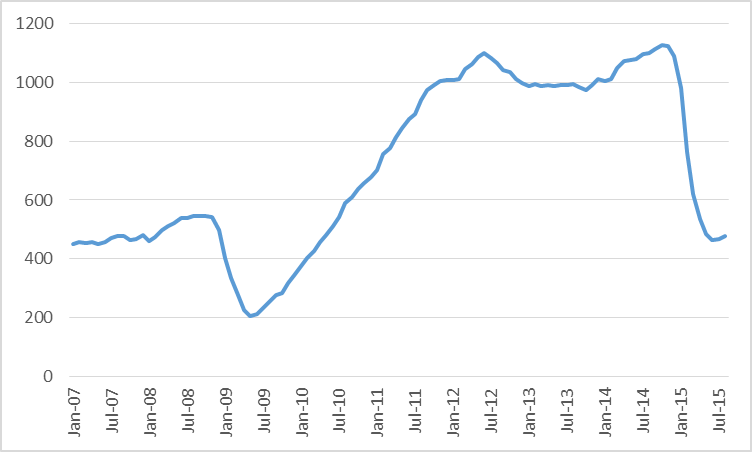

Only 1% of the Bakken Play Breaks Even at Current Oil Prices

(ArtBerman.com) Only 1% of the Bakken Play area is commercial at current oil prices. 4% of horizontal wells drilled since 2000 meet the EUR (estimated ultimate recovery) threshold needed to break even at current oil prices, drilling and completion, and operating costs.

The leading producing companies evaluated in this study are losing $11 to $38 on each barrel of oil that they produce, the very definition of waste.