Editors: Tom Whipple, Steve Andrews

Quotes of the Week

“The big tanks where you pull a ship in and empty the whole thing, that’s all gone. What [storage] you have left is pots and pans.”

Ernie Barsamian, CEO of The Tank Tiger, a US terminal storage clearinghouse.

“We really are in uncharted territory. We have a monster mash-up of the Great Depression in size, the crash of 1987 in speed, and the 9-11 attack in terms of fear.”

Liz Ann Sonders, chief investment strategist at Charles Schwab

Graphics of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

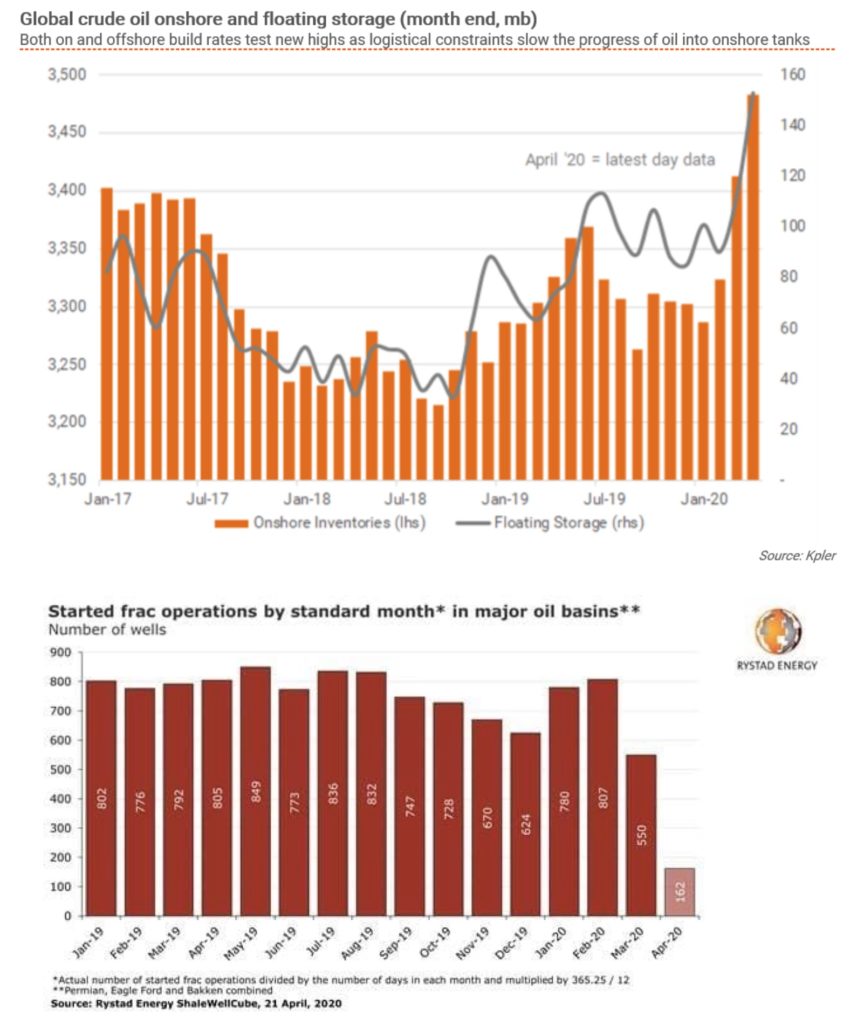

The long-awaited crash in the oil markets came last week when traders finally realized that oil consumption was so low and production was so high that the world was within weeks of having no place to store crude and oil products. The crash, precipitated by the expiration of the May NY futures contract, was violent, falling from $20 a barrel to a low of minus $37 a barrel, a plunge unprecedented in the history of the oil industry. London’s Brent followed New York’s decline and closed out the week at $22 a barrel.

The futures market, however, did not tell the whole story as physical oil spent much of the week trading in single digits a barrel. The prices of actual barrels of crude in Europe, Asia, and Africa plunged to as little as $5, dragging down the entire physical oil market and distressing significant producers. The Dated Brent benchmark, a global reference for nearly two-thirds of the world’s physical flows, plunged to $13.24 a barrel on Tuesday, the lowest since 1999. Dated Brent is used for determining the price of many other physical grades. That means that key European and African crudes will now sell under $10 or even $5 a barrel since many are at hefty discounts to the benchmark, traders said. Grades in Asia are at rock bottom too.

With global oil and product storage due to being full within the next few weeks, prices are so far below any conceivable cost of production that the only answer is to cut oil output as quickly as feasible. The first problem is that we still do not have a solid idea of how much global demand for oil has fallen. A few countries which still have storage space such as China are taking advantage of the low prices to stock up on record-cheap oil, thus inflating the actual consumption.

Estimates of how much global demand has fallen in recent months range from 10 to 40 million b/d. The big unknown is the impact the coronavirus will have on the worldwide economy in coming months. If one assumes that the easing of lockdowns underway in some places will restore at least some of the global economy permanently in the next few weeks, then one can forecast that the drop in global oil demand for 2020 might be only on the order of 10 million b/d. If, however, one assumes that the ultimate impact of COVID-19 is only starting to be felt and that more severe outbreaks are coming with attendant economic impacts, then demand for oil may turn out to be lower than anyone currently realizes.

No matter who turns out to be right, world oil production will have to be curtailed quickly – and by a lot. This is not an easy thing to do as stopping oil production can do severe damage to producing wells and lower the amount of oil that can ultimately be recovered. The Russians are already suggesting that it may be cheaper to burn the oil coming out of a well for a while than risk its long-term potential by closing it down.

Then there is the problem of oil already aboard tankers and in transit. Some 44 million barrels of Saudi crude is expected to reach the US over the next four weeks, according to data from S&P Global Platts. If this oil arrives and is unloaded, it will use up a large share of the remaining storage capacity in the US.

The only oil production that is easy to throttle down is US shale oil production, which requires the drilling of thousands of new wells each year to replace rapidly depleting “legacy” wells. The best indicator of how the shale oil industry is reacting is the rapid drop in the number of oil rigs in operation, which last week fell to a four-year low. Before the coronavirus crisis hit, oil companies ran about 650 rigs in the US. By Friday, more than 40 percent of them had stopped working, with only 378 left.

The amount of oil being taken offline in the US is substantial and likely will be in the millions of barrels per day during the next few months. Nearly all major shale oil drillers have announced cutbacks in capital expenditures, and some say they are shutting down producing shale oil wells as they are no longer economical. The Texas Railroad Commission has been discussing mandatory cuts for production in the state. Still, in the latest update, the three commissioners delayed their vote on the topic until next month. From all available evidence, there is going to be a lot less US shale oil being produced a few months from now. The Canadian oil sands industry has already largely closed down due to production costs exceeding the sale price of a barrel of oil.

In Washington, the Trump administration is working on how to help the beleaguered US oil industry. Ideas range from buying more oil for the strategic reserve to paying producers not to produce and even having the government taking stakes in the energy industry. The big problem is that the Administration has to deal with the Democrat-controlled house, which is opposed to any bailout for the oil industry. Most observers are predicting that the shale oil industry will see a wave of bankruptcies of an unprecedented scale during the next few months.

For the immediate future, we can expect that oil prices will continue to fall as the available storage fills. There are already some 20 million barrels of crude waiting off the California coast as there is no onshore storage capacity left in the state.

2. Geopolitical instability

As the pandemic spreads, shutting down businesses and slowing government revenues, most governments have too much to worry about to carry on confrontations with other countries or political groups. Washington, however, is still carrying on its feuds with Tehran and Caracas despite both being economic basket cases that are being overwhelmed by the virus. The Saudis are trying to tamp down the war with Yemen. Iraq still can’t form a new government. And Moscow is starting to own up to the extent the coronavirus is sweeping across its country.

The US and Iran exchanged invective last week after Tehran launched a “military satellite” and sent a swarm of small patrol boats to harass some passing US warships. President Trump responded by tweeting that he told the US Navy to “shoot down” the patrol boats. The tweet resulted in the Iranian Revolutionary Guard warning that it would target US ships that threatened Iran. Both sides are trying to distract their public’s attention from the virus and deteriorating domestic economies.

The US is still trying to shut off Iranian exports of natural gas and electricity into Iraq. Baghdad needs the imports to keep the lights on, and given the price of oil, does not have the $10 billion required to wean itself off Iranian imports. Iraq already has numerous vital problems, such as the coronavirus, low oil prices, no government, the need to cut oil production under the OPEC+ agreement, and the revival of ISIS attacks on its oil facilities. The only good news is that the Kurds have agreed to help trim oil-production to help with the new OPEC+ cut.

Saudi Arabia plans to draw down $32 billion from its cash reserves and increase borrowing this year by another $32 billion in an attempt to stem the damage from low oil prices and the coronavirus pandemic. The Saudi’s total loans this year will add up to $86 billion, and the country’s GDP is expected to shrink this year. The money the kingdom is spending on the Yemeni war is not helping its situation.

Yemen’s Houthi rebels demanded more concessions from Saudi Arabia last week, including lifting a five-year blockade, before they would resume UN-backed peace talks. The two-week cease-fire ended Thursday. The Saudis say the unilateral truce is a chance to allow Yemen to deal with a looming coronavirus pandemic.

Washington continues to run up the score against the Maduro government in Venezuela. That nation’s troubles grow worse every day. Hardly any gasoline is being produced in the country, and the gas stations have been turned over to the army, which is selling black market gas at $10 a gallon.

Last week, the Trump administration told the remaining American oil companies in Venezuela that they had until December to wind down operations in the country. The US Treasury issued new licenses that only authorizes “limited maintenance of essential operations” in Venezuela, with a wind-down period ending on December 1. Companies affected include Chevron, Halliburton, Schlumberger, Baker Hughes, and Weatherford International.

Essentially, the companies can continue minimal operations in Venezuela but will not be able to export oil. They can only do the bare minimum to comply with contracts; drilling and exporting are barred. Operations will have to end on December 1. Venezuela’s oil production is expected to fall further from the 660,000 b/d it produced in March.

3. Climate change

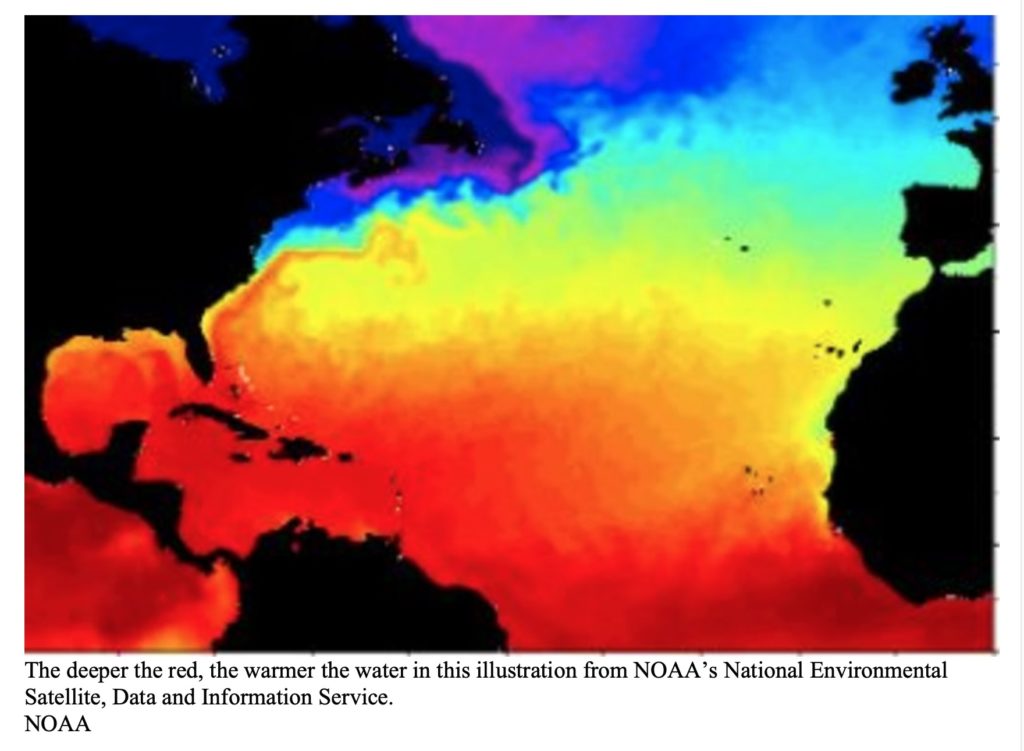

Record high temperatures are causing forecasters to worry that global warming may generate a chaotic year of extreme weather. Parts of the Atlantic, Pacific, and Indian Oceans all hit the record books for warmth last month, according to the US National Centers for Environmental Information. The high temperatures could offer clues on the ferocity of the Atlantic hurricane season, the eruption of wildfires from the Amazon region to Australia, and whether the record heat and severe thunderstorms raking the southern US will continue.

In the Gulf of Mexico, where offshore drilling accounts for about 17 percent of US oil output, water temperatures were 76.3 degrees Fahrenheit (24.6 Celsius), 1.7 degrees above the long-term average, said Phil Klotzbach at Colorado State University. If Gulf waters stay warm, it could be the fuel that intensifies any storm that comes that way.

Record warm water in the Gulf of Mexico spilled over into every coastal community along its shoreline with all-time high temperatures on land, said Deke Arndt, chief of the monitoring section at the National Centers for Environmental Information. Florida recorded its warmest March on record, and Miami reached 93 degrees Wednesday, a record for the date and 10 degrees above normal. Last week a spate of intense storms and tornados passed across the southern US.

Many environmentalists are worried about an uptick in emissions of the lesser-known but more potent greenhouse gas–methane. “Unlike carbon emissions, methane emissions don’t decrease when the world’s economy slows down,” says Poppy Kalesi, at the Environmental Defense Fund. “With lower oil and gas prices, we already see efficiency savings in companies, which means that they might be more relaxed about their environmental protocols.” Atmospheric methane constitutes the second-largest source of global warming after carbon dioxide. Much of that is released during the course of oil and gas production, and much of that, in turn, comes from leaks.

Methane emissions from the Permian basin of West Texas are more than two times higher than federal estimates, a new study suggests. The findings, published in the journal Science Advances, reaffirm the results of a recently released assessment and further call into question the climate benefits of natural gas. Using hydraulic fracturing, energy companies have increased oil production to unprecedented levels in the Permian basin in recent years.

Just how much methane leaking into the atmosphere will be suppressed by the ongoing cutbacks of the US shale oil production is an open question. If abandoned wells are shut down properly, it could help the situation. However, if there is a rush to pull out of a basin as cheaply as possible, the situation could get much worse. There are thousands of miles of deteriorating natural gas pipelines in the US, which are continually leaking methane. Unless there is money to replace these pipelines, the situation is bound to deteriorate.

4. The global economy

During the last three months, the changes to the global economy wrought by the coronavirus are unprecedented in history. As the virus spread from central China to nearly every part of the world, a few countries moved swiftly to close down large parts of their economies to halt the virus’s spread. Other countries, for a variety of reasons, tried to ignore the epidemic until their body counts became too high to be ignored.

The consumption of motor fuels is down on the order of 40-50 percent, causing havoc in the oil industry. Many national borders are closed. Most non-essential retail establishments have closed or had their operations restricted, and hundreds of millions of people are confined to their homes. The efficacy of these measures to limit inter-personal contact appear to be working, but most experts say it is too soon to relax the restrictions.

A significant problem is in countries where the leaders believe that keeping the economic impact of the epidemic as small a possible is vital to their remaining in power. There is evidence that in many countries, the actual number of infections and deaths is several times more than the “official” counts. In many countries, people who died from the virus never sought medical care even if it was available. This problem will become more severe as the infection spreads into Third World countries with limited medical facilities.

China, where the virus first appeared, seems to be the most successful in slowing its spread. For the past month, official government statistics have been saying that few new cases of domestic origin have been reported. This claim is suspect. The government has relaxed some, but not all, of its quarantine and travel restrictions and claims its economy is getting back to “normal.”

However, last week Chinese officials imposed new limits on movement in some northern parts of the country following a spate of new coronavirus infections. This is an indication of how difficult it will be to fully recover from the outbreak that virtually paralyzed that country. The restrictions imposed over the past week include the city of Harbin, with a population of 10 million, in northeastern China. Other cities in the region have also imposed restrictions.

While the Chinese government has ordered its largest firms back into operation, there is the question of who, other than the government, is going to buy the products of the reopened factories. Most of China’s foreign customers are in their own lockdowns and not interested in importing much from China these days. There also is uncertainty as to whether large numbers of Chinese consumers are ready to go shopping again despite the dangers of the virus. Additionally, there is the problem with a constrained delivery system of goods via container ship that used to flow more smoothly.

While March data showed a pickup from China’s economic slump during the first two months of the year, early indicators for this month show domestic demand as still very weak and companies remaining cautious. If Beijing wants to keep its economy growing in the immediate future, it will likely turn to its old standby – state-financed infrastructure projects, whether they make economic sense or not.

Outside of China, the economic news from most industrialized, and even semi-industrialized countries such as India, is mostly bad. Much of Europe, India, and the US are still under lockdown – leading to near-record levels of unemployment and lower economic activity.

The bottom line is that nearly the entire world is in the throes of fighting the coronavirus. The situation is likely to be worse than governments and financial institutions are saying. During the last week, concerns about stability of the world’s food supply have started to appear as meatpackers and other agricultural product processors are forced to close. The problem is not the growing of food but the ability of complex supply chains to get food processed and to consumers. Even China is raising concerns about the impact on food supply, with a top agricultural official saying, “The fast-spreading global epidemic has brought huge uncertainty on international agriculture trade and markets.”

The primary issue around the world, however, continues to be how soon governments can start lifting restrictions on economic activity. Many are currently debating how fast economic activity other than “essential” can be restored without suffering unacceptable numbers of victims.

5. Renewables and new technologies

The best alternative to battery-electric vehicles as replacements for internal combustion engines is widely believed to be hydrogen, and several significant manufacturers already offer hydrogen-fuel cell cars in limited quantities. The problem has always been how to make hydrogen fuel at competitive prices and to distribute it to new and potential consumers. Producing hydrogen by splitting it off natural gas results in unacceptable amounts of carbon emissions, and the electrolysis of water is too expensive. In recent months, however, there has been progress in using solar power to split hydrogen from water or even to use cheap solar energy to produce hydrogen.

Another problem is how to transport hydrogen to refueling stations and store it in tanks and vehicles until it is needed. However, a solution to his question may be in the offing. A team of scientists from Northwestern University says they have developed an ultra-porous material, called a metal-organic framework, or MOF, that can be used for storing hydrogen. An MOF is a framework of organic molecules and metal ions that self-assemble into a multidimensional structure. As the lead author of the project, associate professor Omar K. Farha says, “envision a set of Tinker toys in which the metal ions or clusters are the circular or square nodes, and the organic molecules are the rods holding the nodes together.”

Another technology that is making progress is wireless electric charging for trucks. Researchers at the Department of Energy’s Oak Ridge National demonstrated a 20-kilowatt bi-directional wireless charging system installed on a medium-duty, plug-in electric delivery truck. The project is the first of its kind to achieve power transfer at this rate across an 11-inch air gap, advancing the technology to a new class of larger vehicles with higher ground clearance.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

Storage squeeze: Oil traders are struggling to find enough ships, railcars, caverns, and pipelines to store fuel as more conventional storage facilities fill up amid abundant supply and plummeting demand due to the coronavirus crisis. Dozens of oil tanker vessels have been booked in recent days to store at least 30 million barrels of jet fuel, gasoline, and diesel at sea, acting as floating storage, as on-land tanks are full or already booked. (4/22)

Tanker scrubber squeeze: The gap between those voicing the merits of scrubber economics longer-term and shipowners’ appetite to install them is growing ever wider as oil prices continue to hit fresh lows. Shipping company Stolt-Nielsen just last week said it plans to cancel installations of gas exhaust cleaning systems where possible as it looks to find savings of $30 million in capital spending in its tanker division. (4/22)

North Sea hit: For decades, the oil rigs rising out of the North Sea off Scotland provided Britain with hundreds of thousands of jobs in a thriving industry and billions in tax revenue. The collapse in oil prices from the coronavirus pandemic, coupled with infections aboard the drilling rigs, is imperiling the vast industry that sprawls across the waters off Scotland and Norway. Oil companies are shelving investments worth billions of dollars. (4/23)

Two projects delayed: As oil prices collapse, Shell is postponing the final investment decisions for two planned projects, one in the US Gulf of Mexico and another in the UK North Sea. (4/23)

A Russian pipelaying vessel expected to complete the controversial Nord Stream 2 gas pipeline from Russia to Germany is now headed for Northern European waters. Just 160 km of Nord Stream 2 is left to lay in Danish waters out of the total 2,460 km length. (4/25)

Saudi Arabia has made good on its early-March promise to flood the world with oil. Still, with demand collapsing and storage filling fast, the world’s top oil exporter must now keep its unsold crude on supertankers at sea as no one is rushing to take delivery of oil they can’t process or store. Around the world, at least one in every ten very large crude carriers–each capable of holding 2 million barrels of oil–currently acts as floating storage. (4/23)

India is quickly running out of space to store a swelling stockpile of fuel as every possible container — including those in the 66,000 pump stations nationwide — threatens to overflow. Refiners in India, the world’s third-biggest oil consumer, have filled 95 percent of about 85 million barrels of fuel storage capacity, according to officials at three state-owned processors. Consumption for diesel and gasoline, which account for more than half of India’s oil demand, dropped by more than 60 percent in the first half of April. (4/22)

Australia has finalized a deal with the US to create its first emergency oil stockpile and store it in the US Strategic Petroleum Reserve caverns on the Gulf Coast. The Australian energy ministry said Wednesday that it would spend $59 million to buy crude at current low prices and store the supply in the SPR for an initial period of 10 years. (4/23)

Argentina plans to issue a decree setting a higher local oil barrel price to protect the domestic industry from being further decimated by a collapse in global prices and slumping fuel demand due to the coronavirus pandemic. Refiners are not purchasing all the crude that is being produced, and storage space is growing scarce pressuring prices even more. (4/24)

Mexican hedges: As the oil price crash squeezes oil companies across the globe, Mexico’s Hacienda Hedge is set to deliver $6.2 billion worth of oil. Mexico has been insulated from this week’s extremely volatile oil prices in that their hedging allows Mexico to sell its oil at a price that was determined earlier—before the price crash. In this case, Mexico hedged at $49 per barrel. The current Mexican basket price is hovering a bit above $7 per barrel—a fine save for Mexico. (4/23)

Mexico’s president says his country will shut down new wells in a move that comes just over a week after he almost wrecked a global oil deal by refusing to make deep output cuts. The country invested last year in drilling new wells, Andres Manuel Lopez Obrador said. But “now that oil has no value, we can shut down the valves,” he added. His reasoning: Valves on newer wells “don’t lose pressure” like those on older wells. (4/22)

Mexico’s Pemex declared force majeure on gasoline imports, which it receives from the United States, because of tanking demand. Bloomberg quoted an unnamed source that said there were several tankers carrying fuel from the US and waiting to unload in Mexico. They were, however, unable to do so. Fuel consumption at gas stations fell by as much as 50 percent as Mexicans follow the stay-at-home order. The logjam is about 60 vessels waiting. Each ship carries, on average, 300,000 barrels, bringing the total on the water to about 18 million barrels. (4/25)

Canadian oil companies have begun shutting down steam-driven oil sands production projects as prices continue to fall. The move could have dire long-term consequences for the production facilities. To ensure long-term production within steam-driven oil sands production, the temperature and pressure at such sites must be maintained at a certain level. Disruption could result in permanent damage, which would translate into a permanent loss of production. (4/21)

The US oil rig count shed 60 units last week, dropping the total to 378, down by 53 percent from one year ago, Baker Hughes reported. Gas rigs declined by 4 to 85, down by 54 percent year-over-year. (4/25)

Pipeline storage: pipeline giant Energy Transfer will be asking the Texas Railroad Commission to allow it to idle two pipelines in Texas and turn them into the room for around 2 million barrels of oil, the company told Argus Media this week. US oil producers are struggling amid collapsing demand and oil prices while inventories across America are growing. (4/25)

Deepwater Horizon lessons unlearned: Shortly before 10 p.m. on April 20, 2010, an explosion ripped through the Deepwater Horizon drilling rig in the Gulf of Mexico, unleashing the worst offshore oil spill in US history. This triggered what were supposed to be systemic changes to ensure such a disaster could never happen again. Now, a decade later, all seven members of the bipartisan national commission set up to find the roots of the accident and prevent a repeat said many of their recommendations were never taken seriously. (4/20)

Arctic barrier: The latest front in the war against drilling for oil in Alaska’s rugged wildlife refuge isn’t Washington — it’s Wall Street. Activists trying to keep rigs out of the Arctic National Wildlife Refuge are now focused on choking off the flow of money needed to exploit the reserve. As big as South Carolina, the reserve is home to caribou and grizzlies — and possibly billions of barrels of oil. (4/25)

Net exports: Thanks to lower net imports of crude oil and higher net exports of natural gas, gross US energy exports hit a record-high in 2019, exceeding total energy imports for the first time since 1952, the US EIA said. While gross energy exports hit a record high, the US energy imports fell to their lowest level in nearly 25 years. (4/21)

A California regulator has asked PG&E Corp for governance and oversight changes in its reorganization plan, while also proposing penalties of about $2 billion on the San-Francisco based utility for its role in causing the devastating 2017 and 2018 wildfires in California. The proposal from the regulator “will require PG&E to modify its governance structure, submit to an enhanced oversight and enforcement process if it fails to improve safety, and create local operating regions,” the California Public Utilities Commission said late on Monday. (4/21)

Electric demand off: The coronavirus pandemic has cut power demand by 8 percent to 9 percent in various US markets, with some market regions – New York City, for example – having much more demand destruction. Weather-adjusted load growth was sluggish in 2019, even before the coronavirus impacted demand. (4/23)

US coal-fired power generation totaled 56.1 TWh in February, down 14 percent from January, US EIA data showed. From the year-ago month, the generation was down 29.9%. From the five-year average of about 93.7 TWh produced in February, generation was at a 40.2 percent deficit this year. Out of total power generation, coal took a 17.7 percent share, down 1.5 percentage points from January. (4/25)

US power sector coal stockpiles totaled 140 million st in February, up 4.4 percent from January, US EIA data showed Friday. From the year-ago month, inventories were up 41.8 percent and were at their highest since November 2017. (4/25)

Weekly US coal production tumbled to an estimated 8.62 million tons in the week ended April 18, down 7.5 percent from a week earlier and 41.5 percent lower than the year-ago week. (4/24)

No coal aid $$: Trying to get government support for the US coal industry during the coronavirus pandemic isn’t yet working. Aid remains stubbornly clogged for an industry whose already rapid decline is accelerating because of the economic effects of the virus. (4/21)

Stiff-arming coal: Citigroup will stop providing financial services to thermal coal-mining companies over the next ten years to help accelerate the economy’s shift away from fossil fuels. By 2025, the bank won’t provide underwriting and advisory services to the industry and will cut its credit exposure in half, Citigroup said Monday. (4/21)

NY wind: New York regulators gave the green light for the New York State Energy Research and Development Authority to issue an offshore wind solicitation for at least 1,000 MW. The Public Service Commission’s April 23 order approving the request said moving ahead with a solicitation would “maintain New York’s trajectory in meeting its clean energy goals.” The state wants to source 70 percent of its electricity needs from renewable energy by 2030 and to reach 100 percent carbon-free electricity by 2040. (4/25)

Germany’s solar panels produced record amounts of electricity, exacerbating market forces that were already hammering the profitability of the country’s remaining coal plants. The government forecasts that green power will make up about 80 percent of the electricity mix by 2038, compared with just over 40 percent in 2019. (4/21)

Hurricane season coming: With scientists predicting an above-average Atlantic hurricane season this year, a new North Carolina Climate Science Report warns that the state needs to brace for a future of wetter and more intense hurricanes, plus other climate disruptions. (4/25)

EVs cleaner: Amid a global transport industry crisis brought about by the coronavirus pandemic, a study from clean energy nonprofit Transport and Environment has added strength to the argument that EVs emit far less CO2 than internal combustion engine vehicles do over their lifetimes. The main finding of the study was that on average, electric cars, at least those in Europe, emitted three times less carbon dioxide than internal combustion engine cars. (4/24)

Global vehicle production is now expected to fall more than 20 percent to around 71 million in 2020 as a result of the Covid-19 pandemic and ensuing recession, a top automotive forecaster said Monday. (4/21)

Food hits limits: At a Publix store in St. Petersburg, Florida, handmade signs limit customers to two packages of beef, pork, and Italian sausage. In Toronto, shoppers at a west end Loblaws can’t buy more than two dozen eggs and two gallons of milk. Spoiled for choice before the pandemic, North American shoppers are finding they can’t get everything they want as grocery stores ration in-demand items to safeguard supplies. (4/23)

China’s BRI issues: The BRI is a far-reaching plan for transnational infrastructure development, linking five continents through land and sea corridors and industrial clusters. Launched in 2013, it was initially planned to revive ancient Silk Road trade routes between Eurasia and China. Still, the scope of the BRI has since extended to cover 138 countries, including 38 in sub-Saharan Africa and 18 in Latin America and the Caribbean. As the coronavirus-induced economic slowdown threatens to increase the debt burdens on developing economies and places China itself under added fiscal pressure, Chinese loans linked to BRI projects are once again in the spotlight. A 2019 study by the Germany-based Kiel Institute for the World Economy found China was the world’s largest bilateral creditor, and that the combined debt owed to China by 50 developing countries had grown from an average of 1 percent of their GDP in 2015 to 15 percent by 2017. (4/22)