Editors: Tom Whipple, Steve Andrews

Quotes of the Week

“The US is screwed when it comes to near- to medium-term oil production. It’s not because of Covid-19. US rig count began to decline 15 months before anyone had heard of Covid-19. Even if the road to economic and oil-demand recovery is faster than I believe it will be, it will take a long time to get back to 12 or 13 million barrels per day of production.

“There are good reasons to expect that much lower US oil production will eventually lead to higher oil prices. That may result in renewed drilling and another cycle of over-supply and lower oil prices. That is how things have developed in the past.”

Art Berman, oil industry consultant and commentator

“With the US Oil Rig count now down 75 percent versus last year, a collapse of US shale oil production is now a foregone conclusion.”

Steve St. Angelo, market analyst Financial Sense

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Crude hit four-month highs on Thursday, aided by a tightening market and a better-than-expected US jobs report. The caveat is that the jobs survey took place before the latest Covid-19 wave and the associated business closures. Analysts still expect oil to face resistance to any further gains. On Friday, the bearish sentiment came back and halted the rally. West Texas Intermediate crude declined 0.8% to $40.32 a barrel, and Brent crude dipped 0.8% to $42.80 a barrel.

The American Petroleum Institute estimated on Tuesday a significant draw in crude oil inventories of 8.156 million barrels for the week ending June 26 as analysts were predicting an inventory draw of 710,000 barrels. On Wednesday, the official EIA report said that US commercial crude oil inventories decreased by 7.2 million barrels from June 19 to June 26. The drop marks the first decrease in EIA commercial crude oil inventory data in four weeks.

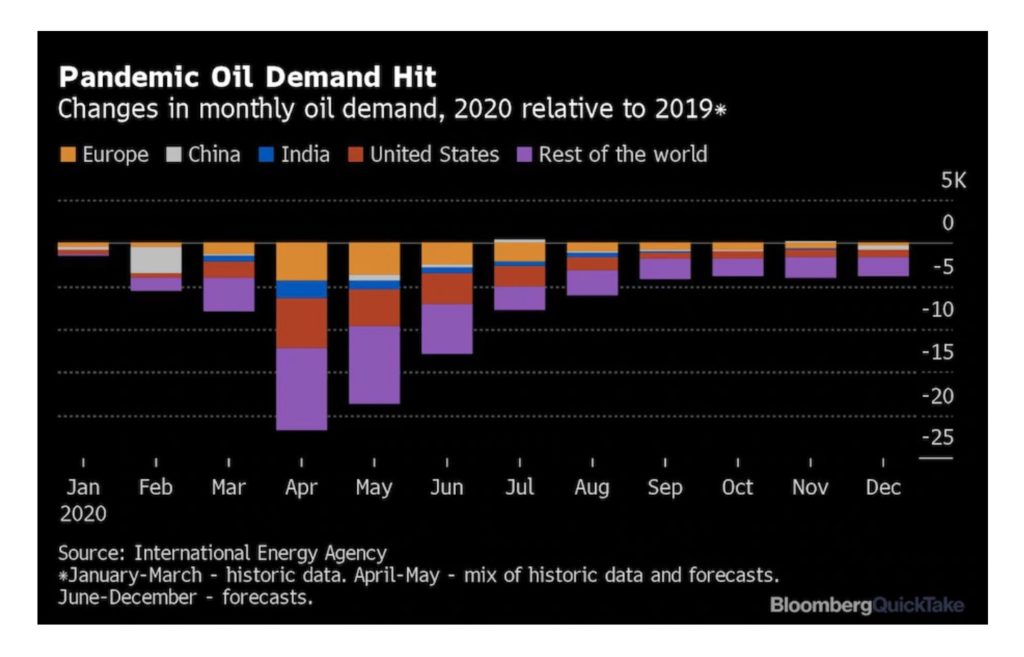

The enormous volumes of oil held at sea have started to shrink and are expected to continue declining into the second half of this year, thanks to recovering demand. According to IHS Markit, crude oil in floating storage dropped to below 150 million barrels by the end of June, from as high as 180 million barrels in April, when global oil demand crashed by 30 million b/d. The volume of refined oil products held at sea also dropped—to 50 million barrels, from a peak of nearly 75 million barrels in the middle of May. According to estimates from the International Energy Agency, floating storage of crude oil dropped in May by 6.4 million barrels to 165.8 million barrels from its all-time high.

One big question emerging from the pandemic is whether the virus will speed up the global shift away from oil. Life under lockdown gave a taste of a world that burns less petroleum, with consumption down by about a quarter and city dwellers from Los Angeles to New Delhi relishing the cleaner air. As restrictions eased, things weren’t exactly returning to normal. Many workers had given up on commuting, and there is talk that air travel might never recover. On the other hand, low oil prices and the desire to avoid crowded public transport have some people driving to work for the first time or taking road trips instead of flying.

Will the world ever get back to producing more than 100 million barrels of oil a day? A lot depends on how the pandemic hampers mobility and trade in the months and years ahead since more than 60 percent of oil is used for transportation. Before the virus, much of the forecast growth in oil demand was based on people getting richer and wanting to fly more. However, jet-fuel demand has declined more than any other petroleum product due to the Covid-19 crisis. Boeing expects a three-year wait before passengers, wary of squeezing into airports and airplanes, make as many journeys as in 2019. Tesla has displaced Toyota as the world’s most valuable, underscoring investor enthusiasm for a company betting that electric vehicles will transform an industry that’s relied on internal combustion engines for more than 130 years.

The pandemic has disrupted supply chains dependent on diesel-powered trucks and ships burning heavy fuel oil. Politicians are urging less reliance on long-distance transport, and the World Trade Organization predicts trade will slump by at least 13 percent in 2020.

Pre-virus, the push to ditch oil was gaining momentum from the 2015 Paris Agreement on climate change and a surge in investment in green projects. The IEA sees carbon dioxide emissions likely falling this year, though recent measurements showed swift rebounds as lockdowns eased. Cars made something of a comeback as city-dwellers avoided buses and trains, and holidaymakers shunned overseas travel. Cheaper oil could slow the switch to electric vehicles and shrinking economies may mean less money for new technologies. On the other hand, pandemic stimulus packages such as Germany’s include more funds for EV charging stations, and more commuters decided to give e-bicycles a try.

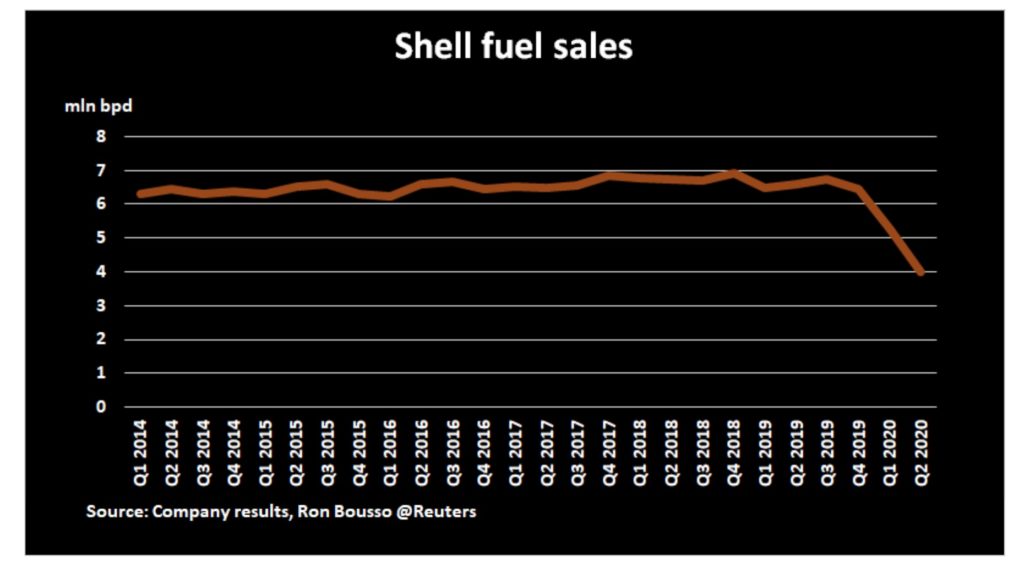

Energy companies are already resetting their sights. Shell cut its dividend for the first time since World War II, and BP said it would review projects against price forecasts that are 20 to 30 percent lower. ConocoPhillips said the US might never return to the record 13 million b/d it produced early in 2020. Lower prices are crippling for nations, including Nigeria and Venezuela, that depend on oil for most of their government revenue. A lot of new trends and crosscurrents have started up in the last few months. It may be time to start thinking about whether fossil fuels will be replaced sooner than previously thought.

OPEC: The cartel’s oil production in June was at the lowest level since May 1991 during the Gulf War, and collectively meeting its promised cut. According to a Bloomberg survey, OPEC cut its output to 22.69 million b/d. Saudi Arabia met its promised cut, holding production to 7.53 million b/d. Saudi Arabia also met its additional voluntary reduction that phases out in July. While Kuwait and the UAE also met their promised cuts, they did not meet all of their voluntary cuts like Saudi Arabia did. To no one’s surprise, Angola, Iraq, and Nigeria did not meet their promised cuts. Of the three, Angola was the most compliant at 83 percent of its pledged cuts in June, while Nigeria hit 77 percent. Iraq remains the biggest laggard of the group.

Saudi Arabia has threatened to ignite an oil-price war unless fellow OPEC members make up for their failure to abide by the cartel’s recent production cuts, delegates said. Saudi energy minister Prince Abdulaziz bin Salman issued the ultimatum in recent weeks. He asked Angola and Nigeria to submit detailed pledges to carry extra oil-production curbs, delegates said. The hardline stance from OPEC’s de facto leader risks a new flare-up within the OPEC countries. It comes just months after Saudi Arabia waged a price war against longtime oil-market ally Russia following disagreements over how to supply global markets as the coronavirus spread.

OPEC+ is not discussing or planning changes to its production cut agreement, which should see the oil producers ease the cuts in August, Russia’s Energy Minister Alexander Novak said at an online conference on Thursday. OPEC+, led by Russia and OPEC’s top producer Saudi Arabia, agreed in June to extend the record production cuts of 9.7 million b/d by one month through the end of July. According to the original agreement reached in April, OPEC+ was to cut 9.7 million bpd in combined production for two months—May and June—and then ease these to 7.7 million b/d, to stay in effect until the end of the year. Then, from January 2021, the production cuts would be further eased to 5.8 million b/d, to remain in effect until end-April 2022.

Shale Oil: ConocoPhillips expects to start bringing back in July part of the oil production it had curtailed in the second quarter in response to the low oil prices. In April, when oil prices slumped to the low teens amid crashing demand in the pandemic and the Saudi pledge to flood the market with oil, ConocoPhillips reduced its 2020 capital expenditure for the second time in one month. They announced curtailment of some oil production in Canada and the US until market conditions improve. ConocoPhillips said it would voluntarily curtail 200,000 barrels of oil equivalent per day net until market conditions improve. The company reduced production at Surmont in Canada due to low Western Canada Select prices and production across its operations in US shale fields.

As much as 30 percent of shale drillers could go under if oil prices fail to move substantially higher, Deloitte said in a recent study, as quoted by CNN. The firm said these 30 percent are technically insolvent at oil prices of $35 a barrel. Right now, West Texas Intermediate is higher than $35 but not by much. Oil is currently trading closer to $35 than to $50—the level at which most shale drillers will be making money.

Banks have started cutting credit lines for shale drillers as they reassess their assets, and the products that they promised would be realized from these assets. According to calculations by Moody’s and JP Morgan, cited by the Wall Street Journal, banks could reduce asset-backed loan availability for the industry by as much as 30 percent, which translates into tens of billions of dollars.

Crude-by-rail shipments from the US Midwest to the West Coast fell 28 percent month on month to 157,000 b/d in April amid lower refining runs and plunging North Dakota oil production. The shipments were down from 211,000 b/d in April 2019. West Coast refineries would have an incentive to max out Bakken flows while prices are low, but a market source said the plants likely saw better waterborne prices from abroad.

Prognosis: Industry analysts are all over the map concerning what will happen to the oil industry in the coming months and years. Some are predicting that oil supply and demand will be back to normal in a couple of years. Others are saying the energy industry will never be the same. Most analysts foresee a limited upside to oil prices due to the resurgence of the coronavirus in the US and the continuation of its rapid spread across the underdeveloped world.

As nobody knows what the pandemic and the global economy will be like six months or a year from now, most long-term commentators fall back on their biases. If one has ties to the fossil fuel industry or even the financial markets, then lacking any real evidence as to what might happen, then you are unlikely to forecast that fossil fuel’s days are numbered. Conversely, if you are more concerned about global warming, you might like to see a transition to non-polluting energy sources soon.

A Bloomberg analysis of longer-term forecasts made by organizations such as the International Energy Agency, energy consultancy Rystad, IHS Markit, Genscape, and Enverus suggests shale will be back on its feet by 2023, with production back to over 12 million b/d. This sounds somewhat optimistic in comparison to others looking at the future.

In a recent report, Moody’s said that the new normal could accelerate a shift away from hydrocarbons as the single most popular source of energy. “COVID-19 lockdown experience of reduced commuting and business travel, alongside better air quality and family time, may deliver lasting changes in energy consumption,”

Royal Dutch Shell said that it could cut the value of its oil and gas assets by as much as $22 billion, as it takes a dim view of the state of the oil market. The move adds more evidence to the notion that a large slice of oil reserves will wind up as stranded assets. Shell cut its Brent oil prices from $60 a barrel to $35 and lowered its 2021 and 2022 forecasts to $40 and $50 per barrel, respectively, down from $60 previously. Shell said the lower outlook reflects the expected damage to the oil market due to the coronavirus and the negative impacts on the global economy.

Crude oil prices are unlikely to return to three-digit levels ever again, Citigroup commodity analysts said in a note. “Oil product demand growth will falter significantly, change its contours, and never return to pre-COVID-19 rates of growth.”

Goldman Sachs’ commodity analysts remain guarded about oil’s potential to rise over the near term, but in 2021, prices may start to improve, commodity chief Jeffrey Currie told Bloomberg’s Alix Steel. Currie is sticking to the $35-a-barrel oil price forecast over the short term, and he said that if prices increased quickly, they would interfere with the market rebalancing by bringing more shale production back online. As for demand and supply, Currie noted a marked improvement in demand. In some parts of the US, it may be adversely affected by the resurgence in Covid-19 cases, notably in Texas and Florida.

The devaluation of large segments of the oil majors’ business operations is not only a reflection of a temporary downturn in the oil market. The majors are essentially acknowledging that a substantial portion of their oil and gas reserves are going to be left in the ground. Calls to avoid “stranded assets” have floated around for years, sometimes by environmental groups, but increasingly from investor groups and shareholders. Now, the majors themselves are recognizing the reality of stranded assets.

“It’s about fundamental change hitting the entire oil and gas sector,” Luke Parker, vice president, corporate analysis at consulting firm Wood Mackenzie, told the Wall Street Journal. “Within this write down, Shell is giving us a message about stranded assets, just like BP did a few weeks ago.”

2. Geopolitical instability

Iran: The number of new daily virus infections and deaths has increased sharply in the last week following the gradual lifting of restrictions that began in mid-April. Supreme Leader Ayatollah Ali Khamenei expressed concern about the rising number of deaths. He said government officials should wear masks to set an example for Iranian youth. Masks will become mandatory in gathering places determined by the health ministry starting on July 5, Iranian President Hassan Rouhani said on Sunday, according to his official website. Tehran is likely to be under-reporting the number of deaths from the coronavirus. Other countries with similar confirmed cases are reporting more than the 11,000 deaths Iran is reporting.

Iran’s financial and military support for Shi’ite proxy paramilitary groups in Iraq, a linchpin of its regional foreign policy, has been dramatically disrupted by the coronavirus pandemic. The US sanctions interruptions caused by the virus, including border closings to prevent the spread of the disease, have drastically cut Tehran’s cash supplies to the militia groups in recent months.

Since the coronavirus hit earlier this year, Iran has reduced its monthly payments to each of the four top militia groups in Iraq to between $2 million and $3 million from $4.5 million to $5 million. The reduced funding has impacted the militia groups’ operations and is forcing them to seek alternative sources of funding for military operations and weapons such as from Shiite businesses.

A fire ripped through a building at Iran’s main nuclear-fuel production facility early Thursday, causing extensive damage to what appeared to be a factory where the country is producing a new generation of centrifuges. A Middle Eastern intelligence official said the blast was caused by an explosive device planted inside the facility. The explosion, he said, destroyed much of the facility’s aboveground parts where new centrifuges — delicate machines that spin at supersonic speeds — are balanced before they are put into operation.

Tehran said it is looking at possible sabotage following recent blasts at several key Iranian sites, including the country’s main nuclear facility. The head of civilian defense said Iran would retaliate against any country that carries out cyber-attacks on its nuclear sites. On Sunday, Israel’s defense minister said the country is not “necessarily” behind every mysterious incident in Iran after a fire at the Natanz nuclear site prompted some Iranian officials to say it was the result of cyber sabotage.

Iraq: Oil production may be nearing the OPEC+ quota as Iraq’s crude oil exports, including from the Kurdistan region, fell to 3.083 million b/d in June — a 497,000 b/d drop from May and the lowest since October 2015. After years of dragging its feet on complying with OPEC oil production quotas, Iraq has taken its most significant steps towards implementing its agreed output cuts. A campaign of financial sweeteners and diplomatic pressure from Saudi Arabia and the US seems to be paying off. The change in sentiment coincides with the financial aid offer from Riyadh to help Kadhimi’s impoverished government. Baghdad also is looking to attract investment from Saudi Arabia in one of its natural gas fields.

A raid ordered by Iraq’s new prime minister on militiamen accused of planning an attack against Baghdad’s international zone could mark a turning point in his government’s efforts to bring Iran-backed groups to heel. The arrest of 14 members of Kataib Hezbollah late last month marked the boldest move yet by any Iraqi leader against the Iran-linked militias, which often operate in Iraq outside the law. Prime Minister Mustafa al-Kadhimi, who took office in May, has vowed to halt their attacks on foreign forces in the country, primarily US troops.

Tribal conflicts in southern Iraq have become more frequent and deadly in recent months, as security forces have been hamstrung by local power structures and distracted by the coronavirus lockdown. The rising violence has drawn the attention of Iraqi Prime Minister Mustafa al-Kadhimi, who plans to begin implementing a new security plan with a visit to Basra later this month. While the battles do not directly affect the oil sector, they threaten to destabilize areas around oil fields responsible for the vast majority of Iraq’s production.

Libya: Russia is sending reinforcements to Libya to help military leader Khalifa Haftar, who is on the defensive after a failed effort to topple the country’s United Nations-backed government, as Moscow seeks to shape the fate of the nation and its vast oil reserves. According to European and Libyan officials, private military contractors from Russia helped Mr. Haftar’s forces take control of Libya’s largest oil field. Russian cargo planes have regularly shuttled between a Russian airbase in Syria and Libya in recent days. Over the weekend, warplanes struck at an airbase that was recently recaptured by Libya’s internationally recognized government from eastern forces with help from Turkey. The strikes were carried out by “unknown aircraft”, according to the military source with the Libyan National Army (LNA) of eastern-based commander Khalifa Haftar.

The leaders of groups affiliated with the Libyan National Army have offered to lift a blockade on oil export terminals that started in January and cost the country’s oil industry some $6 billion in losses. One of the leaders, Ahmed Idris al-Senussi, said that the terminals were reopened and that his and other leaders’ groups had given LNA’s leader, General Khalifa Haftar, a mandate to renegotiate the restart of oil production at fields shut down because of the blockade.

A spokesman for Haftar said the LNA welcomed “any popular mandate to protect oil installations.” A group of tribes and paramilitary groups occupied Libya’s oil export terminals in mid-January as LNA’s Haftar launched an offensive against the UN-recognized government pledging that the country would soon have a single government. The head of the state-run National Oil Corp. told Bloomberg last week that it will take plenty of time and hundreds of millions of dollars to revive Libya’s energy industry, even if the fighting stops soon. Now that Haftar’s forces have been driven back from Tripoli, his promises to the various tribes that he would quickly unite the country may not be fulfilled.

Libya’s National Oil Corporation is preparing for a resumption of oil production and exports from its eastern terminals. However, it is still waiting for the petroleum facilities guards in the Eastern region to lift the oil blockade, the company said on July 1. Force majeure on crude loadings out of the terminals of Marsa el-Hariga, Brega, Es Sider, Ras Lanuf and Zueitina remain in place, as the guards are still blockading the ports, NOC added. NOC is still in talks with regional countries and the Government of National of Accord.

Libya’s Arabian Gulf Oil Co. will restart production in the eastern field of Messla this week, according to a person familiar with the matter. Agoco, as the company is known, will start pumping around 10,000 barrels of crude a day. The oil from Messla will be sent to the Sarir refinery and used domestically, rather than exported, said the person. Messla can pump around 70,000 barrels daily at full capacity.

Venezuela: Crude oil production tumbled by nearly 200,000 b/d in June, to just 422,400 b/d on June 28, as Venezuela struggles to place its oil on the market due to the US sanctions. In the first half of June, production from the Orinoco oil belt slumped by 50 percent to just 148,000 b/d. In the Maracaibo basin, crude oil production plunged by 40 percent to 83,600 b/d. The collapse in oil prices and the tightening US sanctions against Venezuela have accelerated the decline of the oil industry in the country, sitting on the largest crude oil reserves in the world.

3. Climate change

Last week, the House Select Committee on the Climate Crisis released a report that it has been working on since January 2019. While the plan has no chance of becoming legislation in the current Congress, its endorsement by House Speaker Pelosi and moderate Democrats set a marker for what is possible if the Democrats gain control of the government next year.

The 538-page plan recommends eliminating emissions from the electricity generation by 2040 and achieving net-zero emissions across the board a decade after that. It suggests that all new vehicles sold in the United States should be electric by the year 2035. The package of more than 120 pieces of legislation seeks to drive a transition to net-zero carbon emissions by 2050. This is to be achieved by reaching into every corner of the US economy with new investments, standards, and incentives favoring clean energy, job creation, lands protection, and environmental justice.

House Democrats also passed a $1.5 trillion green infrastructure bill that would surge funding to repair the nation’s crumbling roads and bridges while setting aside funds for broadband, schools, and hospitals. Much of the $500 billion in transportation funding in the Moving Forward Act is tied to green measures that require states to set targets for reducing greenhouse gas emissions and make other climate-conscious efforts. “We are going to deal with the largest source of carbon pollution in the United States of America today,” House Transportation Committee Chair Peter DeFazio said. “Naturally this nonsense is not going anywhere in the Senate,” the leader said on the Senate floor Wednesday.

The IEA said that Government spending to develop clean energy technologies last week needs to triple this decade to prevent the worst effects of climate change. While many techniques to reduce carbon emissions from high-polluting sectors like steel and chemical production and shipping already exist, they will need funding to develop to the point that they’re ready to be deployed at the industrial scale. More than half of the emissions reductions required to get the world on a sustainable path will come from technologies currently at the prototype stage, including producing steel without the need for coal, or early-adoption steps, such as producing hydrogen from splitting water in electrolyzers.

European Space Agency satellites have detected vast plumes of methane leaking from the 2,607-mile-long Yamal pipeline that transports natural gas from Siberia to Europe. The massive methane leaks could upset the argument that natural gas is a cleaner fossil fuel that is favored over coal in the global energy mix.

Using the satellite data, energy consultancy Kayrros estimates that one leak was spewing a staggering 93 tons of methane every hour, equal to the amount of CO2 emitted by 15,000 cars in a year. A second leak on the same pipeline was nearly as egregious, gushing 17 tons of the gas every hour. Gazprom, the operator of the giant pipeline, has not responded to requests for comments by Kayrros. The latest discoveries suggest that we have been unfairly blaming volcanoes and natural oil and gas seepages for the sharp increase in atmospheric methane. Our drilling activities could be directly responsible.

4. The global economy and the coronavirus

A change in the coronavirus is appearing. This mutation, associated with outbreaks in Europe and New York, is now found in 95 percent of all the genomes sequenced. At a glance, the mutation seemed trivial. About 1,300 amino acids serve as building blocks for a protein on the surface of the virus. In the mutant virus, the genetic instructions for just one of those amino acids — number 614 — switched in the new variant from a “D” (shorthand for aspartic acid) to a “G” (short for glycine). Its ubiquity is undeniable. Of the approximately 50,000 genomes of the new virus that researchers worldwide have uploaded to a shared database, about 70 percent carry the mutation. It is officially designated D614G but known more familiarly to scientists as “G.”

At least four laboratory experiments suggest that the mutation makes the virus more infectious, although none of that work has been peer-reviewed. Another unpublished study led by scientists at Los Alamos National Laboratory asserts that patients with the G variant have more viruses, making them more likely to spread it to others.

United States: The US economy created a record 4.8 million jobs in June as more restaurants and bars resumed operations, but layoffs remained elevated, and increasing COVID-19 cases across the country threaten the fledgling recovery. The reopening of businesses has unleashed a wave of coronavirus infections in large parts of the country, including populous California, Florida, and Texas. Several states are scaling back or pausing reopening and sending some workers back home.

After recovering rapidly from mid-April through mid-June, the economy has shown signs of sputtering in the past two weeks. The flattening may reflect a pullback by consumers in states where cases of Covid-19 have shot up, the exhaustion of pent-up demand driven by stimulus checks, or merely a pause after the first wave of low-risk workplaces was allowed to reopen. According to data from The Washington Post, at least 4 million private-sector workers have had their pay cut during the pandemic.

According to an analysis of data from the payroll processor ADP, workers are twice as likely to get a pay cut now than they were during the Great Recession. Salary cuts are spreading rapidly in white-collar industries, which suggests a deep recession and slow recovery since white-collar workers are usually the last to feel financial pain. Companies have also trimmed employee hours, leaving many hourly wage workers with leaner paychecks as well. More than 6 million workers have been forced to work part-time during the pandemic even though they want full-time work, Labor Department data show.

Widespread pay cuts are highly unusual. In downturns, firms typically lay off workers rather than dealing with the administrative challenges and morale effects of slashing pay across the board. But as the United States faces the worst economic crisis since the Depression era, some business leaders have tried to save jobs by cutting pay between 5 and 50 percent. The median wage reduction was 10 percent, economists who worked on the Becker Friedman Institute study found.

China: Economic activity is gathering momentum in China. A private gauge of China’s service-sector activity, released Friday, surged in June to its highest level in more than a decade. The easing of virus-control measures in most parts of the country drove consumer demand. Chinese manufacturing activity strengthened in June, but the leading indices provided further evidence that the country’s steel market recovery will be largely domestically driven. The manufacturing purchasing managers’ index, published by Chinese media company Caixin, rose to 51.2 points in June from 50.7 in May, on the back of stronger production and better sales. It was the second consecutive monthly increase and the strongest reading since last December.

While manufacturing and service activity is reviving, the demand for exports is feeble, and Chinese consumers worry about losing jobs and are reluctant to spend. The survey adds to signs China’s economy is gradually recovering, supported by higher government construction spending. But forecasters say global demand for Chinese goods is uncertain as infections rise in the US, Brazil, and many other countries.

The volume of floating crude cargoes in Chinese waters hit a record high, dampening Chinese refiners’ buying interest in August-onward deliveries. There were 42.98 million barrels of crude on tankers idled in Chinese waters for 15 or more days in the week beginning June 29. The volume was 41.6 percent higher than the previous record of 30.36 million barrels set just the week before. The volume of cargoes in Chinese waters for over 15 days has been consistently setting fresh highs since May 18-24’s 11.58 million barrels.

The US and China are moving beyond bellicose trade threats to exchanging regulatory punches that threaten a wide range of industries, including technology, energy, and air travel. The two countries have blacklisted each other’s companies, barred flights, and expelled journalists. The unfolding skirmish is starting to make companies nervous the trading landscape could shift out from under them. “There are many industries where US companies have made long-term bets on China’s future because the market is so promising and so big,” said Myron Brilliant, the US Chamber of Commerce’s head of international affairs.

China is expected to buy large volumes of US soybeans in the fourth quarter but is projected to fall short of Phase 1 trade deal targets. Chinese crushers usually turn to US soybeans in Q4, after the US soybean harvest starts in September. Under the US-China Phase 1 trade deal, signed on January 15, China has committed to purchase $200 billion worth of US goods within two years, including agricultural products valued at $80 billion.

People in Beijing rushed to buy train and plane tickets out of the Chinese capital after the local government began easing travel restrictions for the first time since the June outbreak was discovered. Residents from Beijing’s areas designated “low risk” will be allowed to leave the city without being tested negative for the coronavirus from July 4. Strict controls will remain on people from dozens of medium and high-risk areas. However, local governments in other provinces decide whether or not people arriving from Beijing have to be tested or quarantined, and the rules vary across the country.

Europe: The UK economy shrank more than first thought between January and March, contracting 2.2 percent in the most significant fall since 1979. The Office for National Statistics revised down its previous estimate of a 2 percent contraction, with all the main economic sectors dropping. Companies linked to hospitality, travel and retail in Britain have announced thousands of more job cuts as the longer-term consequences of the COVID-19 pandemic take hold, choosing to slim down for survival rather than await potential government handouts.

Some 5,000 jobs are under threat as travelers stay home amid pandemic. It comes only a day after Airbus cut 15,000 jobs, including 1,700 in the UK. Budget airline EasyJet began consultations with unions on cutting a third of its staff or 4,500 jobs in all. Retail is also taking a huge hit. Even stalwarts such as British shopping icon Harrods reportedly drew plans for 700 cuts, blamed in part on a lack of tourists.

German Chancellor Merkel stated it is “right” to complete the planned 55 billion cm/year Nord Stream gas pipeline from Russia in light of the threat of new US sanctions against the project. Speaking July 1 in the German parliament, Merkel said US sanctions “did not correspond” to Germany’s interpretation of international law. Just 99 miles of Nord Stream 2 is left to lay in Danish waters out of the total 1,528-mile length after the US first implemented sanctions in December. New extended sanctions have been proposed in the US, which, if implemented, would target more companies involved in the construction of the pipeline.

Russia has been particularly hard hit by the coronavirus’s twin blows and the collapse in oil prices. Russia relies on taxes from the oil and gas sector for 40 percent of its budget. Since March, Russian charities and nonprofit organizations experienced a surge in the kind of clients they had not had before: families that had never been in financial crisis but are now desperate. Some of them were unable to buy even food. Some were left homeless.

According to the Russian federal statistics agency, an estimated 4.5 million people were out of work at the end of May. The nation’s economy is predicted to shrink by 5.5 percent this year.

Thousands of small businesses have gone bankrupt in Russia’s economic crisis caused by the pandemic and the collapse in oil prices. The government was slow to respond, and belated, patchy measures left millions of people adrift.

Latin America: The World Bank projects a recession in Latin America and the Caribbean. It will be the worst downturn since reliable data began in 1901, setting back progress on fighting inequality and poverty. The development institution expects a gross domestic product contraction of more than 7 percent for 2020, making it worse than any crisis of the past century, including the Great Depression, the 1980s debt crisis, and the global financial of 2008-2009. The drop in commodity exports based on a plunge in demand in advanced economies, coupled with the collapse of tourism, is hammering the region.

Political systems were fragile before the pandemic and will be severely challenged by the current crisis. The World Bank has been helping more than 100 countries worldwide to deal with the health crisis and working with the International Monetary Fund and Inter-American Development Bank to provide support to Latin America, he said.

India: From March through May, around 10 million migrant workers fled India’s megacities, afraid to be unemployed, hungry, and far from family during the world’s biggest anti-virus lockdown. As Asia’s third-largest economy slowly reopens, the effects of that massive relocation are rippling across the country. Urban industries don’t have enough workers to get back to capacity, and rural states worry that without the flow of remittances from the city, already low-income families will be worse off — and a more significant strain on state coffers. In the first 15 days of India’s lockdown, domestic remittances dropped by 90 percent.

Meanwhile, migrant workers aren’t expected to return to the cities as long as the virus is spreading, and work is uncertain. States are rolling out stimulus programs, but India’s economy is hurtling for its first contraction in more than 40 years, and without enough jobs, a volatile political climate gets more so. “This will be a huge economic shock, especially for households of short-term, cyclical migrants, who tend to come from vulnerable, poor and low-caste and tribal backgrounds,” said Varun Aggarwal, a founder of India Migration Now, a research and advocacy group.

The spread of the virus has prompted states, including Maharashtra and West Bengal, to extend curbs from the world’s strictest lockdown imposed since March that triggered a collapse in economic growth. With the world’s fourth-highest number of coronavirus infections, the South Asian nation expects its first contraction in the gross domestic product in more than four decades. Indian stocks dropped last week on concern that increasing coronavirus infections and the extension of restrictive measures in some states will hinder recovery. “Investors are pricing in the rising pace of infections, which is extending lockdowns at some states and companies,” said Sameer Kalra, an investment strategist at Target Investing in Mumbai. “June-quarter results will be terrible due to a bumpy reopening of the economy.”

Saudi Arabia: Saudi Arabia’s net foreign assets rose slightly in May, reversing three months of declines. The stockpile climbed by 0.2 percent, or about $800 million, to reach $445 billion, according to a report from the Saudi Arabian Monetary Authority. Officials said a record cumulative decline of more than $47 billion in March and April was mainly due to a $40 billion transfer from the central bank to the sovereign wealth fund, intended to support investments abroad to take advantage of market turmoil during the coronavirus pandemic.

With reserves at the lowest in almost a decade, the world’s largest oil exporter has tried to rein in spending at home. It faces a double crisis from the outbreak and a significant decline in energy revenue. The government, which counted on crude for over 60 percent of its income this year, is now contending with oil output cuts and prices well below its break-even level. Finance Minister Mohammed Al-Jadaan said the government would only draw down reserves by up to $32 billion over the whole year, as initially planned in the budget.

The recent increase in oil prices has given officials slightly more breathing space, though the output cuts will result in less of a boost to public finances. Global benchmark Brent crude rose nearly 40 percent in May from April and has traded at over $40 a barrel this month — still far short of the $76.10 the International Monetary Fund estimates Saudi Arabia needs to balance its budget.

Saudi Arabia’s plans to restrict the number of pilgrims during the annual Hajj pilgrimage to a few thousand will likely dent jet fuel demand. In the last Islamic year that ended in August 2019, the kingdom hosted around 2 million Saudi and foreign pilgrims during Hajj, which takes place at the end of the Islamic year. Saudi Arabia also received 7.5 million Saudi and foreign pilgrims in the last Islamic year, who performed the mini-pilgrimage or Umrah during that year.

Jet fuel consumption typically increases by at least 30 percent during the Hajj, but this is unlikely to occur in July this year due to the restrictions. Jet fuel demand in Saudi Arabia will likely decline by around 40 percent this year compared with 2019, accounting for about 20 percent of the jet fuel demand in the Middle East.

5. Renewables and new technologies

The European Commission has decided that the energy transition to non-polluting energy is one of the most important topics for the coming years. The European Green Deal Investment Plan (EGDIP), also referred to as Sustainable Europe Investment Plan (SEIP), is one of the Eurozone’s most ambitious plans to mobilize at least €1 trillion in public-private investments over the next decade. Recently its hydrogen strategy was leaked, revealing how Europe’s top policymakers intend to expand the fuel’s path from production to transportation, storage, and consumption.

A central ‘theme’ in Europe’s sustainability plan is the decarbonization of its industry, which requires high temperatures currently produced by burning coal and natural gas. Hydrogen is extremely promising as it is applicable throughout the energy value chain. Although hydrogen production through electrolysis or perhaps someday in solar panels is preferred, steam methane reforming is used much more often due to low costs. The EC’s hydrogen strategy intends to tackle these challenges and establish a 40 GW market by 2030.

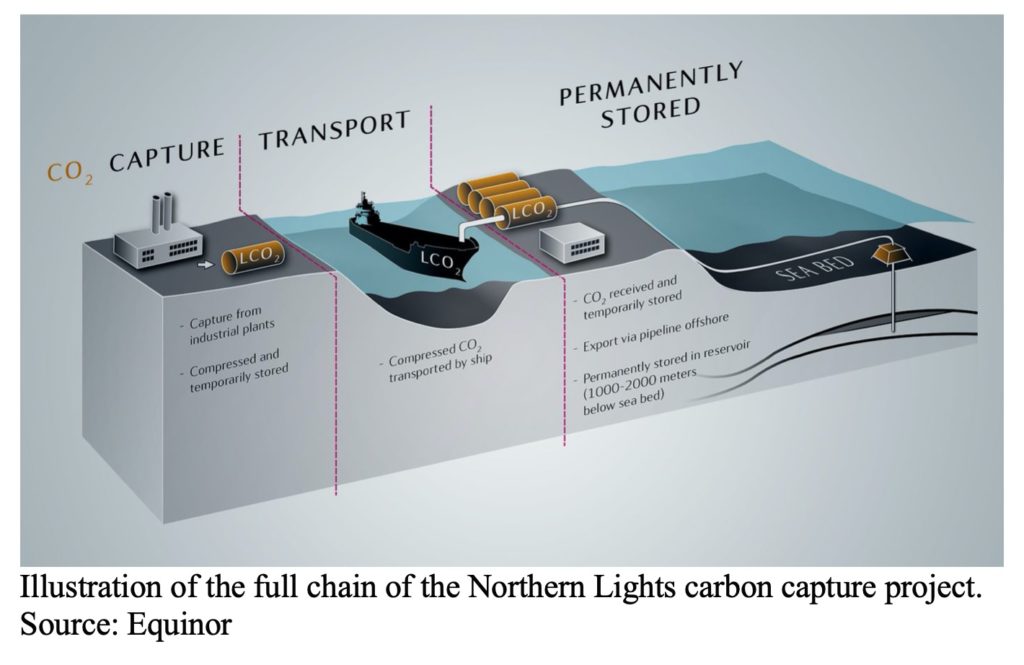

Norway’s Equinor, along with Shell and Total, is already working on making large quantities of “blue hydrogen” from natural gas and then sequestering the resulting CO2 into the earth. “Green hydrogen” is produced from water using non-polluting wind or solar industry. Last week Equinor announced that it is starting work on a project in the UK to develop a large-scale blue hydrogen facility that will be completed by 2030. Equinor said the project would enable industrial customers of the facility to switch over to hydrogen entirely. The local power plant plans to move to a 30 percent hydrogen to natural gas blend. As a result, emissions from the facilities’ customers will reduce emissions by nearly 900,000 tons of CO2 per year.

In Germany, Daimler Truck is pushing forward with series production of fuel cells. Moreover, Daimler is forming a joint venture with the Volvo Group to produce fuel cell systems. Rolls-Royce Power Systems plans to use the fuel cell systems from a joint venture between Daimler Truck AG and the Volvo Group. A comprehensive cooperation agreement is to be drawn up and signed by the end of the year.

Solar and onshore wind power are now the cheapest new sources of electricity for at least two-thirds of the world’s population, further threatening coal and natural gas. The levelized cost of electricity for onshore wind projects has fallen 9 percent to $44 a megawatt-hour since the second half of last year. Solar declined 4 percent to $50 a megawatt-hour, according to a new report from BloombergNEF. Prices are even lower in some countries, including the US, China, and Brazil. Equipment costs have come down, technologies have improved, and governments have boosted clean-power targets.

“Best-in-class solar and wind projects will be below $20 per megawatt-hour before 2030,” Tifenn Brandily, an analyst at BNEF, said in a statement. “There are plenty of innovations in the pipeline that will drive down costs further.” A decade ago, solar was more than $300 a megawatt-hour, and onshore wind exceeded $100 per megawatt-hour. Today, onshore wind is $37 in the US and $30 in Brazil, while solar is $38 in China, the cheapest sources of new electricity in those countries.

Battery storage is also getting more competitive. The levelized cost of electricity stored in utility-scale batteries has fallen to $150 a megawatt-hour, about half of what it was two years ago. That’s made it the cheapest new peaking-power technology in places that import gas, including Europe, China, and Japan.

SunHydrogen is the developer of a technology to produce renewable hydrogen using sunlight and water. The will plans to focus on its more efficient GEN 2 hydrogen production technology, which could significantly reduce the cost of producing renewable hydrogen.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

The international rig count for June reached 781, a decrease of 24 units from May and down 357 units from the 1,138 counted in June 2019, according to Baker Hughes data. The international offshore rig count for June was 194, down 1 unit from May, and down 52 units from the 246 counted in June 2019. The worldwide rig count for June was 1,073, down 103 units from the 1,176 counted in May, and down 1,148 units from the 2,221 counted in June 2019.

Global flight passenger demand, measured in revenue passenger kilometers or RPK’s, contracted 91 percent on the year in May, after falling 94 percent in April, the International Air Transport Association said July 1st. According to IATA, the slight uptick in May relative to April was due to developments in domestic markets with international air travel close to zero in April and May. (7/2)

Angola has endured a lot of strain in the coronavirus period. Straddled with foreign debt, the loss of oil revenues which have been making up roughly a third of the government’s income. Angola was compelled to seek IMF assistance on keeping its economy afloat, including a somewhat risky move of suspending all debt service payments from May 1st until the end of the year. (7/2)

In Colombia, the latest oil price rally, which has seen Brent rise to just over $40 per barrel, has provided little relief for oil producers. That price is below the breakeven price for many Colombian drillers, impacting their profitability and forcing them to curb spending. This has instigated considerable fallout for Colombia’s oil industry and, ultimately, the economy; government spending relies heavily on oil revenues. Baker Hughes reported only one operating drilling rig in the country compared to 25 one year earlier. (6/30)

According to Baker Hughes, the US oil rig count dropped three rigs last week to 185 while increasing the gas rig count by one to 76. That leaves oil rigs down 603 and gas rigs down 98 from last year, a 73 percent decline in the total rig count. (7/4)

Exxon Mobil Corp. incurred an unprecedented second straight quarterly loss as almost every facet of the oil giant’s business slumped amid Covid-19 lockdowns that stunted economic activity. The explorer’s oil and natural gas unit took a hit of as much as $3.1 billion as prices for those commodities slumped. (7/3)

Chesapeake Energy Corp filed for Chapter 11 on Sunday, becoming the most significant US oil and gas producer to seek bankruptcy protection in recent years. It bowed to massive debts and the impact of the coronavirus outbreak on energy markets. (6/29)

Royalty relief: seeking to keep wells from abandonment during a period of crashing oil prices, the US interior department on April 21st declared that oil and gas operators could find lower royalty rates. The government has since cut royalty rates on hundreds of properties, in many cases, from 12.5 percent of sales to 0.5 percent. While a small portion of federal government revenue, energy royalties are significant to resource-rich states in the mountain west that receive about half of what Washington collects inside their borders. (6/29)

Electric bills will increase: As the US faces a blisteringly hot summer, millions of people already reeling from the coronavirus’s economic fallout are about to face sharp increases in electric bills that may drive some to the brink of financial ruin. With soaring temperatures expected in July and August, people stuck at home because they’re unemployed or working remotely will depend on air conditioners more than ever. That’s going to drive up power bills by as much as 25 percent in parts of the US at a time when they were already a significant hardship for about 50 million people. (7/2)

Coal deliveries to US power plants fell to over a 13-year low of 30.02 million tons in April, down 13.5 percent from 34.71 million tons delivered in March and 32.9 percent lower than the year-ago month, according to US EIA data. (7/1)

US coal exports tumbled to a 3.5-year low of 4.28 million tons in May, as metallurgical and bituminous coal both saw declines, while sub-bituminous exports rose in the month released July 2nd. May coal exports were down 13.9 percent. (7/3)

US coal is now poised to receive another blow — one from which it may not recover — from the European Union as part of the EU’s potential new tariffs. The move could reportedly hit parts of the US that are politically crucial for Trump and top GOP lawmakers, reported the New York Post. So, what spurred these proposed tariffs seemingly targeted at Trump? According to some reports, it’s just the latest battle in a lengthy trade war between the US and the EU that can be traced back to a prolonged dispute over aerospace subsidies. (6/29)

Offshore Virginia Beach, two wind turbines now rise higher than the Washington Monument, a $300 million down payment on what state officials wager will be a new industry and a source of clean energy. On Monday, Gov. Northam signed laws creating a state Office of Offshore Wind and setting a mandate for 5,200 megawatts of offshore wind energy by 2034. When the turbines start spinning next month, they’ll be the proof of concept for what’s expected to be the biggest wind farm in federal waters in the US — more than 180 such turbines on this patch of ocean 27 miles offshore should be in operation by 2026. (7/1)

In California, there is a debate heating up over whether dead trees should be cleared and burned for biofuel before they burn where they are in yet another devastating West Coast wildfire. Fires are on track to become both more severe and more frequent thanks to rising temperatures and drier conditions due to climate change. A growing contingent of scientists and experts argues that converting these dead and diseased trees to biomass for energy production will “help to restore forests and reduce CO2 emissions.” (7/1)

China’s hydro industry, as its final two mega-dams (Wudongde and Baihetan) start production this year and next, will be down-shifting toward smaller projects and pumped storage. Engineers have run out of the most accessible locations to build massive power sets of turbines. The falling cost of rival energy sources such as solar means it isn’t worth moving on to more challenging areas. (7/4)

Japanese automakers’ global sales declined 38 percent in May, in the third straight month of big falls as most automotive factories and dealerships remained closed due to coronavirus lockdowns. The country’s seven significant automakers sold a total of 1.47 million vehicles last month, down sharply from 2.38 million units a year ago. (6/29)

Airbus plane output will be 40 percent lower for two years compared to pre-crisis plans, its chief executive said in remarks published on Monday, underscoring the threat to jobs as it draws up rapid restructuring plans due to a travel slump. (6/29)

South Pole warming: At the South Pole, considered the coldest point on Earth, temperatures are rising fast. Climate researchers worry and wonder whether human-driven climate change is playing a more significant role than expected in Antarctica. Temperature data shows that the desolate region has warmed the global warming rate three times over the last three decades up through 2018, the South Pole’s hottest year. But looking at data from 20 weather stations across Antarctica, the South Pole warming rate was seven times higher than the overall average for the continent. (7/1)

The Arctic is enduring its summer of discontent. Wildfires are raging amid record-breaking temperatures. Permafrost is thawing, infrastructure is crumbling, and sea ice is dramatically vanishing. The pace, severity, and extent of the changes are surprising even to many researchers who study the region for a living. Predictions for how quickly the Arctic would warm that once seemed extreme now appear to underestimate what is going on in reality. (7/4)

Busy Alaskan beavers are carving out a growing web of channels, dams, and ponds in the frozen Arctic tundra of northwestern Alaska, helping to turn it into a soggy sponge that intensifies global warming. On the Baldwin Peninsula, near Kotzebue, for example, the big rodents have been so busy that they’re hastening the regional thawing of the permafrost, raising new concerns about how fast those frozen organic soils will melt and release long-trapped greenhouse gases into the atmosphere. (7/1)