Editors: Tom Whipple, Steve Andrews

Quotes of the Week

“Just three years ago, BP’s outlook included a peak in global coal demand for the first time. Now, it sees demand falling ever faster, dropping to a fifth below 2019 levels by 2050. In the ‘rapid’ and ‘net-zero’ scenarios, demand for coal falls by one-third by 2030 and by around 90 percent by 2050.”

Simon Evans, Carbon Brief

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

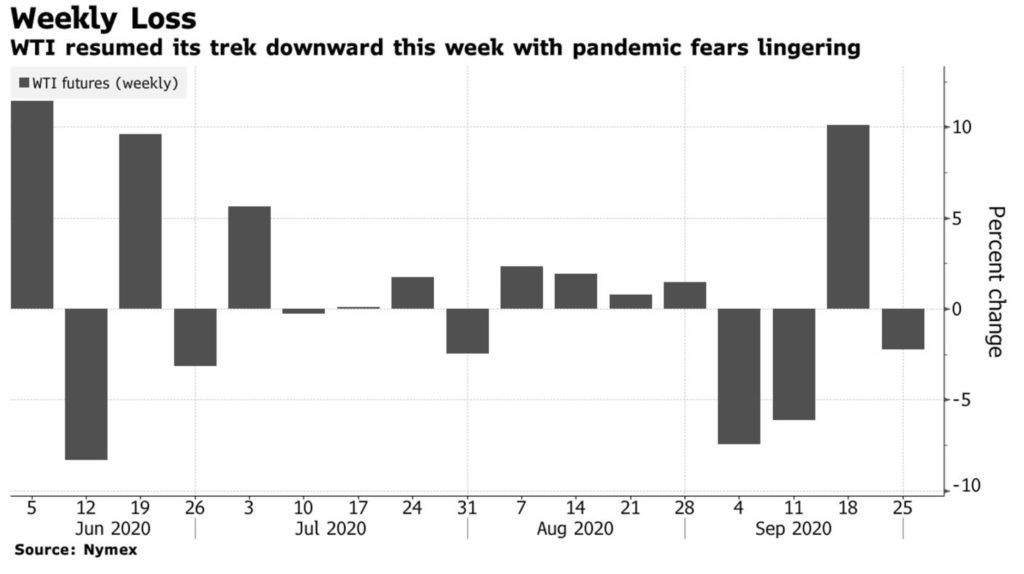

Oil: Prices fell this week amid growing concerns that another wave of the coronavirus pandemic will spark tighter lockdowns and further stifle oil demand. New York futures edged lower Friday and fell 2.1 percent on the week closing at $40.25 in New York and $41.92 in London.

The oil markets are contending with growing supplies. Oil traders expect a sharp increase in Iraqi exports next month, while exports resumed from several Libyan oil terminals. Some analysts say that until the world gets a vaccine, there are widespread reopenings, and a meaningful increase in travel, there will not be a pick-up in demand and a significant price increase.

While much of the market’s attention has been focused on how fast gasoline demand will recover, lower economic activity in all regions of the world has led to an oversupply in distillates, including diesel, gasoil, and jet fuel. Faced with an unprecedented crash in jet fuel demand, refiners have geared toward making more of the other distillate fuels, whose stocks have risen to levels not seen in decades. The glut in diesel and other middle distillates has become so evident in recent weeks that traders have started to charter tankers to store fuels for sale at a later date.

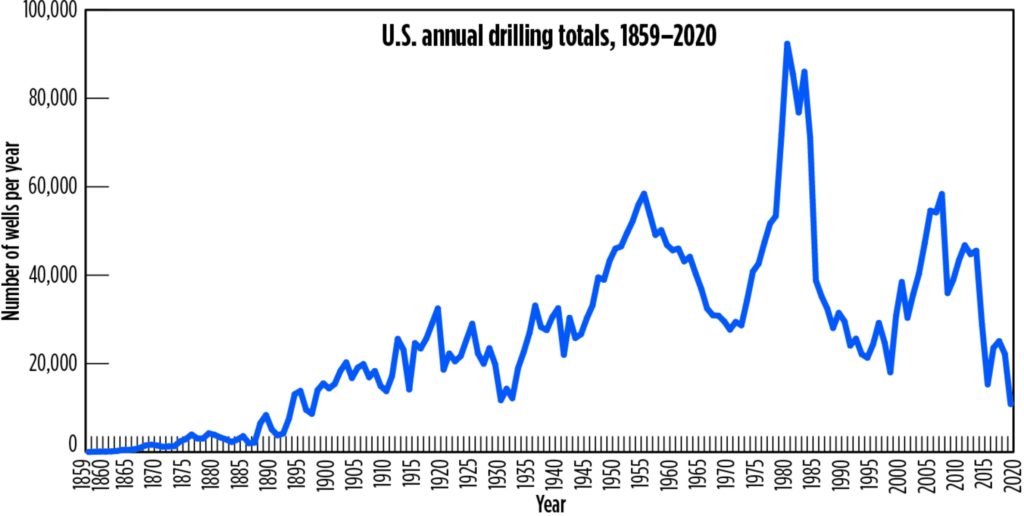

World Oil magazine forecasts that fewer than 11,000 new wells will be drilled in the US during 2020. If this forecast is realized, total wells drilled during the year be the lowest in nearly 90 years. In 1931, 11,716 were drilled. Only last year, some 22,000 wells were drilled. That we are looking at a level potentially below 11,000 wells suggests that recovery will take a long time.

Two-thirds of US oil and gas executives surveyed by the Federal Reserve Bank of Dallas believe US oil production has peaked. Most executives surveyed, 74 percent, also expect OPEC to play a more significant role in determining oil prices ahead, according to the survey of 166 energy firms.

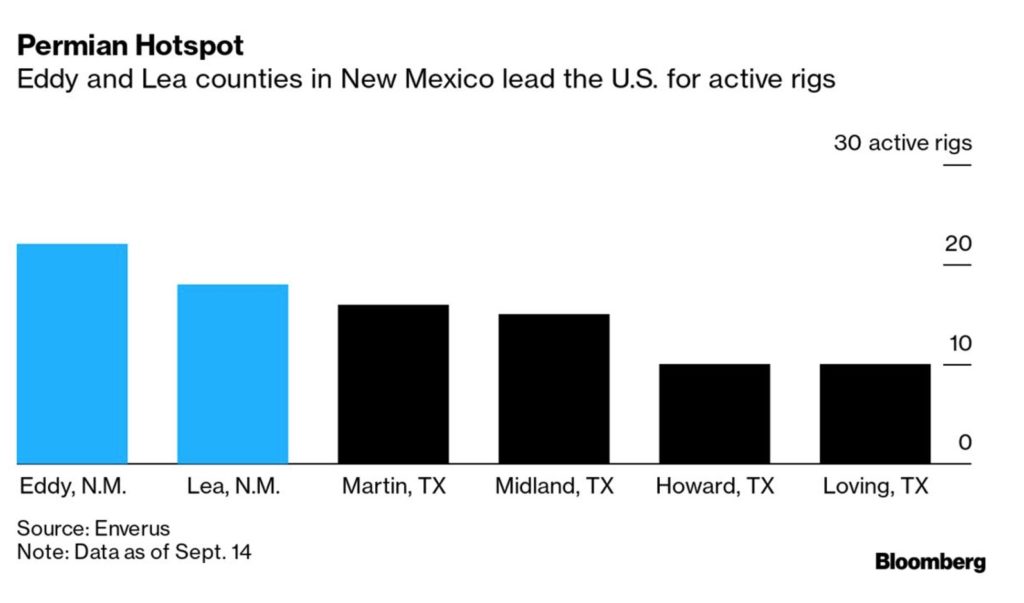

Shale Oil: With the US oil industry reeling from the collapse in demand this year, New Mexico has emerged as the go-to spot for drillers. However, there’s just one problem: Joe Biden wants to ban new fracking on federal property there. In a two-county bloc that forms the far western edge of the Permian shale basin, there are more rigs boring oil wells today than anywhere else in the nation. Once overlooked by drillers obsessed with the much-bigger Texas side of the Permian, New Mexico has become the most profitable place to produce oil in America.

US oil production can reach new highs beyond the 13 million b/d mark achieved in late 2019, although it will take oil prices of around $60/b for that to occur. A lack of well drilling for most of this year and into 2021 should gradually bring up prices to a level around the $60 per barrel level needed to restart activity, upstream specialists said at the Rystad Energy 2020 Americas Virtual Annual Summit.

“If supply is to keep up with demand, we need a lot of shale volume going forward,” Leslie Wei, Rystad’s vice president of E&P research, said. “We believe shale needs to deliver 6 million to 11 million b/d from wells not yet drilled.” To unlock this activity and restart a new shale activity upcycle, “we believe oil prices need to recover significantly from today’s levels, which has dropped back into the mid-to-high $30s in the last couple of weeks,” Wei said.

Natural Gas: Early last week, spot natural gas prices plunged by more than ten percent as the outlook for demand and LNG exports worsened due to the hurricane-caused disruptions in the Gulf of Mexico. By 11:00 am Monday, natural gas prices had fallen by 11.4 percent to $1.81 per million BTUs. However, at the same time, the November contract for natural gas was trading at $2.68 per million — an unusual $0.85 premium over the front-month contract.

However, on Wednesday afternoon, rallying from a seven-week low, natural gas futures rose more than 15 percent as the demand outlook improved. Front-month natural gas futures rose by $0.270 to $2.10. According to Refinitiv, US production of natural gas is on track to fall to its lowest in two years to 83.8 billion cf/d. Also, US pipeline exports to Mexico are on track to reach 6.0 billion cf/d this month, compared to 5.0 last month. Total demand, including exports, is expected to reach 84.4 billion cf/d this week, from 82.0 last week.

OPEC: According to the head of commodities at trader Mercuria Energy Group Global, oil markets won’t be able to absorb production increases by OPEC+ members as demand remains weaker than expected. Oil stockpiles have been building in September and won’t draw down enough in the remainder of the year to be in balance if the cartel follows through with its plan to increase production by 2 million b/d starting January 1st.

Mercuria says global oil stocks increased by 500,000 to 1 million b/d in September but will be drawn down by an average of about 1 million b/d in the fourth quarter. There is a fair amount of oil going into floating storage now and there is a slowdown in the global rebalancing process.

This forecast does not look good for Saudi Arabia, Russia, and the rest of OPEC+ who have made historic output cuts this year to save a market battered by the pandemic. With the cartel due to discuss further easing of their curbs from January, the warning that stockpiles have been building again could force OPEC+ to reconsider.

BP’s Annual Outlook: The world has already passed “peak oil” demand, according to a Carbon Brief analysis of the latest energy outlook from BP. The 2020 edition of its annual outlook reveals – albeit indirectly – that global oil demand probably will not regain the levels seen last year. BP notes that demand could soon fall rapidly in the face of more decisive climate action – by at least 10 percent this decade and by as much as 50 percent over the next 20 years. The latest outlook was delayed by six months to reflect the unprecedented impact of the coronavirus pandemic. The delay also reflects BP’s plans, set out this year, to reach net-zero emissions by 2050 – as an “integrated energy company,” rather than an oil major.

As a part of BP’s Global Energy Outlook, the company ran three scenarios based on differing assumptions regarding how rapidly governments around the world would attempt to adopt emissions-reducing policies and subsidize renewables. The cases were labeled “Rapid” (the most aggressive assumptions), “Net-Zero” (assuming most governments would adopt ‘net-zero by 2050’ policies) and “Business as Usual,” in which progression would continue on the slower path seen to date.

Under the “Business as Usual” scenario, BP projects that global demand will not only recover to pre-COVID levels seen late last year but continue to grow through the year 2030. Past 2030, BP projects that demand would then begin to decline slowly, but only by 10 percent by 2050. While this case gives comfort for those hoping that fossil fuels have a long life ahead, anyone paying attention to the endless string of climate disasters caused by carbon emissions knows better.

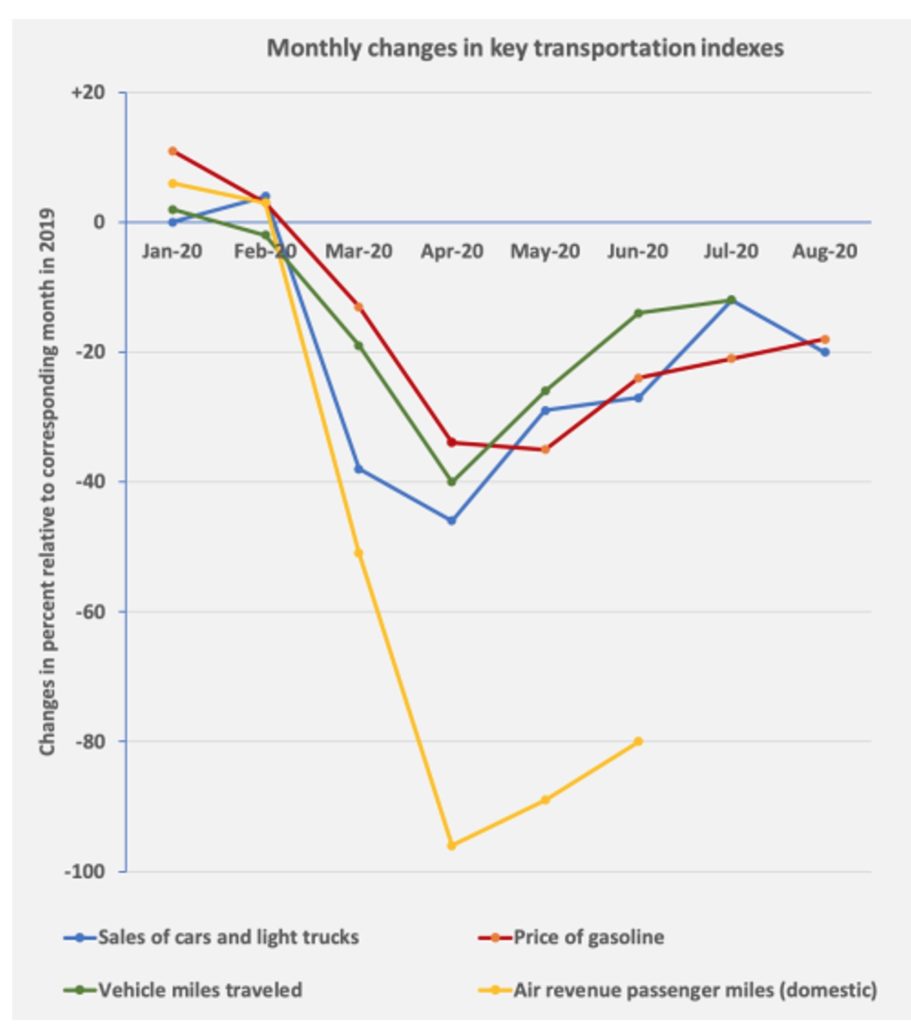

Prognosis: Although everyone knew that air travel would take the longest to recover from the pandemic, it became painfully evident for airlines and aircraft manufacturers at the end of the summer travel season that global air travel is not rebounding as fast as they had expected. International commercial air traffic slowed its recovery pace in August, sending a warning that jet fuel demand might take at least three more years to reach pre-crisis levels—if it ever.

The OPEC+ production cuts and curtailments of shale oil drilling in the US are going to help global inventories to continue drawing down for the rest of the year and most of next year. This will result in a “relatively balanced” market by the end of 2021, the US Energy Information Administration said last week. The OPEC+ deal and the production drops elsewhere have brought global supply below the level of demand for the first time since the middle of 2019, the EIA estimated, noting that the supply deficit has helped bloated global inventories to decline since June.

2. Geopolitical instability

Iran: According to TankerTrackers, Tehran has exported nearly 1.5 million b/d of crude oil and condensate so far in September. This would be the highest level of Iranian exports in a year and a half and double the estimated exports in August. Since the US imposed sanctions on Iran’s oil industry and exports in May 2018, the Islamic Republic has been using various tactics to ship its crude abroad without being detected, including by tankers switching off transponders or forging documents stating the oil does not originate from Iran.

The Trump administration outlined an array of new measures intended to preclude China and Russia from selling weapons to Iran and block the shipment of goods that might be used for its missile programs. The new steps consist of sanctions that were authorized in an executive order signed by President Trump, who said in a statement that his administration would “use every tool at our disposal to stop Iran’s nuclear, ballistic missile, and conventional weapons pursuits.” The measures followed an unsuccessful effort by the US last month to persuade the UN Security Council to extend the arms embargo on Tehran and a later decision by the Trump administration to reimpose almost all the international sanctions in effect before the 2015 Iran nuclear accord.

Having failed to persuade the international community, including its closest European allies, to reinstate the sanctions under the “snapback” provisions, the US is now seeking to pressure foreign companies and foreign governments to go along. These companies and governments insist that Washington doesn’t have a legal basis for restoring the sanctions after it withdrew from the 2015 accord.

The Islamic Revolutionary Guard opened a new naval base in a coastal town on the Strait of Hormuz, a theater of frequent incidents and frictions between Iran and the US. The new base at Sirik was officially opened on Wednesday.

Iraq: The Oil Ministry is attempting to shift some of the financial burden associated with its OPEC-related production cuts onto the international oil companies drilling in the country. The ministry’s efforts to scale down its payment obligations, which multiple industry officials confirmed, are likely to meet resistance from IOCs and send a chilling message to prospective energy sector investors.

Baghdad is joining a global alliance to procure future COVID-19 vaccines — a longer-term measure to combat a pandemic that is likely to worsen in the meantime. “I don’t expect the vaccine to be available before the end of 2020, maybe even early 2021 — let’s hope and see,” said World Health Organization Iraq Representative Dr. Adham Ismail. He believes Iraq’s caseload will spike this winter. “We are now talking about getting ready for a second wave without the presence of any vaccine, and we are facing the winter with nothing but preventative measures.”

Iraq, the world’s second-worst gas flarer, could generate over 3.5 GW of power by capturing 40 percent of associated gas being burned, a GE executive said last week. OPEC’s second-largest oil producer flared some 632 billion cf of gas in 2019, the most of any country except Russia, according to a World Bank study published in July. Flaring deprives states of the economic benefits that would come if the gas associated with pumping oil was processed and sold to the market, rather than burned into the air.

Baghdad currently imports Iranian gas and electricity to feed its power needs. However, it is under increasing US pressure to lower its dependence on Tehran’s energy supplies, which have been under US sanctions since 2018. The US government has shortened the duration of a new sanctions’ waiver, allowing Iraq to continue energy imports from Iran — a sign of enduring tensions between Baghdad and Washington. The further 60-day waiver was approved by Secretary of State Mike Pompeo on Tuesday, a day before the previous 120-day waiver was set to expire.

Libya: Russia said it welcomes the deal that allows Libya to resume oil exports, with revenue distributed across the divided nation. Deputy Prime Minister Maiteeq reached the accord the week before last at a meeting in Sochi, Russia, with military commander Haftar’s son and representatives from eastern Libya. They also agreed to form a special commission to resolve conflicts.

Libya’s oil terminals at Hariga, Brega, and Zueitina are now open for business. The seaport of Mellita is only open to ship condensates, while the biggest port in terms of capacity, Es Sider, is still closed. So is the Zawiya oil terminal which ships the crude produced from Libya’s largest oilfield, Sharara. The Suezmax Delta Hellas left the Marsa el-Hariga terminal on the morning of Sept. 25 after loading a 1-million-barrel cargo, according to data from S&P Global Platts.

Despite having Africa’s largest crude reserves, Libya may struggle to ramp up production quickly, even if the conflict has abated. Its oil industry is crumbling after more than nine years of neglected maintenance amid a civil war that’s killed thousands and destroyed towns across the country. The lack of necessary servicing has left pipelines corroding and storage tanks collapsing.

Venezuela: After defying US sanctions by shipping a cargo of oil condensate to Venezuela two weeks ago, Iran used the same ship to help Caracas export its crude. The shipments give some respite to the nation’s hobbled oil industry, as most shipowners avoid doing business with the country for fear of sanctions.

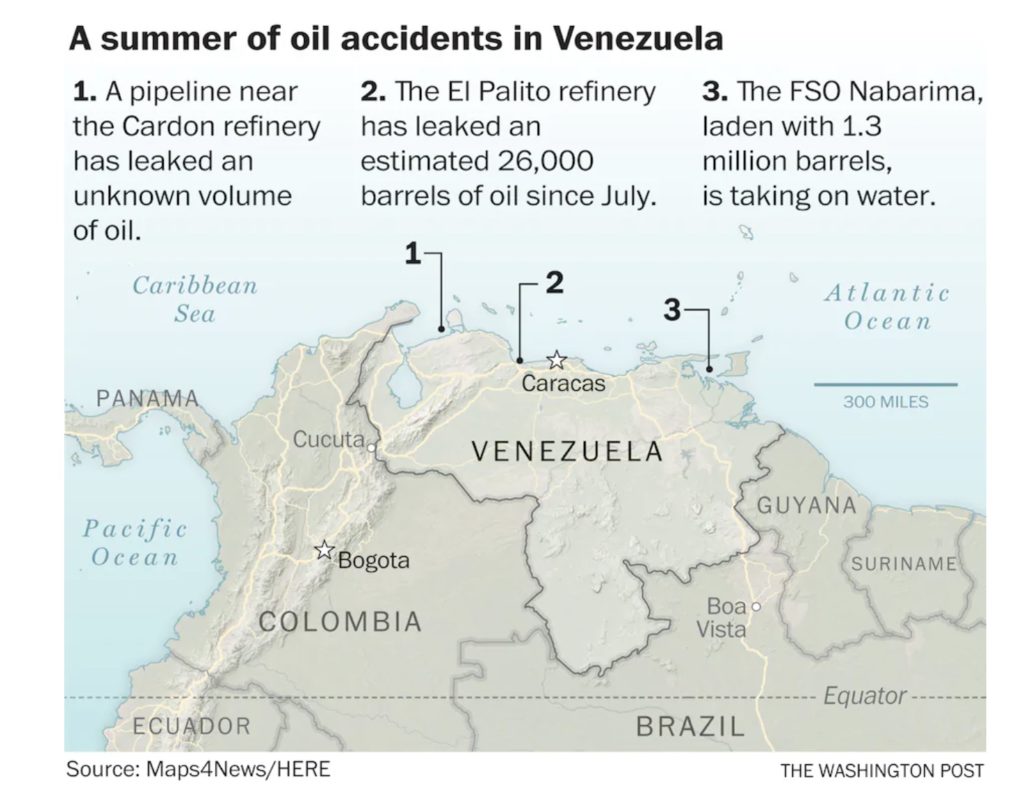

Venezuela’s once-robust oil industry has fallen apart, with years of mismanagement, corruption, falling prices, and a US embargo bringing aging infrastructure to the brink of total collapse. Oil workers say the gushing crude soiling the coast of Falcón state this month came from a cracked underwater pipeline linked to attempts to restart fuel production at the aging Cardón refinery. A fisherman says that not far from the oil slick is a jetting geyser of natural gas from a second broken pipeline.

The leaks are the latest in a spate of oil industry troubles that have alarmed environmentalists here. They include a recent oil spill that has jeopardized corals and rare marine life off sensitive Morrocoy National Park, and a rusting vessel in the Gulf of Paria that observers call a ticking ecological time bomb. Analysts see a growing risk of more and larger spills in a country that has already suffered years of damage from broken wells and abandoned oil fields.

3. Climate change

In a significant step to address climate change and air pollution, California will require that all new passenger vehicles sold by 2035 meet zero-emissions standards to phase out gasoline-powered vehicles in the state. California Gov. Gavin Newsom issued the executive order last week, effectively banning new gas-powered car and SUV sales in the state in 15 years. His order also requires medium- and heavy-duty trucks to meet zero-emission vehicle (ZEV) requirements by 2045. The order will not ban ownership of gasoline-powered cars or prevent their sale on the used car market.

The order also requires the development of new affordable fueling and charging options for EVs. It calls for the state to invest in alternatives to private, car-based transportation, including a statewide train network and projects that support bicycle and pedestrian infrastructure. Transportation is responsible for more than half of carbon pollution in California, the governor said. According to IHS Markit, more than 11 percent of all light vehicles in the US last year were registered in California.

If the order is upheld in the courts, it should have widespread effects on the auto industry. California is a large enough market to influence which vehicles automakers sell across the US. The state already abosrbs 45 percent of total US ZEV sales.

President Xi Jinping of China pledged his country would adopt much stronger climate targets and achieve what he called “carbon neutrality before 2060.” The announcement, made at the UN General Assembly’s annual meeting, is significant because China is the top producer of greenhouse gas emissions. What the country does to curb its emissions, therefore, is crucial to slowing down global warming.

The surprise announcement left many questions, none more important than “How?” China, a massive energy user, and greenhouse gas emitter, mines and burns half the world’s coal, and is the top importer of oil and natural gas. Transitioning that economic behemoth to carbon-neutrality within a few decades could cost $5.5 trillion, Sanford C. Bernstein & Co estimates, and require the widespread deployment of technologies that are barely in use today.

However, “If any country can achieve such ambitious goals, it will be China,” said Gavin Thompson, Asia-Pacific vice-chairman at consultancy Wood Mackenzie Ltd. “State support and coordination have proved extremely effective at reaching economic goals; if this is now directed towards climate change, then China is capable of transforming its carbon emissions trajectory over the coming four decades in the same way it has transformed its economy over the past 40 years.”

ExxonMobil, Chevron, ConocoPhillips, BP, Shell, Total, Eni, and Equinor may have to divest combined resources of up to 68 billion barrels of oil equivalent in various geographies, with an estimated value of US$111 billion and spending commitments in 2021 totaling US$20 billion, according to a study by Rystad Energy. The companies in the survey have pledged various commitments to become net-zero energy companies and significantly expand their renewable energy portfolios. For example, BP said in its new strategy last month that it would reduce its oil and gas production by 40 percent by 2030 and would not enter exploration in new countries.

4. The global economy and the coronavirus

The official worldwide count of coronavirus cases is now about 33 million and the death toll is rapidly approaching 1 million. However, because of spotty diagnosis, poor reporting, and political needs to keep the number of deaths as low as possible, the actual toll is likely much higher.

United States: Four US states reported record one-day increases in new COVID-19 cases on Friday as the nation surpassed the grim milestone of over 7 million total infections.

The first study to analyze the structure of the novel coronavirus from two waves of infection in Houston found a more contagious strain that dominates recent samples. The study, which has not yet been reviewed by outside experts, found that nearly all strains in the second wave had a mutation, known as D614G, which has been shown to increase the number of “spikes” on the crown-shaped virus. The spikes allow the virus to bind to and infect cells, increasing the mutated virus’s ability to infect cells.

Progress in slowing the coronavirus’s march has stalled in much of the US, and the pathogen is spreading at dangerous rates in many states as autumn arrives and colder weather — traditionally congenial to viruses — begins to settle across the nation. Federal Reserve Chair Powell has said repeatedly, including several times this week alone, that the strength of the country’s economic recovery depends on keeping the novel coronavirus under control — critical to instilling confidence in Americans that it is safe to resume regular activity.

The number of applications for unemployment benefits has held steady in September at just under 900,000 a week as employer uncertainty about the economic recovery six months into the coronavirus pandemic continued to restrain hiring gains. Jobless claims increased slightly to 870,000 last week from 866,000 a week earlier. Foot traffic to US restaurants and stores showed little improvement last week, and signs emerged of deepening stress for small businesses as economists worry the recovery from coronavirus lockdowns continues to slow.

House Speaker Pelosi abruptly shifted course Thursday and moved to assemble a new coronavirus relief bill to form the basis for renewed talks with the White House, amid mounting pressure from moderates in her caucus and increasingly alarming economic news. The new legislation would be significantly narrower in scope than the $3.4 trillion Heroes Act the House passed in May. Pelosi has more recently focused on an additional $2.2 trillion in aid — a figure Republicans say is still too high.

China: Beijing appears to have reduced stockpiling oil for a second consecutive month in August. This suggests that China’s record-breaking oil imports and the support they gave to the oil market may be over.

Beijing has been buying a lot of US crude oil lately, perhaps in a belated attempt to fulfill some of the energy import quotas agreed with Washington last year or perhaps in a bid to take advantage of supercheap US crude. But the buying spree is about to end. This month China could import between 867,000 and 900,000 b/d. And then the flow of US oil into China will decline, and it will drop sharply. The reason is as simple as it is worrying. Since July, the US crude that has been going into China and reaching significant records in terms of volume was bought much earlier in April, May, and June. This was oil bought when West Texas Intermediate was trading at multi-year lows. By June, it had recovered to about $40, Russell notes, so purchases since then have been more modest.

A bipartisan bill aimed at keeping goods out of the US made with the forced labor of detained ethnic minorities passed Tuesday overwhelmingly in the House of Representatives despite concerns about the potential effects on bilateral relations.

According to new estimates that underscore the supply shortfall in the world’s top protein market two years after the arrival of African swine fever, China has nearly exhausted its reserves of frozen pork. The level of reserves is a state secret in China, the world’s number one producer, consumer, and importer of pork. But Enodo Economics, a London based consultancy focused on China, estimates that reserves fell by about 452,000 tons between September 2019 and August this year.

European Union: European governments and citizens want to avoid returning to the full-blown lockdowns of early 2020, including widespread business closures and stay-at-home orders. The cities and regions that have become Europe’s new coronavirus hot spots are so far struggling to configure local, lighter-touch restrictions that let economic recoveries continue but are also effective against the virus.

From Madrid to Marseille to the English Midlands, local interventions range from restrictions on bars to limits on social gatherings, to travel. But, so far, infections are still rising rapidly in the worst-affected areas. “These measures are not very effective,” said French epidemiologist Catherine Hill. “We are headed straight for disaster.”

In the UK, where about 13 million people are currently under some form of heightened local restrictions, there are some signs that they work. The Scottish city of Aberdeen crushed infection rates and was able to remove its local measures. But the city of Leicester in central England has had to maintain local restrictions of varying severity for months.

France’s economic recovery stumbled this month, with a report showing a decline in activity, demand, and employment in the private sector. IHS Markit’s composite Purchasing Managers Index for France unexpectedly fell to a four-month low of 48.5 from 51.6 in August, with services leading the decline.

German airline Lufthansa, already bailed out by the government, says it will have to make more staff cuts and mothball more jumbo jets than initially planned. The outlook for air travel is worse than the company first predicted. The company said last week it would have to drop more than the already announced 22,000 full-time positions. The airline will also pull its remaining eight Airbus A380 jets out of service and put them in long-term storage, along with ten four-engine A340-600 aircraft.

Airbus SE Chief Executive Officer Guillaume Faury stepped up his warning on forced job cuts at the European planemaker. A sharper-than-expected decline in travel leads carriers to push back deliveries of new jets. “The situation has worsened” coming out of the summer high season, he said Tuesday. “Airlines are in a more difficult situation after the holidays than what we were hoping.”

Russia and the US continue to clash over the future of the Nord Stream 2 gas pipeline, with Moscow hitting out at calls from Washington to create a “coalition” of nations aimed at blocking completion of the project. A little over 150 km of Nord Stream 2 remains to be laid in Danish and German waters, but with the political debate becoming ever more frenzied, it remains unclear how and when the pipeline will be completed. Nord Stream 2 would double the capacity of the gas corridor via the Baltic Sea to Germany to 110 Bcm/year and would reduce the need for Russia to use Ukraine as a transit country for gas.

5. Renewables and new technologies

Analysts estimate that whenever battery prices for electric vehicles drop to $100/kWh, they will be price-competitive with internal combustion vehicles. EV maintenance and fuel costs are considerably lower, and the range and availability of recharging concerns are being overcome. Industry experts believe that the $100/kWh milestone could be reached as early as in 2024, or even sooner—and that milestone will unleash the electric vehicle revolution. Governments from California to much of Europe have imposed dates after which fossil fuel powered vehicles can no longer be sold.

A study by BloombergNEF pointed out that battery prices have declined by 87 percent from 2010 to 2019, with the average cost of traction batteries estimated to be around $156/kWh last year. Bloomberg forecasts that by 2030, battery pack prices are expected to reach $61/kWh.

Last week Elon Musk, CEO of Tesla motors, gave a much-anticipated “Battery Day” presentation which outlined an innovative approach to battery design, and substantial improvements in vehicle manufacturing and battery integration. He projects that these developments will result in a 56 percent reduction in cost of EV batteries and enable the production of a $25,000 electric vehicle in two to three years. He did not announce specific dates as new manufacturing facilities that will achieve these efficiencies must be completed first.

If Tesla can reach its goal of anywhere near 56 percent reduction in battery costs in the next two or three years, it suggests that the company’s battery cost would be below $70/kWh and that internal combustion vehicles and even electric vehicles produced by current methods would no longer be price competitive.

China’s electric vehicle startups are on the move again, thanks to Tesla. The country’s growing fascination with Tesla’s sleek designs and cutting-edge technology is giving a string of second-wave electric car manufacturers the incentive to raise more funding, expand production, and boost sales.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

Royal Dutch Shell is looking to slash up to 40 percent off the cost of producing oil and gas in a drive to save cash so it can overhaul its business and focus more on renewable energy and power markets. Shell’s new cost-cutting review, known internally as Project Reshape and expected to be completed this year, will affect its three main divisions. Any savings will come on top of a $4 billion target set in the wake of the COVID-19 crisis. (9/24)

BP issue: Just a week after revealing its plan to turn itself into a clean-energy giant, BP Plc watched its share price drop to a 25-year low. The slide suggests CEO Bernard Looney’s pitch didn’t convince shareholders. (9/26)

The world’s first Very Large Containership fueled by LNG left the shipyard of Hyundai Samho Heavy Industries earlier this month to be delivered to Singapore’s Eastern Pacific Shipping, one of the world’s biggest ship owners. This is just the crest of what could become a wave of LNG-powered ships in the future. (9/21)

Nord Stream 2 standoff: The US is building a coalition to prevent the completion of the Nord Stream 2 pipeline that will substantially increase the flow of Russian gas into Europe. From the US point of view, Nord Stream 2 endangers Europe because it depends on Russian gas and endangers Ukraine – which the US thinks worries many Germans. (9/23)

East Mediterranean Gas Assoc: Greece, Italy, Egypt, Israel, Cyprus, and Jordan will form a permanent organization called the East Mediterranean Gas Organization, to promote regional co-operation and develop joint gas projects in the Eastern Mediterranean at a time when Turkey is actively exploring their waters. (9/23)

Middle East debt burgeoning: Dubai. Abu Dhabi. Bahrain. And, of course, Saudi Arabia. When the going is good, the money flows. When oil prices crash, they issue debt to keep going until prices recover. This time, there is a problem. Nobody knows if prices will recover. (9/22)

India used the ultra-low crude oil prices earlier this year to top its strategic petroleum reserves with oil at $19 a barrel, saving nearly US$700 million in the process compared to the $60 price in January 2020. (9/22)

New Zealand refinery closure? According to IEA estimates, it will take at least two years until the refining sector recovers fully from the current demand loss ramifications. With refinery utilization rates expected to drop to an annual average of 72 percent this year and 77 percent in 2021, some downstream firms are considering closing down altogether. (9/25)

Egypt boosted its gas production by 12.4 percent on the year to a record 7.2 billion cf/d in the fiscal year 2019-20 (July-June) and is undertaking new exploration activities. Egypt’s gas fortunes turned around in 2015 when Italy’s Eni discovered the 30 Tcf supergiant Zohr field in the Mediterranean, helping bring the North African country back to self-sufficiency in gas. (9/21)

Africa: Exploration is not dead. It is especially not dead in Africa—a hot spot in oil and gas before the pandemic. This month, French Total and the Uganda government signed a deal to build a pipeline that will carry Ugandan oil to Kenya’s coast. Overall the picture appears to be better in Africa’s frontier oil regions than in legacy producing parts of the world. (9/24)

In Brazil, during January 2020, Latin America’s largest economy saw its all-important petroleum industry achieve a new milestone, pumping on average a record 3.168 million barrels of crude daily. The COVID-19 pandemic and March 2020 oil price collapse did little to slow the oil boom underway in Latin America’s largest economy. (9/22)

In Argentina, the energy minister of Neuquen province, where the vast Vaca Muerta field is located, said that resurrecting the shale play will take more than a year. Achieving pre-COVID-19 production levels will take an estimated 12-18 months due to a lack of market demand, which may not be bouncing back any time soon. (9/21)

Mexico could delay its planned energy sector reform until next year after President Andres Manuel Lopez Obrador asked regulators this week to help prop up state oil major Pemex. Lopez Obrador asked regulators to suspend new permits for private companies to reduce competition against Pemex. Also, the President said he planned to refinance Pemex’s debt, which is the largest in the global oil industry. (9/24)

In Canada’s natural resources sector, job losses hit an all-time high in the second quarter, at 43,000, highlighting the severe impact the pandemic has had on the industry. The loss of oil demand drove the job losses, CBC reported citing Statistics Canada, with employment in the sector falling 7.3 percent during the second quarter. (9/26)

The US oil rig count increased by 4 to 183 while the gas rig count inched up by 2 to 78k, Baker Hughes reported on Friday. (9/26)

Switcheroo: US President Donald Trump said he had extended a ban until 2032 on oil drilling off the coast of North Carolina and Virginia, weeks after a similar extension affecting offshore drilling in the waters off Florida, Georgia, and South Carolina. Initially, the administration worked to end existing drilling bans but encountered fierce opposition. (9/26)

Ending decommissioning dodges: The US Department of the Interior proposes a regulation that will not allow oil producers to avoid picking up their offshore well decommissioning tab when they go bankrupt. (9/21)

Coal exports out of the terminals in the Hampton Roads region in Virginia during August were down 26.8 percent from July and 42.8 percent lower than the year-ago month. (9/24)

Major dam problem: Ethiopia, Egypt, and Sudan all ultimately share the water of the Blue Nile, but Egypt and Sudan—both of which sit downstream from Ethiopia on the river—fear putting control of a vitally needed water supply in Ethiopia’s hands. The dispute has lasted for years, but with millions’ livelihoods depending on the project and the smooth flow of the water, it is crucial that the African Union (AU) helps to resolve the deadlock imminently. (9/26)

Climate commitments: Ten cities around the world on Tuesday joined New York and London in committing to divest from fossil fuel companies as part of efforts to combat climate change. Berlin, Cape Town, Los Angeles, New Orleans, Oslo, and others pledged to take “all possible steps to divest city assets from fossil fuel companies and increase financial investments in climate solutions. The cities have a total of 36 million residents. (9/23)

Climate plan: The Prince of Wales rolled out a six-step “Marshall-like plan” to put the world on better footing to fight global warming. Prince Charles has warned that the unfolding climate emergency will soon dwarf the impact of the Covid-19 pandemic. On Thursday, he laid out his proposal for addressing the crisis. (9/25)

Walmart Inc. said it is targeting zero emissions from its global operations by 2040 in the latest climate-focused step to reduce carbon footprints. The retailer also plans to secure enough wind, solar, and other renewable energy sources to power its facilities with 100 percent green power by 2035. The company also said it aims to electrify and eliminate emissions from all of its vehicles, including long-haul trucks, by 2040. (9/21)

The only significant airlines making money these days are busy flying cargo, not passengers. Of the world’s 30 largest airlines by revenue, just four reported profits for the April-June quarter. They are all based in export-heavy South Korea or Taiwan, benefiting from the surge in demand for tech components and electronic gadgets as more people work from home and personal protective equipment, much of it produced in Asia. (9/23)

Unusual fuel blending: The fuel that powers passenger planes is generally among the most expensive oil products, but in a sign of the times, the coronavirus has turned it into a blending component for typically cheaper shipping fuel. Straight-run kerosene, usually processed into jet fuel, is now being used to make very low-sulfur fuel oil for the maritime industry amid a plunge in airlines’ consumption. (9/21)

Hydrogen-powered plane? European planemaker Airbus unveiled three designs it is studying to build hydrogen-powered aircraft as it races to bring a zero-carbon passenger plane into service by 2035. The approaches include a turbofan jet with capacity for as many as 200 passengers flying more than 2,000 nautical miles. (9/22)