Editors: Tom Whipple, Steve Andrews

Quotes of the Week

“In terms of transportation fuels, this is what the oil industry is facing: an unprecedented, and until now unimaginable collapse in demand that has persisted for over four weeks. While it may improve ever so gradually as we move forward, it will remain at multi-decade low levels until the US economy’s travel and commuting patterns, and its shipping patterns find their way to whatever the new normal might look like.”

Wolf Richter, The Wolf Street Report

Graphics of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Crude posted its first weekly gain in a month as global production cuts start to lift physical markets. Futures in New York rose 17 percent last week to close at $19.78 in NY and $26.44 in London. Oil companies have announced significant production closures with Chevron saying it will shut down as much as 400,000 barrels of daily output, and Exxon reporting it will cut rigs in the Permian Basin by 75 percent by the end of the year. At the same time, OPEC+’s pledge to trim supply by 9.7 million b/d has gone into effect. Algerian Energy Minister Arkab, who holds OPEC’s rotating presidency, called on members of the cartel to implement more than 100 percent of their agreed production cuts. Globally, the number of rigs drilling for oil and gas fell almost 20 percent in April, and in the US, the oil rig count dropped by 53 to 325, a seventh straight week of declines.

After the collapse of the previous OPEC+ deal in early March, the cartel opened the taps in April, pumping at its highest level in 13 months. Top producer Saudi Arabia and close ally the UAE saw their output jump to records last month, more than offsetting declines in Iran, Libya, and Venezuela. OPEC pumped a total of 30.25 million b/d of oil in April—the highest level since March 2019 and a rise of 1.61 million b/d compared to March 2020. Saudi Arabia was the major contributor to the higher OPEC supply as it produced a record volume of 11.3 million b/d in April, according to the Reuters survey.

Crude came off highs during the session on Friday due to lingering concerns over a glut of oil and a lack of places to store it. “We are going to be facing a storage capacity situation at Cushing,” said Robert Yawger, director of the futures division at Mizuho Securities USA, referring to the key US hub in Oklahoma.

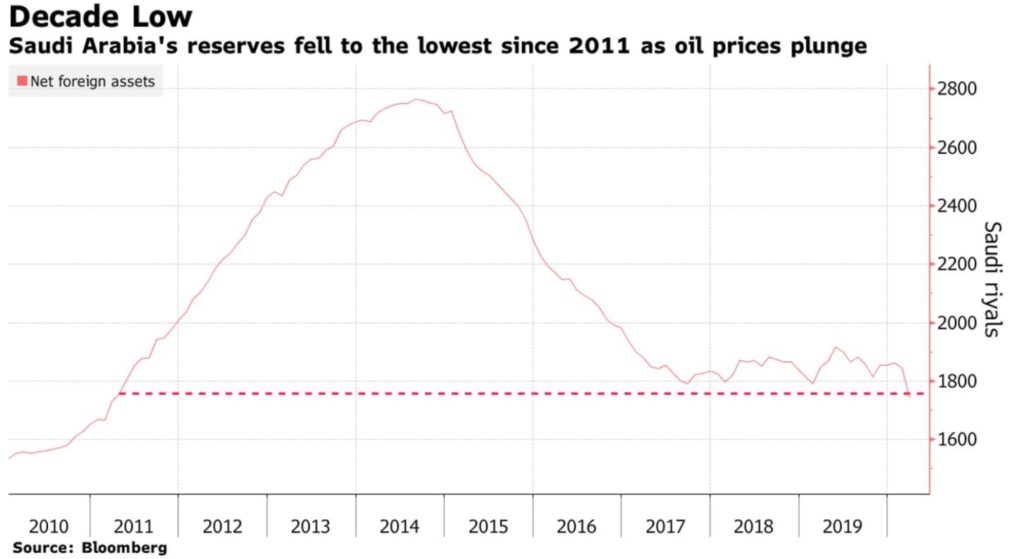

Moody’s projects that Saudi’s fiscal deficit will widen to more than 12 percent of GDP in 2020 from 4.5 percent of GDP in 2019. This will cause government debt to increase to around 38 percent of GDP by the end of 2021. The price of Brent crude crashed by more than 50 percent in March and has fallen further since. It trades around $26 a barrel — far short of the $76.10 the International Monetary Fund estimates Saudi Arabia needs to balance its budget.

2. Geopolitical instability

Crown Prince Mohammed bin Salman’s plans are unraveling. After a failed boycott of neighboring Qatar, a disastrous military campaign in Yemen, and international condemnation over the gruesome murder of columnist Jamal Khashoggi, this was going to be a time for him to regroup. Now, he’s been hit by a devastating oil price war and the destruction of the coronavirus, which has led to travel bans that slowed tourism to a halt and stopped the influx of much-needed foreign labor. The Prince now faces some tough choices about which projects at home and which forays overseas he can realistically afford. There are signs the kingdom is taking less of a hard line on regional foes Iran and Qatar, and it announced a cease-fire in Yemen earlier this month.

Venezuelan President Maduro appointed his economy vice president, Tareck El Aissami, who has been indicted in the US on drug trafficking charges, as oil minister, amid acute fuel shortages across the country. Maduro also named Asdribal Chavez, cousin of the late President Hugo Chavez, as interim president of PDVSA. Venezuela’s 1.3 million-barrel-per-day refineries have all but collapsed after years of under-investment. US sanctions aimed at ousting Maduro have strangled fuel imports, prompting Venezuelans to either wait hours outside gas stations or turn to the pricey black market.

Halliburton will suspend most of its operations in Venezuela, the company announced, after Washington banned US companies operating in the country from drilling for oil, transporting it, or providing any equipment for use in Venezuela. The Trump administration also banned Halliburton from the design, construction, installation, repair, or improvement of any wells or other facilities or infrastructure in Venezuela or the purchasing or provision of any goods or services, except as required for safety.

Venezuela seems to be changing tactics when it comes to managing its oil resources. PDVSA is considering a significant industry reform that would increase private company activities in its troubled oil industry, according to a document seen by Reuters. This would be a far cry from its current socialist agenda that allowed only a limited role of private oil companies in the country.

3. Climate change

The International Energy Agency expects carbon dioxide emissions to decline by 8 percent this year due to the devastation the coronavirus wreaked on energy demand. However, experts cautioned that the drop should not be seen as good news for efforts to tackle climate change. When the pandemic subsides, and nations restart their economies, emissions could quickly soar again unless governments make concerted efforts to shift to cleaner energy as part of their recovery efforts. “This historic decline in emissions is happening for all the wrong reasons,” said Fatih Birol, the agency’s executive director. “People are dying, and countries are suffering from enormous economic trauma right now.

There is good news for renewables, however. According to the IEA, demand for energy from renewable sources of energy will increase this year, bucking the trend. This would be possible thanks to low operating costs and “preferential access to many power systems”. Right now, however, the state of electricity demand is dramatic. Every week, according to the IEA, countries in full lockdown are experiencing a 25-percent drop in demand. For countries on partial lockdowns, the rate of energy demand loss is a little lower but still significant, at 18 percent a week.

European utilities with bulging renewable energy portfolios are showing that the way out of the coronavirus slump is colored green. Energy companies from Orsted to Iberdrola reported robust first-quarter earnings in a period that has seen a downturn in energy demand and a collapse in gas prices. Owning significant wind and solar portfolios has so far protected those companies from the worst effects of the crisis.

Germany has become a model for countries around the world, showing how renewable energy could replace fossil fuels in a way that drew broad public buy-in by passing on the benefits—and much of the control—to local communities. The steps Germany took on this journey, and the missteps it made along the way, provide critical lessons for other countries seeking to fight climate change.

Germany’s experience holds many lessons for the US. The two countries have a lot in common, economically, and culturally. They are heavily industrialized economies with powerful energy and automotive industries. Both were built, in part, using inexpensive coal power, and both have emissions challenges partly shaped by car cultures that are difficult to change.

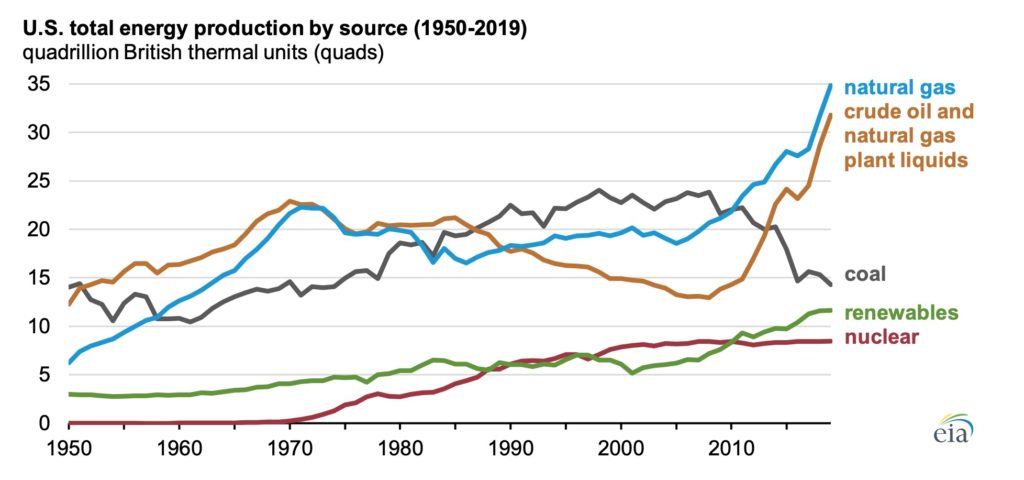

However, while Germany has made immense progress on climate and clean energy, the US has lagged far behind. Germany now generates 43 percent of its electricity from renewable sources, compared with 17.5 percent in the United States.

The flames across the Permian Basin have sparked criticism from investment bankers and shale pioneers who say the energy industry is wasting a valuable resource by burning off natural gas. Yet the flares are proving a more significant contributor to climate change if they are unlit. The Environmental Defense Fund recently surveyed more than 300 sites in the Permian and found that roughly 1 in 10 flares were unlit or malfunctioning. That means more gas is being released straight into the atmosphere, contributing a lot more to the basin’s methane emissions than previously thought.

Flaring is meant to get rid of fuel that companies can’t or don’t put into pipelines by burning off methane, a greenhouse gas at least 30 times more potent than carbon dioxide at heating the planet. The practice has skyrocketed in the last few years as output in the Permian has surged.

The 2,500-mile Mekong is one of the world’s longest rivers – winding through China, Myanmar, Laos, Thailand, Cambodia, and Vietnam – and millions of people rely on it daily for food and income. During the last two decades, China has built 11 dams along the tributaries of the Mekong river affecting the food and livelihood for millions of people downstream in Southeast Asia.

The annual flood pulse is critically essential to drive the natural resource base of the Mekong, which produces 20 percent of the world’s freshwater fish catch and supplies the livelihoods of tens of millions. A new study of the Mekong water flow says that Southeast Asia would have likely experienced much less severe drought last year if it were not for China’s dams. The study confirms what locals, especially those living along the Mekong on Thai-Lao border in Chiang Rai, have experienced for over two decades – unusual water fluctuations. “This includes extended (and/or unseasonal) drought conditions and sudden water level rises.” The study found that during last year’s wet season, China had above average water, but that did not flow downstream to other countries.

The system of dams “has disrupted downstream flows of water, sediment, and vital nutrients, which in turn have had devastating impacts on the ecosystem and aquatic resources important for communities living in the Lower Mekong countries.” China’s Foreign Affairs Spokesperson Geng Shuang, however, appeared to have partially dismissed the findings of the study. The state-owned Xinhua news agency quoted Geng as saying natural conditions caused the drought. But he also promised to improve the sharing of information about the Mekong with countries downstream.

The situation on the Mekong is a lot like the one in the Middle East where Iraq’s water crisis is intensifying as Turkish dams curb water flows to the Euphrates and Tigris Rivers. Most of the water coming down to the lower reaches of the two rivers comes from the Turkish highlands where Ankara is building large-scale irrigation and water-management projects. Syria has also been directly impacted by Ankara’s dam-building projects, which have reduced water flows to Syria by an estimated 40 percent.

4. The global economy

The story of the coronavirus’s impact on the world’s economy has yet to be written. Around the world, billions of people are still quarantined or living under social separation rules that severely restrict economic activity. Until either a vaccine for the virus is developed and disseminated to the 7.6 billion of us, or a “herd immunity” arises under which some 60-70 percent of the world’s population has been infected by the virus, this story will go on. Last week parts of the US and Europe relaxed harsh stay-at-home mandates, which had stopped much economic activity.

This relaxation of the lockdown in the US and EU came with complex rules of social behavior that are supposed to slow the growth of the contagion. It will be several weeks before we know how well the new standards work, and even more important is whether a critical mass of people is willing to risk lives by engaging in “non-essential” economic activities such as going to shopping malls. If this vital mass does not form, then many formerly profitable commercial businesses will not be profitable until the epidemic is over, which could take years.

In the meantime, global air travel is virtually halted, although the Chinese claim it has started up again while giving few details. Many international borders are closed, and there is close to zero tourist industry in operation. Even more severe is that the global supply chain has been severely damaged, and many economic enterprises can no longer receive adequate supplies of raw materials, parts, or finished goods. In the past week, the specter of global food shortages have arisen.

The US economy contracted in the first quarter at its sharpest pace since the Great Recession as stringent measures to slow the spread of the novel coronavirus almost shut down the country. The drop in the GDP at an annual rate of 4.8 percent reported on Wednesday reflected a plunge in economic activity mostly in the last two weeks of March. The rapid decline in GDP reinforced analysts’ predictions that the economy was already in a deep recession and left economists bracing for a record slump in output in the second quarter.

With much of the economy paralyzed, the Congressional Budget Office has estimated that economic activity will plunge this quarter at a 40 percent annual rate. “The longer consumers are stuck at home and workers can’t get to their jobs, the greater the structural damage to the US economy — permanent loss of household income, permanent business closures, permanent job losses, reduced business investment — which would prevent a strong rebound,” said Gus Faucher, chief economist at PNC Financial Services Group.

With a flood of unemployment claims continuing to overwhelm many state agencies, economists say the job losses may be far worse than government tallies indicate. The Labor Department said Thursday that 3.8 million workers filed for unemployment benefits the week before last, bringing the six-week total to 30 million. But researchers say that millions of others have lost jobs but have yet to see benefits. Traffic congestion and hours worked in South Carolina, and other states in which lockdowns were eased late last week, indicate workers and consumers haven’t resumed their pre-pandemic routines.

The eurozone economy contracted at a record rate, and by more than expected in the first three months of the year, as much economic activity in March came to a halt because of the pandemic. According to a preliminary flash estimate of the European Union’s statistics office Eurostat, economic output in the 19 countries sharing the euro in January-March was 3.8 percent smaller than in the previous three months — the sharpest quarterly decline since the time series started in 1995.

German officials signaled there won’t be a significant further easing of restrictions on public life for at least another week as data showed coronavirus infections in Europe’s biggest economy rose the most in four days. Helge Braun, who heads Chancellor Merkel’s office, said limits on public contact would be extended at least until May 10, in line with a strategy already adopted by regions including Bavaria. Both Braun and Stephan Weil, the premier of Lower Saxony, said that officials want to wait for data on the impact on the outbreak of this week’s reopening of some shops. Two weeks of information is needed to provide a reliable basis for discussion on a potential further easing of curbs.

As the coronavirus outbreak ebbs in China, the country’s companies and officials have made significant strides in restarting its economy. Its factories are humming again, and even air pollution is coming back. Empowering consumers could be a more demanding task. Many lost their jobs or had their pay slashed. Still others were shaken by weeks of idleness and home confinement, a time when many had to depend on their savings to eat. For a generation of young Chinese people known for their American style shopping sprees, saving and thrift hold an immediate new appeal. Beijing can pour money into its economy, start massive infrastructure projects, and lift travel restrictions. Still, it can’t spur export demand from foreign customers or from its consumers who are afraid to go shopping or patronize restaurants.

China’s first-quarter total services trade fell 10.8 percent from a year earlier to $162 billion, according to the Ministry of Commerce. Services exports in the Jan.-to-March period declined 4.1 percent while imports dropped 14.5%, the ministry said on May 2. The narrowing of the trade deficit that started last year continues, it said.

SAIC Motor, the biggest automaker in China, said the coronavirus outbreak is set to hit its profitability for months to come after earnings slumped in the first quarter. First-quarter net income at the partner of Volkswagen AG and General Motors Co. plunged 82 percent to $158 million as revenue fell 48 percent. Car sales in China are falling for the third year.

China is suffering its own oil crisis resulting in Capex cuts for its major oil companies that seek to derail Beijing’s plans to get a stronger foothold in the world’s oil market. China’s three largest state-run oil and gas companies—PetroChina, CNOOC, and Sinopec—are making significant cuts in their 2020 spending plans as oil prices falter. CNOOC will cut Capex this year by 11 percent over previously published figures to $10.6-12.0 billion. It will not only reduce CAPEX at home but abroad as well, including across its operations in Canada and the United States.

Flight bookings in China surged by up to 15 times after Beijing relaxed quarantine rules. The Chinese capital had until Wednesday lived under some of the strictest coronavirus preventive measures in the country, including a mandatory 14-day quarantine for anyone arriving in the city. That requirement was scrapped from Thursday for travelers from low-risk areas of China, just ahead of a five-day May Day holiday, beginning on Friday.

Harbin, a northeastern Chinese city of 10 million people, is struggling with the country’s biggest coronavirus outbreak, and shut dine-in services on Saturday, as the rest of China eases restrictions designed to hamper the spread of the disease. Catering services operating in the city, such as barbecue eateries and those selling skewers, shabu, and stew, suspended dine-in meals until further notice.

Three-fifths of new coronavirus cases in China showed no symptoms of the illness when they were diagnosed, according to data that is likely to complicate moves by governments around the world to lift strict lockdown measures. A Financial Times analysis of the more complete data into Covid-19 that the Chinese government began publishing at the start of April found that 60 percent of confirmed cases recorded over the past month were non-symptomatic at the time of testing. The prevalence of non-symptomatic instances will be a concern for the authorities not just in China but around the world as they seek to reopen their countries. It suggests that large numbers of people are likely to be out in the community spreading the virus without knowing it.

Russian crude and condensate production in April totaled 11.3 million b/d, up 0.5 percent on month and 1 percent on year. Russia was free to produce at will in April, as the previous OPEC+ agreement expired at the end of March, and the current deal only came into force at the beginning of May. Russia initially expected to increase output by 200,000 b/d in April, but the impact of the coronavirus pandemic and the sharp fall in oil prices affected these plans. From May, Russia has agreed to cut production under the latest OPEC+ agreement significantly. It decided to cut crude output by 2.5 million b/d in May and June, 2 million b/d in July-December, and 1.5 million b/d in January 2021-April 2022. Its baseline for cuts is 11 million b/d. On Wednesday, Russian energy minister Alexander Novak said he expects Russian oil output to be down 19 percent in May from February 2020 levels. He said that production is likely to fall by 10 percent on year in 2020.

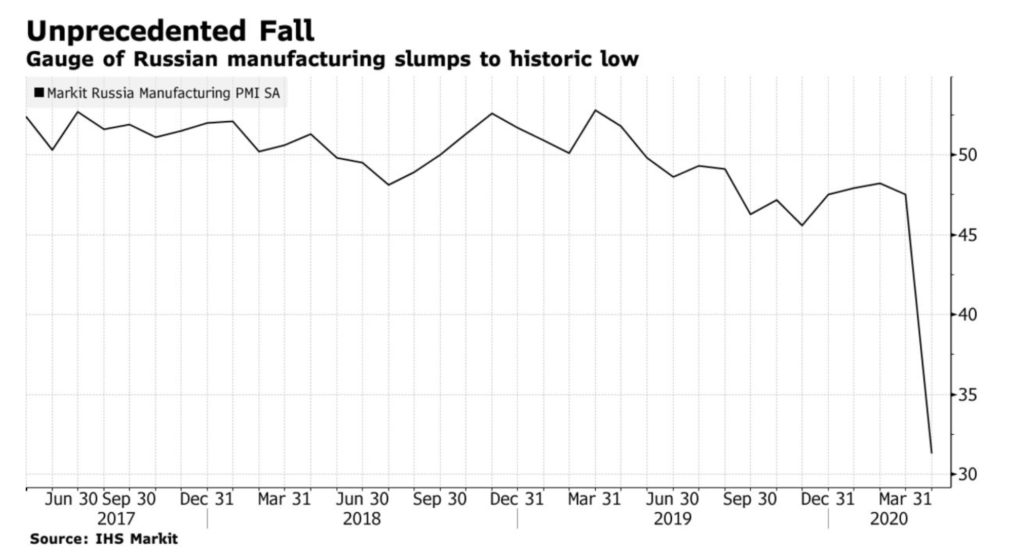

A gauge of Russian manufacturing slumped to the lowest level since records began in 1997 as lockdowns across Europe choked demand. “Output and new orders contracted at unprecedented rates as domestic and foreign client demand slumped,” Sian Jones, an economist at IHS Markit, said in a statement. “A depreciation of the ruble and supplier shortages drove costs higher, with some firms still partly able to pass costs on to clients.” The indicator gives the first sign of how badly Russia’s economy could be hit by the fallout from the coronavirus. President Putin could be heading for the deepest contraction of his 20-year reign as the world’s biggest energy exporter takes a double blow from the pandemic and the slump in oil prices.

Moscow’s mayor has warned that Russia’s coronavirus outbreak is likely to be far more extensive than government data suggest. The government said the official number of Covid-19 cases jumped by more than 10,000 on Sunday to 135,000 with 1,100 deaths, a new record daily increase and the largest outside the US. The figure underscores warnings from the Kremlin that the pandemic will continue to spread. Moscow’s mayor said on Saturday that a new survey using improved testing methods suggested 2 percent of the capital’s citizens were infected with coronavirus, equal to more than 250,000 people, or four times the number of officially confirmed cases in the city.

Prime Minister Mishustin announced he had been diagnosed with the new virus and was temporarily stepping down to recover. President Putin has admitted that there is a shortage of protective kits for medics as the country battles the coronavirus. Putin warned that the peak of the coronavirus infection rate had not yet been reached in the country, and the population must remain vigilant.

5. Renewables and new technologies

In the move towards non -polluting sources of energy, the power of tides and moving rivers, which is available 24/7, has not been exploited anywhere close to wind and solar. Only a few significant tidal power stations are in service anywhere in the world. Last week, however, a new tidal station was installed in China. The 18-meter (59 feet) turbine was manufactured in Wuhan and was lowered into the waters between two islands in the Zhoushan archipelago, south of Shanghai.

Developers of tidal stream projects have long promised that the technology could be a renewable power source that’s more reliable than wind and sunshine. However, by the end of last year, Bloomberg NEF estimated only 12 megawatts of tidal power projects had been built worldwide. If the Chinese go into large scale production of tidal turbines, there is likely to be a considerable drop in the costs making them more competitive with wind turbines.

In South Korea, plans are underway to invest $246 million in facilities to produce and distribute liquid hydrogen suitable for hydrogen/fuel cell cars. The new plant will have an annual production of 13,000 tons of liquid hydrogen—enough to fuel 100,000 sedans. It will be the world’s single largest liquid hydrogen manufacturing facility and is expected to be completed in 2022.

Windows that let in light and produce electricity at the same time would have considerable potential if they can be made to work. Making a thin solar-cell film to stick on window glass is easy enough. Making it convert sunlight into electricity at any useful level of efficiency is the hard part. Scientists from Australia say they have developed a new kind of semi-transparent solar cell with an organic conductor that can be transformed into a polymer. The new solar cells have a conversion efficiency of between 15 and 20 percent.

In another development, The National Renewable Energy Laboratory has been able to build composite Silicon-Perovskite cells with an efficiency of 27 percent compared to just 21 percent when only silicon is used. These developments suggest that solar power has become more affordable than ever before. According to the International Renewable Energy Agency, solar power generation is now fully competitive with fossil fuel power plants, with the global weighted average levelized cost for utility-scale solar PV cells having declined 75 percent to below ten cents a kWh.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

Global gas prices witnessed a historic convergence over the past week as pandemic-fueled economic shutdowns across the globe continue to erode demand and fill regional storage inventories. In Northeast Asia, Europe, and the US, benchmark month-ahead gas contracts all traded Wednesday in the mid-$1.80s/MMBtu. As the worldwide supply glut continues to linger, many analysts now anticipate global gas prices to remain depressed through 2020. Global LNG prices aren’t likely to recover before next winter, as the supply surplus and trade uncertainty continue to weigh on the market. (4/30)

LNG cratering: The global market for natural gas is also cratering. At least 20 cargoes of US liquefied natural gas (LNG) have been cancelled by buyers in Asia and Europe. The global pandemic and the unfolding economic crisis have slashed demand for gas worldwide. Cheniere Energy has seen an estimated 10 cargoes cancelled by buyers halfway around the world. The price for LNG in Asia was already crashing before the pandemic, owing to a substantial increase in supply last year. Prices for LNG in Asia for June delivery have recently traded at $2/MMBtu, only slightly higher than Henry Hub prices in the US. As recently as October, LNG prices in Asia traded at just under $7/MMBtu. (4/28)

Demand drop, generation shifts. The coronavirus lockdown will cause the biggest drop in energy demand in history, with only renewables managing to increase output through the crisis. As people around the world consume less oil, gas and coal, electricity generated from the wind and sun will keep flowing, resulting in an unprecedented 8 percent decline in global carbon dioxide emissions this year. (4/30)

Tanker rates: The daily rate for chartering an oil tanker from Saudi Arabia to China has plunged by over 50 percent in one week to $100,000 as OPEC+ begins on Friday its collective cut to remove 9.7 million b/d from the oversupplied market. Although tanker owners and operators will see reduced volumes of oil to transport from oil producers to oil-importing countries, the oil shipping industry expects its business to be supported through the end of the year by the most sought-after ‘commodity’ these days—storage space. (5/2)

Iran’s gas production: Reaching natural gas production of one billion cubic meters per day (Bcm/d) has been one of Iran’s three core hydrocarbons resource strategies since the Islamic Republic began to seriously develop the supergiant South Pars non-associated gas field in 1990. Iran announced last week that it is finally to achieve its monumental and long-awaited gas production target this Iranian calendar year (ending on 20 March 2021). At the same time, it also announced that its flagship Persian Gulf Star Refinery – essential to Iran’s new-found gasoline self-sufficiency – is ramping up its refining capacity. (4/27)

In Nigeria, the oil price crash isn’t getting any easier. Traders caution that Nigeria’s prices — $10 a barrel or less if the market doesn’t improve — still may not tempt enough buyers because of the demand collapse triggered by the coronavirus. Traders estimated that, as of late last week, about 30 out of 65 May-loading cargoes still hadn’t been sold. Normally just a handful would still be available so late in a month. (4/29)

Gulf of Guinea piracy: With offshore oil storage bursting at the seams as a result of a disastrously timed oil price war and the demand-decimating effects of COVID-19, the pirate’s treasure trove is shifting. The Gulf of Guinea, a key oil production hub adjoining no less than eight oil-exporting countries off the western African coast, is now officially the world’s deadliest piracy hotspot. (4/30)

A Venezuelan commission set up to study the restructuring of state PDVSA had recommended lifting state control over all its operations and is calling for private national and international capital to open up the country’s oil business. The 64-page proposal, which recognizes that Venezuela is no longer a strategic player in the oil market, aims to bring oil production up to 2 million b/d from the current 618,000 b/d “in the shortest possible time.” (4/29)

Mexico’s Pemex is cutting personnel on platforms by 50 percent to reduce the risk of infections and implement distancing measures. “Indispensable staff will remain on board to keep up production,” a source at Pemex told Reuters, noting that the “It’s a situation similar to when a hurricane comes.” So far, Pemex has registered 248 cases of coronavirus, including 28 deaths. (4/28)

In Canada, Rystad Energy now expects total 2020 upstream spending to fall below C$21 billion. This represents a 41 percent year-over-year decline, with reductions in shale and oil sands accounting for more than 80 percent of the decrease. In percentage terms, 2020 represents the most drastic spending reduction in Canada in recent memory, and far surpasses year-over-year declines of 31 percent in 2015 and 33 percent in 2009. (4/28)

The US oil rig count dropped sharply last week, dropping by 53 rigs to 325, Baker Hughes reported. That down 60 percent from the 807 oil rigs drilling last year at this time. Gas rigs declined by 4 to 81, down 56 percent from 183 one year ago. (5/2)

SPR rental: Nine companies including Chevron, Exxon Mobil and Alon USA have agreed to rent space to store 23 million barrels of crude in the US emergency oil reserve, a US official said on Wednesday, as the Trump administration tries to help energy firms deal with the crash in oil prices. (4/30)

Oil traders are hiring expensive US vessels, normally only used for domestic shipments, to store gasoline or ship fuel overseas, five shipping sources said, in a sign of the energy industry’s desperation for places to park petroleum amid a 30 percent drop in worldwide demand. Several shippers said they have started to book Jones Act (JA) vessels for foreign voyages or to store refined products. The century-old Jones Act requires that vessels traveling between domestic ports be owned and operated by US crews, and they are generally more expensive than other vessels. (4/28)

Corpus Christi crankdown: Ever since this Gulf Coast city’s leaders helped persuade the Obama administration and Congress to lift the export ban on liquid fossil fuels in 2015, the Port of Corpus Christi has been a steady tide of construction, creating nearly 10,000 permanent jobs and bringing in $54 billion in capital investment. But the coronavirus pandemic, which has slammed the brakes on economic activity across the nation, threatens to halt investment in planned projects and abandon thousands of more new jobs. (5/1)

Chesapeake Energy Corp, the oil and gas exploration and production company that was at the forefront of the past decade’s US shale boom, is preparing a potential bankruptcy filing as it grapples with an unprecedented rout in energy prices. (4/30)

Weekly US coal production declined for the fourth straight week to an estimated 8.58 million tons in the week ended April 25, 39.4 percent lower than the year-ago week, US EIQ data showed. The total was the lowest for any week in the last 10 years and was also 37.5 percent lower than the five-year average. Despite the lower production, utility stockpiles remained higher on an aggregate basis, up roughly 22.3 percent from a year earlier. (5/1)

Global coal demand is heading for an 8 percent decrease in demand, its biggest annual drop since World War II, as economic activity plunges due to coronavirus lockdowns. Burning coal to make electricity in several European countries has become unprofitable and socially untenable — crowded out by cheap natural gas and the proliferation of renewable energy as well as powerful environmental movements. The pandemic has only hastened its demise. (4/30)

Coal is the loser: As demand drops, the biggest loser is coal. In the U.S., coal’s share of power generation has dropped more than 5 percentage points since February on the nation’s biggest grid while output from natural gas plants and wind farms held steady. In Europe, it’s down 2 points. Even in China and India, where coal still dominates, it’s losing market share during the pandemic. It comes down to cost. Coal power is more expensive than gas and renewables in many places and, hence, is the first fuel priced out of the market when demand falls. (4/28)

Zimbabwe’s new coal: Rio Energy Ltd. will build a 2,800-megawatt thermal power plant with a Chinese group (CGGC) in northern Zimbabwe at a projected cost of $3 billion. CGGC will develop the project and assist with the fund raising. The power plant at Sengwa powered by domestically produced coal, will be constructed in four phases of about 700 megawatts each. A 250-kilometer pipeline will carry water from Lake Kariba to Sengwa. The pipeline, and a 420 kilovolt-ampere power line, will be built by Power China. The first phase of the project will cost about $1.2 billion. (4/29)

Solar and onshore wind power are now the cheapest new sources of electricity in at least two-thirds of the world’s population, further threatening the two fossil-fuel stalwarts — coal and natural gas. The levelized cost of electricity for onshore wind projects has fallen 9 percent to $44 a megawatt-hour since the second half of last year. Solar declined 4 percent to $50 a megawatt-hour. Prices are even lower in countries including the U.S., China and Brazil. A decade ago, solar was more than $300 a megawatt-hour and onshore wind exceeded $100 per megawatt-hour. Today, onshore wind is $37 in the US and $30 in Brazil, while solar is $38 in China, the cheapest sources of new electricity in those countries. (4/29)

Floating power plants: As economic lockdowns complicate efforts to bring electricity to every corner of the planet, one company is putting generation units on ships that can sit offshore and plug into local grids at short notice. Karpowership is busy marketing floating power plants across the developing world, where governments are seeking extra voltage to power hospitals and other facilities to keep the lights on during the coronavirus pandemic. Vessels can hook into an onshore grid quickly, sidestepping the red-tape and construction issues involved with building a traditional power plant. And these ships come with their own fuel — liquefied natural gas and fuel oil — tapping into markets that are currently oversupplied. (5/2)

Italian car sales crash: You can’t get much more of a “worst case scenario” in auto sales than watching numbers plunge an astounding 98%. But that’s exactly what has happened with new car sales in Italy, which remains mostly on lockdown, for the first 24 days of April for this year. (4/30)

Greenland’s meltdown: Using their elevation data, the researchers found that Greenland is losing about 200 billion tons of mass each year on average. That’s enough to raise sea levels by about eight millimeters, or a third of an inch, over the study period. (5/2)

“Locust-19”: First came the floods. The waters swamped bean and corn fields and created a breeding ground for a swarm of desert locusts the size of Manhattan that fanned out and destroyed a swath of farmland across eight East African nations as large as Oklahoma earlier this year. Now their offspring are threatening a historic infestation—a second wave of locusts, 20 times as large as the first, that could chew their way through 2 million square miles of pastureland, farms and gardens, around half the size of Western Europe. The swarms, which would be by far the largest on record, are expected to descend as the new coronavirus accelerates across East Africa, raising the prospect of a double shock to some of the world’s poorest and most heavily indebted economies. Aid agencies warn that, together, they could lead to a collapse in agricultural production and mass food shortages. (4/30)