output increased by 38%. (9/15)

The US nuclear sector has been in decline for quite a while. It has never recovered from the influx of cheap natural gas that came with the domestic shale revolution. New threats from climate change include water shortages for reactor cooling and catastrophic flooding from severe storm events. A $65 million US DOE grant is meant to help the industry study and address these threats, such as cybersecurity. (9/17)

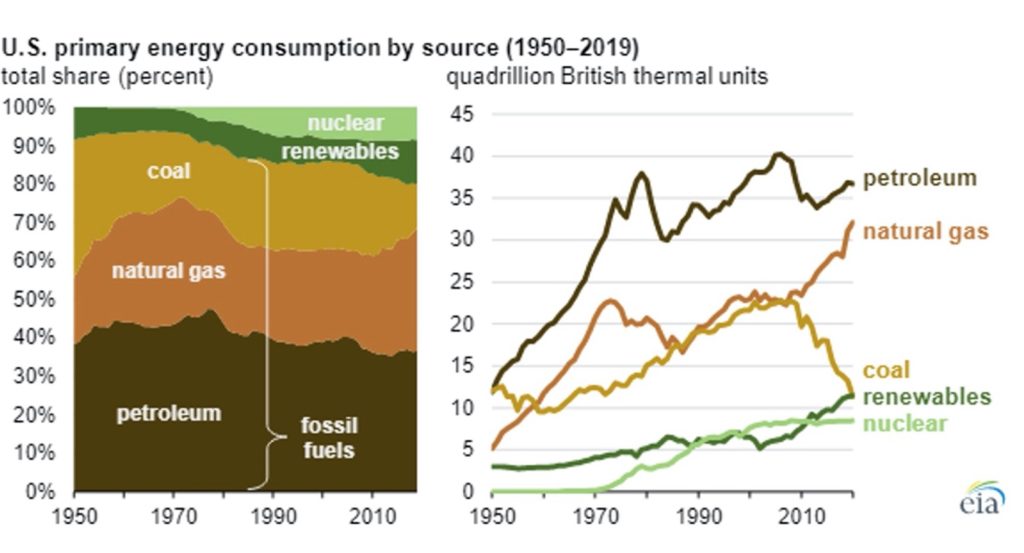

Renewable energy sources and increased penetration of electric vehicles are becoming increasingly competitive with the dominant energy sources of the 20th century—oil, coal, and natural gas. All analyses point to slowing growth in oil and gas consumption. (9/15)

European daily wind power generation plunged Sept.15th, sending spot power prices to 2020 highs, data aggregated by WindEurope showed. (9/16)

Cruise ship fire sale: Amidst the shutdown of pandemic-induced cruise ship travel, Carnival Corp. — the parent company of nine cruise brands, including Princess, Costa, and Carnival — announced in third-quarter earnings filing that it plans to sell 18 cruise ships in 2020, which amounts to 17 percent of the company’s vessels. Carnival accounts for 45 percent of the industry. (9/17)