Editors: Tom Whipple, Steve Andrews

Quotes of the Week

“We are now putting an end to the fossil era and drawing a straight line between our activities in the North Sea and the Climate Act’s goal of climate neutrality in 2050.”

Dan Joergensen, Denmark’s climate minister, after announcing the termination by 2050 of all offshore drilling and exploration leases for oil and gas

“Today we put the oil industry on notice. Any oil companies that bid on lease sales for the coastal plain of Arctic National Wildlife Refuge should brace themselves for an uphill legal battle fraught with high costs and reputational risks.”

Jamie Rappaport Clark, president and CEO of Defenders of Wildlife

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

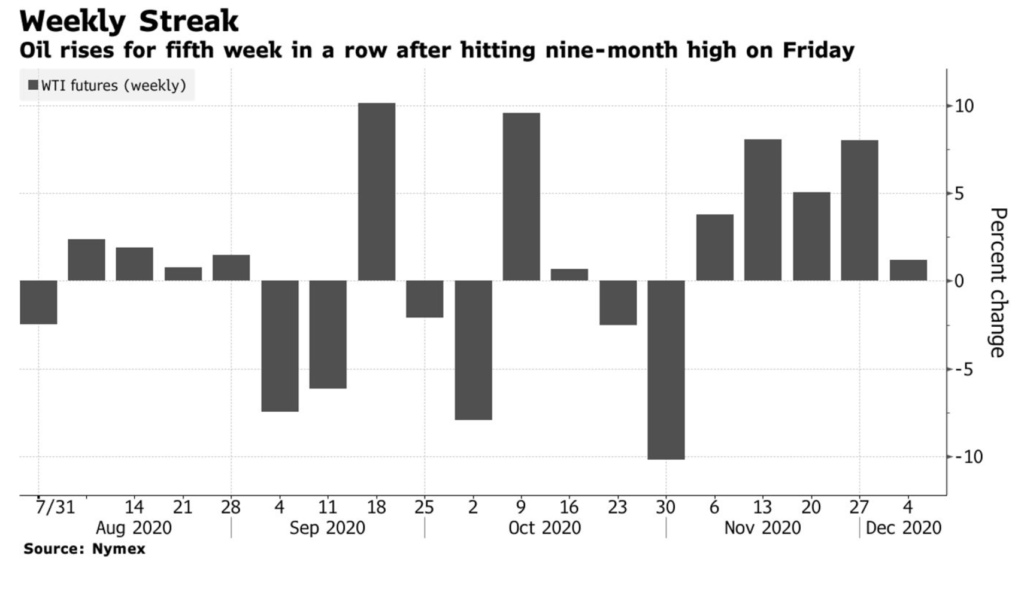

Oil: Prices rose for a fifth straight week with support from the OPEC+ deal and hopes for another round of US stimulus. Futures in New York and London closed at nine-month highs on Friday, with signs momentum is building toward a fiscal stimulus plan that could provide a demand boost before a vaccine is widely available.

OPEC+ reached a compromise agreement that offers something for members concerned about the fragility of the market and nations who want to pump more to take advantage of higher prices. The deal involves adding 500,000 b/d of production to the market next month and holding monthly meetings to decide on subsequent moves. West Texas Intermediate settled at $46.26 a barrel, posting a 1.6 percent weekly gain, and Brent settled at $49.25 a barrel, up more than 2 percent last week.

Baker Hughes reported that the number of oil rigs in the United States rose by 5 to 246—the highest number of rigs since mid-May. The EIA’s estimate for oil production in the US is now at 11.1 million b/d, with US production still rangebound between 9.7 million bpd and 11.1 million bpd for months.

US refined product inventories climbed in the week ended Nov. 27th as the pandemic blunted demand during the typically travel-heavy US Thanksgiving Day holiday weekend. Total US gasoline inventories rose 3.49 million barrels to 233.64 million barrels, while distillate stocks moved 3.24 million barrels higher to 145.87 million barrels. While gasoline inventories typically climb in late-November, last week’s build was the largest weekly uptick since early April, when state and local governments were ramping up pandemic lockdowns.

Brent crude, the international gauge for oil prices, may be overhauled to reflect the growing importance of US exports in global energy markets. By March 2022, S&P Global Platts is likely to start using crude drilled from wells near Midland, Texas, to help set the price of Dated Brent, a gauge that has historically reflected physical oil prices in Europe’s North Sea. On Thursday, the price-reporting agency began consulting market participants on the proposed change and aimed to conclude the review by February.

Since the late 1980s, Dated Brent has acted as the benchmark on which most traded barrels of oil in the world is priced. For years, however, Dated Brent had faced a significant problem. Brent, drilled from underneath the East Shetland Basin off Scotland’s coast, is fast running out. Platts responded by introducing different varieties of crude produced in the North Sea into its calculations. Dated Brent has evolved into a basket of crudes, including not just its namesake but Forties, Ekofisk, Troll, and Oseberg. But supplies of other North Sea crudes are also depleting alongside those of Brent.

The proposal to include West Texas Intermediate crude in Dated Brent is designed to resolve that problem, creating a benchmark that better reflects the underlying oil market’s reality. It underscores the US’s rapid emergence as the world’s key swing supplier of oil over the past half-decade.

OPEC: The cartel and a group of Russia-led oil producers agreed to increase their collective output by 500,000 b/d next month, signaling that the world’s biggest producers are betting the worst of a pandemic-inspired shock to demand is behind them. The deal marks a compromise after sharp disagreements. In recent weeks, international oil prices have started to bounce back, climbing some 25 percent since the start of last month. Asian economies have been recovering strongly, boosting oil demand there.

A day after OPEC reached an agreement to boost oil production, Russian Deputy Prime Minister Novak told local media that the cumulative increase in output would reach 2 million barrels daily by April. “The compromise comes down to the fact that we will gradually increase production to the level stipulated in the agreement. By adding 500,000 b/d to total production each month during the first quarter by April, we will reach a production increase level of 2 million b/d,” Novak explained.

The 500,000 b/d production increase will be divvied up proportionally, with Saudi Arabia and Russia, the two largest members, each allowed to pump 126,000 b/d more. The Saudis and Russia will now have quotas of 9.119 million b/d. OPEC’s second-largest producer Iraq will have a cap of 3.857 million b/d, while the UAE, the third-largest, will be held to 2.626 million b/d. That does not include any so-called “compensation cuts” owed for overproducing above quotas in previous months. OPEC’s 13 members will be allowed to raise production by 304,000 b/d, and the nine non-OPEC partners will be allowed a 196,000 b/d increase.

The pandemic has amplified the economic disparity between poor and wealthy members of the oil exporter alliance, adding to the challenge of finding a consensus to suit all their fiscal oil price break evens. Wealthy producers, such as Saudi Arabia and the UAE, still need oil prices around $80 per barrel to balance their budgets and still own sizeable foreign exchange reserves or sovereign wealth funds to absorb economic shocks. Weaker members, including Iraq, Nigeria, and Iran, have fewer financial buffers and are more vulnerable to low prices.

Russia, the leading non-OPEC partner in the coalition, can better absorb oil shocks than its Gulf Arab allies because of its flexible exchange rate to the US dollar, the currency used to price its crude. With its comparatively strong resilience to low oil prices compared to other producers, Moscow may encourage the Kremlin’s policymakers to seek smaller cuts for a shorter duration in the future.

Shale Oil: BloombergNEF says the US shale industry has further reduced its break-evens over the past year. However, the decline in drilling costs alone may not be sufficient to help producers to lift production after this year’s downturn. Oil firms in America are currently under pressure from investors to turn in profits and return part of them to shareholders. From the smallest driller to the largest corporations, all shale oil drillers have reduced capital spending this year in response to the collapse in oil prices. They will continue to show discipline in spending next year amid the uncertain recovery of oil demand and oil prices. The COVID-inflicted crisis accelerated bankruptcies across the shale industry, with more filings expected in the coming months.

According to Bloomberg’s report, exploration and production companies operating in the lowest-cost Delaware deposit of the Permian Basin can now profitably drill a well at an oil price of $33 a barrel, down from a $40 per barrel break-even last year. “Contract renegotiations, ongoing efficiency gains, and process improvements have allowed the oil industry to slash the cost to drill and complete a well.” According to the report, crude prices in the range of $35 to $45 next year would keep crude oil production flat in the four principal oil plays in the US. The Q3 Dallas Energy Survey from end-September showed that most executives from 154 oil and gas firms—66 percent—believe US oil production has peaked.

Natural Gas: A closely watched US natural gas price spread flipped to negative, signaling that traders have all but given up on the prospect of a cold winter. Gas for January delivery is now trading below February prices, a first for the 2021 contracts. January futures tumbled to a two-month low on Thursday, for the worst performance among major commodities, as near-term forecasts for chillier conditions were scaled back. According to The Weather Company, temperatures may be above average in much of the Midwest and parts of the Northeast in mid-December.

The market extended declines after a government report showed that only 1 billion cubic feet of gas were taken out of storage last week, much lower than the five-year average draw of 41 billion for this time of year. Just over a month ago, hedge funds’ bullish wagers on gas climbed to a six-year high as liquefied natural gas exports rose to a record and shale drillers reined in production amid low oil prices. But with few signs of the weather cooperating to support a rally, money managers are now unwinding those bets, leaving prices futures mired below $3.

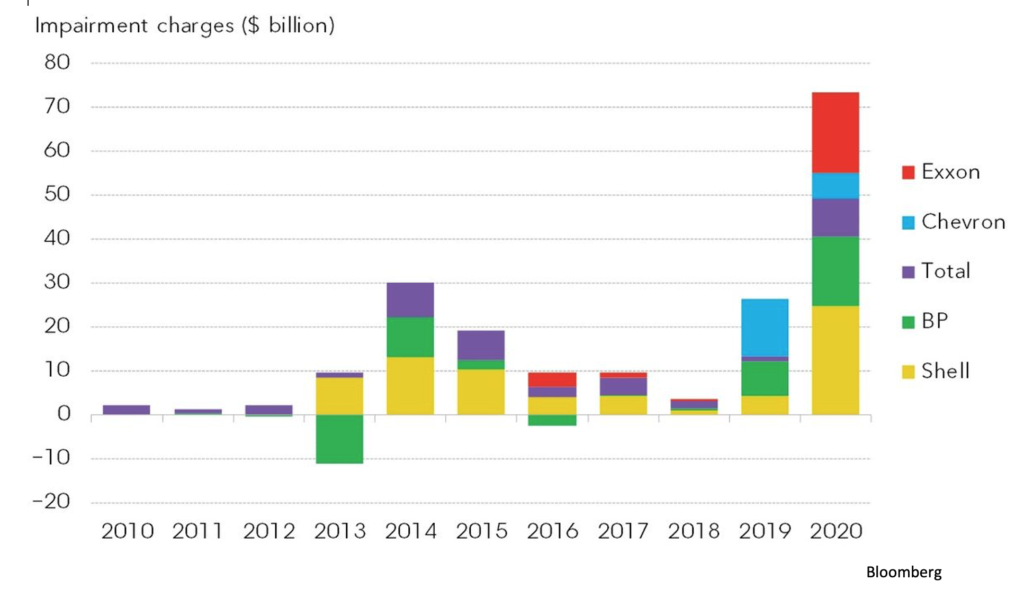

Prognosis: Exxon Mobil’s impending write-down of natural gas fields rounds out a record year for Big Oil charge offs stemming from misplaced optimism on the future of fossil fuels. The five Western supermajors have now identified more than $70 billion of asset impairments this year, by far the most in at least a decade. The pandemic-induced crash in energy markets has forced companies to lower price forecasts and scale back drilling plans, severely reducing the value of their oil and gas resources.

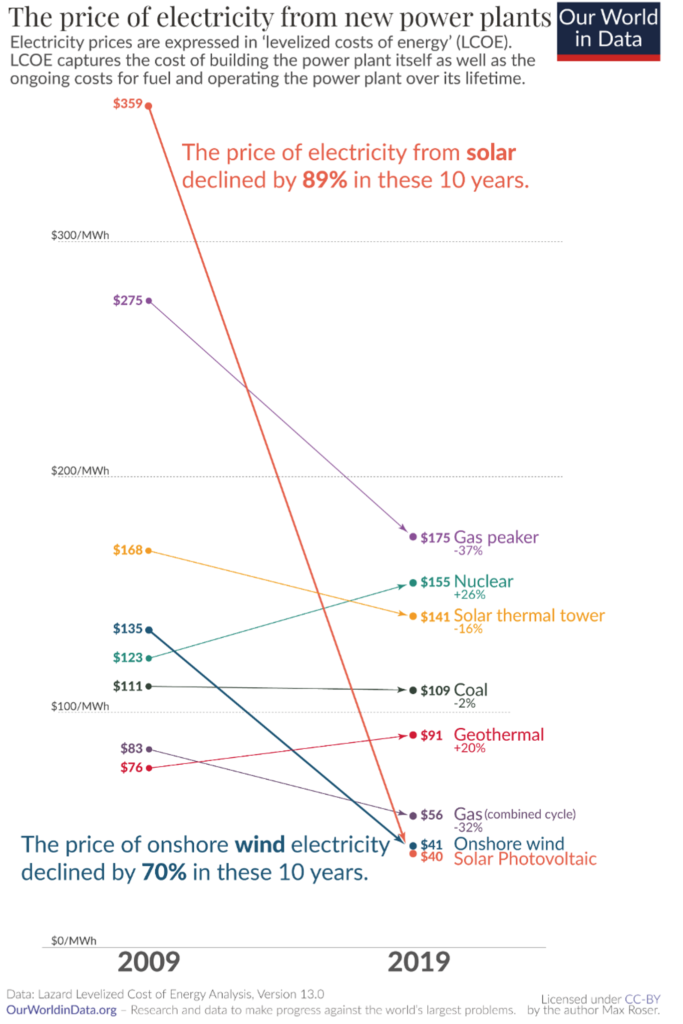

“Peak oil demand is more of a serious threat, though not a complete revamp in the business,” said an analyst at BloombergNEF in London. Big oil is becoming “more realistic in their expectations for oil prices going forward.” The European supermajors used the 2020 crisis to revamp their business model with a pivot toward renewable energy, with BP even pledging to reduce oil and gas production over time. By contrast, Exxon and Chevron Corp., America’s largest oil companies, say they have little competitive advantage in the renewables and are sticking with traditional fossil fuels for the long haul.

Even so, the US giants have severely pared back investment plans. Exxon reduced its capital spending budget by one-third, or $10 billion, this year, and spending will be significantly lower than pre-pandemic forecasts until 2025. Chevron made similar cuts, and though it hasn’t provided long-term guidance, CEO Mike Wirth has made financial discipline his mantra.

Energy efficiency is expected to record its weakest progress in a decade, creating additional challenges to the world achieving international climate goals. Plunging investments and the economic crisis have markedly slowed the progress in energy efficiency this year, to half the improvement rate seen in the previous two years, the IEA said in its Energy Efficiency 2020 report. Global primary energy intensity, a key indicator of how efficiently the world’s economic activity uses energy, is expected to improve by less than 1 percent in 2020, the weakest rate since 2010.

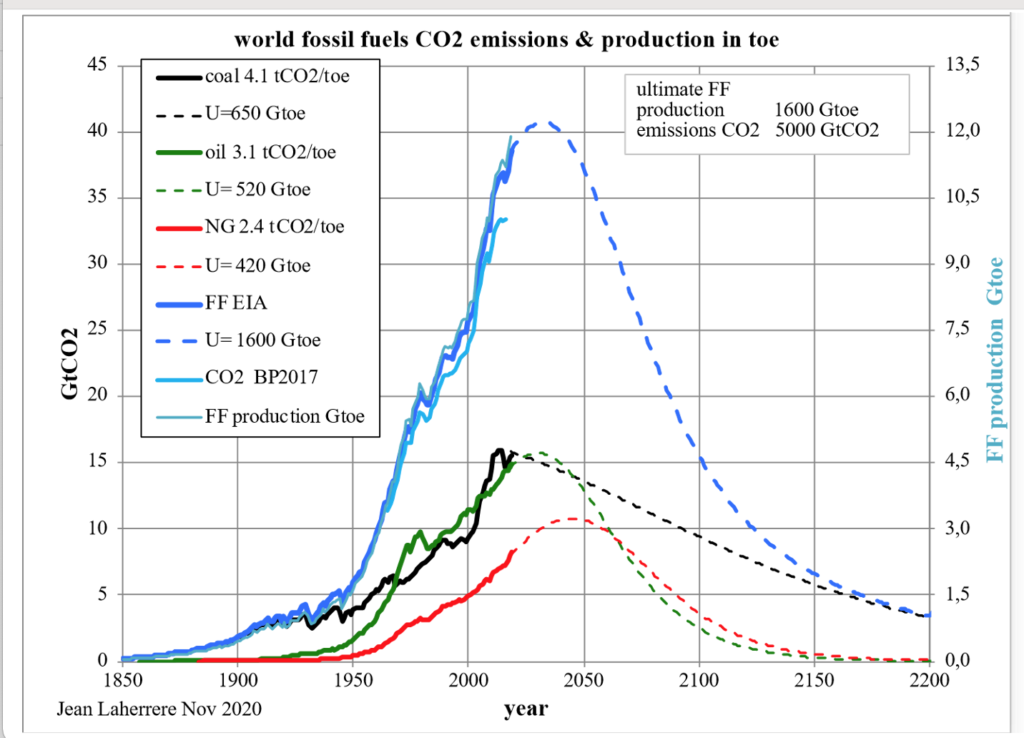

A year ago, if anyone in the petroleum business had suggested that the moment of Peak Oil had already passed, they would have been laughed right off the drilling rig. Then 2020 happened. Planes stopped flying. Office workers stayed home. “Zooming with the grandkids” replaced driving to see the family. A year of global hunkering yielded the sharpest drop in oil consumption since Henry Ford sold the first Model T. At its worst, global demand dropped by a staggering 29 million b/d. As a once-in-a-century pandemic played out, British oil giant BP made an extraordinary call: Humanity’s thirst for oil may never again return to prior levels. That would make 2019 the high-water mark in oil history.

BP wasn’t the only one sounding an alarm. While none of the prominent forecasters were quite as bearish, predictions for peak oil started popping up everywhere. Even OPEC, the bullish cartel of major oil exporters, suddenly acknowledged an end in sight—albeit still two decades away. Taken together, these forecasts mark an emerging view that this year’s drop in oil demand isn’t just another crash-and-grow event as seen throughout history. Covid-19 has accelerated long-term trends that are transforming where our energy comes from. Some of those changes will be permanent.

2. Geopolitical instability

(These are the situations that are reducing the world’s energy supplies or have the potential to do so.)

Iran: The parliament has approved plans to dramatically increase its nuclear enrichment program in contravention of its agreement with global powers. In a sign of the deep divisions between the hardliners in parliament and moderates, the centrist government of President Hassan Rouhani immediately opposed the move. Centrists say such a move could harm their chances of resuming talks with the US. President-elect Biden is keen to restart negotiations over the 2015 nuclear deal that President Trump abandoned in 2018.

Iran plans to install hundreds more advanced uranium-enriching centrifuges at an underground plant. The International Atomic Energy Agency says Iran plans to install three more cascades, or clusters, of advanced IR-2m centrifuges in the underground plant at Natanz, built to withstand aerial bombardment.

Iran currently is saying it will not accept preconditions from a new Biden administration over its nuclear program, and the US must return to a 2015 deal before talks can take place. Both sides appear to want the other to re-adopt the agreement’s terms first before agreeing to negotiations.

Iraq: Nationwide oil exports fell by about 134,000 b/d in November, as Iraq cut back production towards its OPEC quota obligations after a significant output increase in October. The federal Oil Ministry said it averaged 2.70 million b/d in exports for the month, down from 2.87 million b/d in October. The Kurdistan Regional Government posted 435,000 b/d in independent oil sales, up from 401,000 b/d the previous month.

China National Petroleum Corporation and China National Offshore Oil Corporation are considering acquiring ExxonMobil’s 32.7 percent stake in Iraq’s supergiant West Qurna 1 oil and gas field. However, China is already dominant at the site, not only through the 32.7 percent stake held by PetroChina but also through the gradual acquisition of a range of large supposedly ‘contract-only’ awards made to Chinese companies for work on the field.

Thousands of demonstrators have taken to the streets in Kurdistan to protest delayed salary payments, raising the pressure on the Regional Government as it contends with overlapping financial and political crises. According to both protesters and security officials, several protesters were injured in violent crackdowns by security forces, and about three dozen were arrested.

Islamic State militants launched a rocket strike against an Iraqi refinery, causing its shut-down for a few hours. In a statement on the terrorist group’s official channel, IS took responsibility for the attack, which caused a fire at a fuel storage tank, which has been brought under control. The Siniya refinery, located in Northern Iraq, has a daily processing capacity of 300,000 b/d. Although officially defeated, the news suggests the Islamic State is still capable of interfering in Iraq’s oil industry.

Libya: The Tripoli government said that a meeting of all stakeholders involved agreed to work toward unfreezing Libya’s oil revenues. Earlier last week of representatives of the internationally recognized government, the Central Bank of Libya and the National Oil Corporation decided to “look into mechanisms to lift the current freeze and restore matters to normal, with emphasis on activating the monitoring mechanisms and adherence to the standards of disclosure and transparency.” Libya has restored the level of oil production to volumes it was pumping before the blockade of its oil ports and oilfields in January this year. Still, disposition of the revenues from oil sales have been the sticking point in returning to normal operations.

Venezuela: Oil exports jumped in November to more than 500,000 b/d from less than 370,000 in October. In November, the heavily sanctioned country’s oil exports picked up substantially after it found new buyers, which include Xiamen Logistic Grass, Olympia Stly Trading, Zaguhan & Co., Karaznbas, Kalinin Business International, and Poseidon GDL Solutions, all who are mysterious and rather convenient nonentities that are taking the place of traditional oil companies now prohibited from purchasing Venezuela’s oil due to the US sanctions. The new companies are all registered in Russia. ENI, Rosneft, and Repsol are among the companies that have officially had to stop purchases of PDVSA crude.

PDVSA suspended gasoline production at the El Palito refinery after a problem led to a fire. El Palito had only been in operation for less than a week before the fire occurred. After the suspension of operations at El Palito, Venezuela is now left with only the Cardon refinery to produce much-needed gasoline. The Cardon facility has a processing capacity of 300,000 b/d of crude, but gasoline output was 30,000 b/d last week. The gasoline shortage in Venezuela results from lower production of oil and years of mismanagement at refineries, as well as US sanctions, which have cut off gasoline imports into the country.

3. Climate change

A spat over the EU’s plan to tighten its 2030 climate goal adds to a list of conflicts that the region’s leaders will have to deal with at a summit in Brussels Dec. 10-11. Old fault lines between eastern and western member states are resurfacing over the costs of an ambitious economic clean-up just as Poland and Hungary threaten to veto the bloc’s budget and a recovery fund. At the heart of the climate conflict is the effort to deepen the EU emissions-reduction target to at least 55 percent by the end of the next decade from 1990 levels. Raising the target from the existing goal of 40 percent would need an additional investment of $424 billion.

The EU’s economy-wide greenhouse gas emissions fell by 3.7 percent in 2019 to the lowest in three decades. The fall in GHG emissions — which took the bloc’s emissions down to 24 percent below 1990 levels — came as the EU’s GDP grew by 1.5 percent. “The European Union is proving it is possible to reduce emissions and grow your economy,” said executive vice-president for the European Green Deal, Frans Timmermans.

A group representing major automakers vowed to work with President-elect Biden to reduce vehicle emissions even as the industry remains split over a Trump administration effort to bar California from setting emissions rules. The group, representing General Motors, Volkswagen, Toyota, Ford, Nissan, and other major automakers, said that it “looks forward to engaging with the incoming Biden administration … to advance the shared goals of reducing emissions and realizing the benefits of an electric future.”

The 2020 hurricane season officially closed last week. This year surpassed 2005 as the busiest ever on record, with 30 named storms forming over the Atlantic basin. The season, which officially runs from June 1 to Nov. 30, set a record-breaking pace almost from the start, ending with Hurricane Iota, the season’s first Category 5 storm.

Global efforts to reduce wasted energy had a significant setback in 2020, sidelining a relatively simple way of slashing emissions and hitting climate goals. That’s the conclusion from an IEA report, which recorded the weakest improvement in efficiency since 2010, as investments in technologies that can cut emissions have slowed. The report highlights a challenge for policymakers looking to improve how the world consumes energy across almost every part of life.

Even though emissions are set to drop in 2020, slow progress on energy efficiency could have long-term consequences for the climate far more significant than this year’s temporary emissions relief. Improving the way the world heats and cools its buildings as well as powers its cars over the next 20 years would lead to a considerable drop the pollution cuts needed to ensure the climate targets set out in the Paris Agreement are hit.

4. The global economy and the coronavirus

Over 1.5 million people have lost their lives due to COVID-19, with one death reported every nine seconds. Nearly 65 million people globally have been infected by the disease, and the worst affected country, the US, is currently battling its third wave of infections. World Health Organization officials warned governments and citizens not to drop their guard over the COVID pandemic now that a vaccination is close, saying healthcare systems could still buckle under pressure.

The pandemic has fueled a 40 percent increase in the number of people needing humanitarian assistance, the UN said last week, as it appealed for roughly $35 billion to help many of those expected to be in need next year. The pandemic has wreaked carnage across the most fragile and vulnerable countries. The United Nations has set out 34 humanitarian response plans covering 56 countries for 2021, aiming to help 160 million people.

United States: America had one of the very worst weeks since the pandemic began nine months ago. On Friday, a national single-day record was set, with more than 226,000 new cases. It was one of many data points that illustrated the depth and spread of a virus that has killed more than 278,000 people in this country. In California, where daily case reports have tripled in the last month, Gov. Gavin Newsom announced a new round of regional stay-at-home orders to address a mounting crisis over intensive-care beds.

Infectious-disease experts have gained a better understanding of who is the most vulnerable among the nation’s nearly 330 million residents. Nursing home deaths have consistently represented 40 percent of the country’s Covid-19 deaths since midsummer, even as facilities kept visitors away and took other precautions.

The head of the US Center for Disease Control warned on Wednesday the pandemic, still raging with unprecedented fury nationwide, will pose the country’s grimmest health crisis ever over the next few months before vaccines become widely available. The sober message from one of the nation’s top health officers followed Thanksgiving holiday observances in which millions of Americans disregarded warnings to avoid travel and large gatherings even as COVID infections and hospitalizations surged mostly unchecked.

US job growth slowed sharply in November, suggesting the labor-market recovery is losing steam amid a surge in coronavirus cases and new business restrictions. Employers added 245,000 jobs last month, down from 610,000 jobs in October, the Labor Department reported Friday. The labor market has now regained 12 million of the 22 million jobs lost at the onset of the pandemic.

The weekly reports on US claims for unemployment benefits will soon come with a disclaimer that the figures aren’t accurately capturing how many people are claiming benefits after the GAO found the statistics to be “flawed.”

China: President Biden will not immediately cancel the Phase 1 trade agreement that President Trump struck with China nor take steps to remove tariffs on Chinese exports. In an interview with Times columnist Thomas Friedman, Biden gave clues as to how the new administration will proceed on foreign policy. Last week Reuters reported that Trump was eyeing more steps to box Biden into hardline positions on Beijing, backed by the anti-China sentiment in Congress that has often unnerved financial markets in the past four years.

Trump’s presidency is far from over, and neither is his trade war with China. Last week Trump announced that he intends to extend the United States’ blacklist of Chinese companies that are allegedly military controlled. The newest proposed additions to the list are China’s largest chip producer SMI and oil giant CNOOC, which will have the effect of “escalating tensions with Beijing before President-elect Joe Biden takes office.”

Beijing published a draft law to ensure national food security and reform the management of grain reserves in the country. The draft law comes when China’s grain purchases, especially corn, have unexpectedly surged in 2020 and seeks to establish clear guidelines on storage, usage, sales, rotation, and supervision.

According to a researcher with the nation’s primary grid operator, new coal power plants in China will face severe restrictions after 2026 as the country pivots to a carbon-neutral future. China could add another 100 to 200 gigawatts of coal power generation through 2025 before it places the limitations on new plants.

The nation with the largest fleet of coal power plants globally is beginning to reckon with President Xi Jinping’s surprise announcement in September that China plans to be carbon neutral by 2060. BloombergNEF estimates it will cost $7.9 trillion in new power generation through 2050 if the country adopts a more accelerated energy transition toward that goal.

European Union: The EU will call on the US to seize a “once-in-a-generation” opportunity to forge a new global alliance to bury the Trump era’s tensions and meet the “strategic challenge” posed by China. A draft plan for revitalizing the transatlantic partnership proposes new co-operation on everything from digital regulation and tackling the Covid-19 pandemic to fighting deforestation. The paper, prepared by the European Commission, says the EU-US partnership needs “maintenance and renewal” if the democratic world is to assert its interests against “authoritarian powers” and “closed economies [that] exploit the openness our societies depend on.”

Talks about reaching a post-Brexit trade deal have been paused because UK and EU negotiators say “significant divergences” remain. Commission President Ursula Von Der Leyen and PM Boris Johnson discussed the plan on Saturday. State aid subsidies, fishing, and enforcement of new rules remain the critical sticking points in negotiations. If a deal is not agreed upon by December 31st, the two sides will trade on World Trade Organization rules, meaning the introduction of taxes on imports.

France will veto any trade deal between the UK and the European Union that doesn’t respect its interests, French European Affairs Minister Clement Beaune said on Friday. “If there is a deal which is not good, then we would oppose it. We always said so.” France is concerned about last-minute concessions over access to British fishing waters and UK businesses getting an unfair competitive advantage.

European refiners are struggling with their weakest market in decades. But some industry watchers have become cautiously optimistic that improved demand, plant closures, and longer OPEC+ supply cuts could put a floor under margins.

Russia: Moscow began distributing the Sputnik V COVID-19 vaccine via 70 clinics on Saturday, marking Russia’s first mass vaccination against the disease. The vaccine would first be made available to doctors and other medical workers, teachers, and social workers because they run the highest risk of exposure to the disease. Moscow, a city of around 13 million people and the epicenter of Russia’s coronavirus outbreak, registered 7,993 new cases overnight on Saturday, up from 6,868 a day before and well above the daily tallies of around 700 seen in early September.

The vaccine received regulatory approval in early August. However, giving the vaccine a go-ahead drew considerable criticism from experts because, at the time, Sputnik V only had been tested on several dozen people.

Russian gas supplies to Europe remained at 2020 highs in November, with average deliveries of 439 million cu m/d. Russian exports to Europe via the four main corridors — Nord Stream, Yamal-Europe, Ukraine, and TurkStream — totaled 13.18 billion cm last month. November flows were higher on a daily average basis. In the past two months, deliveries have been significantly higher than any other month this year, beating the previous monthly high of 11.65 billion cm.

According to a notice to seafarers, the developer of the almost-complete Nord Stream 2 gas pipeline from Russia to Germany is set to resume pipe-laying work in German waters next month. The resumption would mark the first activity on laying the pipe for almost a year and suggest the developer has found a way to continue work despite the threat of US sanctions.

The annual US defense policy bill unveiled by lawmakers last week contains sanctions that backers say will halt the Nord Stream 2 gas pipeline, which is more than 90 percent complete. Russia says the project to deliver gas under the Baltic Sea to Europe via Germany will begin operating next year. But the Trump administration, which is eager to offer Europe US shipments of gas, and many US lawmakers oppose the pipeline.

Saudi Arabia: The foreign minister said on Friday a resolution to a bitter dispute with Qatar seemed “within reach” after Kuwait announced progress towards ending the row. Washington says the dispute hampers a united Gulf front against Iran. Saudi Arabia, the United Arab Emirates, Bahrain, and Egypt have imposed a diplomatic, trade, and travel embargo on Qatar since mid-2017. “We have made significant progress in the last few days thanks to the continuing efforts of Kuwait. Also, thanks to strong support from President Trump,” Saudi Foreign Minister Prince Faisal bin Farhan Al Saud told a conference.

India: As India’s virus numbers swell and the economy stumbles, Prime Minister Narendra Modi has another crisis to deal with. Tens of thousands of angry farmers are vowing to camp outside the capital for months. The farmers — mostly from Punjab, often called India’s bread-basket — want him to repeal three laws passed in September that allow them to sell crops directly to private firms instead of licensed intermediaries at state-controlled markets. India’s 146 million farms average less than three acres in size, and many farmers believe that the new laws will lead to lower prices and lead the way to corporate takeovers of their small farms.

Another aspect of the problem is the burning of crop residue, which leaves much of northern India with heavily polluted air every winter. The new laws impose prison and fines, which can reach $135,000 for burning crops. Negotiations over a settlement are underway as the strikes spread to other parts of India.

India has announced its intention to resume oil imports from Iran and Venezuela as part of its objective to diversify its oil suppliers. Imports were halted after President Trump imposed sanctions on the two OPEC countries when he came to office in 2017. But President-elect Biden’s policies offer hope to countries wanting to resume trade with the oil-rich nations. Oil minister Dharmendra Pradhan said, “As a buyer, I would like to have more buying places.”

5. Renewables and new technologies

If proposals to build a new industry producing green hydrogen succeed, we may have the final piece of the puzzle to prevent devastating climate change. If they fail, we may be about to spend hundreds of billions of dollars on a white elephant. That’s why there’s both excitement and trepidation around the run of hydrogen announcements from Europe, Australia, and Chile in recent months. The European Union alone envisages spending $558 billion on green hydrogen by 2050. To shift the whole world in the same direction would cost at least twice as much.

IHS Markit forecasts that annual global investments in green hydrogen will exceed $1 billion by 2023. The elevated investment outlook is attributed to falling costs and policy support from governments looking to shift towards low-carbon economies. A viable green-hydrogen industry could power production of steel, cement, and fertilizers; fuel trucks, trains, ships, and aircraft; and balance wind- and solar-based power grids — and in the process eliminate roughly a quarter of the world’s carbon dioxide emissions.

At present, most electrolyzers are manufactured by hand and 99 percent of the world’s industrial hydrogen is “gray,” produced from gas or coal with the carbon emissions to match. The biggest producer of electrolyzers, Norway’s Nel ASA, can make only 80 megawatts per year. Putting the world on a path to zero emissions would require the installation of two million megawatts a year or more.

There are plenty of obstacles standing in the way of developing the first zero-emission, hydrogen-powered plane. It’s tricky to store and use the highly combustible fuel safely. The cost of green hydrogen itself currently is prohibitive if you want to avoid producing greenhouse gases. Yet in September, Airbus gave itself five years to develop a commercially viable hydrogen aircraft. The world’s biggest plane maker has backing from its stakeholders—the French, Spanish, and German governments, who have pledged to be carbon neutral by 2050—and billions of euros in government subsidies.

Alstom, the main transport and mobility group in the Italian region of Lombardy, will supply six hydrogen fuel cell trains for a total amount of approximately $195 million, with the option for eight more. The first train delivery is expected within 36 months. The new hydrogen trains will be based on Alstom’s Coradia Stream regional train platform dedicated to the European market and are already being produced for Italy by Alstom’s main Italian sites.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

Norway, in a bid to support global efforts to prop up oil prices and ease the glut, decided back in June that it would cut its crude oil production by 250,000 b/d and then maintain a 134,000-bpd lower rate of production for the rest of 2020. But by year’s end, the government will be ending its production cuts. (12/2)

Denmark’s government agreed late Dec. 3 to end oil and gas exploration and production in the North Sea by 2050, as well as canceling its latest licensing round. (12/4)

France’s supermajor Total is in talks to sell its 18 percent stake in an oilfield in Iraq’s semi-autonomous region of Kurdistan, with which it could raise around $500 million. Total is looking to divest assets as it is weathering this year’s oil price downturn and is preparing for the future of low-carbon energy. (12/5)

Russia’s Novatek has completed its first trial delivery of LNG shipped in ISO containers to Shanghai, it said Dec. 1, as it eyes the use of ISO containers for entry into Asian downstream LNG markets. ISO — or intermodal — containers are standardized according to International Organization for Standardization (ISO) rules and are suitable for transportation by ship, rail, and truck. (12/1)

Turkey has halted a survey for oil and gas in the Mediterranean and ordered its survey vessel back to a Turkish port, days before European Union leaders are set to discuss the possibility of EU sanctions on Turkey over its intention to drill for oil and gas in waters that EU members Greece and Cyprus consider part of their territorial waters. (12/2)

Saudi Arabia’s crude oil exports to the US fell to the lowest in 35 years in October, averaging less than 100,000 bpd. (12/4)

Nigeria’s active rig count has dropped significantly by 30 percent to seven in October 2020 against ten recorded in the previous month. The rig count reflects the level of exploration, development, production, and general activities in the petroleum sector. This shortfall was coming when the OPEC rig count dropped from 363 in August to 325 in September. (12/1)

African pirates: Greek authorities say negotiations are underway to free three sailors kidnapped off the Nigerian coast. Analysts warn there has been a “sharp increase” in incidents in the Gulf of Guinea. The owner of a fuel tanker is in talks to secure the release of three Greek sailors who were abducted by pirates off the coast of West Africa. (11/30)

Fracking activity in Argentina’s Vaca Muerta shot up 58 percent month on month in November, reaching the highest level this year, according to data released Dec. 1, as Mexico’s Vista Oil & Gas and Argentina’s state-backed YPF stepped up their investment in Argentina’s biggest shale play. (12/2)

Offshore Guyana, ExxonMobil could install as many as ten floating production, storage, and offloading vessels, or FPSOs, at the Stabroek block over the next decade, the company’s manager for deepwater projects said Dec. 1. (12/3)

The US oil rig count rose by 5 to 246, Baker Hughes reported on Friday. Active gas rigs declined by two. Total oil and gas rigs in the US are now down by 476 compared to this time last year. (12/5)

ANWR sale: The US Bureau of Land Management plans to hold an oil and gas lease sale for Alaska’s Arctic National Wildlife Refuge next month, weeks before President-elect Joe Biden, who has opposed drilling in the region, is set to take office. Conservation groups criticized Thursday’s announcement as rushed and based on environmental reviews challenged in court as flawed. (12/4)

New Mexico was, until recently, a lucky state. Despite being one of the states with the weakest economies—and high unemployment—New Mexico had the Permian, and oil revenues from drillers there flowed into the state’s coffers. Last year, $3.1 billion of oil revenues made up as much as 39 percent of New Mexico’s general fund revenues. That rich run is now over. (12/2)

Colorado producers on Jan. 15 will face the most-stringent drilling setback rules in the US when buffers quadruple to 2,000 feet as a backlog of 6,000 pending permits has built up in state regulatory offices over the past year. (12/1)

Exxon Mobil Corp. is about to incur the most significant writedown in its modern history as what was once an exemplar of American capitalist might shudder under the weight of debilitated energy markets. Exxon — already hobbled by cratering crude prices, a global supply glut, and a pandemic-driven collapse in fuel sales — on Monday disclosed it would write down the value of North and South American natural gas fields by between $17 billion and $20 billion. (12/2)

ExxonMobil has called off the potential multibillion-dollar sale of its oil and gas assets in Australia’s Bass Strait due to low bid prices. The decision comes just six weeks after the deadline for indicative bids for the portfolio set by adviser JPMorgan. (11/30)

Exxon Mobil Corp. is suspending employee bonuses for this year after the crude-market collapse spurred a record run of quarterly losses for the oil titan. Top executives, however, will still receive stock awards. (12/2)

Optimism has returned to the oil markets, mainly thanks to promising developments with vaccines and an uptick in oil prices. Even conservative BP has backtracked on its earlier projections that we might have passed peak oil, with the company now saying oil demand might not peak till around 2030. Yet, Big Oil is still far from being out of the woods, with big dividend payers remaining in a precarious position. With WTI trading at ~$45, Raymond James analyst Pavel Molchanov says ExxonMobil is still not bringing in enough cash to fund its dividend and faces an “unenviable choice:” selling assets or taking on more debt. (12/1)

ConocoPhillips may dismiss as much as one-fourth of its Houston headquarters staff—as many as 500—as the largest independent oil explorer cuts costs and prepares for the takeover of Concho Resources Inc. (12/2)

The first commercial-scale US offshore wind power project has delayed its application for federal approval in a move that will leave a final decision in the hands of a renewables-friendly Biden administration. Vineyard Wind, whose turbines would stand 15 miles south of the Massachusetts island of Martha’s Vineyard, is a test case for more than a dozen wind leases in federal waters along the US Atlantic coast. (12/3)

More coal bankruptcies: Lighthouse Resources Inc., a coal company with mines in Wyoming and Montana, and White Stallion Energy LLC, a miner that operates in Indiana and Illinois, both filed for bankruptcy after the pandemic dropped coal prices. Coal companies have struggled amid an increase in natural gas and renewable energy, and US coal production in the second quarter of this year was the lowest in almost 50 years. (12/4)

Coal’s drop: With four more weeks until the end of the year, US 2020 coal output is annualized to nearly 536 million tons, down 23.9 percent from 2019. (12/4)

Declining coal demand across several sectors, especially electricity generation, has led to a 28-percent slump in US coal mining productive capacity since the peak in 2009, the EIA said on Wednesday. Coal production capacity declined from 1,407 million short tons in 2009 to 1,009 million st. (12/3)

US thermal and metallurgical coal exports totaled about 4.6 million mt in October, down 6.1 percent from the previous month, data released Dec. 4 said. From the year-ago month, exports declined 21.5%, the smallest year-on-year decline in four months. (12/5)

UK battery: The UK Department for Business, Energy and Industrial Strategy has approved the construction of the UK’s biggest battery storage project. It is one of the largest such projects in the world, the company developing the site said on Monday. The project is expected to provide 320MW/640MWh of capacity. (12/1)

EV report dubious: EV researchers criticize an automaker-sponsored report they say overstates how many miles battery-powered cars need to be driven before they’re cleaner than those running on combustion engines. The report compiled by British carmaker Aston Martin Lagonda and several of its industry peers made headlines in the wake of U. Prime Minister Boris Johnson’s 2030 ban on vehicles lacking a plug. (12/3)

Some dealers shunning EV’s: About 150 General Motors Co. dealers, or 17% of all such dealers, have decided to part ways with Cadillac rather than invest in costly upgrades required to sell electric cars, indicating some retailers are skeptical about making the pivot to battery-powered vehicles. GM recently gave Cadillac dealers a choice: Accept a buyout offer to exit the brand or spend roughly $200,000 on dealership upgrades—including charging stations and repair tools—to get their stores ready to sell electric vehicles.

UK EV sales up While the UK’s total new car sales slumped in November due to the second lockdown, electric vehicles (EVs) recorded their third highest ever monthly share of registrations at 9.1 percent. (12/5)

Meat and dairy producers are under pressure to go greener as raising animals accounts for about 15 percent of global emissions, with methane about 30 times more potent than carbon dioxide. Researchers and companies will explore a range of solutions, including breeding ‘climate-smart’ cattle and masks for cows. Still, there’s a long wait for testing and obtaining regulatory approval for a food supplement Bovaer that might cut cow emissions by 30%. (12/3)

Green H2: The UK and Scottish authorities fund the world’s first trial of a 100 percent green hydrogen generation, storage, and distribution network to heat 300 homes in Scotland as part of the UK and Scottish ambitions to achieve net-zero emissions within three decades. (12/1)

UK CO2 cuts: The UK government has committed to a more ambitious target to cut greenhouse gas emissions by 68 percent from 1990 levels by 2030, it said late Dec. 3, setting a policy target that it hopes will unleash a wave of clean infrastructure investment. The increase in climate ambition follows a recent 10-point plan for a green industrial revolution announced by the government on Nov. 18. (12/5)

Financial info merger: IHS Markit, based in London, has a market value of about $37 billion; S&P’s is about $82 billion. The deal would combine one of the oldest names in financial markets with a relative newcomer. S&P traces its roots to an 1860 compendium of information for railroad investors and is best known for its bond ratings and its iconic stock-market indexes, which serve as shorthand for global markets’ health. (11/30)