Editors: Tom Whipple, Steve Andrews

Quotes of the Week

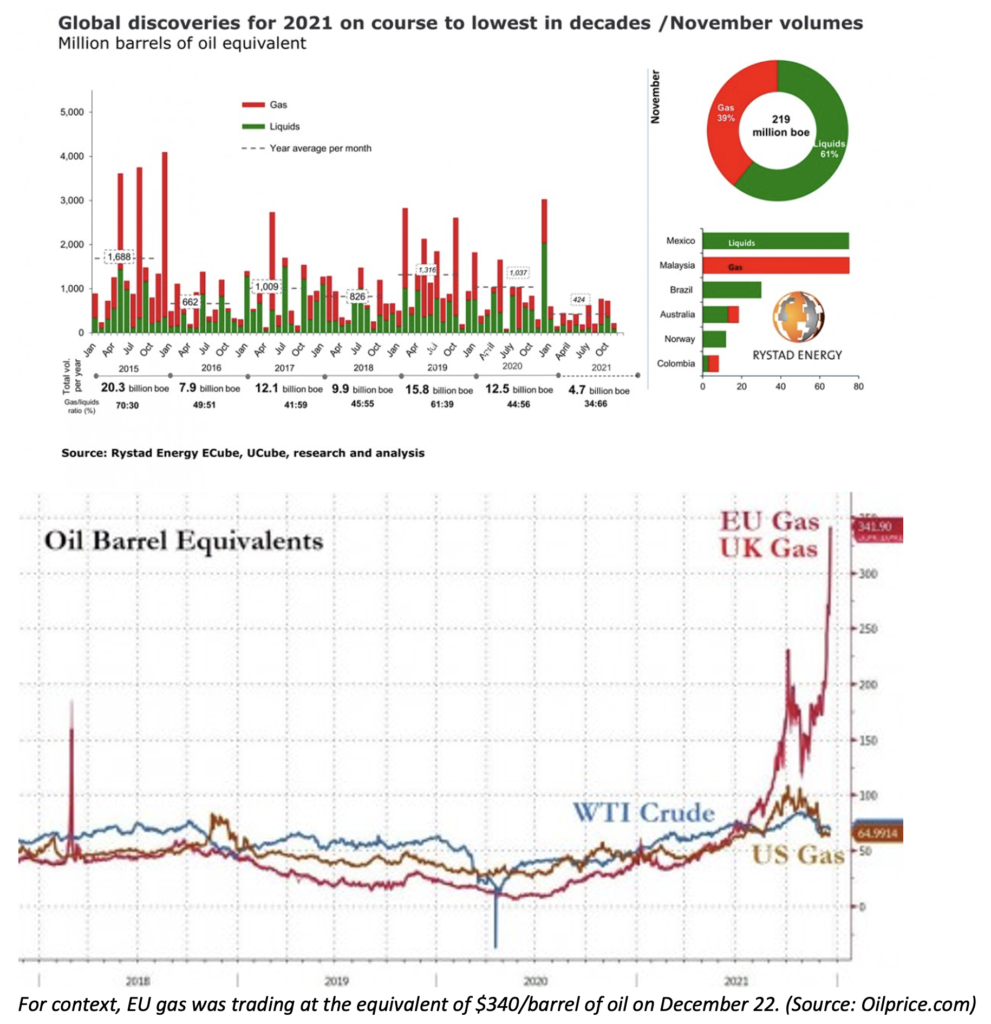

“…the cumulative discovered volume for 2021 [4.7 billion barrels-of-oil-equivalent, through November] is on course to be its lowest in decades.”

Palzor Shenga, vice president of upstream research at Rystad Energy

“When it comes to conserving energy and lowering carbon footprints, focusing on the UHNWIs [ultra-high-net-worth individuals] will provide the most bang for the buck–and analysts know it …. The wealthiest 1% account for 15% of the world’s emissions–more than twice the emissions generated by people in the bottom 50%.

Julianne Geiger, Oilprice.com

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

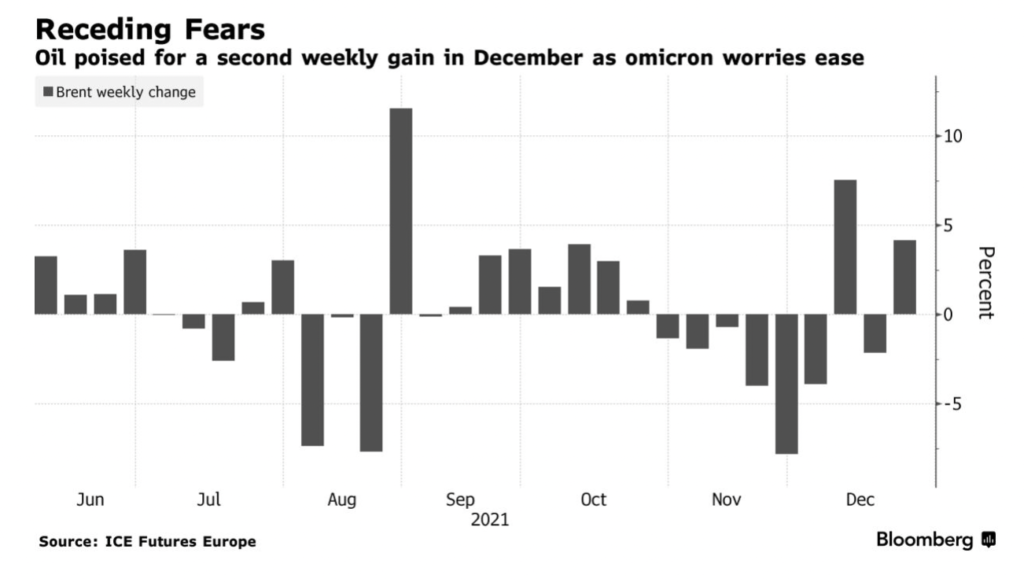

Oil: The New York futures exchange was closed on Friday, while London futures slipped towards $76 a barrel in very light holiday trading. “If the news is confirmed that omicron is not as dangerous as earlier variants, that could end up being quite bullish for oil next year,” said the head of commodities research at Bank of America. “There’s a risk oil spikes next year.” Crude is heading for a yearly gain, but the rally has faltered, in part due to concerns about omicron. Nevertheless, there are some signs of tightening emerging, with supply disruptions in Libya and Nigeria.

According to a new Rystad Energy analysis, global oil and gas finds in 2021 will hit their lowest full-year level in 75 years if the remainder of December fails to yield any significant finds. As of the end of November, total global oil discoveries this year will be at about 4.7 billion barrels of oil equivalent (boe), which marks a significant drop from the 12.5 billion which Rystad says were discovered in 2020, In 2019 15.8 billion boe were found; 2018 saw 9.9 billion boe, 2017 saw 12.1 billion boe, 2016 saw 7.9 billion boe, and 2015 saw 20.3 billion boe. The world consumes some 36 billion barrels per year, so the new discoveries in recent years are nowhere near keeping up with consumption.

Air travel is showing the first signs of sustained growth since the pandemic. The percentage of crude oil turned into jet fuel has risen consistently since mid-November and is holding at 9% or higher. Typically, about 10% or 11% of crude is used to make jet fuel, the biggest laggard in the oil market’s recovery.

Shale Oil: Plasma Pulse Technology is a new fracking technique that requires no chemicals or water. Its developers describe it as a method of fracturing horizontal oil wells complementary to hydraulic fracking at a fraction of the cost. Although fracking has proven to be a highly effective means of boosting oil and natural gas production, the process requires millions of gallons of water. There is also the potential to contaminate water supplies. Although hydraulic fracking isn’t going away soon, it would be beneficial if there were some other methods of fracking if conventional fracking should prove to be too water intensive.

The technology was invented at St. Petersburg State Mining University in Russia. Conventional fracking uses water at high pressure to break open channels that enable the flow of oil or natural gas into the well. In contrast, Plasma Pulse Technology, through a powerful electrical discharge, produces a high-pressure plasma pulse (5,000 psi), and the subsequent compression shock wave propagates along the path of least resistance (i.e., into the perforations). These compression shock waves propagate over long distances. The first two or three pulses clean the perforation. Subsequent pulses penetrate the reservoir, clean the existing channels, and create a micro-crack network. This enables oil to more easily flow into the well. Following the application of the technique, oil production can be boosted for several years.

Natural Gas: European gas and power prices eased after surging to a new record on Tuesday as Russia kept shipments to Europe capped. Russian gas flows into Germany’s Mallnow compressor station remained halted, and the critical Yamal-Europe pipeline was instead flowing gas eastward to Poland, according to network operator Gascade. The so-called reverse flows are likely the result of lower requests from buyers in Europe. The Yamal-Europe pipeline was operating in a reverse mode for a sixth day on Sunday, shipping fuel from Germany to Poland, data from German network operator Gascade showed.

On Tuesday, European gas prices leaped 23 percent to a record €182 per megawatt-hour. “Europe’s gas market has now broken clear,” said Ciaran Roe, global director of LNG at Platts. “Every major destination market for LNG cargoes is below the major European gas hubs.” According to data from Platts, the difference between European and Asian prices is currently the widest on record. Spot LNG shipments to Europe were priced at roughly $48.5 per million British thermal units compared versus $41 million in Asia. During October and November, prices in Asia had averaged $5 million above those in Europe, the brokerage firm said.

Ships carrying liquefied natural gas destined for Asia are changing destination in mid-voyage to supply European consumers willing to pay a hefty premium as prices across the region surge to new peaks. For much of the year, buyers in China, Japan, and South Korea have outbid Europeans for shipments of LNG used in power stations to generate electricity. But with storage now full across the region, uncommitted cargoes from the Atlantic basin heading for Asia are being turned around by their owners and sent to Europe to cash in on soaring prices and demand.

For a glimpse of how much longer this year’s energy crunch is going to last, look no further than the European natural gas market. Forward prices have more than doubled over the past month, with traders betting the unprecedented squeeze will last into early 2023. Gas will be expensive even when the weather is hot. Futures prices for the summer exceeded $113 a megawatt-hour this week, the highest on record.

The export value for LNG cargoes loading on the US Gulf Coast 30-60 days forward jumped more than $16 per million Btu to new highs during the week of Dec. 14-21st, reflecting the strength of European delivered prices. Traders said that to justify the high prices for US Gulf Coast cargoes, suppliers would need slot availability to land in Europe. However, that was being made more challenging with so many LNG tankers in the Atlantic trying to get there to take advantage of the arbitrage. Meanwhile, the volatile market fundamentals were continuing to spur new commercial activity for US exporters and liquefaction terminal developers as buyers seek out term deals that carry a lower fixed price. In addition, cheap feedgas costs and destination flexibility have made US contracts more appealing in a high spot price environment.

All six major US LNG liquefaction facilities in operation appear to be running at capacity as they established a new record for LNG feedgas demand. According to S&P Global Platts Analytics data, the new US LNG feedgas demand of 13 billion cf/d was registered on Dec. 21st.

Temperature forecasts show unusually mild weather over the next two weeks in Texas and the US Southeast, which could keep a lid on regional spot gas prices in the near term despite soaring LNG feedgas demand. The above-average temperatures continues a trend of warmer weather in both regions this winter.

The New York City Council moved to ban natural gas hookups for new buildings last week as part of its plans to decarbonize. A large portion of a city’s emissions comes from its buildings, so these moves by cities to reduce the natural gas consumption associated with buildings could have a significant effect on demand over the long term. While some cities and industries are planning to move away from natural gas, the transition will take time, and natural gas still has a crucial role in powering the world.

Coal: The coal industry has experienced a dramatic rebound this year, with production levels set to hit an all-time high in 2021. The surge in demand is primarily due to the faster-than-expected global economic recovery following the Covid-19 pandemic. China and India are the world’s two largest coal producers, making up two-thirds of global coal demand.

India is reviewing a proposal to stop new coal-fired capacity construction under a plan to meet its climate pledges, India’s Economic Times reported on Wednesday. As part of its pledges during the COP26 climate summit last month, India—where coal currently accounts for around 70% of electricity generation—committed to net-zero emissions by 2070 and 500 gigawatts of renewable energy capacity by 2030. In late October, an expert committee appointed by the power ministry submitted new recommendations for amending India’s National Electricity Policy. The committee recommended that the country not consider new coal-fired capacity. However, the report of the committee is still under consideration.

Electricity: Companies are poised to install record amounts of batteries on America’s electric grid this year, as government mandates and a steep decline in costs fuel rapid growth in power storage. The US, which had less than a gigawatt of large battery installations in 2020—roughly enough to power 350,000 homes for a handful of hours—is on pace to add six gigawatts this year and another nine gigawatts in 2022, according to S&P Global Market Intelligence.

Giant batteries, often paired with solar farms, can charge when sunshine is plentiful, then send electricity to the grid later when the sun goes down or demand spikes and power is more valuable. The installations, most of which currently use lithium-ion batteries like those found in electric vehicles and laptops, resemble rows of boxy shipping containers, and usually provide up to four hours of backup power.

2. Geopolitical instability

(These are the situations that reduce the world’s energy supplies or have the potential to do so.)

Ukraine: The Russian Defense Ministry said more than 10,000 troops would return to their permanent bases in the Southern Military District after over a month of training in the region, including areas near the Ukrainian border. According to a statement posted Saturday on the ministry’s website, the exercises took place throughout the district, including the Crimea and Rostov regions that border Ukraine. Ukraine estimates 122,000 Russian troops are within 200 kilometers of their shared border, up from about 100,000 just weeks ago.

President Putin said the US and Russia would meet in January in Geneva for talks over Ukraine, which he says were essential to protect Moscow from what he claimed were existential threats from NATO. Speaking at his annual press conference, the Russian president welcomed a “positive reaction” from the US to two sets of draft proposals on European security that Moscow published last week.

Putin’s comments marked openness to resorting to diplomacy first, in a slight softening from earlier this week when he threatened to use Russia’s military if his security demands were not met. But the Russian leader also made it clear he viewed Ukraine as an existential, unfinished issue dating back to the USSR’s collapse in 1991, claiming that parts of its neighbor were Moscow’s “historical territories.”

The US has warned allies in Europe that Moscow has been massing about 100,000 troops near Ukraine’s border to launch a possible invasion, which the Kremlin first denied. But on Thursday, Putin refused to rule out another military solution to the tensions with Ukraine. Kyiv, he claimed, was planning an offensive to reclaim Donbas, the eastern border region now controlled by Russia-backed separatists, which broke away in 2014 following Moscow’s annexation of Ukraine’s Crimean Peninsula.

Iran: An eighth round of the Iran nuclear talks will start on Dec. 27th as the US adds pressure to break the stalemate. EU envoy Enrique Mora said the next round would “define the way ahead,” adding that it was “important to pick up the pace on key outstanding issues and move forward, working closely with the US.” S&P Global Platts Analytics now assumes the sides will reach an interim deal to freeze Iran’s nuclear development and lift some US sanctions, increasing Iranian oil supply by an estimated 700,000 b/d from April to December.

As Iran’s conflict with the US continues, frustrations have grown over how the country’s leaders have reacted to crippling sanctions. Public support is at a record low, in part because of crackdowns on dissent. Now a long-brewing crisis over water scarcity, the result of decades of unchecked industrial expansion, poses a challenge that could eclipse Tehran’s fight with Washington over how to revive the 2015 nuclear deal.

The worst drought in decades has led to protests as climate change exposes decades of policy failure. Iranians flooded the barren riverbed of the Zayandeh Rud, in the ancient town of Esfahan, on Nov. 19th to protest against the state’s management of water resources. It was a gushing river that turned the city of Esfahan into a cultural paragon that twice served as the capital of the Persian Empire. But today, as it trickles through Iran, the Zayandeh Rud is dried up.

Under the sanctions, Iran’s priority remains the ongoing development of its vast West Karoun oil field and its supergiant South Pars offshore gas field and the optimization of its already world-scale petrochemicals industry. Increasing output and revenues from its petrochemicals have always been key to Iran’s ‘resistance economy’ model, the concept of generating value-added returns by leveraging intellectual capital into business development wherever possible.

Regardless of whether a new iteration of the Joint Comprehensive Plan of Action is reached with the US, Iran regards the continued development of the petrochemical sector as essential to its long-term economic survival. Last week Tehran announced that it aims to achieve the number one position in the Middle East in petrochemicals by 2027. Iran will bring on stream 130 million cm/d of additional gas production capacity in 2022, including from the delayed phase 11 of the offshore South Pars field.

Libya: The election to take place on Dec. 24th was postponed, and a new election is planned for some time in the next 30 days if the country can hold together. Armed groups descended on the capital Tripoli last week amid the election chaos. Libya’s critical southwestern oil fields of Sharara and Hamada, and the 300,000 b/d Zawiya oil terminal, were shut down after a blockade by a unit of the Petroleum Facilities Guards. An armed group affiliated with the PFG has closed the oil fields and the pipeline, which connects into the Zawiya oil terminal, due to a dispute with the state-owned National Oil Corp.

3. Climate change

The world will probably have one of the warmest years on record in 2022, underscoring concerns about the need to tackle climate change. The UK’s Meteorological Office said last week that the average global temperature is anticipated to be about 1.96 degrees F. above pre-industrial levels. While temperatures are expected to be slightly lower than in some years since 2015, it’ll mark the eighth consecutive year where they exceed 1 degree C above the pre-industrial period.

The Washington Post editorial board recently noted that the world’s massive ice stores are melting, and researchers are only beginning to evaluate what that means. This is but one of many signals that climate change will not wait until it is more convenient for humanity to face it; the board says that world governments must tackle the problem now.

In Antarctica, a major bulwark against rapid ice disintegration is likely to shatter into hundreds of icebergs, according to new satellite images showing that the eastern ice shelf abutting the massive Thwaites Glacier is cracking and could break up within the next few years. Once gone, the enormous mass of glacial ice that the shelf currently holds back will move toward the sea at three times its current rate, threatening a substantial boost in sea levels.

Perilous climate feedbacks threaten to initiate dangerous downward spirals. For example, rain in typically frigid places such as Greenland can make the surface ice darker — and therefore more prone to absorb solar radiation, causing more melting. Likewise, increased wildlife activity in a warmer Arctic could disturb the permafrost, with potentially dire consequences. Whatever carbon is locked within the permafrost, in the form of long-frozen organic matter, could thaw and escape, sending vast amounts of greenhouse gases into the atmosphere.

Glaciers across the Himalayas are melting at an extraordinary rate. New research shows that the vast ice sheets there shrank ten times faster in the past 40 years than during the previous seven centuries. Avalanches, flooding, and other effects of the accelerating loss of ice imperil residents in India, Nepal, and Bhutan and threaten to disrupt agriculture for hundreds of millions of people across South Asia. And since water from melting glaciers contributes to sea-level rise, glacial ice loss in the Himalayas also adds to the threat of inundation and related problems faced by coastal communities worldwide.

Next year, how much water flows into Southwestern US cities will depend on the coming snowfall and the resulting snowpack accumulation. So far, it’s not looking good. High mountain snows, the source of most of the region’s water supplies, are projected to be lower than usual this winter in the Southern Rockies. This means that come spring, forecasters expect less snowmelt to flow into the Colorado River Basin and other nearby watersheds.

The Dalton Highway and the Trans-Alaska Pipeline are companions that rank among Alaska’s most vital and iconic pieces of infrastructure. The pipeline exists because of the highway. The highway exists because of the pipeline. What threatens one threatens the other. The road is being battered by flooding, staggered by thawing permafrost, and confronted by monstrous underground landslides known as frozen debris lobes. Since 2015, the highway has undergone a half dozen significant overhauls to bolster it against natural disasters triggered by climate change.

President Biden will need to rely more on regulation to meet his promise to cut greenhouse gas emissions in half by 2030 since his roughly $2 trillion economic plan and its crucial climate provisions suffered a potentially fatal setback in Congress. The tax-and-spending bill rejected by West Virginia Democratic Senator Manchin included a record $550 billion for climate measures, including a slew of tax credits for clean energy generators, the nuclear power industry, and the makers of electric vehicles. Passed by the House, the Build Back Better bill included a first-time fee on methane emissions from oil and gas operators.

4. The global economy and coronavirus

The Omicron variant of the coronavirus is spreading faster than the Delta variant and is causing infections in people already vaccinated or who have recovered from the COVID-19 disease. However, three separate teams of scientists have found that Omicron infections more often result in mild illness than earlier variants of the virus. This finding offers hope that the current surge may not be quite as catastrophic as feared.

The world’s economic output will exceed $100 trillion for the first time next year, and it will take China a little longer than previously thought to overtake the US as the No.1 economy. British consultancy Cebr predicts China will become the world’s top economy in dollar terms in 2030, two years later than forecast last year.

United States: The CDC said last week that Omicron had overtaken the Delta variant of the coronavirus in the US and accounted for an estimated 73% of infections for the week ending Dec. 18th. The CDC said that Omicron now makes up more than 90% of cases in many parts of the US. Infectious-disease experts have said they believe the actual share is likely even higher than that. The US authorized Pfizer’s antiviral COVID-19 pill for at-risk people aged 12 and above, making it the first oral treatment and one which can be taken at home. This pill could be an essential tool in the fight against the fast-spreading Omicron variant.

Signs are mounting that the US economy is losing some steam as the Omicron variant spreads rapidly through parts of the country. The number of diners seated at restaurants nationwide was down 15% in the week ended Dec. 22 from the same period in 2019, a steeper decline than in late November. US hotel occupancy was at 53.8% for the week ended Dec. 18th, slightly below the previous week’s level. Rising case numbers are leading many businesses to close for a short period, entertainment venues to cancel shows, universities to shift classes to online, and offices to delay or reverse reopening plans.

Europe: The energy crisis deepened last week as spiraling gas prices pushed European electricity contracts to unprecedented highs. France faces a winter supply crunch, with heavy industries forced to curb production across the region. Electricity for delivery next year jumped to an all-time high in both Germany and France, two of the biggest economies in the European Union. Facing outages at nuclear plants, France will need to suck up supplies instead of exporting power to neighboring countries. The situation is so severe that it forces factories to cut output or shut down altogether. Richard Leese, chair of the Energy Intensive Users Group, warned that concerns were rife that “as inflation starts to bite, demand might subside and when it does, companies will still be left with very high operational costs.”

China: Beijing locked down 13 million people in the central city of Xi’an as the country battles to contain increasingly frequent coronavirus outbreaks that threaten its economic recovery. The Xi’an city government ordered all residents to stay home and designate one person per household to collect essential supplies once every other day. In addition, non-essential travel outside the city has been banned. The lockdown is one of the most severe imposed in China since authorities restricted movement in Wuhan in early 2020 at the start of the global pandemic. It comes just months before the Beijing Winter Olympics, a politically sensitive event at which the government has banned visitors from overseas.

Chinese companies are laying off tens of thousands of workers as Beijing’s regulatory clampdowns weigh on the technology, education, and property sectors, which in many cases offered higher salaries than other industries and helped drive economic growth.

Video-streaming services are cutting staff. Companies that offer tutoring are reducing teachers, and real estate agents have been let go as China’s housing market slows. Beijing has unleashed a raft of new regulations on the industries as Chinese leader Xi Jinping seeks to rein in what Chinese officials have described as capitalist excesses.

China’s voracious appetite for natural gas has sparked a wave of deals with US exporters of the fuel, strengthening energy trade between the world’s two biggest economies even as their relationship grows more fraught. The latest sales were announced last week when Venture Global LNG said it had signed contracts to ship 3-5 million tons a year of the fuel to state-owned China National Offshore Oil Corporation, the country’s biggest LNG importer.

Since October, the CNOOC deals have brought to seven the number of significant contracts signed between US exporters and Chinese customers. Some of the contracts are to last decades. As a result, analysts say that China is poised to surpass Japan as the world’s largest LNG buyer this year. At the same time, the US will leapfrog Australia and Qatar in LNG export capacity next year.

CATL has given China a commanding lead in electric car batteries, a technology central to the green revolution. The company already supplies batteries to almost all of the world’s automakers, including G.M., Volkswagen, BMW, and Tesla. CATL has emerged as one of the biggest winners of the electric car boom, along with Tesla. The battery giant stands as a crucial link in a green-technology supply chain increasingly dominated by China.

Chinese companies, particularly CATL, have secured vast supplies of the raw materials that go into the batteries. That dominance has stirred fears in Washington that Detroit could someday be rendered obsolete, and that Beijing could control American driving in the 21st century the way that oil-producing nations sometimes could in the 20th.

Chinese property developers have been hit by record numbers of downgrades from international credit rating agencies this year, as Evergrande’s collapse fuels concerns over the health of China’s economy. The downgrades come after Beijing introduced measures last year to cool an overheating property market. Moody’s, Fitch, and S&P downgraded Chinese developers’ ratings 43, 54, and 30 times, respectively, in 2021, compared with six, 12, and 11 in 2020, adding further pressure on their ability to refinance offshore debt during a housing slowdown.

Buoyed by China’s rapid urbanization, the country’s real estate developers are large borrowers domestically and overseas. In Asia, they make up a significant portion of the region’s $400 billion corporate high-yield bond market. However, they came under stress after Chinese president Xi Jinping’s government moved to constrain their leverage over fears of asset bubbles in the property sector.

Russia: Moscow’s oil output is expected to rise in 2022, although factors including the coronavirus pandemic and the release of strategic petroleum reserves could lead OPEC+ to amend its production plans. Analysts expect the OPEC+ agreement to continue to be the key driver of Russian crude output, with potential changes to Western economic sanctions policy and spare capacity also playing a role. “We estimate a new drilling program will get Russian supply growth back in line with its OPEC+ quota hikes, allowing crude production to increase by nearly 500,000 b/d by June 2022 versus November 2021,” says Platts Analytics.

Gazprom’s 2022 budget took a typically conservative view of gas prices, despite record-high energy costs in its primary export market and few signals Europe’s energy crunch is abating. According to a company presentation made to investors on Wednesday, the Russian gas producer is basing its 2022 budget on what it calls a “conservative” export price of $296 per 1,000 cubic meters.

In its budget for 2021, the company made a similarly reserved call on export prices of $250/1,000 cm that didn’t materialize. As a result, the gas producer’s average 2021 export price is higher, at over $280/1,000 cm, according to Deputy Chief Executive Famil Sadygov. Gazprom’s conservative 2022 budget comes as Europe, its primary export market, buckles under a supply crunch.

India: The government’s recent decision to ban agricultural trading contracts marked Prime Minister Modi’s latest effort to ease widespread fears about rising inflation ahead of state elections early next year. The country’s consumer price index rose to 4.9% in November after bottoming out in September. The wholesale price index, which reflects prices for businesses, has surged to a record of 14% and has remained in double digits for most of the year.

Indian authorities have taken similar steps to outlaw futures trading in the past despite a lack of evidence that it helps control inflation. “Derivatives are not behind the price rise,” said Kishore Narne, head of commodities at brokerage Motilal Oswal. “It’s more for the optics . . . The government wants to show people that it’s trying to control food inflation.”

5. Renewables and new technologies

Researchers at the National Accelerator Laboratory and Stanford University may have found a way to revitalize rechargeable lithium batteries, potentially boosting the range of electric vehicles and battery life in the next generation of electronic devices. As lithium batteries cycle, they accumulate tiny islands of inactive lithium cut off from the electrodes, decreasing the battery’s capacity to store a charge. But the research team discovered that they could make this “dead” lithium creep like a worm toward one of the electrodes until it reconnects, partially reversing the unwanted process.

Scotland and Canada plan to become pioneers in tidal energy technology, while the rest of the world is sitting and waiting to see if these investments pay off. Tidal power is expected to grow exponentially over the next decade as several countries boost investments in this renewable energy source. As Scotland secures funding for a substantial new project, Canada expects to start tidal energy operations in 2022.

Experts predict that air taxis could become a reality as battery technology and autonomous flight becomes more advanced. Electric aircraft startups are already making significant waves in the market, with at least two companies hitting the NYSE this year alone. The new advancements in tech could also have a considerable impact on the deliveries industry as startups race to build next-gen all-electric cargo planes. Significant brands like Boeing, Airbus, Hyundai, and Toyota are now promising to whisk riders through the skies in flying taxis and receiving a heady dose of Wall Street endorsement; the dream is increasingly getting closer to reality.

6. The Briefs (date of the articles in the Daily Energy Bulletin is in parentheses)

Climate clamp on oil? Access to the equivalent of 600 billion barrels, or 40% of the world’s recoverable oil and gas reserves, could be threatened by droughts, extreme temperatures, rising tides, and flooding resulting from climate change. Major producers Saudi Arabia, Iraq, and Nigeria are among the most vulnerable, according to a new study by risk consultancy Verisk Maplecroft. (12/20)

Abu Dhabi’s National Oil Company committed to boosting its crude oil output from the current 4 million b/d to 5 million b/d by 2030. Last week saw an announcement from ADNOC that it has discovered a new crude oil, condensate, and natural gas site that holds around 1 billion barrels of oil equivalent—a step that will help it meet its goal. (12/22)

Dubai International Airport, the world’s busiest hub for international travel in 2019, has returned to 100% operational capacity in a potential boon to regional jet fuel demand. The airport handled 25.9 mil passengers in 2020, down 70% in 2019. Middle East jet fuel demand will rise 20% in Q4 2021. (12/20)

In Nigeria, Royal Dutch Shell halted crude shipments from the 200,000 b/d Forcados export terminal, dealing another blow to the African nation, which has struggled to stem falling production. Since Shell announced the month-long force majeure at the Bonny site in October, only one ship has loaded cargo from that terminal. (12/23)

With Brazilian oil demand set to continue, Petrobras is making big plans for oil and gas and testing the water with greener fuels. However, it is not yet investing in other renewables such as solar or wind power. (12/25)

Colombia, Latin America’s third-largest oil producer, is in danger of losing its energy self-sufficiency and a significant part of its GDP in the future unless the pace of exploration accelerates. This year, crude oil production in Colombia is on track to hit its lowest level since 2009, currently averaging at just over 730,000 barrels per day (bpd). (12/22)

The US oil rig count increased last week by 5 to 480, while the gas rig count was up 2 to 106, according to Baker Hughes. The total US rig count is up by 238 over last year’s 348 count; that’s up 68%. Canada’s oil rigs dropped by 20 to 84 while their gas rigs dropped by 13 to 49. (12/25)

Robot rig: A new, fully automated oil and gas rig recently debuted in the Permian Basin. The rig uses digital technology and Canrig robotics to ‘man’ the platform. (12/21)

SAF: National carrier Malaysia Airlines has completed its first flight using sustainable aviation fuel and plans to make SAF a greater part of its fuel choice for regular flights by 2025, according to SAF supplier Neste. The plane used a blend of about 38% SAF and conventional jet fuel. (12/20)

MPG move: On Monday, the Biden administration raised fuel-efficiency standards for passenger cars and light-duty trucks, saying the new measures will reduce pollution and save consumers billions of dollars at the gas pump. Automakers must meet a fleetwide average of 55 mpg for cars and light trucks by the model year 2026, up from the 43 mpg standard set by the Trump administration for that year. The fleetwide mileage standard for the current 2021 model year is 40 mpg. (12/21)

NYC’s EV push: The City of New York will invest $420 million in electric vehicles, charging infrastructure, and alternative fuels to accelerate the transition to an all-electric municipal vehicle fleet. The new investments will help the City achieve an all-electric fleet by 2035, five years sooner than the previous goal of 2040. (12/24)

EV essential: Graphite is a critical element that forms the anode of lithium batteries. There will be no energy revolution without it, and the trillion-dollar EV market might not exist. Each EV battery contains 20-30% graphite, which means that graphite demand will soar with EV demand. Both China and the US are now struggling with a graphite squeeze. (12/22)

Russian EV buses: The 900th electric bus has hit the streets of Moscow. The electric buses were launched on 66 bus routes with a total length of almost 800 kilometers. This year electric buses carried more than 77 million passengers, and more than 150 million people were carried in the three years of the operation. (12/21)

Belgian H2: Energy companies Engie and Equinor have announced the H2BE project, which aims to develop the production of low-carbon hydrogen from natural gas in Belgium. The project aims at producing hydrogen from natural gas using auto thermal reforming (ATR) technology combined with carbon capture and storage (CCS). The ATR technology allows for decarbonization rates above 95% and produces hydrogen at a large scale at competitive cost levels. The captured CO2 is planned to be transported in liquid form and permanently and safely stored at a site on the sub-surface of the North Sea. (12/20)

German H2: Germany will put 900 million euros ($1 billion) into a funding scheme to support green hydrogen. The H2Global project is designed to speed up the global market ramp-up of green hydrogen by using a “double auction.” (12/24)

A research team has developed a new artificial photosynthesis device with remarkable stability and longevity. It selectively converts sunlight and carbon dioxide into two promising sources of renewable fuels: ethylene and hydrogen. (12/25)

Brazilian drought: parts of Brazil, the world’s biggest soybean exporter, are already showing the impact of the La Nina weather pattern that’s expected to roil global food markets in the coming months. A La Nina drought has led to no rain during the last 60 days in some parts of the best soybean-growing region. (12/23)

The US Supreme Court, with its 6-3 conservative majority, is considering one of the most sweeping changes to the federal regulatory policy that we can imagine. The court is hearing a case that could vote to overturn the so-called Chevron deference. What this may mean in practice is that the high court swats down what it views as unduly broad environmental and other regulations. At the same time, a divided Congress fails to rewrite new, more specific legislation. This could result in a wholesale rollback of federal authority over broad segments of the economy. (12/21)